US Debt Ceiling: August Deadline Looms, Treasury Warns

Table of Contents

What is the US Debt Ceiling and Why is it a Problem?

The US debt ceiling is a legally mandated limit on the total amount of money the federal government can borrow to meet its existing obligations. This isn't about spending new money; it's about paying for what Congress has already authorized. When the debt ceiling is reached, the government can no longer borrow to cover its expenses, including paying salaries to federal employees, Social Security benefits, and interest on the national debt.

Exceeding the debt ceiling carries severe consequences. A failure to raise the limit could lead to a partial or complete government shutdown, impacting essential services. More alarmingly, it could result in a default on US debt obligations – a situation with potentially catastrophic economic ramifications. This creates a high-stakes political battle, as partisan disagreements frequently hinder timely action.

- Definition of the US debt ceiling: A legal limit on the total amount of money the US government can borrow.

- Historical context of debt ceiling increases: The debt ceiling has been raised numerous times throughout US history, often with political maneuvering and brinkmanship.

- Impact on US credit rating and global markets: A US default would severely damage the country's credit rating and trigger global market turmoil.

- Potential consequences for social security and other government programs: Failure to raise the debt ceiling could lead to delays or cuts in vital social programs.

The August Deadline: A Ticking Time Bomb

Treasury Secretary Janet Yellen has issued stark warnings, projecting a potential default as early as August if Congress doesn't act to raise the debt ceiling. The Treasury has already begun employing "extraordinary measures" – accounting maneuvers to temporarily manage cash flow – but these are not a long-term solution. The exact date of potential default remains uncertain, influenced by factors such as tax revenues and government spending.

- Specific date of the projected Treasury deadline: While the exact date is fluid, August is currently cited as a critical timeframe.

- Explanation of the Treasury's use of "extraordinary measures": These are accounting techniques to temporarily postpone default, buying time for Congressional action.

- Potential scenarios depending on congressional action (or inaction): A range of outcomes are possible, from a last-minute deal to a significant economic crisis.

- Timeline of events leading up to the deadline: Tracking the negotiations and the countdown is crucial to understanding the evolving situation.

Potential Economic Consequences of a Default

A US default on its debt would have devastating economic consequences, both domestically and internationally. A global recession could ensue, with increased interest rates and heightened market volatility. The value of the US dollar would likely plummet, impacting international trade and investment. Individual Americans would face potential job losses, decreased investment opportunities, and increased uncertainty about the economy.

- Potential rise in interest rates: A default would likely trigger a spike in interest rates, making borrowing more expensive for businesses and consumers.

- Risk of a global recession: The US plays a significant role in the global economy; a default could trigger a domino effect, leading to a worldwide recession.

- Impact on the stock market and other financial assets: A default would likely lead to significant declines in the stock market and other financial assets.

- Consequences for consumer spending and economic growth: Reduced consumer confidence and spending would stifle economic growth.

- Impact on the value of the US dollar: The US dollar's position as the world's reserve currency could be threatened.

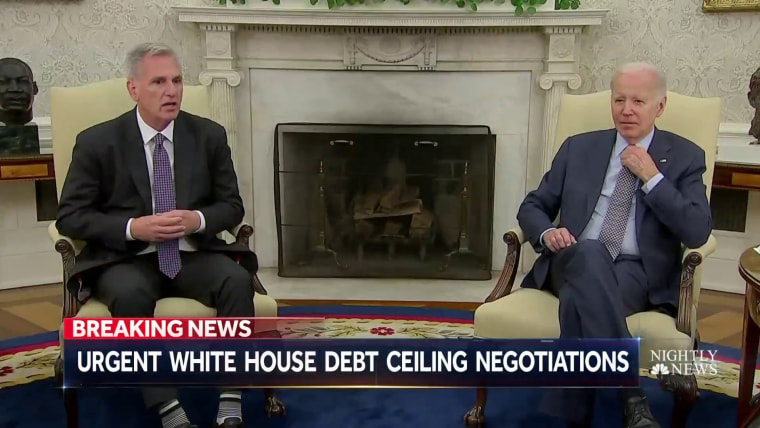

Political Maneuvering and Potential Solutions

Reaching a bipartisan agreement on raising the debt ceiling is proving exceptionally challenging. Political divisions and differing priorities complicate the process, making a timely resolution uncertain. Several compromise proposals are under consideration, but their success hinges on bridging the gap between opposing political viewpoints. Alternative strategies, such as a short-term increase coupled with longer-term spending negotiations, are also being debated.

- Positions of different political parties: Understanding the specific demands and concerns of each party is key to analyzing the likelihood of a compromise.

- Potential compromise solutions under consideration: Different proposals involve varying levels of spending cuts and debt ceiling increases.

- Role of the President and Congress in resolving the crisis: Both branches of government bear responsibility for finding a solution before the deadline.

- Analysis of potential legislative pathways: The procedural aspects of passing a debt ceiling increase through Congress are complex and time-sensitive.

Conclusion

The looming August deadline for the US debt ceiling presents a significant threat to the US and global economies. Failure to reach a resolution could have devastating consequences, ranging from a government shutdown to a full-blown financial crisis. Understanding the intricacies of the US debt ceiling and its potential impacts is crucial for informed civic engagement. The debt ceiling crisis demands immediate attention.

Call to Action: Stay informed about developments surrounding the US debt ceiling crisis. Contact your representatives in Congress and urge them to prioritize a bipartisan solution to avoid a catastrophic default. Learn more about the US debt ceiling and its implications for the future of the American economy. Your voice matters in preventing a potential debt ceiling default.

Featured Posts

-

Beyonces Cowboy Carter Streams Double Following Tour Kickoff

May 10, 2025

Beyonces Cowboy Carter Streams Double Following Tour Kickoff

May 10, 2025 -

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025 -

Trump Mulls Jeanine Pirro For Dc Prosecutor A Fox News Perspective

May 10, 2025

Trump Mulls Jeanine Pirro For Dc Prosecutor A Fox News Perspective

May 10, 2025 -

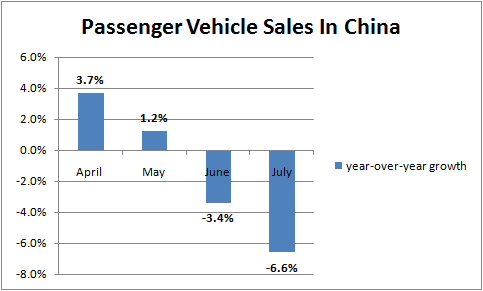

Analyzing The China Market The Struggles Of Premium Automakers Like Bmw And Porsche

May 10, 2025

Analyzing The China Market The Struggles Of Premium Automakers Like Bmw And Porsche

May 10, 2025 -

Municipales 2026 La Strategie Ecologiste Pour Dijon

May 10, 2025

Municipales 2026 La Strategie Ecologiste Pour Dijon

May 10, 2025