News Corp's Hidden Value: Underappreciated Business Units And Future Growth

Table of Contents

Dow Jones & Co. - More Than Just the Wall Street Journal

H3: A Foundation of Financial News and Data:

The Wall Street Journal, a cornerstone of Dow Jones & Co., boasts an enduring value proposition built on its subscription model and its undeniable dominance in financial news. Its reputation for high-quality journalism and insightful analysis attracts a loyal and affluent subscriber base, forming a solid foundation for revenue generation. This is further strengthened by Dow Jones Newswires, which provides real-time data crucial for financial professionals worldwide. This real-time data feed is a critical component of many trading desks and financial analysis platforms. The potential for growth is significant, particularly through expanding digital subscriptions, targeting new demographics, and penetrating emerging financial markets in Asia and South America.

- Strong brand recognition: The Wall Street Journal name is synonymous with trusted financial news.

- Loyal subscriber base: A history of providing reliable information fosters strong customer retention.

- Potential for international expansion: Untapped markets offer significant growth opportunities.

- Data-driven revenue streams: Dow Jones Newswires provides a diverse and expanding revenue stream.

H3: Beyond the Journal: Diversification and Future Prospects:

Dow Jones's offerings extend far beyond the Wall Street Journal. Its portfolio includes risk and compliance solutions, crucial for navigating the complex regulatory landscape of the financial world. These solutions represent a growing segment of the market, offering significant opportunities for increased revenue. Furthermore, strategic acquisitions of smaller, niche financial data providers could further strengthen its position and expand its product offerings. This approach could also introduce new technologies and capabilities, reinforcing its competitive advantage.

- Market leadership: Dow Jones maintains a leading position in financial news and data.

- Diverse revenue streams: Reducing reliance on any single product mitigates risk.

- Opportunities for technological innovation: Integrating new technologies enhances efficiency and appeal.

- Strategic partnerships: Collaborations with other financial institutions expand reach and influence.

News Corp's Book Publishing Division - A Steady Revenue Stream with Growth Potential

H3: HarperCollins' Strength in a Changing Market:

HarperCollins, a major player in the global book publishing industry, demonstrates remarkable adaptability in a constantly evolving market. Its success lies in its ability to publish across various formats, seamlessly integrating print and digital offerings to cater to a broader audience. Its diverse portfolio spans numerous genres, including bestsellers, literary fiction, and educational materials, providing a balanced and resilient revenue stream. Furthermore, there's significant potential for expansion into new markets, focusing on untapped regions and emerging literary scenes. Growth in digital publishing formats, including audiobooks and e-books, offers further opportunities for expansion.

- Strong author relationships: HarperCollins fosters strong collaborations with leading authors.

- Diverse publishing portfolio: A broad range of titles mitigates risk and captures diverse markets.

- Adaptation to digital trends: HarperCollins successfully embraces and integrates new technologies.

- Global reach: International expansion offers significant opportunities for growth.

H3: Leveraging Intellectual Property for Future Growth:

HarperCollins possesses a vast library of intellectual property, a valuable asset often overlooked in traditional valuation models. This intellectual property presents exciting avenues for creating new revenue streams. Film and television adaptations of successful books, for example, can generate significant income and further enhance brand recognition. Strategic partnerships with media companies could unlock the full potential of this IP, creating synergistic opportunities for expansion into related markets. Acquisitions of smaller publishing houses with strong IP portfolios can also significantly enhance the overall value of this division.

- Strong IP portfolio: HarperCollins owns the rights to numerous successful literary works.

- Potential for brand extensions: Expanding into related merchandise and licensing opportunities.

- Opportunities for synergistic collaborations: Partnering with media companies to leverage IP.

News Corp's Real Estate Portfolio - An Often-Overlooked Asset

H3: Strategic Real Estate Holdings and Their Value:

News Corp owns a significant portfolio of real estate, often undervalued in traditional financial analyses. These properties, strategically located in key metropolitan areas, possess considerable potential for appreciation. The company could monetize these assets through strategic sales or long-term leasing arrangements. This could provide a significant influx of capital that can be reinvested into other growth areas within the company, bolstering its overall financial health and stability.

