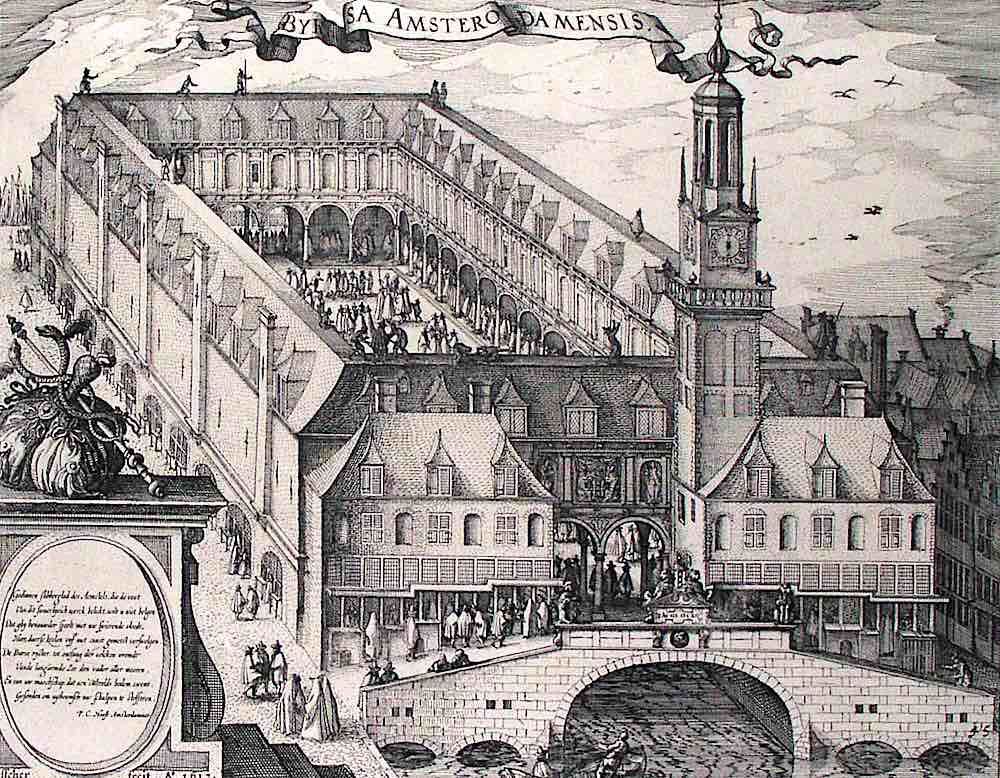

7% Fall In Amsterdam Stock Market: Intensifying Trade War Impacts

Table of Contents

The Role of the Global Trade War

The ongoing global trade war, characterized by escalating tariffs and trade restrictions between major economic powers, is a primary driver of the recent Amsterdam Stock Market decline. This uncertainty significantly impacts investor confidence, leading to a sell-off in various sectors. The ripple effect of this conflict is felt worldwide, and the Netherlands, with its export-oriented economy, is particularly vulnerable.

-

Increased tariffs impacting Dutch exports: Higher tariffs imposed on Dutch goods by trading partners directly reduce export revenues, impacting the profitability of numerous Dutch companies listed on the Amsterdam Stock Market. This is especially true for sectors heavily reliant on international trade.

-

Uncertainty affecting investor confidence: The unpredictable nature of the trade war creates significant uncertainty for investors. This uncertainty makes it difficult to forecast future profits, leading to a risk-averse approach and a reduction in investment in the Amsterdam Stock Market.

-

Decline in global trade impacting Dutch companies: The trade war's broader impact is a slowdown in global trade. Reduced global demand directly affects Dutch companies reliant on international markets, further depressing the Amsterdam Stock Market.

-

Specific examples of Dutch companies heavily affected by tariffs: [Insert examples of specific Dutch companies and sectors experiencing significant losses due to tariffs. Include ticker symbols for SEO purposes]. For example, companies in the agricultural sector, which heavily relies on exports, have reported significant declines in profits.

-

Analysis of the impact on specific sectors (e.g., technology, agriculture): The technology sector, while relatively resilient, is also susceptible to disruptions in global supply chains caused by the trade war. The agricultural sector, as noted, is facing significant challenges due to trade restrictions and increased tariffs on exported products.

Impact on Key Dutch Industries

The recent fall in the Amsterdam Stock Market has disproportionately affected certain sectors. A detailed analysis reveals which industries are most vulnerable and which demonstrate greater resilience.

