Navigate The Private Credit Boom: 5 Do's & Don'ts

Table of Contents

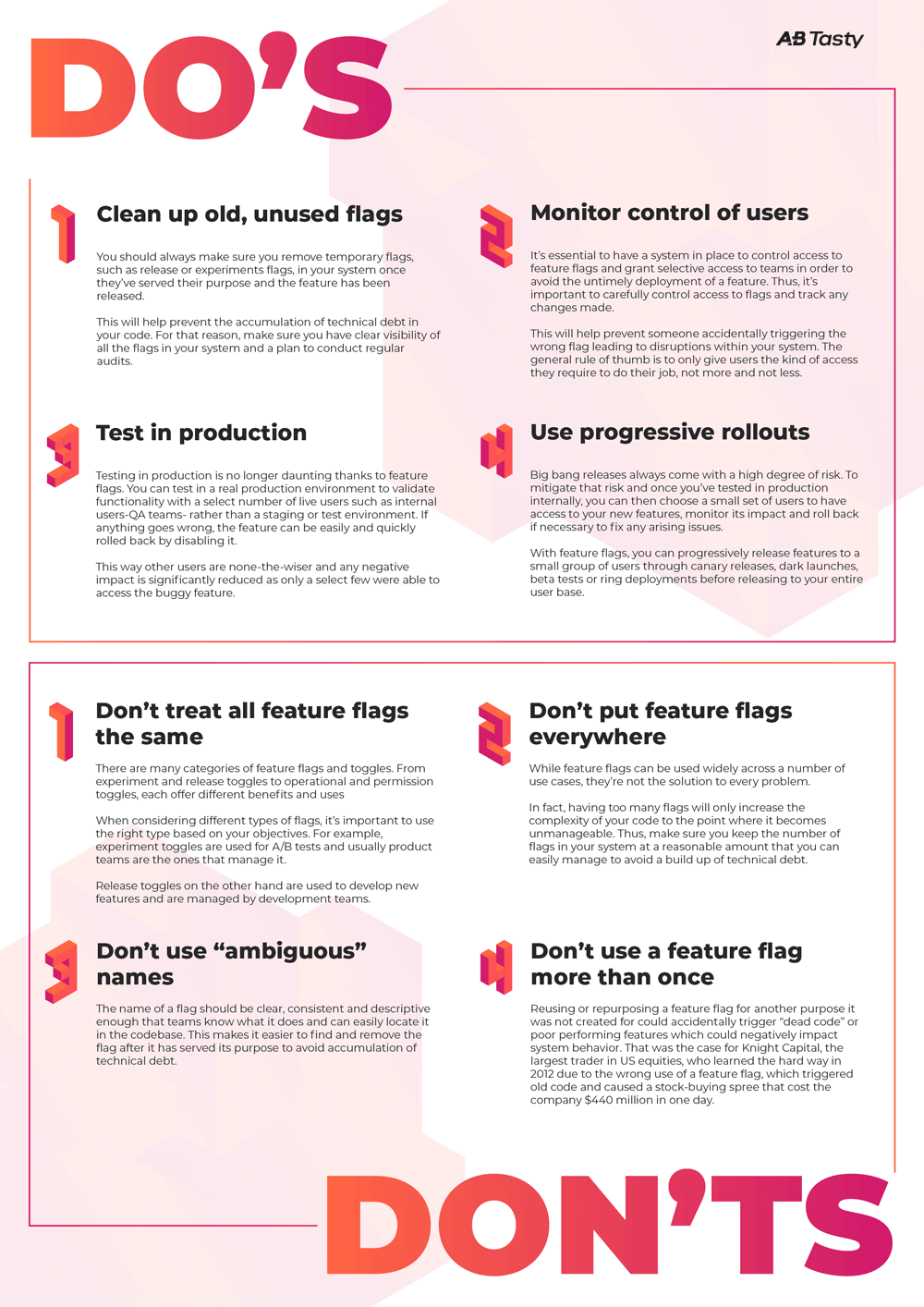

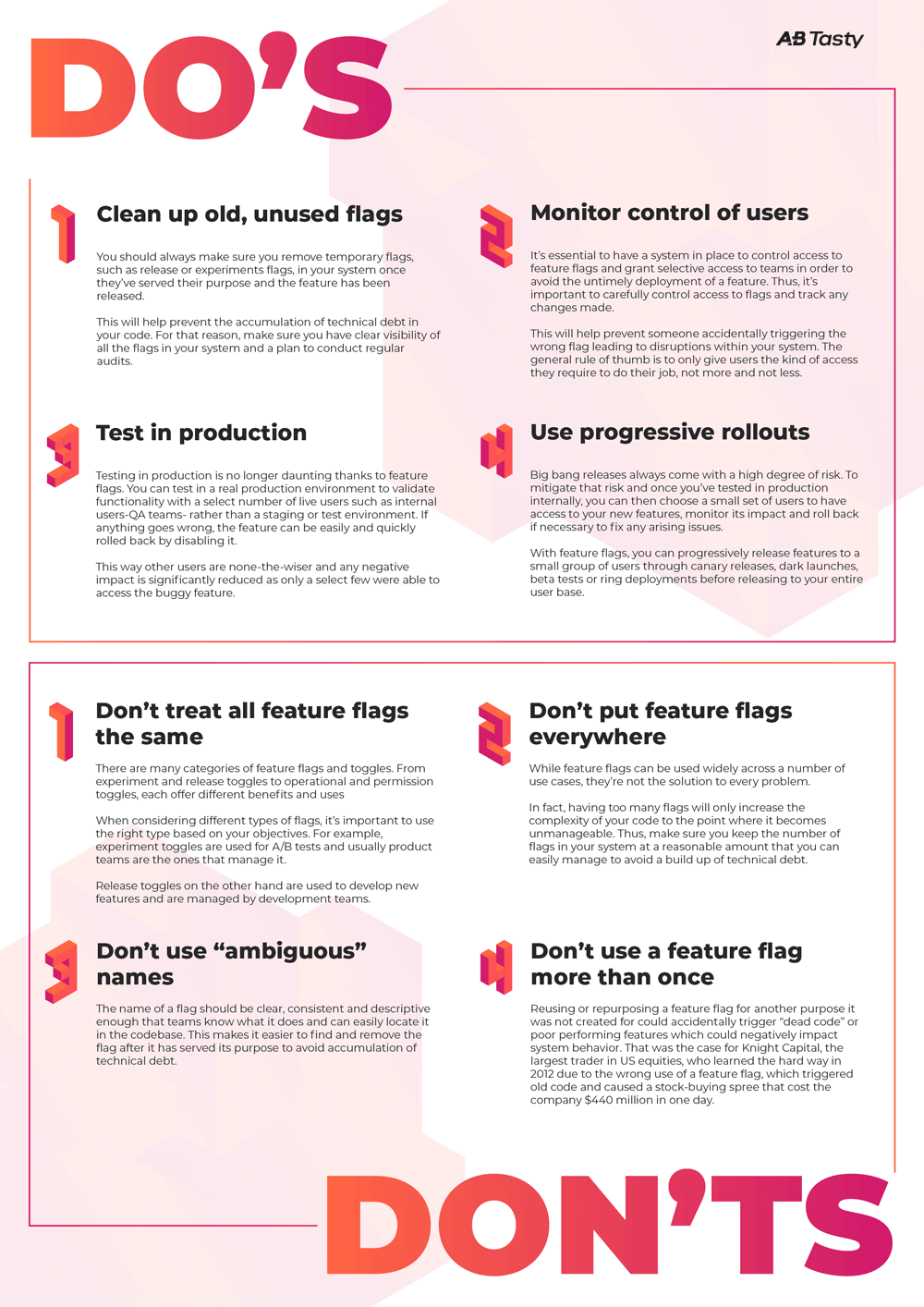

Do's - Strategies for Success in the Private Credit Market

Do #1: Conduct Thorough Due Diligence

Rigorous due diligence is paramount in the private credit market. Before committing to any private debt investment, a comprehensive assessment of the borrower's creditworthiness, financial health, and management team is essential. This involves:

- Credit Risk Assessment: Thoroughly analyze the borrower's credit history, including past defaults, payment patterns, and overall creditworthiness. Utilize credit scoring models and industry benchmarks to gauge risk.

- Financial Health Analysis: Perform a detailed review of the borrower's financial statements, including income statements, balance sheets, and cash flow statements. Look for trends, inconsistencies, and red flags.

- Management Team Evaluation: Assess the experience, expertise, and track record of the borrower's management team. A strong management team is crucial for successful business operations and debt repayment.

- Financial Modeling & Sensitivity Analysis: Employ sophisticated financial modeling techniques to project future cash flows and assess the impact of various scenarios, including economic downturns and unexpected events. This will help you better understand potential risks and downside scenarios inherent in private debt investments.

- Leveraging Expertise: For complex transactions, consider engaging specialized private credit due diligence firms with extensive experience in alternative lending analysis. They possess the resources and expertise to conduct in-depth investigations and provide valuable insights.

