Amundi Dow Jones Industrial Average UCITS ETF (Dist): Daily NAV Updates And Their Significance

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Defining NAV

Net Asset Value (NAV) represents the market value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the ETF per share. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), the NAV reflects the collective value of the stocks comprising the Dow Jones Industrial Average held within the ETF. This value fluctuates daily, mirroring the performance of the index.

NAV Calculation

Calculating the NAV involves determining the total market value of all the assets held by the ETF (in this case, the Dow Jones Industrial Average constituent stocks). From this total, any liabilities, such as management fees and expenses, are subtracted. The result is then divided by the total number of outstanding ETF shares to arrive at the NAV per share.

- NAV reflects the true value of the ETF's underlying assets.

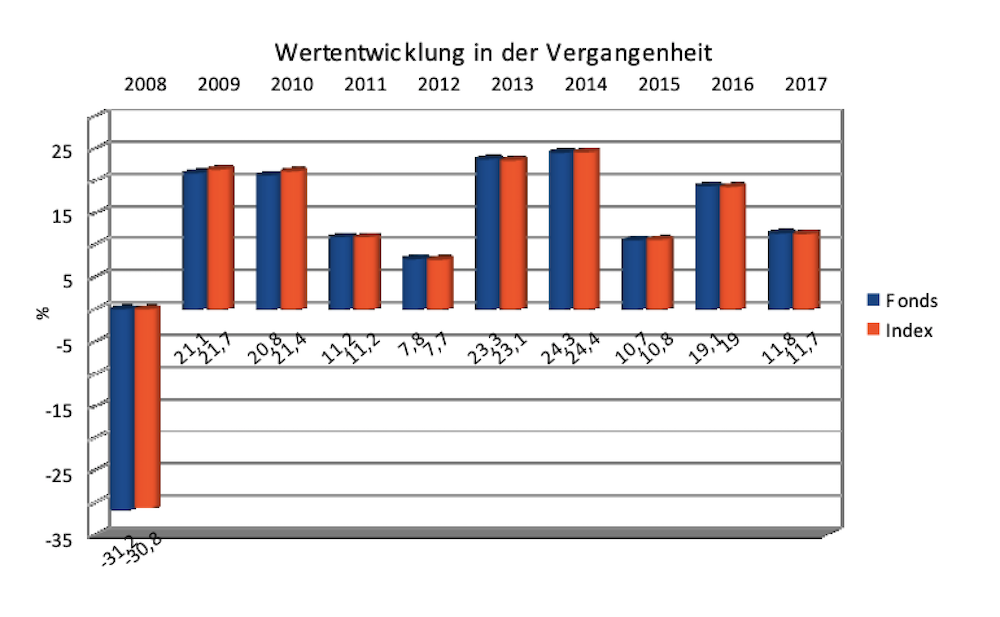

- Daily NAV changes show the ETF's performance against the Dow Jones Industrial Average.

- Understanding NAV helps investors track their investment's growth or decline.

- NAV is crucial for buy/sell decisions. A rising NAV generally indicates growth, while a falling NAV suggests a decline in value.

Daily NAV Updates for the Amundi Dow Jones Industrial Average UCITS ETF (Dist): How to Access Them

Official Sources

The most reliable source for daily NAV updates of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is the official Amundi website. Many brokerage platforms where the ETF is traded will also provide this information. Check your brokerage account statements or online platform for daily or end-of-day NAV figures.

Third-Party Data Providers

Several reputable financial data providers, such as Bloomberg, Refinitiv, and Yahoo Finance, offer real-time or delayed NAV data for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF (Dist). However, always verify the information against the official Amundi source.

- [Insert link to Amundi website, if available]

- NAV updates are typically presented in tables or charts, showing the NAV for each trading day.

- There might be a slight delay in reporting the NAV at the end of the trading day.