-

Detailed analysis of the performance of specific sectors (e.g., financials, energy, technology): The financial sector has shown some resilience, while the energy and technology sectors have experienced more significant declines due to their exposure to international markets and supply chain disruptions.

-

Examples of individual companies experiencing significant losses: [Insert specific examples of companies in various sectors experiencing significant losses, including their ticker symbols]. This illustrates the widespread impact of the market downturn.

-

Discussion of the resilience or vulnerability of different sectors: Sectors with a strong domestic focus show greater resilience compared to those heavily reliant on exports. However, even domestically-focused companies are affected indirectly by the overall economic uncertainty caused by the trade war.

-

Graphs or charts illustrating the performance of key sectors: [Insert relevant graphs and charts to visually demonstrate the performance of key sectors within the Amsterdam Stock Market. Ensure charts are appropriately labeled and cited.]

Investor Sentiment and Market Volatility

The 7% drop in the Amsterdam Stock Market has significantly impacted investor sentiment, leading to increased market volatility.

-

Analysis of investor behavior during the market drop: Investors reacted to the news with a significant sell-off, leading to increased trading volume and price fluctuations. This reflects a loss of confidence in the short-term outlook for the Amsterdam Stock Market.

-

Discussion of trading volume and activity levels: Trading volume increased sharply during the downturn, indicating significant investor activity and a heightened level of uncertainty.

-

Mention of expert opinions and market analyses: [Include quotes from financial analysts and experts regarding the market downturn and its potential causes. Attribute quotes properly.]

-

Predictions about future volatility and potential recovery: The level of future volatility will depend on several factors, including the resolution of the trade war and government responses. A recovery is anticipated, but the timeline remains uncertain.

Government Response and Potential Mitigation Strategies

The Dutch government is likely to implement measures to mitigate the negative impacts of the trade war on the Amsterdam Stock Market and the Dutch economy.

-

Analysis of potential government policies to stimulate the economy: Potential policies include tax cuts, infrastructure investments, and targeted support for affected industries.

-

Discussion of measures to support affected industries: The government might offer financial assistance, subsidies, or tax breaks to help companies cope with decreased export revenues and increased competition.

-

Evaluation of the effectiveness of past government interventions: An analysis of past government interventions during similar economic downturns can inform current strategies.

-

Exploration of international cooperation to address the trade war: International cooperation to de-escalate the trade war is crucial for a broader economic recovery, and the Netherlands should actively participate in these efforts.

Long-Term Outlook for the Amsterdam Stock Market

While the short-term outlook is uncertain, the long-term prospects for the Amsterdam Stock Market depend on several factors.

-

Analysis of long-term growth prospects for the Dutch economy: The Netherlands' strong fundamentals and diversified economy suggest long-term growth potential.

-

Discussion of the potential for recovery and future stability: The market is expected to recover eventually, but the speed of recovery hinges on several factors, including the resolution of global trade tensions.

-

Factors that could contribute to a positive or negative outlook: A resolution of the trade war would significantly contribute to a positive outlook. Conversely, a prolonged trade war could lead to further economic slowdown and market instability.

-

Consideration of global economic trends and their impact: Global economic growth and stability will play a crucial role in the future performance of the Amsterdam Stock Market.

Conclusion

The 7% fall in the Amsterdam Stock Market highlights the significant impact of the escalating global trade war on even established economies. The downturn has affected key industries, shaken investor confidence, and necessitates proactive government responses. While the long-term outlook remains uncertain, understanding the interconnectedness of global markets and the specific vulnerabilities within the Amsterdam Stock Market is crucial for informed decision-making.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and the global trade war to make informed investment decisions. Regularly monitor news and analysis regarding the Amsterdam Stock Market for updates on market trends and potential recovery.

Featured Posts

-

Yevrobachennya 2025 Chotiri Potentsiyni Peremozhtsi Za Versiyeyu Konchiti Vurst

May 24, 2025

Yevrobachennya 2025 Chotiri Potentsiyni Peremozhtsi Za Versiyeyu Konchiti Vurst

May 24, 2025 -

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025 -

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025 -

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 24, 2025

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 24, 2025

Latest Posts

-

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 24, 2025 -

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025

Rio Tinto Addresses Concerns Over Pilbara Sustainability Following Forrests Comments

May 24, 2025 -

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025

3 Billion Cut To Sse Spending Impact Of Reduced Growth

May 24, 2025 -

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025

Environmental Concerns In The Pilbara Rio Tintos Perspective

May 24, 2025 -

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025

Andrew Forrest Vs Rio Tinto A Debate On The Future Of The Pilbara

May 24, 2025