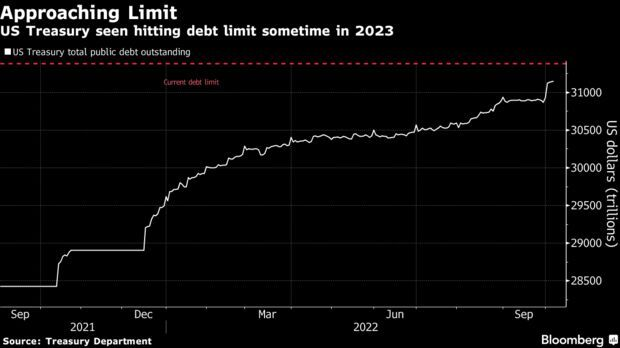

Treasury Official: US Debt Limit Measures Could Expire In August

Table of Contents

Understanding the US Debt Limit and its Implications

What is the Debt Ceiling?

The US debt ceiling, also known as the debt limit, is a legally mandated limit on the total amount of money the US government can borrow to meet its existing obligations. It's not a limit on spending; rather, it's a limit on how the government finances its already-approved spending. Congress sets this limit, and raising it requires congressional action.

- Historical Context: The debt ceiling has been raised numerous times throughout US history, reflecting the country's evolving fiscal needs.

- Past Close Calls: There have been several instances where the debt ceiling debate came down to the wire, creating uncertainty in financial markets. In 2011, a similar standoff led to a downgrade of the US credit rating.

- Keywords: debt ceiling, debt limit, government borrowing, fiscal responsibility, national debt.

The Impact of Reaching the Debt Limit

Failing to raise the debt ceiling before the limit is reached has severe potential consequences:

- Government Shutdowns: The government might be forced to shut down non-essential services due to a lack of funding.

- Default on US Debt Obligations: This is the most serious risk. A default would severely damage the US's reputation and creditworthiness, leading to global economic turmoil.

- Credit Rating Downgrade: A default could result in a downgrade of the US credit rating, making it more expensive for the government to borrow money in the future.

- Global Market Instability: A US default would likely trigger widespread market volatility, impacting global stock markets and potentially leading to a global recession.

- Keywords: government shutdown, default risk, credit rating downgrade, economic uncertainty, financial crisis.

The Treasury Department's Warning and the August Deadline

The Treasury's Extraordinary Measures

To avoid breaching the debt limit before Congress acts, the Treasury Department employs "extraordinary measures." These are accounting maneuvers that allow the government to continue paying its bills for a limited time. These measures include prioritizing payments and suspending investments in certain government programs.

- Mechanics of Extraordinary Measures: The Treasury might prioritize payments on certain types of debt, such as Treasury bonds held by foreign governments, while delaying payments on other obligations.

- Keywords: extraordinary measures, Treasury Department, accounting maneuvers, debt management, fiscal flexibility.

The August Deadline and its Significance

The Treasury Department's warning points to a potential exhaustion of these extraordinary measures as early as August. This is not a precise date, however, as it depends on factors like tax revenue collection and government spending.

- Uncertainty of the Exact Date: The actual date of expiration remains uncertain and depends on various economic factors.

- Potential for Earlier Expiration: Lower-than-projected tax revenues could force an earlier expiration of the measures.

- Keywords: August deadline, expiration date, fiscal year, revenue projections, uncertainty.

Potential Economic Consequences and Political Fallout

Economic Ramifications

The failure to raise the debt ceiling could have devastating economic ramifications:

- Economic Recession: A government default could trigger a severe economic recession, resulting in job losses and business closures.

- Inflation: The uncertainty surrounding the debt ceiling could lead to higher inflation rates.

- Market Volatility: Financial markets would likely experience significant volatility, with potential declines in stock prices and increased bond yields.

- Increased Borrowing Costs: The US government's borrowing costs would rise, making it more expensive to finance the national debt.

- Keywords: economic recession, inflation, market volatility, interest rates, economic impact.

Political Implications and Negotiations

The debt limit debate is highly politicized, with potential for significant partisan gridlock:

- Political Gridlock: Disagreements between the political parties on spending levels and fiscal policy could prevent a timely resolution.

- Bipartisan Negotiations: Reaching a compromise between the Democrats and Republicans will be essential to avoid a crisis.

- Role of Congress and the President: Congress is responsible for raising the debt ceiling, while the President plays a key role in negotiations and in urging Congress to act.

- Keywords: political gridlock, bipartisan negotiations, Congress, White House, political stalemate.

Conclusion

The impending expiration of extraordinary measures to avoid exceeding the US debt limit in August presents a significant risk to the US and global economy. The potential for severe economic consequences, including a government default, market volatility, and a potential recession, underscores the urgency of swift political action. The failure to raise the debt ceiling could have devastating repercussions.

To avoid a US debt ceiling crisis, it is crucial to stay informed about the latest developments. Contact your representatives to express your concerns about the US debt limit and the potential consequences of inaction. Regularly search for updates on the "US debt limit," "debt limit debate," and "avoiding a US debt default" to remain informed about this critical issue. The future of the US economy depends on it.

Featured Posts

-

Can Nigel Farages Reform Party Deliver A Realistic Assessment

May 10, 2025

Can Nigel Farages Reform Party Deliver A Realistic Assessment

May 10, 2025 -

West Bengal Madhyamik Exam Result 2025 Download Merit List Pdf

May 10, 2025

West Bengal Madhyamik Exam Result 2025 Download Merit List Pdf

May 10, 2025 -

The Countrys Fastest Growing Business Areas A Comprehensive Guide

May 10, 2025

The Countrys Fastest Growing Business Areas A Comprehensive Guide

May 10, 2025 -

Bangkok Post Reports Increased Advocacy For Transgender Rights

May 10, 2025

Bangkok Post Reports Increased Advocacy For Transgender Rights

May 10, 2025 -

Pirros Comments On Due Process For Us Detainees In El Salvador

May 10, 2025

Pirros Comments On Due Process For Us Detainees In El Salvador

May 10, 2025