Westpac (WBC) Q[Quarter] Results: Declining Profits And Margin Challenges

![Westpac (WBC) Q[Quarter] Results: Declining Profits And Margin Challenges Westpac (WBC) Q[Quarter] Results: Declining Profits And Margin Challenges](https://autolinq.de/image/westpac-wbc-q-quarter-results-declining-profits-and-margin-challenges.jpeg)

Table of Contents

Impact of Rising Interest Rates on Westpac's Profitability

Rising interest rates, while generally positive for bank profitability, have presented a complex challenge for Westpac in Q3. The impact on the bank's net interest margin (NIM) has been significant, squeezing profits despite increased lending rates. The increase in the cost of funds, necessary to maintain liquidity and meet regulatory requirements, has put considerable pressure on the bank's margins.

- Increased cost of funds: The Reserve Bank of Australia's (RBA) aggressive rate hikes have increased the cost of borrowing for Westpac, directly impacting its profitability.

- Pressure on loan demand: Higher interest rates have dampened loan demand, particularly in the housing market, reducing the volume of interest-earning assets.

- Potential for NIM compression: The widening gap between the cost of funds and the interest earned on loans has led to NIM compression, significantly impacting Westpac's bottom line.

- Analysis of the bank's interest rate hedging strategies: While Westpac employs hedging strategies to mitigate interest rate risk, their effectiveness in the current volatile environment requires further scrutiny. The efficacy of these strategies will be a key factor in determining Westpac's future profitability.

Increased Competition in the Australian Banking Sector

The Australian banking sector is increasingly competitive, with both major banks and smaller financial institutions vying for market share. This intense competition has directly impacted Westpac's revenue and profitability in Q3. The aggressive pricing strategies employed by competitors have placed considerable downward pressure on margins.

- Aggressive pricing strategies of competitors: Competitors are offering highly competitive interest rates and fees, forcing Westpac to respond strategically.

- Impact on customer acquisition and retention: The competitive landscape makes attracting and retaining customers more challenging, necessitating increased investment in marketing and customer service.

- Increased marketing and promotional expenses: Westpac has likely had to increase spending on marketing and promotions to remain competitive, further impacting its profitability.

- Analysis of Westpac's competitive positioning: Westpac's strategic response to increased competition will be crucial in determining its future market share and profitability. This includes enhancing customer service, improving digital offerings, and potentially exploring mergers or acquisitions.

Rising Operating Costs and Expense Management

Westpac's increased operating costs in Q3 represent another significant headwind. These escalating costs, coupled with the challenges mentioned above, have contributed to the decline in profits. While the bank is implementing cost-cutting measures, their effectiveness remains to be seen.

- Technology investments and digital transformation costs: Investments in technology and digital transformation, while essential for long-term competitiveness, represent significant short-term expenses.

- Regulatory compliance expenses: The increasing regulatory burden in the financial sector adds to operating costs.

- Staffing costs and employee benefits: Salaries, wages, and employee benefits represent a substantial portion of Westpac's operating expenses.

- Efficiency ratios and their implications: Analyzing Westpac's efficiency ratios—which measure the bank's ability to manage costs—is crucial in assessing its ability to navigate the current challenges.

Analysis of Westpac's (WBC) Strategic Initiatives and Outlook

Westpac is undertaking several strategic initiatives to address the challenges outlined above. These include cost reduction targets, focusing on growth in specific market segments, and investment in new technologies and services. The success of these initiatives will be crucial in determining Westpac's future profitability and overall performance.

- Cost reduction targets and timelines: Westpac has announced specific cost reduction targets, and the success in achieving these will be critical for its financial health.

- Growth strategies in specific market segments: Focusing on specific market segments where Westpac enjoys a competitive advantage is key to driving future growth.

- Investment plans in new technologies and services: Investing in innovative technologies and enhancing digital services will be essential for improving efficiency and attracting new customers.

- Management's commentary on future profitability: Closely monitoring management's outlook and guidance on future profitability will be important for investors and analysts.

Westpac (WBC) Q3 Results: A Path Forward?

