Recession Concerns? Why Stock Investors Are Optimistic

Table of Contents

Strong Corporate Earnings Despite Economic Headwinds

Despite the whispers of a looming recession, robust corporate earnings reports are defying predictions of widespread economic downturn. Many companies are exceeding expectations, showcasing the resilience of the business world. This strong performance fuels the optimism in the stock market.

- Examples of outperformance: Several tech giants, along with companies in the consumer staples and healthcare sectors, have reported surprisingly strong earnings, demonstrating their ability to navigate challenging economic conditions. For example, [Insert example of a company exceeding expectations and cite source].

- Resilient sectors: Certain sectors, such as healthcare, consumer staples, and utilities, are proving to be recession-resistant, showing consistent growth even amidst broader economic uncertainty. These sectors often benefit from consistent consumer demand, regardless of the overall economic climate.

- Pricing power: Many companies possess significant pricing power, allowing them to pass increased costs onto consumers and maintain profitability. This ability to offset inflation contributes significantly to their strong earnings reports. This pricing power is a key indicator of the strength of the corporate sector.

This sustained strength in corporate profits and earnings growth, even in the face of economic headwinds, is a major factor contributing to investor optimism.

The Federal Reserve's Actions and Their Impact

The Federal Reserve's monetary policy plays a crucial role in shaping investor sentiment and the overall health of the stock market. While interest rate hikes aim to curb inflation, their impact on the stock market is complex and subject to interpretation.

- Interest rate hikes and inflation: The Fed's aggressive interest rate hikes are intended to combat inflation and cool down the economy. While this may lead to slower economic growth in the short-term, it is ultimately designed to prevent a more severe and prolonged economic downturn.

- The possibility of a "soft landing": Many economists believe the Fed might achieve a "soft landing," slowing economic growth enough to tame inflation without triggering a full-blown recession. This scenario would be positive for the stock market, as it would avoid a sharp correction.

- Commitment to price stability: The Fed's unwavering commitment to price stability assures investors that they are taking the necessary steps to address inflation concerns, a key factor underpinning investor confidence.

The Federal Reserve’s actions, although potentially disruptive in the short term, are viewed by many as a necessary measure to ensure long-term economic stability, bolstering investor optimism despite the current uncertainty.

