Stock Market Today: Dow & S&P 500 Live Updates For May 5th

Table of Contents

Dow Jones Industrial Average (DJIA) Performance

Opening Prices and Initial Trends

The Dow Jones Industrial Average opened at 33,800.50 on May 5th, representing a 0.2% increase compared to the previous day's closing price of 33,736. This positive opening suggests a cautiously optimistic start to the trading day, potentially fueled by [insert specific news or economic indicator that contributed to the positive opening, e.g., positive manufacturing data].

- Opening Price: 33,800.50

- Percentage Change from Previous Close: +0.2%

- Contributing Factors: Positive economic data releases, strong earnings reports from key Dow components.

Intraday Fluctuations and Key Movers

Throughout the trading day, the Dow experienced moderate fluctuations. While the initial positive trend persisted for a few hours, the index saw some volatility in the afternoon session.

- Top Performers:

- Company A: +2.5% (Driven by strong Q1 earnings beat)

- Company B: +1.8% (Positive analyst upgrades)

- Company C: +1.5% (Benefiting from positive sector trends)

- Worst Performers:

- Company D: -1.2% (Disappointing earnings guidance)

- Company E: -0.9% (Concerns over supply chain disruptions)

- Company F: -0.7% (Negative regulatory news)

Dow Jones Technical Analysis (Optional)

The Dow briefly tested the 33,750 support level early in the trading session before recovering. Resistance appears to be around the 34,000 mark, a level the index has struggled to break through recently.