Westpac's Q3 results paint a challenging picture, highlighting the significant impact of rising interest rates, intensified competition, and escalating operating costs. While the bank is implementing strategic initiatives to address these issues, the effectiveness of these measures remains to be seen. Staying informed about Westpac's future performance is critical for investors and stakeholders alike. Follow future Westpac (WBC) quarterly results and analyze expert financial commentary to track the bank's progress and gauge its long-term prospects for navigating these challenges and achieving sustainable profitability.

![Westpac (WBC) Q[Quarter] Results: Declining Profits And Margin Challenges Westpac (WBC) Q[Quarter] Results: Declining Profits And Margin Challenges](https://autolinq.de/image/westpac-wbc-q-quarter-results-declining-profits-and-margin-challenges.jpeg)

Featured Posts

-

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025 -

Election Aftermath Potential For Australian Asset Growth

May 06, 2025

Election Aftermath Potential For Australian Asset Growth

May 06, 2025 -

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

May 06, 2025

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

May 06, 2025 -

Surprisingly Good Cheap Stuff A Buyers Guide

May 06, 2025

Surprisingly Good Cheap Stuff A Buyers Guide

May 06, 2025 -

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025

Latest Posts

-

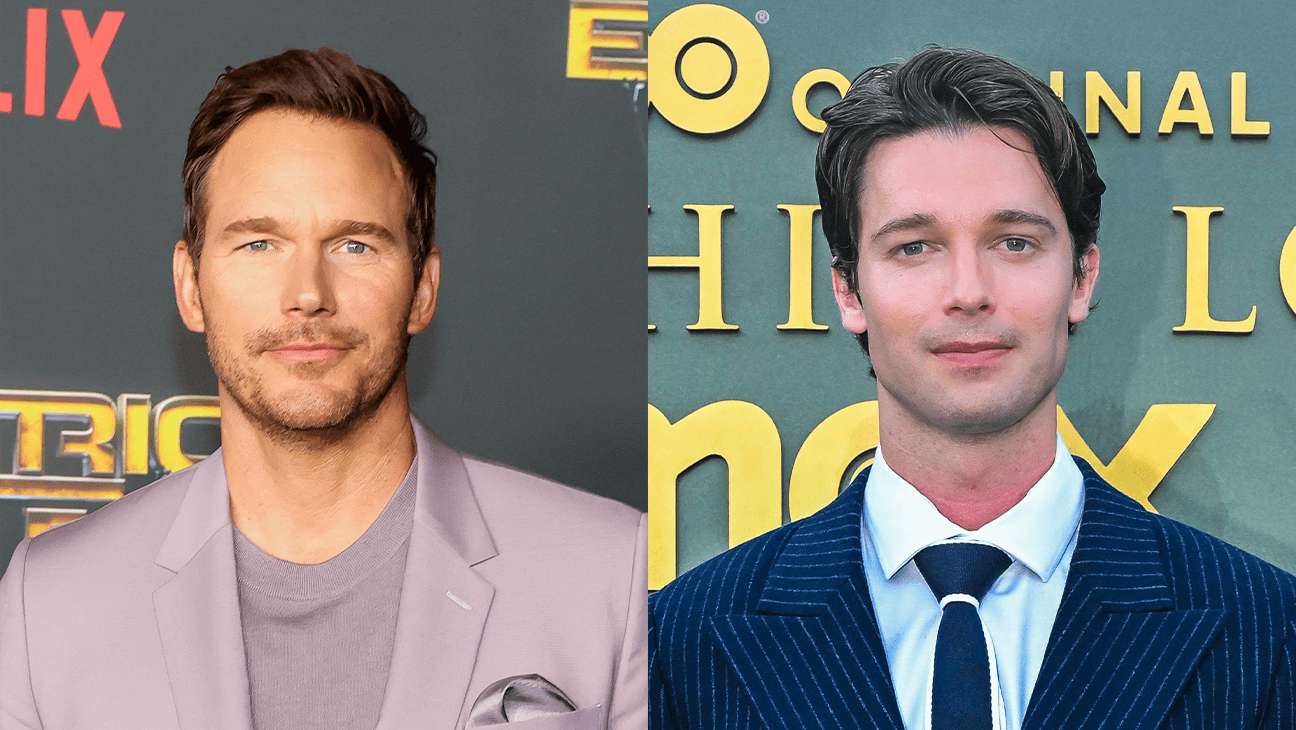

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

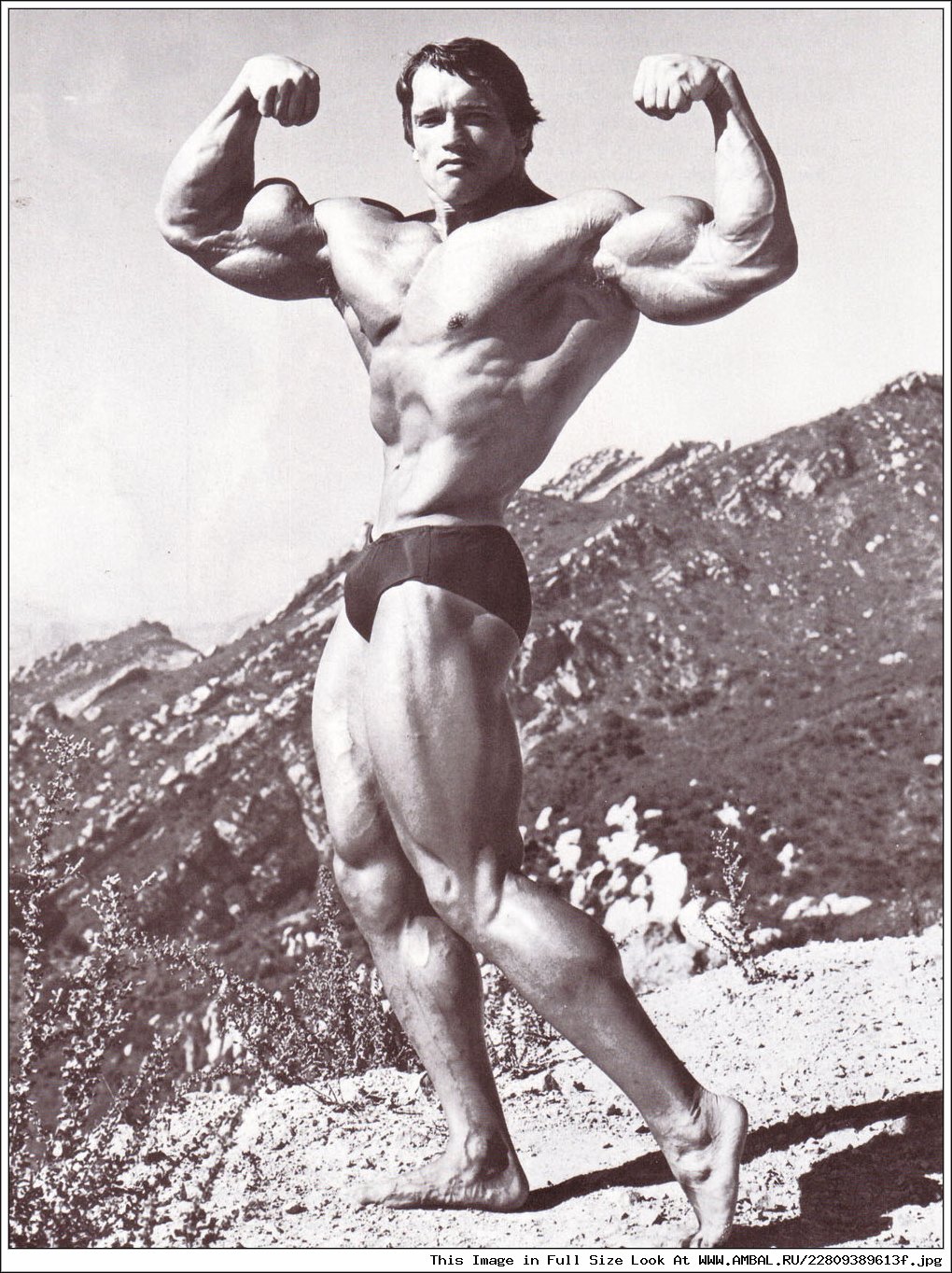

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025