Long-Term Growth Potential and Innovation

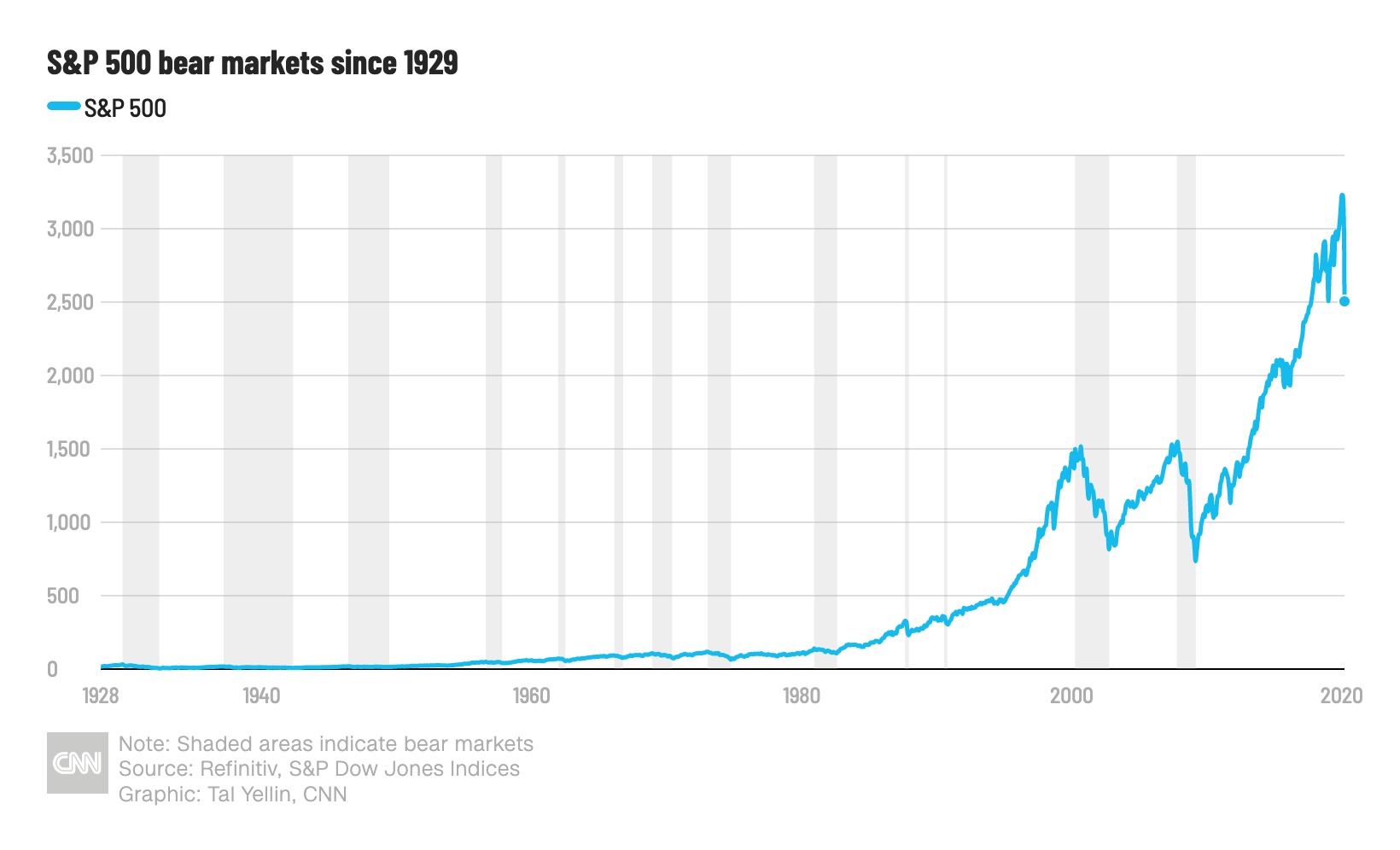

Beyond short-term economic fluctuations, the long-term growth potential of the stock market remains significant. Technological innovation and the expansion of emerging markets present exciting opportunities for investors.

- Technological advancements: Breakthroughs in artificial intelligence, renewable energy, and biotechnology are driving substantial growth and creating new investment opportunities. These innovations offer the potential for exponential returns and make the market attractive for long-term investors.

- Emerging markets: The rapid growth of emerging markets, particularly in Asia and Africa, presents significant long-term investment opportunities. These markets offer diverse growth prospects, partially mitigating the risks associated with developed economies.

- Innovation as a recession hedge: Technological innovation often acts as a buffer against economic downturns. Companies at the forefront of innovation often continue to thrive even during periods of economic contraction.

These factors point towards a future where technological advancements and global growth drive long-term stock market appreciation, which is why many investors remain optimistic despite near-term recession concerns.

Investor Sentiment and Market Psychology

Understanding market psychology is crucial when assessing the current optimistic sentiment. Investor behavior is driven by a complex interplay of fear and greed, and the current market reflects a certain level of resilience.

- Fear and greed: While fear of a recession is undeniably present, many investors are also factoring in the potential for significant gains once the economic uncertainty subsides. This interplay between fear and greed fuels market fluctuations.

- Contrarian investing: Some investors are employing contrarian strategies, buying stocks when prices are depressed due to recession concerns, anticipating future growth.

- Lagging indicator: Investor sentiment is often a lagging indicator. Optimism may emerge only after a period of economic recovery has already begun, suggesting that the current optimism could foreshadow positive developments.

The psychological aspect of the market – a blend of cautious optimism and contrarian strategies – plays a crucial role in shaping the current investor outlook.