Interpreting Daily NAV Changes and Their Impact on Your Investment

Factors Affecting NAV

Several factors influence the daily fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)'s NAV. The most significant is the performance of the Dow Jones Industrial Average itself. Market movements of the index's constituent stocks directly impact the ETF's value. Currency fluctuations (if the underlying assets are in different currencies) can also affect the NAV, as can changes in the ETF's expense ratio.

Relationship to the Dow Jones Industrial Average

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) aims to track the performance of the Dow Jones Industrial Average. Therefore, the daily NAV changes should closely mirror the index's movements. However, slight deviations can occur due to tracking errors and other factors.

- Positive NAV changes reflect an increase in the value of your investment.

- Negative NAV changes indicate a decrease in value.

- Comparing daily NAV changes with the Dow Jones Industrial Average's performance helps assess the ETF's tracking efficiency.

- Dividend distributions (explained below) will also affect the NAV.

The Significance of the 'Dist' in Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Understanding Dividend Distributions

The "Dist" in Amundi Dow Jones Industrial Average UCITS ETF (Dist) signifies that this ETF distributes dividends to its shareholders. These dividends are derived from the dividends paid by the underlying companies within the Dow Jones Industrial Average.

Impact of Distributions on NAV

Dividend payouts reduce the NAV of the ETF on the ex-dividend date. The NAV will drop by the amount of the dividend paid per share. The exact date and amount of the dividend distribution are typically announced in advance by Amundi. You can usually find this information on their investor relations page.

- Dividend distributions are taxable events.

- The frequency of dividend payments depends on the dividend policies of the companies within the Dow Jones Industrial Average.

- You can monitor dividend payments through the changes in NAV around the ex-dividend date.

Conclusion

Regularly monitoring the daily NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Dist) holdings is essential for effective investment management. Understanding the factors influencing NAV changes, particularly the Dow Jones Industrial Average's performance and dividend distributions, allows for informed decision-making. By utilizing official sources and carefully analyzing the NAV data, you can better track the progress of your investment in this index-tracking ETF. Remember to regularly check the official Amundi website and your brokerage account for the most accurate and up-to-date Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV information.

