Ripple (XRP) Price Surge: Will XRP Hit $3.40?

Table of Contents

Current Market Analysis of XRP

Understanding XRP's current state is crucial for any price prediction. As of [Insert Current Date], XRP is trading at [Insert Current Price]. Its market capitalization places it at [Insert Market Cap Rank] among cryptocurrencies. The 24-hour trading volume is currently [Insert 24-Hour Trading Volume], indicating [Describe the trading volume - high, low, average, etc.]. The overall market sentiment towards XRP is currently [Describe Sentiment - bullish, bearish, neutral, etc.], largely influenced by [Mention key influencing factors].

- Current XRP Price: [Insert Current Price]

- 24-Hour Trading Volume: [Insert 24-Hour Trading Volume]

- Market Capitalization Rank: [Insert Market Cap Rank]

- Key Technical Indicators: The Relative Strength Index (RSI) is currently at [Insert RSI Value], suggesting [Interpretation of RSI]. The Moving Average Convergence Divergence (MACD) shows [Interpretation of MACD]. These indicators, combined with price action, suggest [Overall technical analysis interpretation].

Factors Contributing to a Potential XRP Price Surge

Several factors could fuel a significant XRP price surge, potentially driving the price towards $3.40.

Positive Ripple News and Developments

Positive developments from Ripple Labs significantly impact XRP's price. Recent positive news includes:

- Recent Ripple partnerships and collaborations: [List recent partnerships and collaborations, highlighting their potential impact on XRP adoption and price.]

- Progress in the ongoing SEC lawsuit: [Summarize the progress of the lawsuit and its potential positive outcomes for Ripple and XRP.]

- Adoption of XRP by financial institutions: [Provide examples of financial institutions adopting XRP and explain the impact on price.]

- New technological innovations from Ripple: [Highlight any new technologies developed by Ripple that could enhance XRP's functionality and attract more users.]

Increasing Institutional Interest in XRP

Growing institutional interest is a key driver of price appreciation in cryptocurrencies. Large-scale investments can significantly boost liquidity and price stability.

- Examples of institutional adoption of XRP: [Provide examples of institutional investors holding or using XRP.]

- Analysis of institutional investment trends: [Discuss the overall trend of institutional investment in XRP.]

- Impact of institutional investment on liquidity and price stability: [Explain how institutional investment improves liquidity and stability, making the price less volatile.]

Growing Adoption of XRP in the Payment Sector

XRP's potential as a fast, efficient, and cost-effective cross-border payment solution is a significant factor. Increased usage in this sector drives demand.

- Examples of real-world use cases of XRP in payments: [Provide examples of real-world applications using XRP for payments.]

- Comparative analysis of XRP with other payment solutions: [Compare XRP with other payment solutions, highlighting its advantages.]

- Potential for future widespread adoption: [Discuss the potential for XRP to become a widely adopted payment solution.]

Factors that Could Hinder XRP Reaching $3.40

Despite the positive factors, several challenges could hinder XRP's price from reaching $3.40.

Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's future. Regulatory uncertainty can significantly impact investor confidence.

- Summary of the ongoing SEC lawsuit against Ripple: [Summarize the lawsuit and its potential implications.]

- Potential regulatory implications for XRP in different jurisdictions: [Discuss the potential regulatory implications in various countries.]

- Impact of regulatory uncertainty on investor confidence: [Explain how regulatory uncertainty affects investor sentiment and price.]

Market Volatility and General Crypto Market Conditions

The cryptocurrency market is notoriously volatile. Broader market trends and unforeseen events can negatively impact XRP's price.

- Correlation between Bitcoin's price and XRP's price: [Analyze the correlation between Bitcoin and XRP prices.]

- Impact of macroeconomic factors on cryptocurrency prices: [Discuss the impact of economic factors on crypto prices.]

- Potential for unexpected market corrections: [Discuss the possibility of market corrections impacting XRP's price.]

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies in the payment sector. The emergence of new technologies and competitors could hinder XRP's growth.