Do #2: Diversify Your Private Credit Portfolio

Diversification is a cornerstone of successful private credit investing. Spreading your investments across various sectors, geographies, and borrower types significantly reduces your exposure to individual risks. Strategies include:

- Sector Diversification: Don't put all your eggs in one basket. Invest in companies across different industries to reduce the impact of sector-specific downturns.

- Geographic Diversification: Consider spreading your investments across different regions to mitigate the impact of localized economic shocks.

- Borrower Type Diversification: Diversify your portfolio across various borrower types, such as large corporations, small and medium-sized enterprises (SMEs), and real estate developers.

- Credit Strategy Diversification: Explore different private credit strategies, such as senior secured loans (which offer lower risk), mezzanine debt (which carries higher risk but potentially higher returns), and unitranche financing (which combines elements of both).

- Direct Lending and Fund Investments: Combining direct lending with investments in private credit funds provides a balanced approach to portfolio diversification, offering exposure to different types of private debt.

Do #3: Negotiate Favorable Terms and Covenants

Negotiating favorable terms and covenants is crucial to protect your investment. Strong covenants and collateral arrangements are critical to mitigating risk and ensuring repayment. This involves:

- Robust Covenants: Negotiate strong protective covenants that limit the borrower's ability to take actions that could negatively impact your investment.