Featured Posts

-

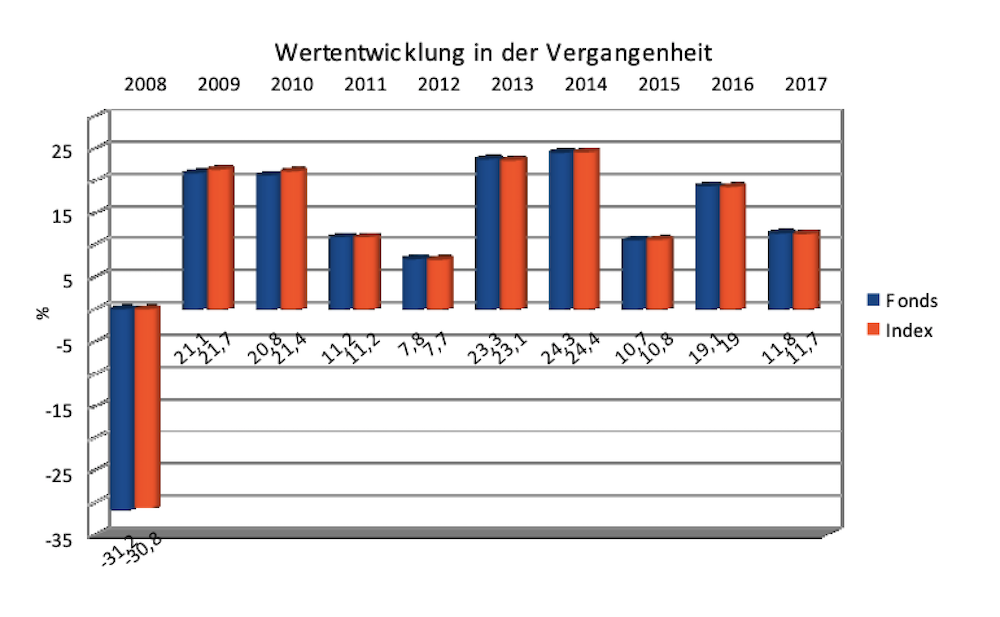

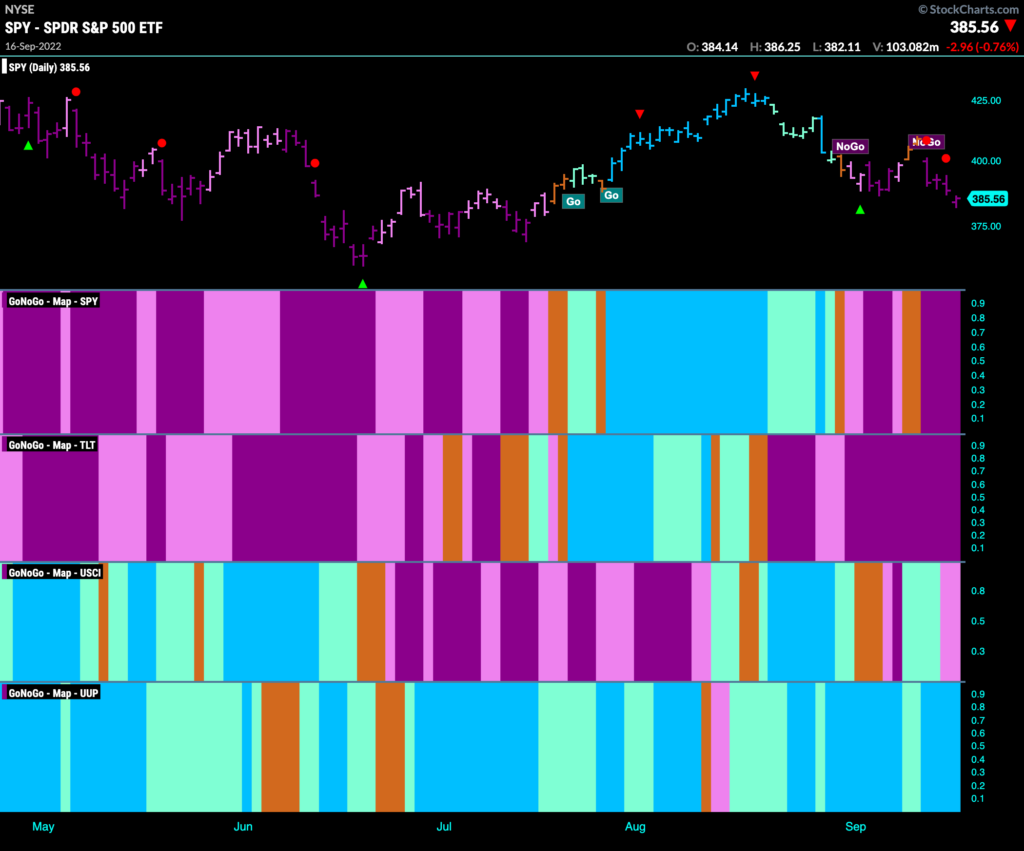

Aapl Stock Analysis Of Upcoming Price Levels

May 24, 2025

Aapl Stock Analysis Of Upcoming Price Levels

May 24, 2025 -

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

Country Escape Checklist Everything You Need To Know Before You Go

May 24, 2025

Country Escape Checklist Everything You Need To Know Before You Go

May 24, 2025 -

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025

Latest Posts

-

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025 -

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025 -

Mia Farrows Return Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Return Is Ronan Farrow The Key

May 24, 2025 -

Florida Film Festival A Look At Past Celebrity Appearances Including Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival A Look At Past Celebrity Appearances Including Mia Farrow And Christina Ricci