- Prime locations: Properties are situated in high-value urban centers.

- Potential for significant capital appreciation: Real estate values tend to increase over time.

- Diversification of asset portfolio: Reducing reliance on solely media-related assets.

H3: Future Development and Strategic Decisions:

Future plans for News Corp’s real estate assets could significantly impact its overall valuation. Decisions regarding redevelopment, expansion, or strategic partnerships will be crucial in maximizing the long-term value of these holdings. Careful management of these assets can create a significant and stable source of revenue, contributing substantially to long-term shareholder value.

- Long-term investment potential: Real estate provides a stable and long-term investment.

- Opportunity for strategic partnerships: Collaborating with developers to maximize value.

- Potential for increased revenue streams: Leasing or developing properties can generate substantial income.

Conclusion

News Corp's hidden value lies not only in its established brands but also in its underappreciated business units and strategic assets. By examining the potential of Dow Jones, HarperCollins, and its real estate holdings, investors can gain a more nuanced understanding of the company’s true worth and future growth trajectory. This overlooked potential suggests a compelling investment opportunity for those willing to look beyond the headlines. Investing in News Corp is investing in a diversified media and business conglomerate with significant potential for growth. Therefore, a closer look at News Corp and its hidden value is strongly recommended for discerning investors.

Featured Posts

-

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025 -

Diese Eissorte Dominiert Nrw Ein Unerwarteter Favorit

May 24, 2025

Diese Eissorte Dominiert Nrw Ein Unerwarteter Favorit

May 24, 2025 -

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025 -

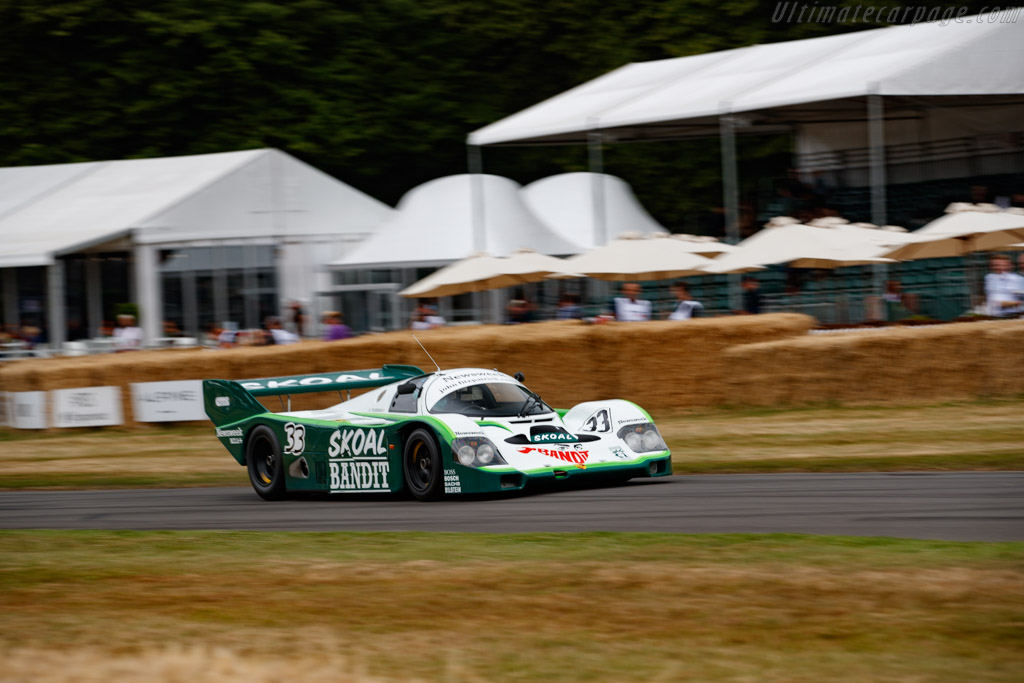