- Collateral Arrangements: Secure appropriate collateral to protect your investment in case of default. The type and value of collateral should be commensurate with the risk profile of the loan.

- Competitive Interest Rates and Fees: Negotiate interest rates and fees that are competitive with market conditions and reflect the risk profile of the investment.

- Regular Reporting and Monitoring: Insist on regular reporting and financial monitoring to stay informed about the borrower's performance and identify potential problems early on. This is especially important in the alternative lending space.

Do #4: Employ Experienced Professionals

Navigating the complexities of the private credit market requires the expertise of experienced professionals. This includes:

- Private Credit Professionals: Utilize the services of experienced professionals for deal sourcing, due diligence, portfolio management, and overall strategy.

- Legal Counsel: Engage legal counsel specializing in private credit transactions to ensure compliance and protect your interests.

- Valuation Specialists: For complex assets, consider employing independent valuation specialists to provide objective assessments of asset values. This is particularly crucial in direct lending situations where asset values can fluctuate.

Do #5: Monitor the Market and Adapt Your Strategy

The private credit market is dynamic and constantly evolving. Staying informed about market trends and adapting your strategy accordingly is crucial for long-term success. This entails:

- Market Analysis: Regularly monitor market trends, macroeconomic conditions, and regulatory changes. Understand how these factors may impact your investments.

- Portfolio Review and Adjustment: Regularly review and adjust your portfolio allocation based on market dynamics. This may involve selling underperforming investments or adding new investments to capitalize on emerging opportunities.

- Strategy Adaptation: Be prepared to adjust your investment strategy in response to changing market conditions and risk appetites. Flexibility is key in the private credit market.

Don'ts - Avoiding Pitfalls in the Private Credit Boom

Don't #1: Overlook Risk Assessment

Thorough risk assessment is crucial. Rushing into investments without a proper understanding of the risks involved can lead to significant losses. Never underestimate the importance of due diligence and credit analysis in the private credit market.

Don't #2: Over-Concentrate Your Portfolio

Over-concentration in a single borrower, sector, or geographic region dramatically increases your exposure to risk. Diversification is critical to mitigating risk in the private credit market.

Don't #3: Neglect Legal and Regulatory Compliance

Adhering to all applicable legal and regulatory requirements is essential to avoid potential penalties and reputational damage. Consult with legal counsel to ensure compliance throughout the investment process. This is especially vital within alternative lending and direct lending frameworks.

Don't #4: Underestimate Liquidity Risk

Private credit investments typically have lower liquidity compared to publicly traded securities. Factor liquidity risk into your investment strategy and time horizon. Understanding the illiquidity premium is crucial.

Don't #5: Ignore Market Cycles

The private credit market is cyclical. Be aware of the cyclical nature of the market and prepare for potential downturns by adjusting your investment strategy accordingly. Economic forecasting and credit cycle awareness are paramount.

Conclusion

The private credit boom presents a wealth of opportunities for savvy investors, but success requires careful planning and a thorough understanding of the inherent risks. By following the "Do's" outlined above and avoiding the "Don'ts," investors can significantly improve their chances of navigating this dynamic market successfully and generating strong returns. Remember, diligent due diligence, portfolio diversification, and a proactive approach to risk management are essential for thriving in the world of private credit. Start navigating the private credit boom effectively today!

Featured Posts

-

When Does Chelsea Handlers The Feeling Premiere On Netflix

Apr 26, 2025

When Does Chelsea Handlers The Feeling Premiere On Netflix

Apr 26, 2025 -

Nintendo Switch 2 Preorder The Game Stop In Store Experience

Apr 26, 2025

Nintendo Switch 2 Preorder The Game Stop In Store Experience

Apr 26, 2025 -

An Easy Chair Discussion Karli Kane Hendrickson

Apr 26, 2025

An Easy Chair Discussion Karli Kane Hendrickson

Apr 26, 2025 -

Tom Cruises Mission Impossible Dead Reckoning First Look Review

Apr 26, 2025

Tom Cruises Mission Impossible Dead Reckoning First Look Review

Apr 26, 2025 -

Post Roe America How Otc Birth Control Reshapes Family Planning

Apr 26, 2025

Post Roe America How Otc Birth Control Reshapes Family Planning

Apr 26, 2025

Latest Posts

-

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025 -

Trump On Banning Congressional Stock Trading Full Time Interview Discussion

Apr 26, 2025

Trump On Banning Congressional Stock Trading Full Time Interview Discussion

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Position Revealed In New Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Position Revealed In New Time Interview

Apr 26, 2025 -

Trump Wants To Ban Congressional Stock Trading A Time Magazine Interview Analysis

Apr 26, 2025

Trump Wants To Ban Congressional Stock Trading A Time Magazine Interview Analysis

Apr 26, 2025 -

Trumps Stance On Banning Congressional Stock Trading Key Takeaways From Time Interview

Apr 26, 2025

Trumps Stance On Banning Congressional Stock Trading Key Takeaways From Time Interview

Apr 26, 2025