Warren Buffett's Greatest Investing Wins And Losses: Key Lessons Learned

Table of Contents

Warren Buffett's Greatest Investing Wins

Buffett's phenomenal success stems from his unwavering commitment to value investing and long-term perspective. Let's examine some of his most celebrated wins:

Coca-Cola Investment

Buffett's investment in Coca-Cola is a textbook example of long-term value investing. Berkshire Hathaway began acquiring Coca-Cola stock in 1988, with an initial investment reportedly exceeding $1 billion. This investment wasn't just a financial gamble; it was a bet on the enduring power of a globally recognized brand. The long-term returns have been extraordinary, fueled by consistent dividend growth and increasing consumer demand for Coca-Cola products. This success underscores the importance of:

- Long-term investment: Patience is key. Buffett held Coca-Cola stock for decades, weathering market fluctuations and reaping substantial rewards.

- Brand strength: Investing in companies with powerful brands and strong consumer loyalty often delivers significant long-term returns.

- Dividend investing: Coca-Cola's consistent dividend payouts have significantly contributed to Berkshire Hathaway's overall returns.

This Coca-Cola investment solidified Buffett's reputation as a master of value investing and demonstrated the power of a long-term Berkshire Hathaway investment strategy.

American Express Acquisition

Buffett's shrewd investment in American Express following the 1966 Salad Oil scandal is a prime example of contrarian investing. While many investors fled American Express due to market fear, Buffett saw an opportunity. He recognized the company's underlying strength and capitalized on the temporary downturn. This investment showcased:

- Contrarian approach: Going against the prevailing market sentiment can yield significant returns if the underlying fundamentals remain strong.

- Value investing: Buffett identified American Express's intrinsic value, which was significantly undervalued by the market due to short-term panic.

- Market downturn: Capitalizing on market fear can lead to exceptional investment opportunities.

This bold move generated substantial profits for Berkshire Hathaway, highlighting the potential of value investing during times of market uncertainty.

Geico Investment

Buffett's early investment in Geico, an auto insurance company, demonstrated his keen ability to identify a company with a sustainable competitive advantage. He recognized Geico's efficient underwriting practices and its focus on low-cost operations, leading to a significantly profitable investment. This success highlighted:

- Understanding business fundamentals: Before investing, Buffett thoroughly analyzes the business model, management, and competitive landscape.

- Long-term growth: Geico's consistent growth and profitability have made it a cornerstone of Berkshire Hathaway's portfolio.

- Competitive advantage: Identifying companies with durable competitive advantages is critical to long-term investment success.

The Geico investment serves as a testament to the importance of understanding a business's core strengths and its potential for sustained growth within the insurance industry.

Warren Buffett's Notable Investing Losses

Even the Oracle of Omaha has experienced setbacks. Studying his losses provides equally valuable insights:

Dexter Shoe Company

Buffett's investment in Dexter Shoe Company, a footwear manufacturer, proved to be a costly mistake. The investment ultimately failed due to several factors:

- Lack of management expertise: Poor management decisions contributed significantly to the company's decline.

- Changing market dynamics: The shoe industry was undergoing significant changes, and Dexter Shoe failed to adapt effectively.

- Investment failure: This experience underscored the importance of thorough due diligence and understanding the management team's capabilities.

This case highlights the critical need for comprehensive due diligence and a deep understanding of a company's management team before investing. Thorough market analysis is also crucial to assess potential risks and opportunities.

Energy Investments

Buffett's early investments in the energy sector haven't all been home runs. Some ventures didn't perform as expected, due to factors including:

- Overestimation of growth potential: Some energy investments didn't meet projected growth targets.

- Unexpected market volatility: The energy sector is known for its cyclical nature and price volatility.

- Risk management: The experience highlighted the importance of diversification and prudent risk management across a portfolio.

These investments emphasized the importance of diversification within a portfolio and the need for careful risk management within the energy sector investment and broader investment strategy. This highlights the importance of avoiding over-concentration in a single sector.