Navigating Recession Concerns and Maintaining Stock Market Optimism

In summary, despite valid recession concerns, several factors contribute to sustained stock market optimism: strong corporate earnings, the Federal Reserve's proactive measures, long-term growth potential fueled by innovation, and a complex investor psychology that balances fear and potential for significant gains. It's crucial to remember that recessions are a possibility and that investing always entails risk.

However, by carefully considering these factors and performing thorough research, investors can make more informed decisions. Assess your risk tolerance, develop a long-term investment strategy, and manage your portfolio effectively in light of recession concerns. Consider consulting a financial advisor to discuss your individual circumstances and investment goals.

The potential for growth in the stock market remains substantial, even amidst recession concerns. A well-informed and carefully considered approach to investing is essential for navigating the complexities of the current market and capitalizing on future opportunities.

Featured Posts

-

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025 -

The Everything App A Head To Head Comparison Of Altman And Musks Visions

May 06, 2025

The Everything App A Head To Head Comparison Of Altman And Musks Visions

May 06, 2025 -

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025 -

Westpac Wbc Q Quarter Results Declining Profits And Margin Challenges

May 06, 2025

Westpac Wbc Q Quarter Results Declining Profits And Margin Challenges

May 06, 2025 -

La Wildfires A Reflection Of Our Times Through Disaster Betting

May 06, 2025

La Wildfires A Reflection Of Our Times Through Disaster Betting

May 06, 2025

Latest Posts

-

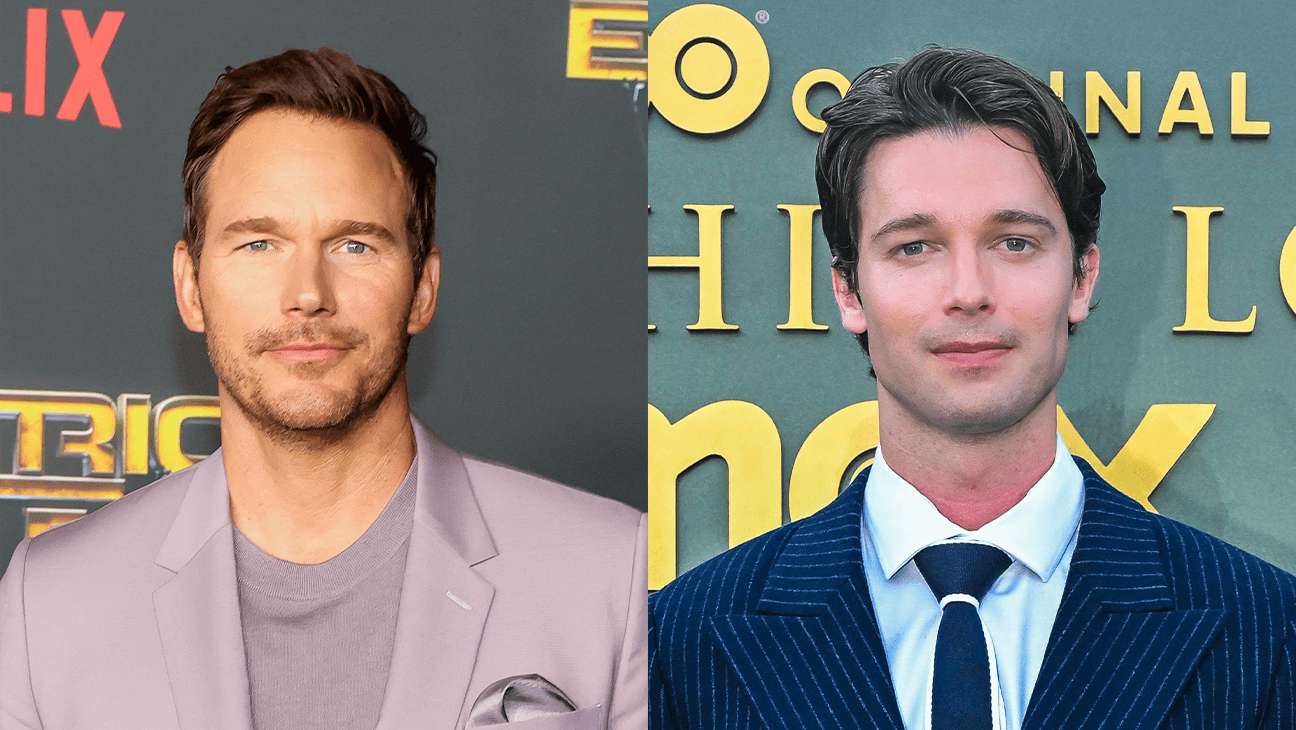

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

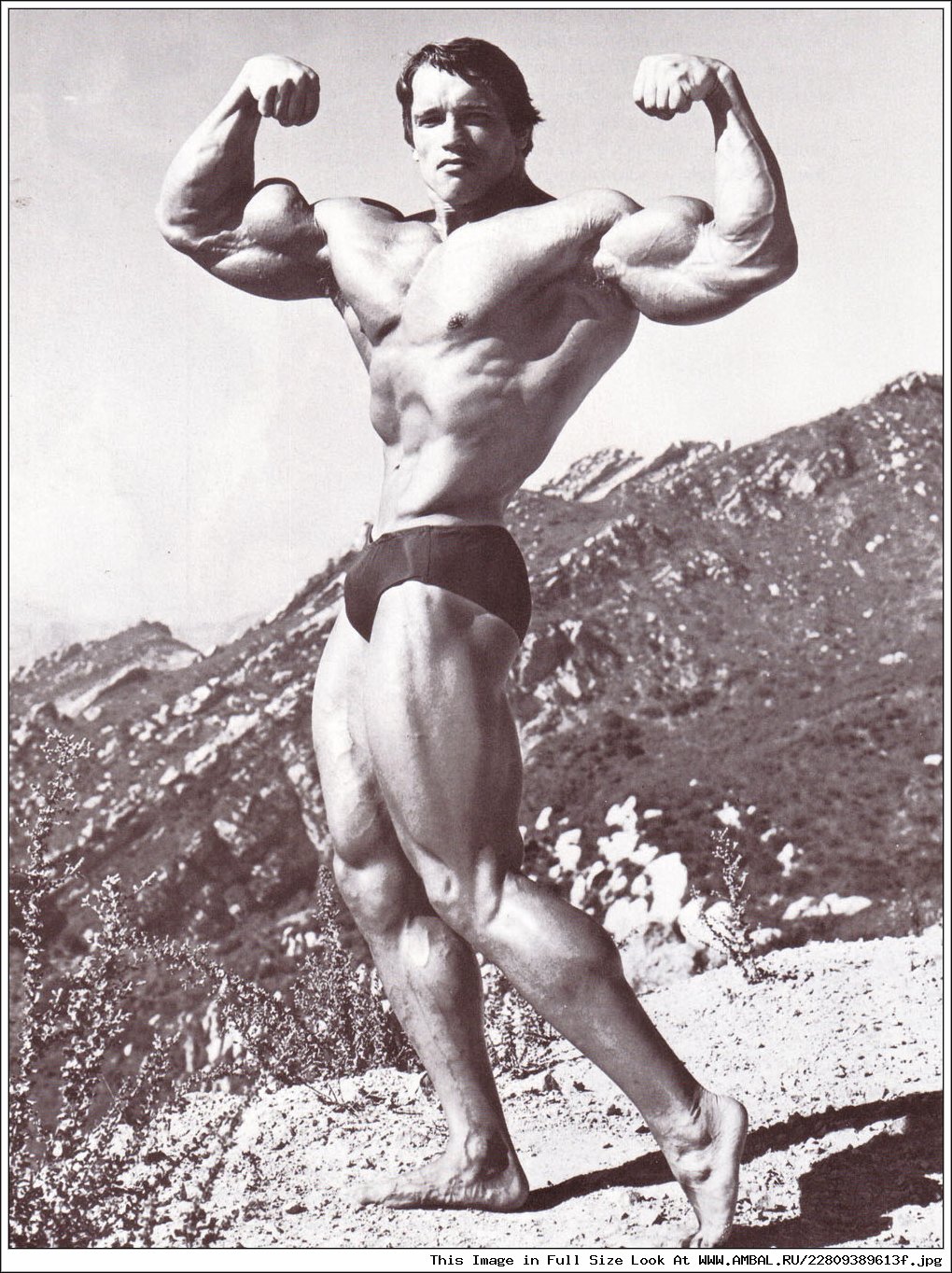

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

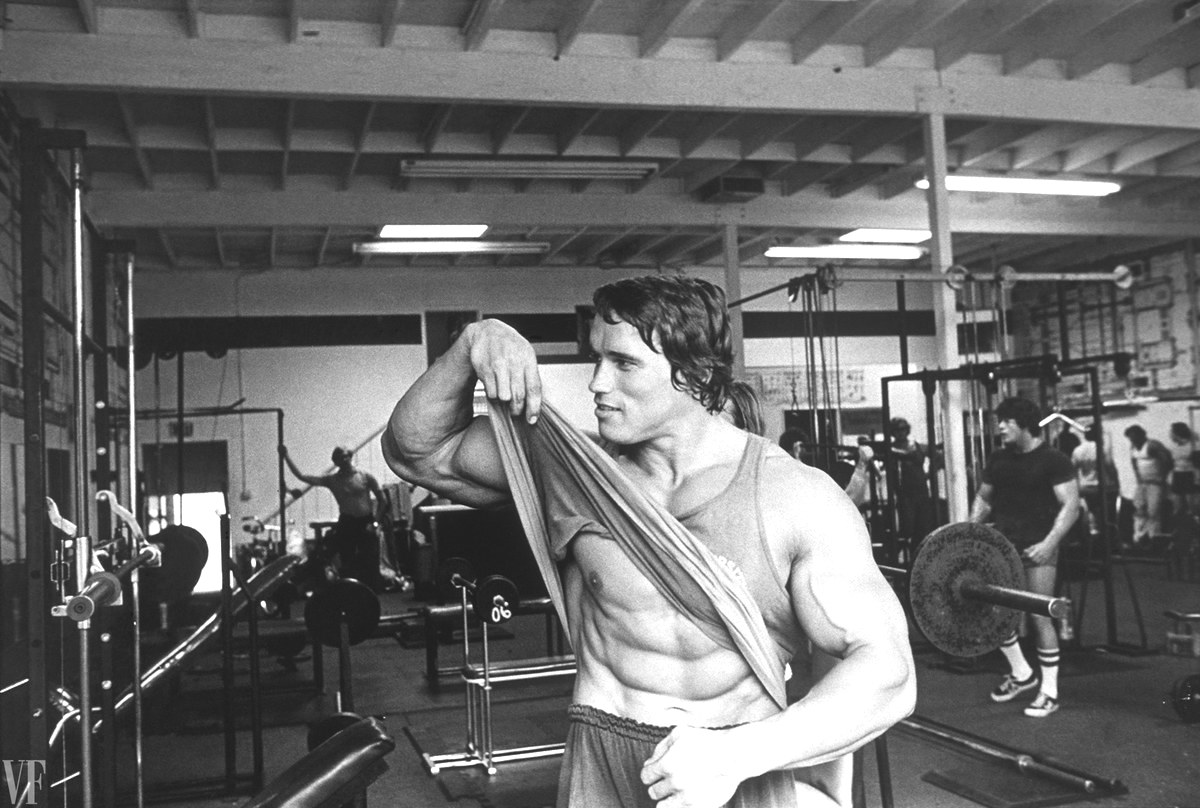

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025