Apple Stock: Q2 Earnings And Implications For Investors

Table of Contents

Q2 Earnings Report: Key Highlights

Apple's Q2 2024 earnings report revealed a mixed bag for investors. While certain segments showed robust growth, others fell slightly short of expectations. Analyzing these key highlights is vital for understanding the overall picture and making informed predictions about the future of Apple stock.

-

Apple Q2 Revenue: Apple reported [Insert Actual Q2 Revenue Figure] in revenue, [Insert Percentage Change compared to Q1 and Q2 of previous year] compared to the same quarter last year and [Insert Percentage Change compared to analyst expectations] compared to analyst expectations. This demonstrates [Positive/Negative/Neutral - choose one and explain] growth across the board, with particularly strong performance in [mention specific product categories showing strong growth, e.g., Services, Wearables]. However, the [mention specific product categories showing weaker performance, e.g., iPhone] segment experienced a [Percentage] decline, potentially due to [mention possible reasons, e.g., economic slowdown, increased competition].

-

Apple EPS (Earnings Per Share): Apple's EPS came in at [Insert Actual EPS Figure], exceeding analyst expectations of [Insert Analyst Expectations] by [Insert Percentage Difference]. This surpasses last year's Q2 EPS of [Insert Last Year's Q2 EPS] by [Insert Percentage Difference]. This positive surprise can be attributed to [mention key contributing factors, e.g., cost-cutting measures, strong sales in key markets].

-

Apple Guidance: Apple provided Q3 guidance of [Insert Q3 Guidance Figure], representing [Insert Percentage Change] compared to Q2. This suggests [Optimistic/Cautious - choose one] outlook for the remainder of the year, with the company citing [mention factors influencing the guidance, e.g., anticipated new product launches, macroeconomic conditions] as key influencing factors.

-

Gross Margins: Apple's gross margin remained relatively stable at [Insert Gross Margin Percentage], showing [Positive/Negative/Neutral - choose one] change compared to the previous quarter. This stability indicates [explain the impact on profitability; e.g., effective cost management, resilience in pricing strategies].

-

One-Time Items: [Mention any significant one-time items impacting the earnings report, such as restructuring charges or asset sales, and their effect on the overall financial picture].

Impact on Apple Stock Price

The immediate market reaction to Apple's Q2 earnings report was [Describe market reaction: increase, decrease, or stability]. The Apple stock price [Describe price movement and percentage change]. This reaction can be attributed to several factors, directly linked to the elements of the earnings report.

-

Market Sentiment: Investors reacted [Positively/Negatively/Neutrally - choose one] to the reported results, primarily driven by [mention specific aspects of the earnings report that influenced investor sentiment, e.g., exceeding EPS expectations, weaker-than-expected iPhone sales].

-

Short-Term and Long-Term Implications: The short-term outlook for Apple stock appears [Bullish/Bearish/Neutral - choose one], with the price potentially influenced by [mention short-term catalysts, e.g., upcoming product releases, market volatility]. The long-term outlook, however, remains [Bullish/Bearish/Neutral - choose one], predicated on [mention long-term factors, e.g., continued growth in services revenue, expansion into new markets].

-

Technical Analysis: [Include relevant technical analysis, such as support and resistance levels, chart patterns, or other indicators, if applicable.]

-

Potential Catalysts: Future catalysts that could significantly impact the Apple stock price include [list potential catalysts, e.g., new iPhone models, advancements in augmented reality/virtual reality technology, regulatory changes].

Implications for Investors: Should You Buy, Sell, or Hold?

Based on the Q2 results and the outlook for the remainder of the year, the investment strategy for Apple stock depends heavily on individual risk tolerance and investment timelines.

-

Investment Recommendation: For investors with a long-term horizon and a higher risk tolerance, a [Buy/Hold/Sell - choose one] recommendation might be appropriate, given the potential for long-term growth in Apple's services segment and expansion into new technologies. For investors with a shorter-term horizon or a lower risk tolerance, a [Buy/Hold/Sell - choose one] strategy may be more suitable, given the potential for near-term market volatility.

-

Risks and Opportunities: Investing in Apple stock presents both risks and opportunities. Risks include macroeconomic headwinds, increased competition in the smartphone market, and potential supply chain disruptions. Opportunities lie in Apple's strong brand recognition, loyal customer base, and potential for growth in emerging technologies.

-

Investment Strategies: Long-term investors may consider dollar-cost averaging to mitigate risk, while short-term investors might employ more active trading strategies based on technical analysis and market sentiment.

