Pre-Q2 Apple Stock: A Look At Current Market Conditions

Table of Contents

Analyzing Recent Apple Stock Performance

Key Performance Indicators (KPIs)

Understanding the recent Apple stock price fluctuations is crucial for assessing the Pre-Q2 Apple Stock outlook. Let's examine some key performance indicators:

- Stock Price Fluctuations: Over the past [insert timeframe, e.g., month], Apple's stock price has shown a [insert percentage and direction, e.g., 5% increase], largely attributed to [cite reason, e.g., positive investor sentiment regarding new product launches]. (Source: [Insert reputable financial source, e.g., Yahoo Finance])

- Trading Volume: Trading volume has been [insert description, e.g., relatively high], indicating [insert interpretation, e.g., significant investor interest]. (Source: [Insert reputable financial source])

- Market Capitalization: Apple's market capitalization currently stands at [insert figure] demonstrating its [insert interpretation, e.g., continued dominance] in the tech sector. (Source: [Insert reputable financial source])

Impact of Global Economic Conditions

Macroeconomic factors significantly influence Apple stock price. The current global economic climate presents both challenges and opportunities for Apple:

- Inflation: Rising inflation could reduce consumer spending on discretionary items like Apple products, potentially impacting Pre-Q2 Apple Stock negatively.

- Interest Rates: Increasing interest rates might affect borrowing costs for businesses and consumers, impacting demand for Apple's products and services.

- Global Supply Chain Issues: Ongoing supply chain disruptions could affect Apple's production and delivery timelines, potentially influencing the Apple market performance and Pre-Q2 Apple Stock price.

Assessing Pre-Q2 Analyst Predictions and Expectations

Review of Analyst Ratings and Price Targets

Financial analysts offer valuable insights into the anticipated Q2 earnings forecast for Apple. Let's review their predictions:

- Consensus Estimates: The consensus among analysts points towards a [insert percentage and direction, e.g., 7% increase] in Apple's Q2 revenue compared to the same period last year. (Source: [Insert reputable financial source, e.g., Bloomberg])

- Price Targets: Several analysts have set price targets for Apple stock ranging from [insert price range, e.g., $170 to $200], indicating varied expectations for Pre-Q2 Apple Stock. (Source: [Insert reputable financial source])

Market Sentiment and Investor Confidence

Investor sentiment plays a crucial role in determining Apple stock price. Currently, the market sentiment seems to be [insert description, e.g., cautiously optimistic], influenced by:

- Recent Product Launches: The launch of [insert recent Apple product, e.g., the iPhone 15] has generally been well-received, boosting investor confidence.

- Technological Advancements: Apple's continued investments in research and development fuel expectations for future innovation and growth.

- Competitive Landscape: The competitive landscape remains intense, requiring Apple to maintain its innovative edge to retain its market share.

Identifying Potential Risks and Opportunities for Pre-Q2 Apple Stock

Geopolitical Risks and Supply Chain Challenges

Geopolitical uncertainties and supply chain vulnerabilities pose risks to Apple's business:

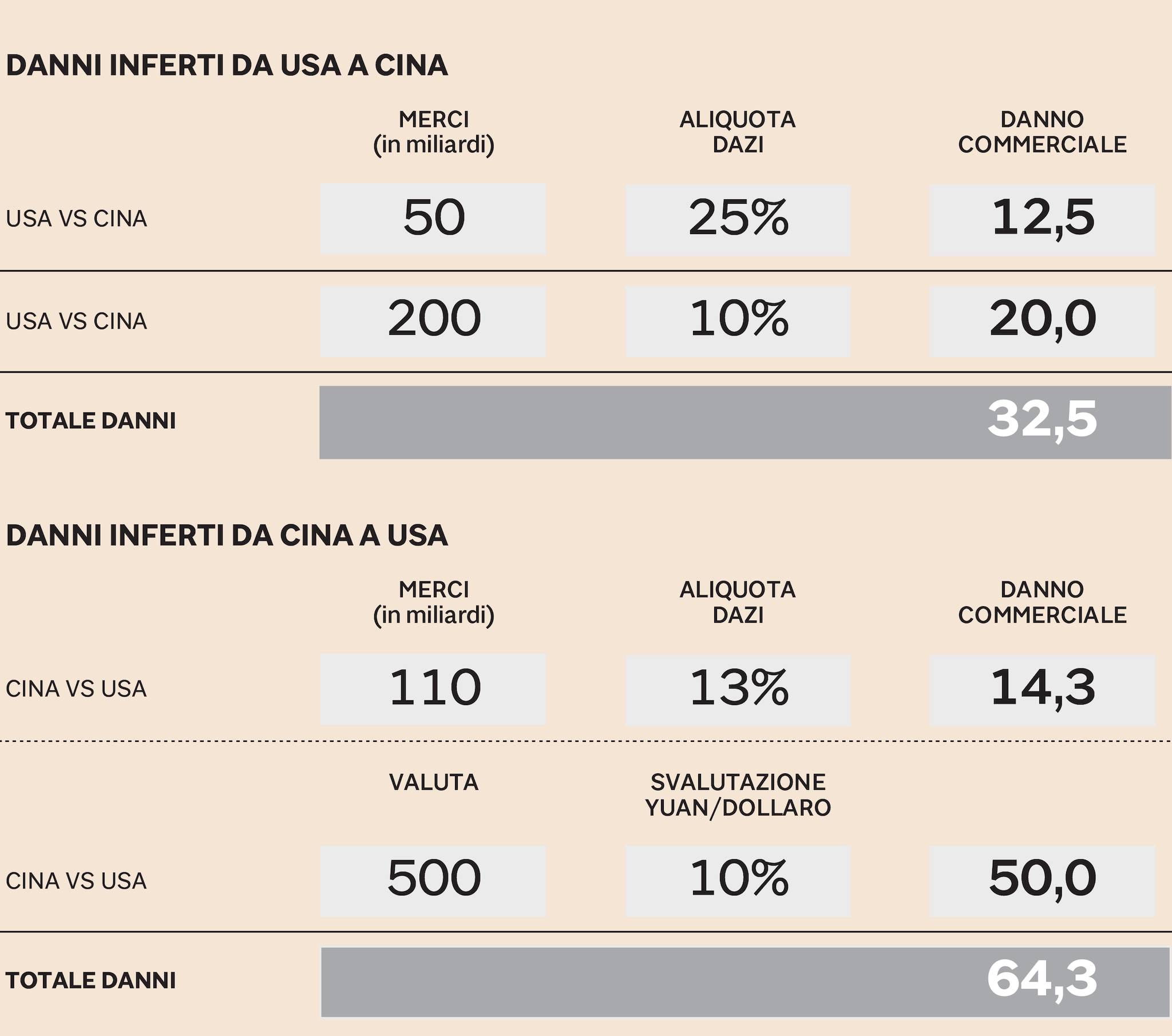

- Geopolitical Instability: [mention specific events, e.g., Trade tensions between the US and China] could disrupt Apple's supply chains and affect its manufacturing operations.

- Supply Chain Disruptions: [mention specific challenges, e.g., Component shortages] could constrain Apple's production capacity, impacting its revenue and potentially depressing the Pre-Q2 Apple Stock value.

Competitive Landscape and Technological Innovation

Apple faces increasing competition and needs to continue innovating to maintain its leadership:

- Competition: [mention specific competitors, e.g., Samsung and Google] are strong competitors, putting pressure on Apple to maintain its product differentiation.

- Technological Innovation: Apple's ability to deliver groundbreaking products and services is essential for maintaining its premium valuation and driving future growth for Pre-Q2 Apple Stock.

Investing in Pre-Q2 Apple Stock: A Final Verdict

Analyzing Pre-Q2 Apple Stock requires a thorough understanding of recent performance, analyst expectations, and potential risks. While the outlook appears [insert overall assessment, e.g., relatively positive], significant factors like global economic conditions and geopolitical events could significantly impact the Apple market performance. The information provided here is for informational purposes only and does not constitute financial advice.