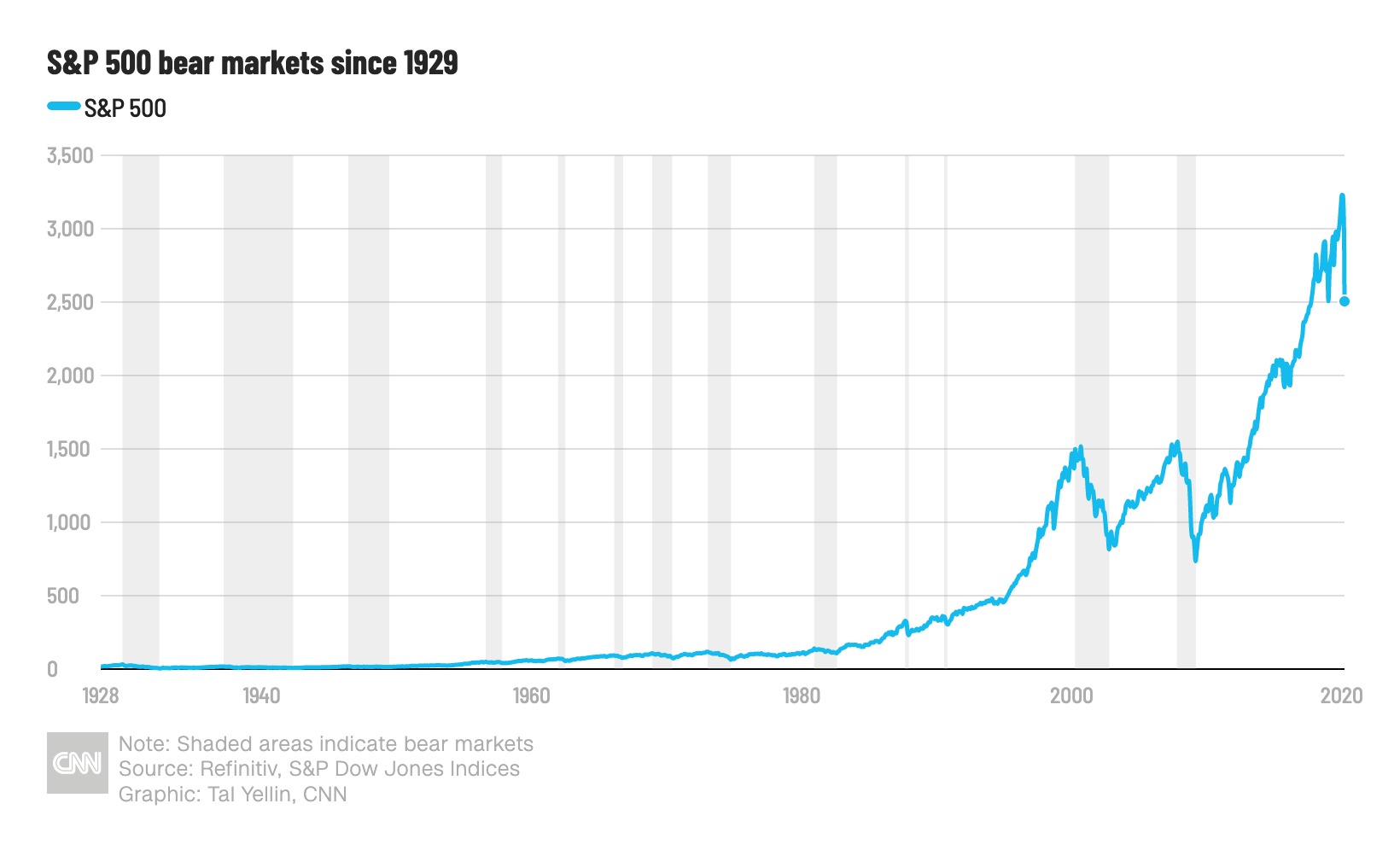

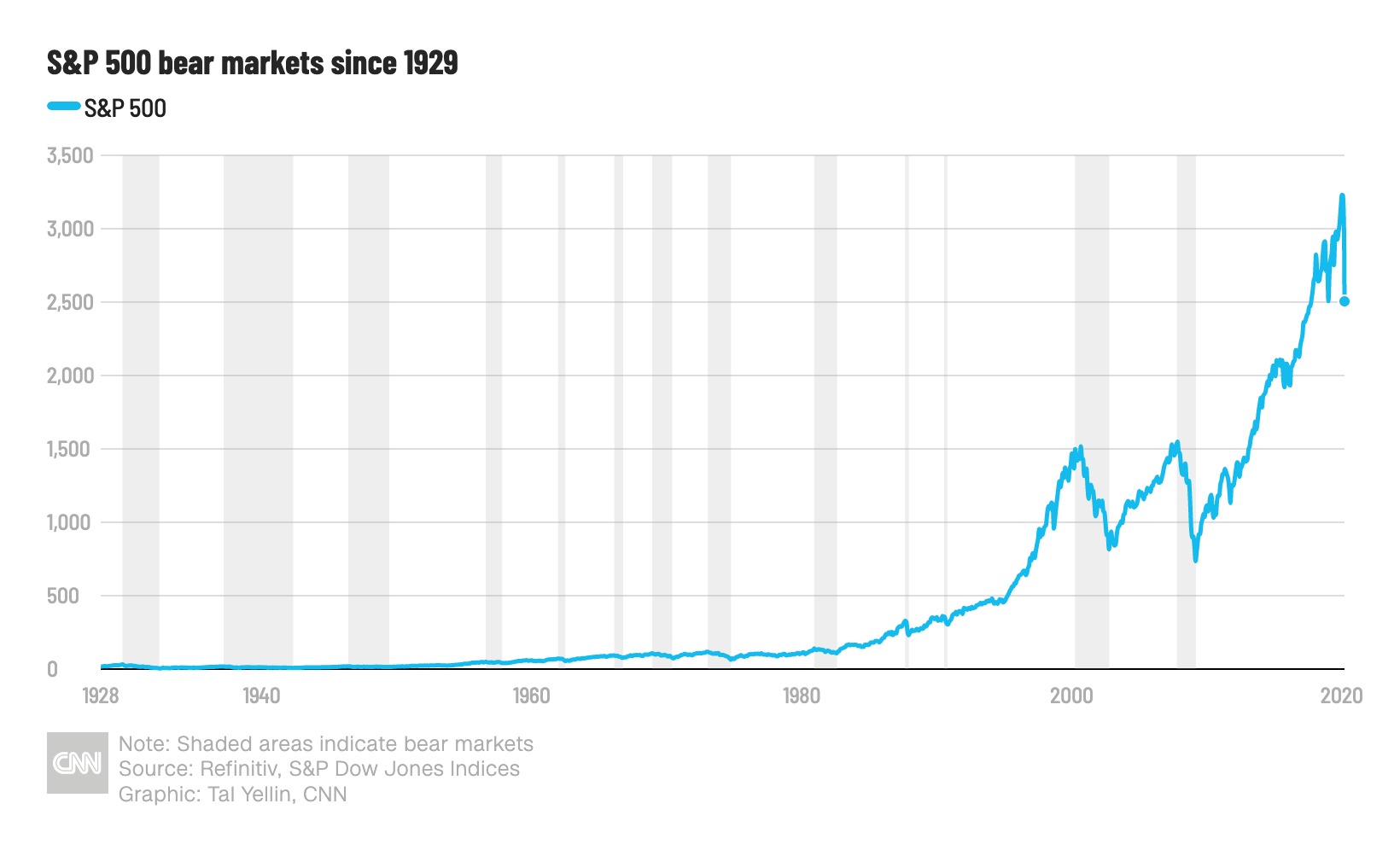

S&P 500 Index Performance

Opening Prices and Initial Trends

The S&P 500 opened at 4,145.50, showing a slight increase of 0.1% compared to the previous day's close. This mirrored the Dow's cautious optimism, indicating a generally positive market sentiment at the open.