Porsche 956 Muezede Tavan Sergilemesinin Nedenleri

May 24, 2025

Porsche 956 Muezede Tavan Sergilemesinin Nedenleri

May 24, 2025 -

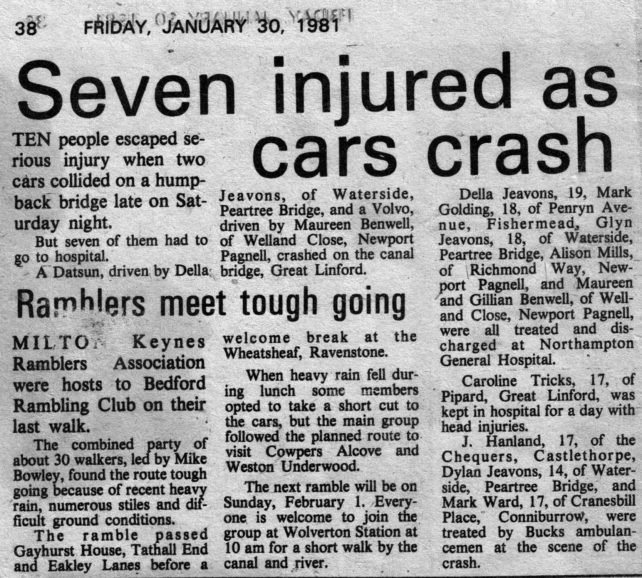

Emergency Services Respond To Major Crash One Person Injured

May 24, 2025

Emergency Services Respond To Major Crash One Person Injured

May 24, 2025

Latest Posts

-

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

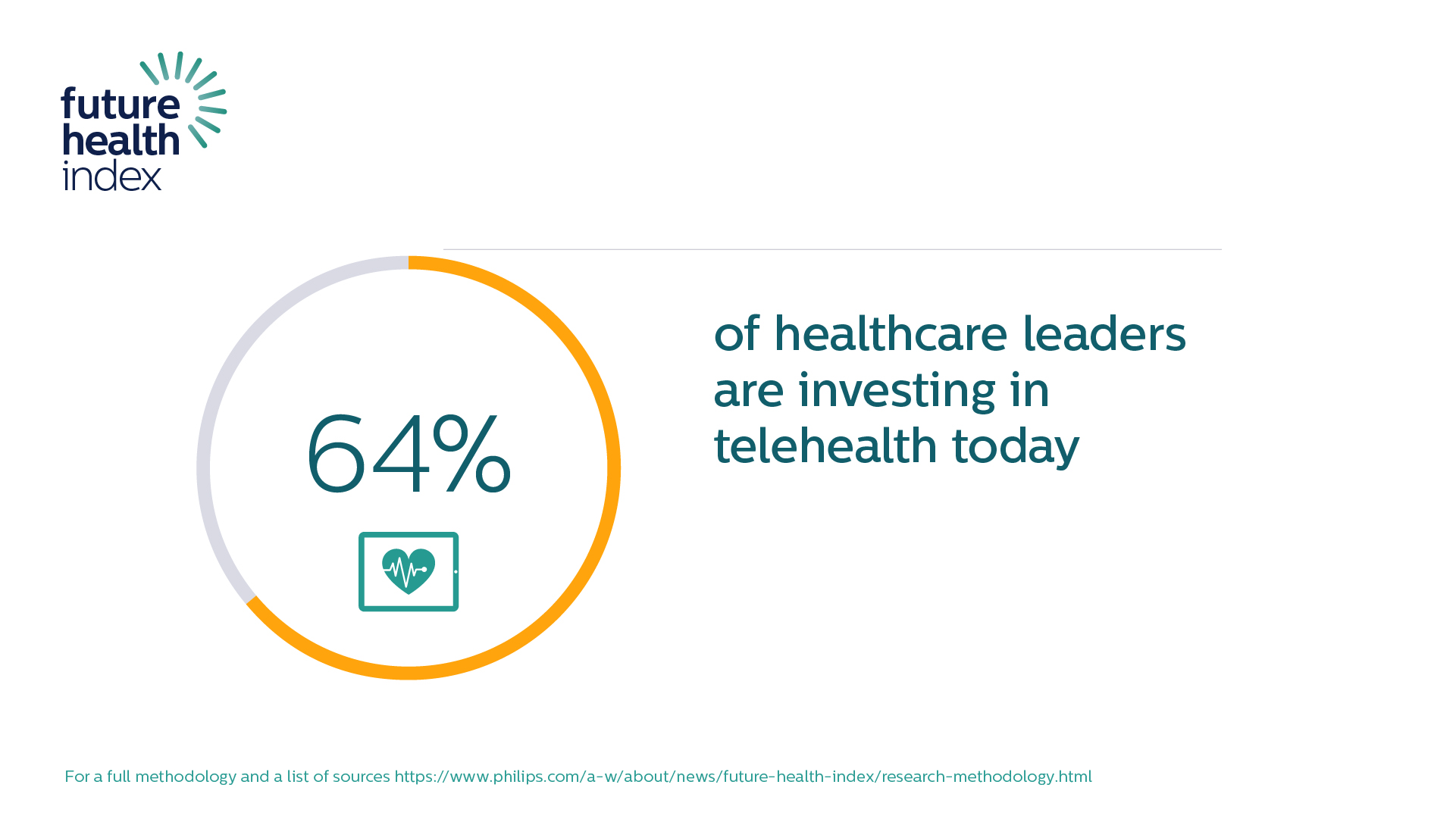

Philips Future Health Index 2025 Ais Transformative Impact On Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Impact On Global Healthcare

May 24, 2025 -

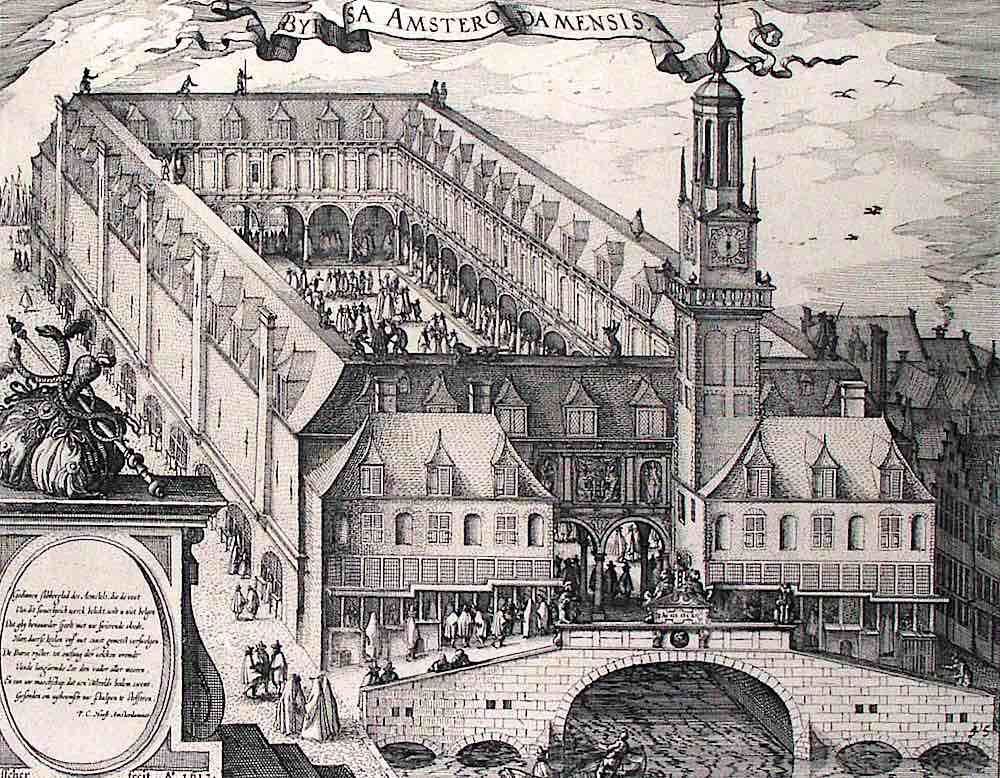

7 Fall In Amsterdam Stock Market Intensifying Trade War Impacts

May 24, 2025

7 Fall In Amsterdam Stock Market Intensifying Trade War Impacts

May 24, 2025 -

Sharp Decline In Amsterdam Stock Market Plunges 7

May 24, 2025

Sharp Decline In Amsterdam Stock Market Plunges 7

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025