-

Alternative Investments: Investors might consider diversifying their portfolio by exploring alternative investments within the tech sector, such as [mention examples of other tech stocks].

Conclusion

Apple's Q2 earnings report paints a picture of [positive/negative/mixed – choose based on the analysis] performance. While revenue growth in certain key areas was strong, other segments showed some weakness. The implications for investors are [summarize recommendation: bullish, bearish, or neutral], depending on their individual risk profiles and investment horizons.

Call to Action: Understanding the nuances of Apple's Q2 earnings and their impact on the Apple stock price is crucial for informed investment decisions. Stay tuned for further analysis and continue to monitor the Apple stock and its performance in the coming quarters. Learn more about effective Apple stock investment strategies and make informed decisions today!

Featured Posts

-

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025 -

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025 -

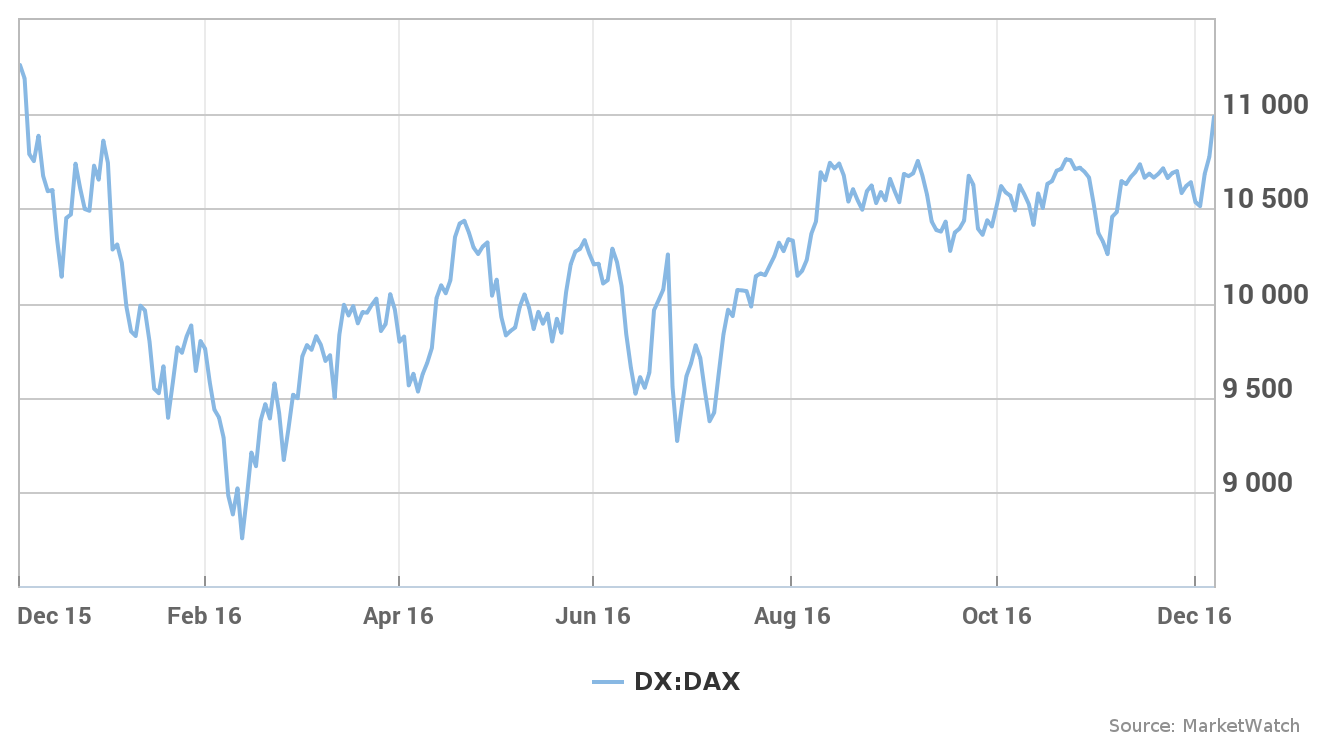

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025 -

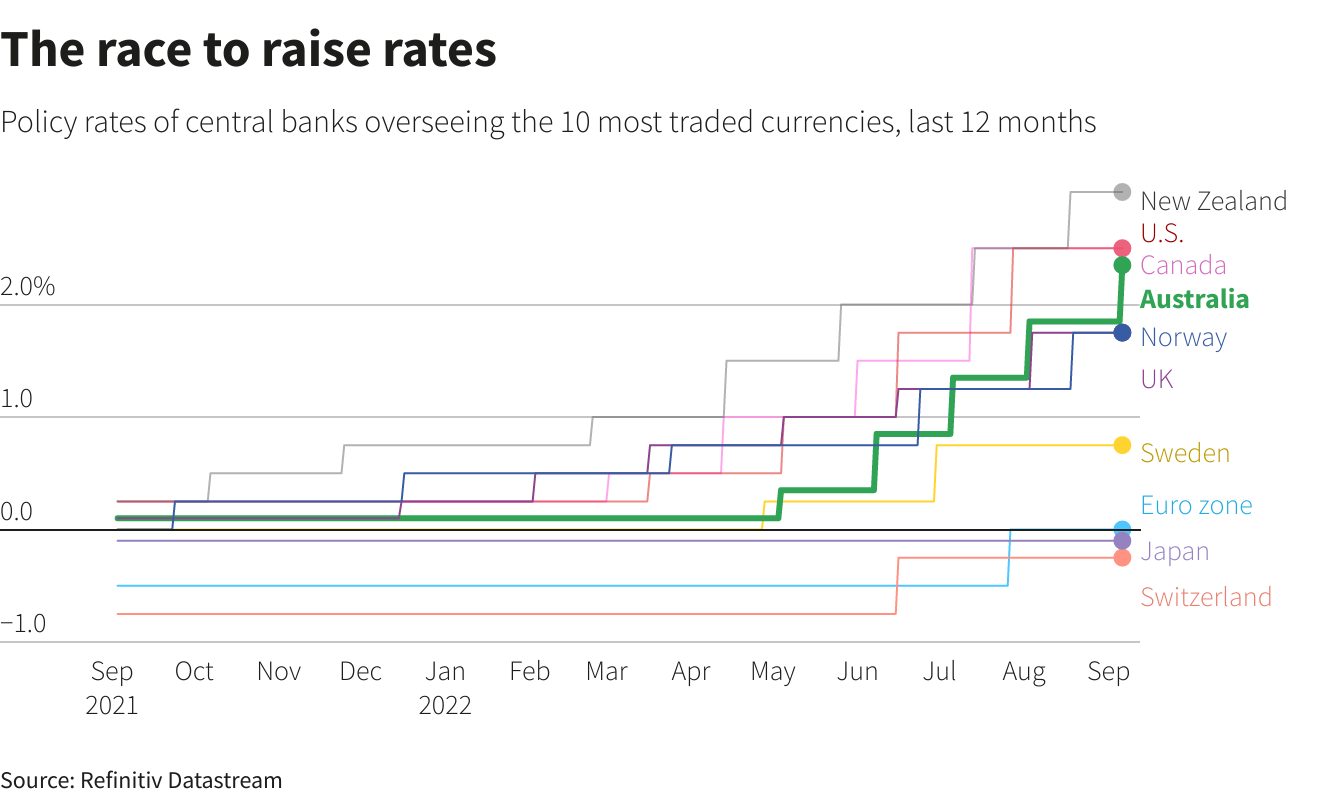

Boe Rate Cut Probabilities Fall As Uk Inflation Surprises Boosting Pound

May 24, 2025

Boe Rate Cut Probabilities Fall As Uk Inflation Surprises Boosting Pound

May 24, 2025

Latest Posts

-

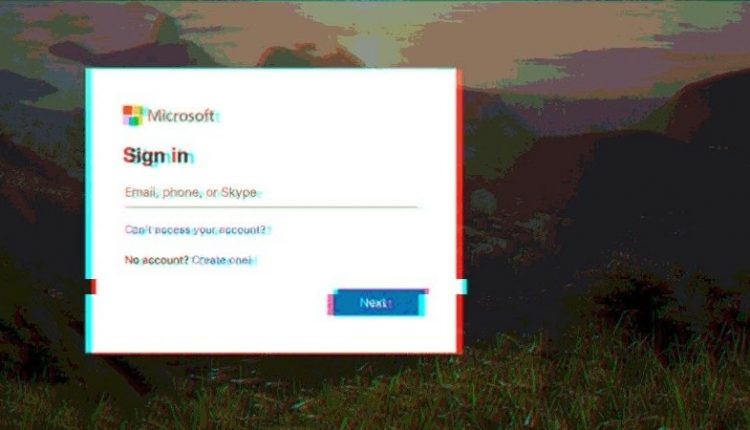

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 24, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 24, 2025 -

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025 -

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025 -

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025 -

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025