May 24, 2025 -

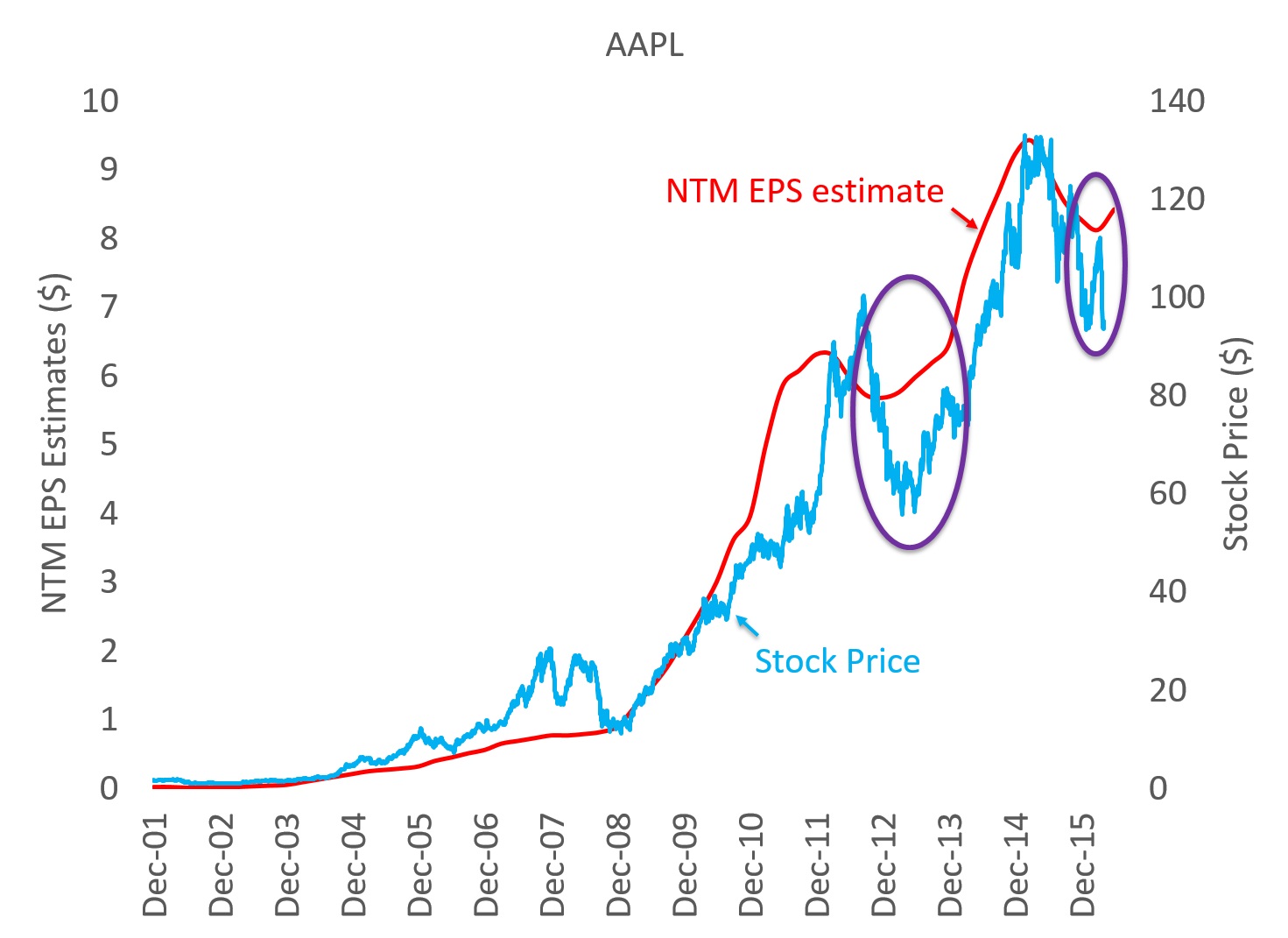

Apple Stock Navigating The Pre Q2 Earnings Uncertainty

May 24, 2025

Apple Stock Navigating The Pre Q2 Earnings Uncertainty

May 24, 2025