Key Lessons Learned from Warren Buffett's Investing Journey

Warren Buffett's career provides a masterclass in investing. Here are some key takeaways:

Patience and Long-Term Perspective

Successful investing requires a long-term perspective. Avoid short-term market fluctuations; focus on fundamental value and long-term growth.

Thorough Due Diligence

Always conduct comprehensive research and thoroughly understand a company's financials, management, and competitive landscape before investing.

Understanding Business Fundamentals

Focus on a company's intrinsic value, its ability to generate cash flow, and its long-term growth potential, rather than chasing market trends.

Risk Management and Diversification

Diversify your investment portfolio across various asset classes to mitigate risk. Don't put all your eggs in one basket.

Contrarian Investing

While risky, identifying undervalued companies during market downturns can lead to significant returns. This requires careful analysis and understanding of market sentiment.

Conclusion

Warren Buffett's investing wins and losses offer profound lessons for all investors. His success wasn't just about luck; it was built on a foundation of value investing, long-term perspective, thorough due diligence, and effective risk management. By studying his triumphs and setbacks, we can learn to refine our investment strategies and improve our chances of achieving long-term financial success. Master Warren Buffett's investing strategies, learn from his investing wins and losses, and improve your investing approach with insights from this legendary investor. Start your journey to successful investing today! Explore further resources on value investing strategies!