- Key competitors to XRP in the payment sector: [List key competitors and their strengths.]

- Comparative analysis of XRP's strengths and weaknesses against competitors: [Compare XRP with competitors, highlighting advantages and disadvantages.]

- Potential for disruption from emerging technologies: [Discuss the potential for disruptive technologies to impact XRP's market share.]

Conclusion: The Future of Ripple (XRP) and its $3.40 Target

The potential for a Ripple (XRP) price surge to $3.40 hinges on a complex interplay of factors. While positive developments from Ripple Labs, growing institutional interest, and increasing adoption in the payment sector are bullish indicators, regulatory uncertainty, market volatility, and competition present significant headwinds. Whether the XRP price prediction of $3.40 materializes depends on how these competing forces play out. It's crucial to conduct thorough research and consider your own risk tolerance before investing in XRP. Will the Ripple (XRP) price surge continue? What is the future price of XRP? Can XRP truly hit $3.40? Share your thoughts and predictions in the comments below!

Featured Posts

-

Anthony Edwards Nba Suspension The Costly Mistake

May 07, 2025

Anthony Edwards Nba Suspension The Costly Mistake

May 07, 2025 -

Bitcoin Surges Past 10 Week High Nears Us 100 000

May 07, 2025

Bitcoin Surges Past 10 Week High Nears Us 100 000

May 07, 2025 -

The Timberwolves And Julius Randle A Case Study In Player Development

May 07, 2025

The Timberwolves And Julius Randle A Case Study In Player Development

May 07, 2025 -

Why Middle Managers Are Essential For Company Success

May 07, 2025

Why Middle Managers Are Essential For Company Success

May 07, 2025 -

Las Vegas Aces Release Forward During Training Camp

May 07, 2025

Las Vegas Aces Release Forward During Training Camp

May 07, 2025

Latest Posts

-

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

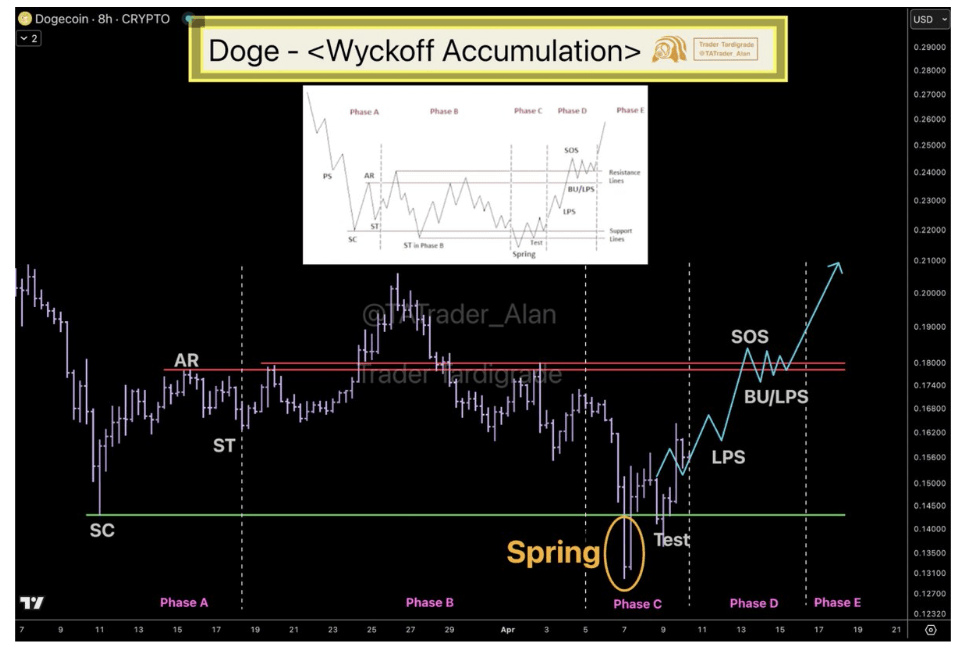

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Accumulation Suggest A Bullish Trend

May 08, 2025