To make informed decisions regarding Pre-Q2 Apple Stock, conduct thorough independent research, consider your own risk tolerance, and consult with a financial advisor before making any investment decisions. Stay informed on the latest developments leading up to Apple's Q2 earnings announcement to make well-informed decisions regarding Pre-Q2 Apple Stock and its future performance.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Calculation And Its Importance For Investors

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Calculation And Its Importance For Investors

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025 -

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025 -

Evrovidenie 2014 Konchita Vurst Ot Kaming Auta V 13 Let Do Mechty O Roli Devushki Bonda

May 24, 2025

Evrovidenie 2014 Konchita Vurst Ot Kaming Auta V 13 Let Do Mechty O Roli Devushki Bonda

May 24, 2025 -

Stijging Aex Een Contrast Met De Onrust Op De Amerikaanse Beurs

May 24, 2025

Stijging Aex Een Contrast Met De Onrust Op De Amerikaanse Beurs

May 24, 2025

Latest Posts

-

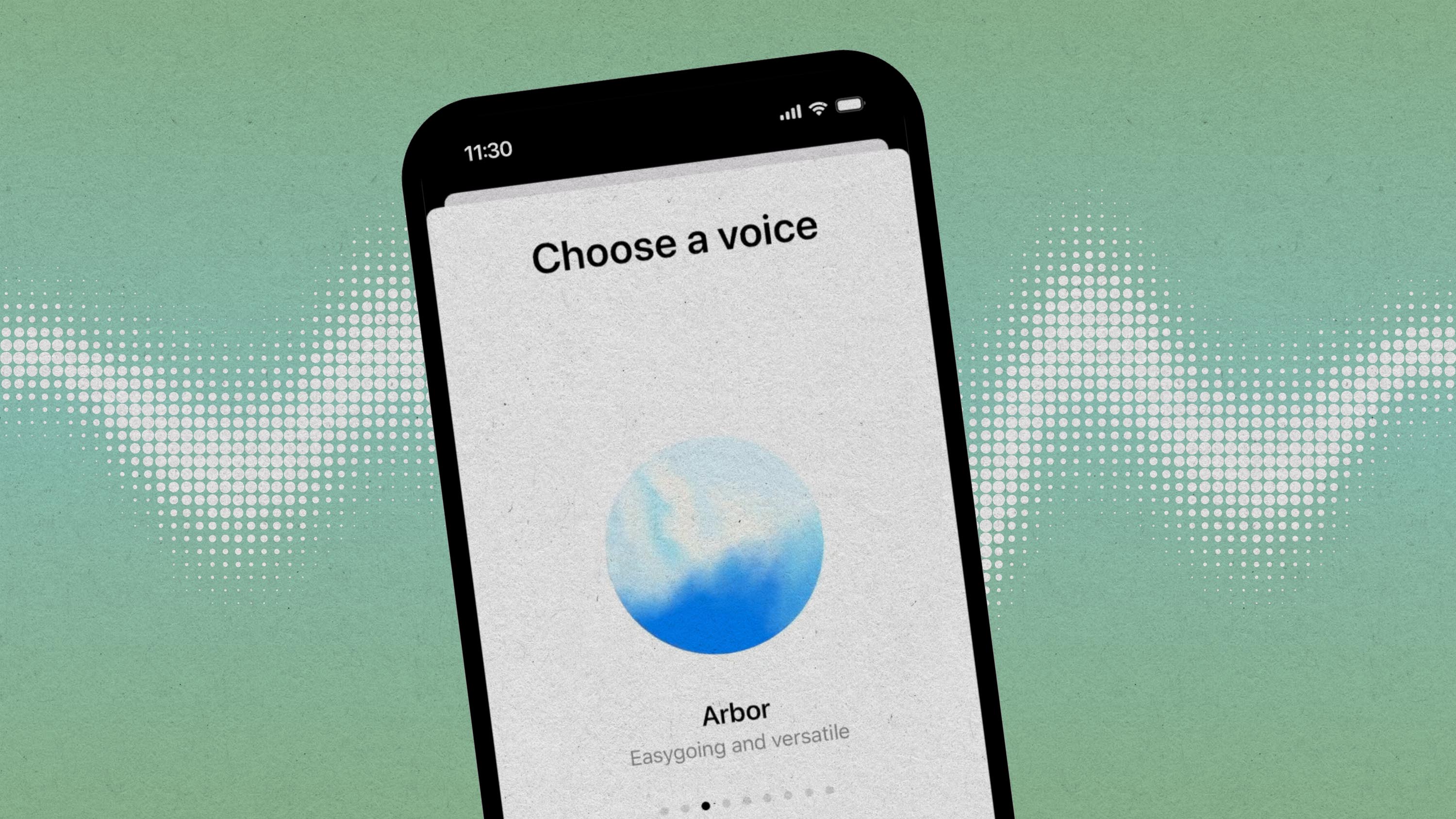

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025 -

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025 -

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025