Featured Posts

-

Carneys Plan A Generation Defining Economic Transformation

May 06, 2025

Carneys Plan A Generation Defining Economic Transformation

May 06, 2025 -

The Challenges Of Chinas Automotive Market A Look At Bmw Porsche And Others

May 06, 2025

The Challenges Of Chinas Automotive Market A Look At Bmw Porsche And Others

May 06, 2025 -

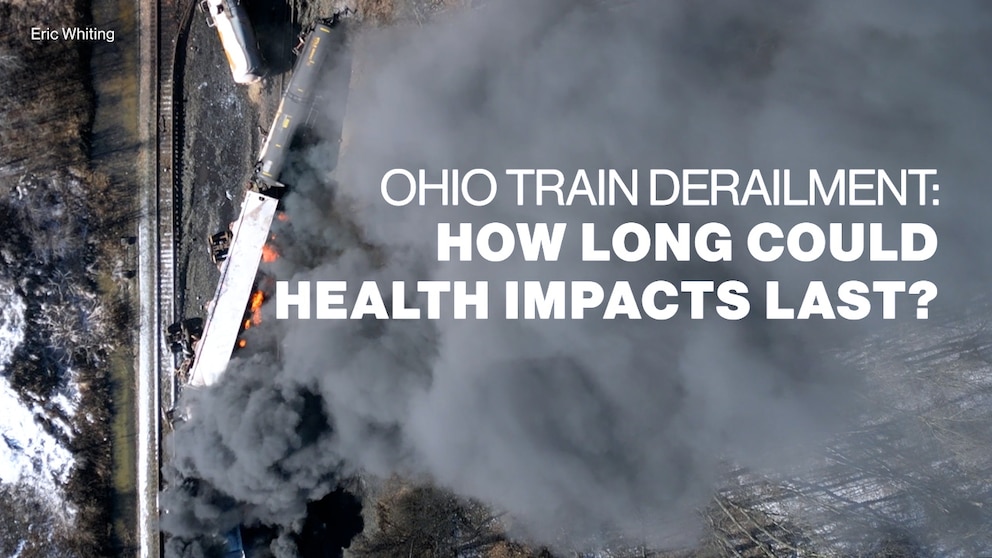

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

May 06, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

May 06, 2025 -

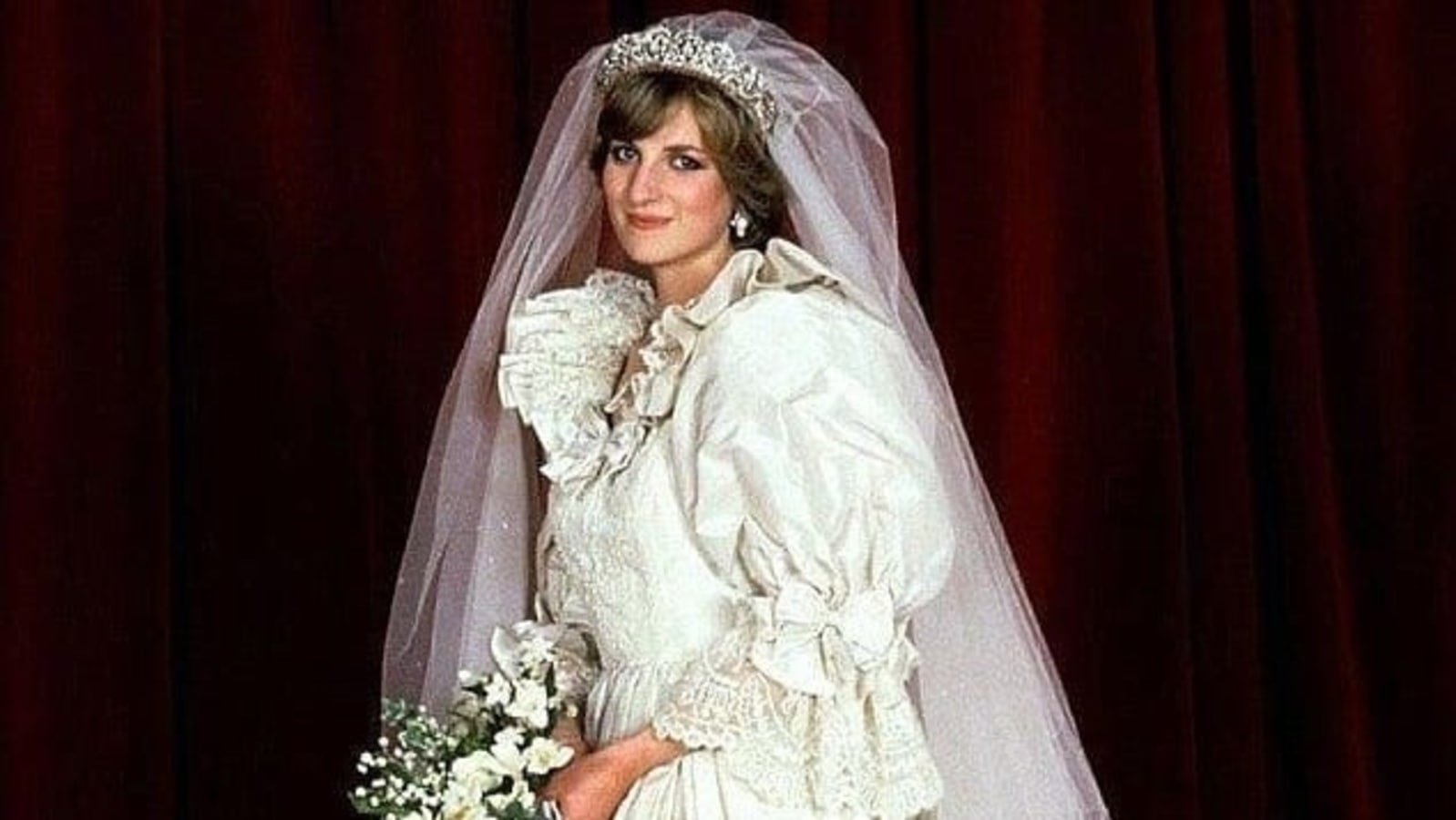

The Risque Dress Uncovering The Alterations To Princess Dianas Iconic Met Gala Gown