- Opening Price: 4,145.50

- Percentage Change from Previous Close: +0.1%

- Contributing Factors: Similar to the Dow, positive economic indicators and strong earnings from several large-cap companies likely contributed to the positive opening.

Intraday Fluctuations and Key Sectors

Sector performance within the S&P 500 was mixed. The Technology sector showed strength throughout the day, while the Energy sector experienced some profit-taking after recent gains.

- Top Performing Sectors:

- Technology: +1% (Strong investor confidence in the sector)

- Consumer Discretionary: +0.8% (Positive consumer spending data)

- Worst Performing Sectors:

- Energy: -0.5% (Concerns over potential slowing demand)

- Utilities: -0.3% (Rotation out of defensive sectors)

S&P 500 Technical Analysis (Optional)

The S&P 500 remains within a key trading range, with support around 4,100 and resistance near 4,200. Breaking above 4,200 could signal a renewed bullish trend.

Overall Market Sentiment and Outlook

Investor Sentiment

Overall market sentiment remains somewhat cautious but optimistic. While the positive openings for both the Dow and S&P 500 suggest a bullish bias, the intraday fluctuations indicate a level of uncertainty persists amongst investors.

- Key Factors: Inflation concerns, potential interest rate hikes, and ongoing geopolitical uncertainties are all affecting investor confidence.

Expert Opinions (Optional)

[Insert brief quotes from market analysts or financial experts regarding their outlook for the near future. Attribute the quotes properly.]

Conclusion: Stock Market Today - Your Daily Summary

The stock market today, May 5th, saw a mixed performance for the Dow and S&P 500. Both indices opened higher, reflecting a generally positive sentiment, although intraday fluctuations revealed some underlying uncertainty. Key sectors within the S&P 500 showed varying degrees of strength and weakness, reflecting the dynamic nature of the market. Staying updated on these daily movements is crucial for informed investment decisions. Check back regularly for more live updates on the Dow and S&P 500 and stay tuned for tomorrow's stock market analysis to remain informed about the ever-evolving landscape of the stock market.