May 06, 2025

The Risque Dress Uncovering The Alterations To Princess Dianas Iconic Met Gala Gown

May 06, 2025 -

Generational Divide In The House Democrats Public Dispute Over Senior Members

May 06, 2025

Generational Divide In The House Democrats Public Dispute Over Senior Members

May 06, 2025

Latest Posts

-

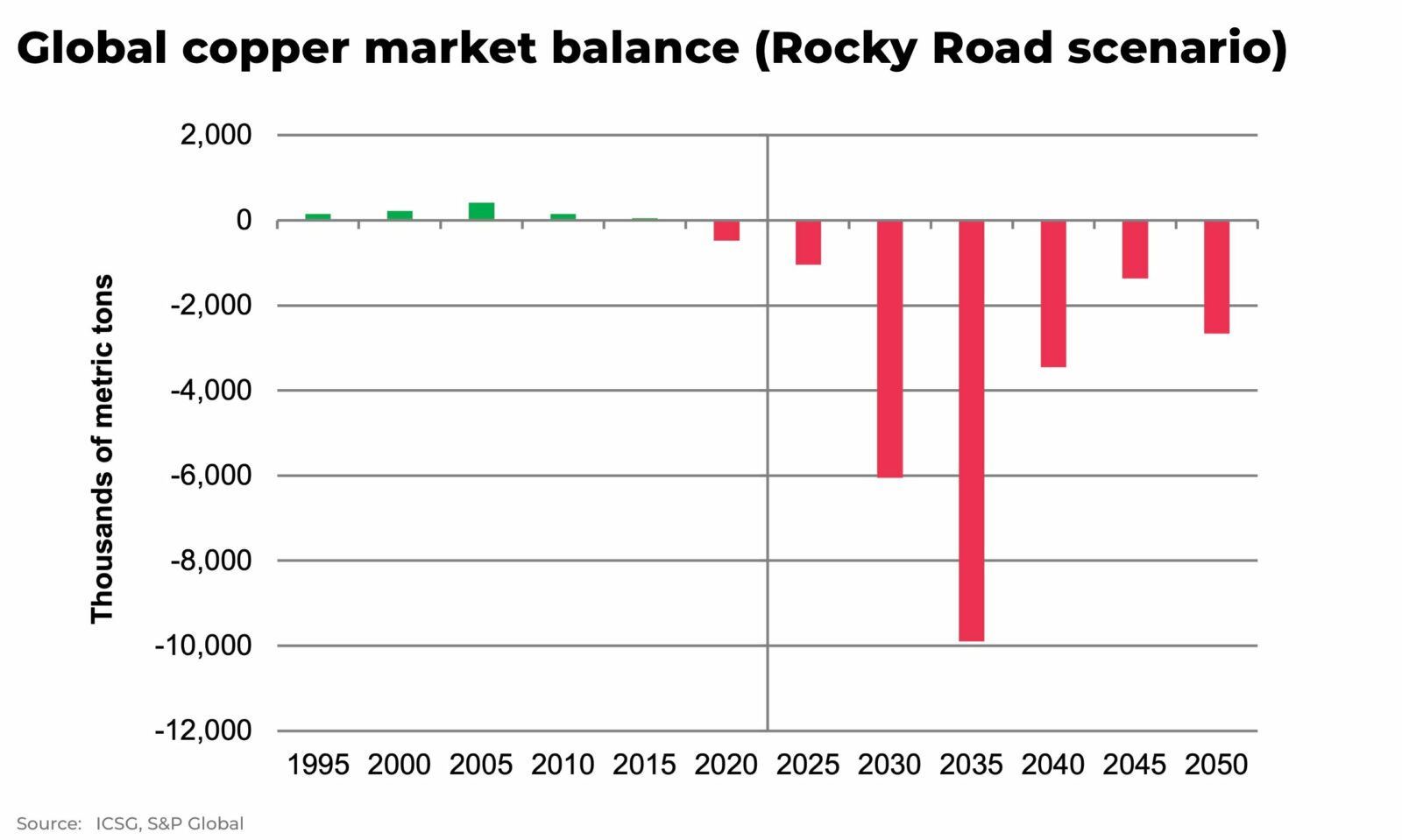

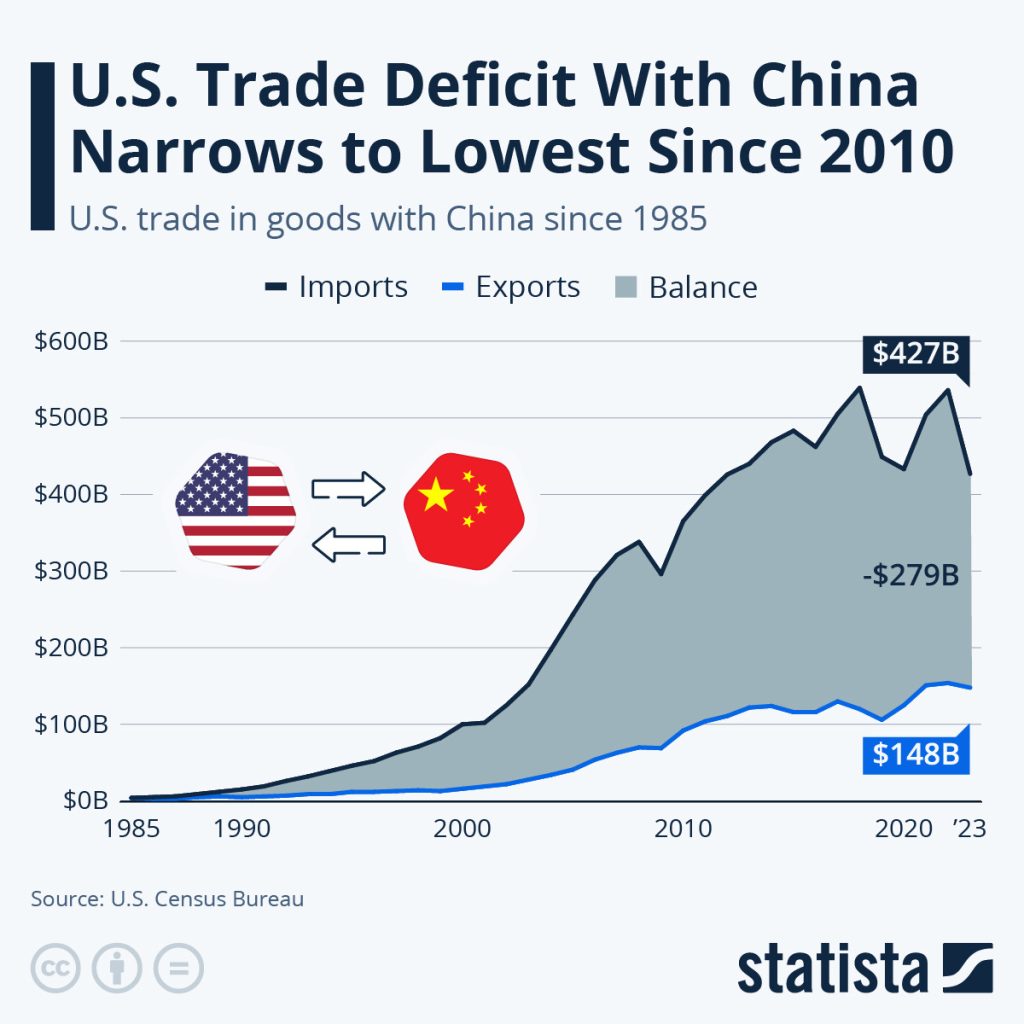

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025 -

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025 -

The Copper Market And The Us China Trade Dynamic

May 06, 2025

The Copper Market And The Us China Trade Dynamic

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025 -

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025