Featured Posts

-

Trade Deals Take Center Stage As Trump Plays Down Economic Risks

May 06, 2025

Trade Deals Take Center Stage As Trump Plays Down Economic Risks

May 06, 2025 -

Latest From Putin Nuclear Weapons Unnecessary In Ukraine

May 06, 2025

Latest From Putin Nuclear Weapons Unnecessary In Ukraine

May 06, 2025 -

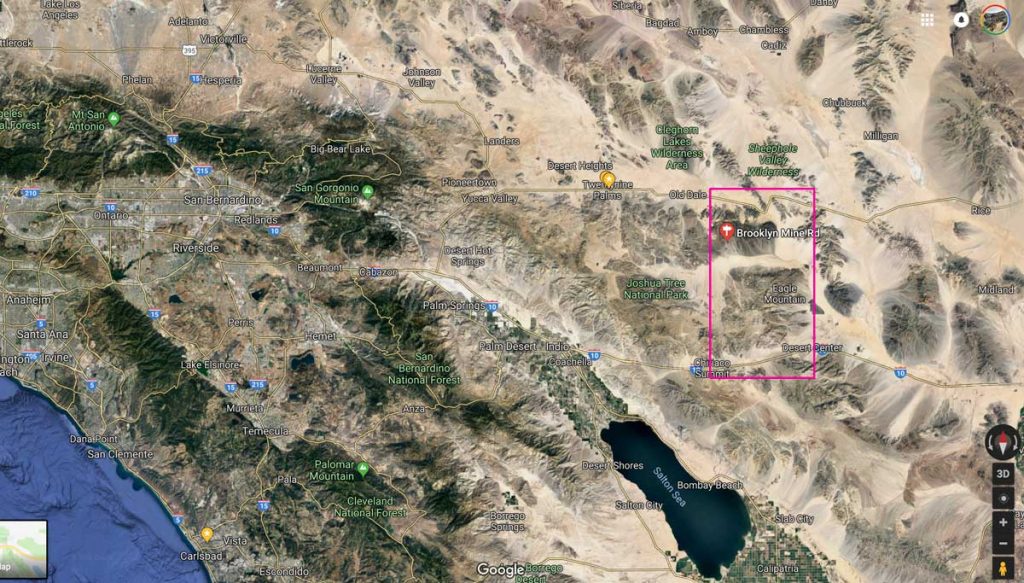

Abandoned Gold Mines Exploring The Toxic Legacy Left Behind

May 06, 2025

Abandoned Gold Mines Exploring The Toxic Legacy Left Behind

May 06, 2025 -

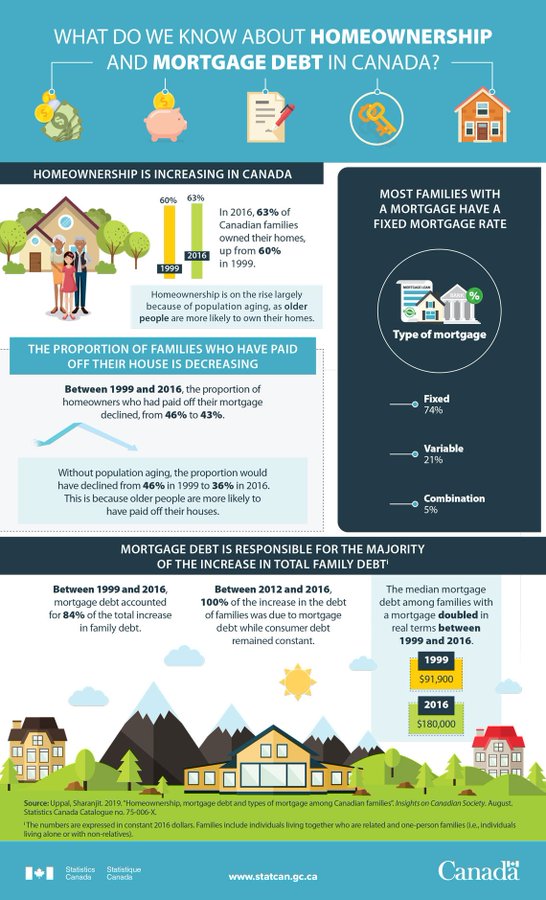

Understanding The Low Demand For 10 Year Mortgages In Canada

May 06, 2025

Understanding The Low Demand For 10 Year Mortgages In Canada

May 06, 2025 -

Google Faces Potential Breakup U S Demands Restructuring Of Advertising Business

May 06, 2025

Google Faces Potential Breakup U S Demands Restructuring Of Advertising Business

May 06, 2025

Latest Posts

-

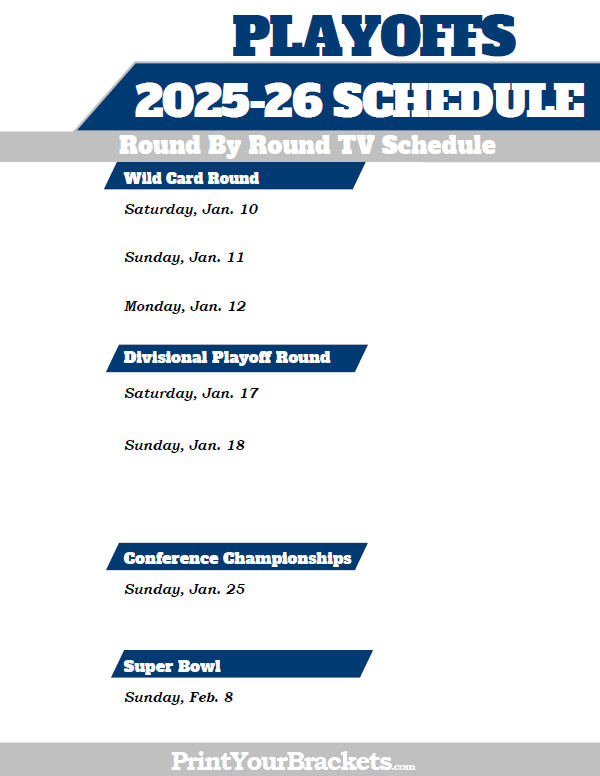

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025 -

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025 -

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream Info

May 06, 2025

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream Info

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025