Trump's Stance On Banning Congressional Stock Trading: Key Takeaways From Time Interview

Table of Contents

Trump's Explicit Support for a Ban

In his Time interview, Donald Trump explicitly voiced his support for a ban on congressional stock trading. He didn't merely suggest it; he presented it as a necessary measure to restore public trust and combat the appearance of conflicts of interest.

- Quote: "[Insert direct quote from the Time interview expressing Trump's support for a ban on congressional stock trading]. This quote clearly indicates his strong stance on the issue."

- Reasons: While the specifics of his reasoning may require further examination, the interview strongly implied that Trump sees such a ban as crucial for upholding ethical standards in government. He likely connected it to his broader campaign against what he perceives as the corruption and swamp of Washington.

- Strength of Position: Trump's endorsement appears unwavering, presenting a significant shift in the political landscape. His strong stance, given his influential position within the Republican party, could significantly impact the debate and push for legislative action concerning a Congressional Stock Trading Ban.

- Political Impact: A Trump endorsement carries substantial weight. His support could galvanize both Republican and independent voters who share concerns about the ethical implications of congressional stock trading, potentially tipping the scales in favor of legislative action regarding a Congressional Stock Trading Ban.

Potential Implications for Campaign Finance Reform

The debate over a Congressional Stock Trading Ban is intrinsically linked to broader campaign finance reform efforts. Addressing the issue of lawmakers potentially profiting from their positions is paramount for a healthy and transparent political system.

- Conflicts of Interest: A ban directly addresses concerns about conflicts of interest. Lawmakers might be tempted to make decisions that benefit their personal investments rather than the interests of their constituents. A ban removes this temptation.

- Reducing Special Interest Influence: A Congressional Stock Trading Ban could significantly reduce the influence of special interests. Lobbyists and corporations might currently leverage stock investments to influence legislative decisions. A ban could mitigate this form of undue influence.

- Arguments Against & Counterarguments: Opponents argue that a ban infringes on individual liberties and could have unintended consequences, potentially excluding qualified individuals from serving in Congress. However, counterarguments highlight that the public's trust and faith in government outweigh individual financial interests in this specific context. Stronger ethics regulations and oversight could mitigate unintended consequences.

- Lobbying's Role: Lobbying efforts are often intertwined with financial incentives. A ban on congressional stock trading could curb the effectiveness of lobbying aimed at influencing specific legislation beneficial to certain sectors, thereby promoting a more equitable playing field in the political process relating to the Congressional Stock Trading Ban.

Public Perception and Restoring Trust in Government

The lack of stringent regulations on congressional stock trading has contributed significantly to the erosion of public trust in government. A Congressional Stock Trading Ban could play a crucial role in restoring this trust.

- Erosion of Trust: Numerous instances of perceived conflicts of interest have damaged public confidence in the integrity of elected officials. This has fueled skepticism and cynicism towards the political process.

- Public Opinion: Polls consistently show widespread public support for stricter regulations or outright bans on congressional stock trading. [Cite relevant polls and surveys here]. This demonstrates a clear public demand for greater transparency and accountability.

- Restoring Faith: A decisive action like a Congressional Stock Trading Ban could significantly restore public faith in the integrity of lawmakers. It would signal a commitment to transparency and ethical conduct.

- Downsides of Inaction: Failure to enact a ban will likely reinforce negative media narratives and public discourse, further eroding trust and potentially fueling calls for broader political reform. The lack of action on a Congressional Stock Trading Ban will only serve to increase public dissatisfaction.

The Role of Transparency and Disclosure

Even without a complete ban, increased transparency and stricter disclosure requirements are crucial steps toward addressing concerns about congressional stock transactions.

- Current Regulations & Limitations: Current disclosure regulations are often insufficient, with significant loopholes and delays that hinder effective oversight.

- Improving Disclosure Rules: Strengthening disclosure requirements to include more timely and detailed information on asset holdings and transactions is essential. Clearer guidelines and stricter penalties for non-compliance are also necessary.

- Technology & Data Analysis: Leveraging technology and data analysis can enhance transparency. Automated systems could track transactions, identify potential conflicts of interest, and flag suspicious activity, significantly improving oversight concerning the Congressional Stock Trading Ban.

- Benefits of Transparency: A more transparent system will allow the public to scrutinize the financial activities of their representatives, fostering accountability and discouraging unethical behavior. This contributes greatly to a healthier democracy related to the Congressional Stock Trading Ban.

Conclusion

Trump's stance on a Congressional Stock Trading Ban, as expressed in his Time interview, signals strong support for a measure many believe is necessary to combat conflicts of interest and restore public trust. The potential implications are significant, impacting both campaign finance reform and the overall perception of government integrity. A ban, or at a minimum, strengthened transparency and disclosure regulations, is crucial for addressing the concerns surrounding this issue. The ongoing debate surrounding a Congressional Stock Trading Ban necessitates continued engagement and informed discussion.

Call to Action: Stay informed about the ongoing discussion regarding a Congressional Stock Trading Ban. Follow the developments in Congress and continue to engage in civic discussions about this vital issue impacting government transparency and accountability. Understanding the nuances of this debate is critical for informed participation in our democracy.

Featured Posts

-

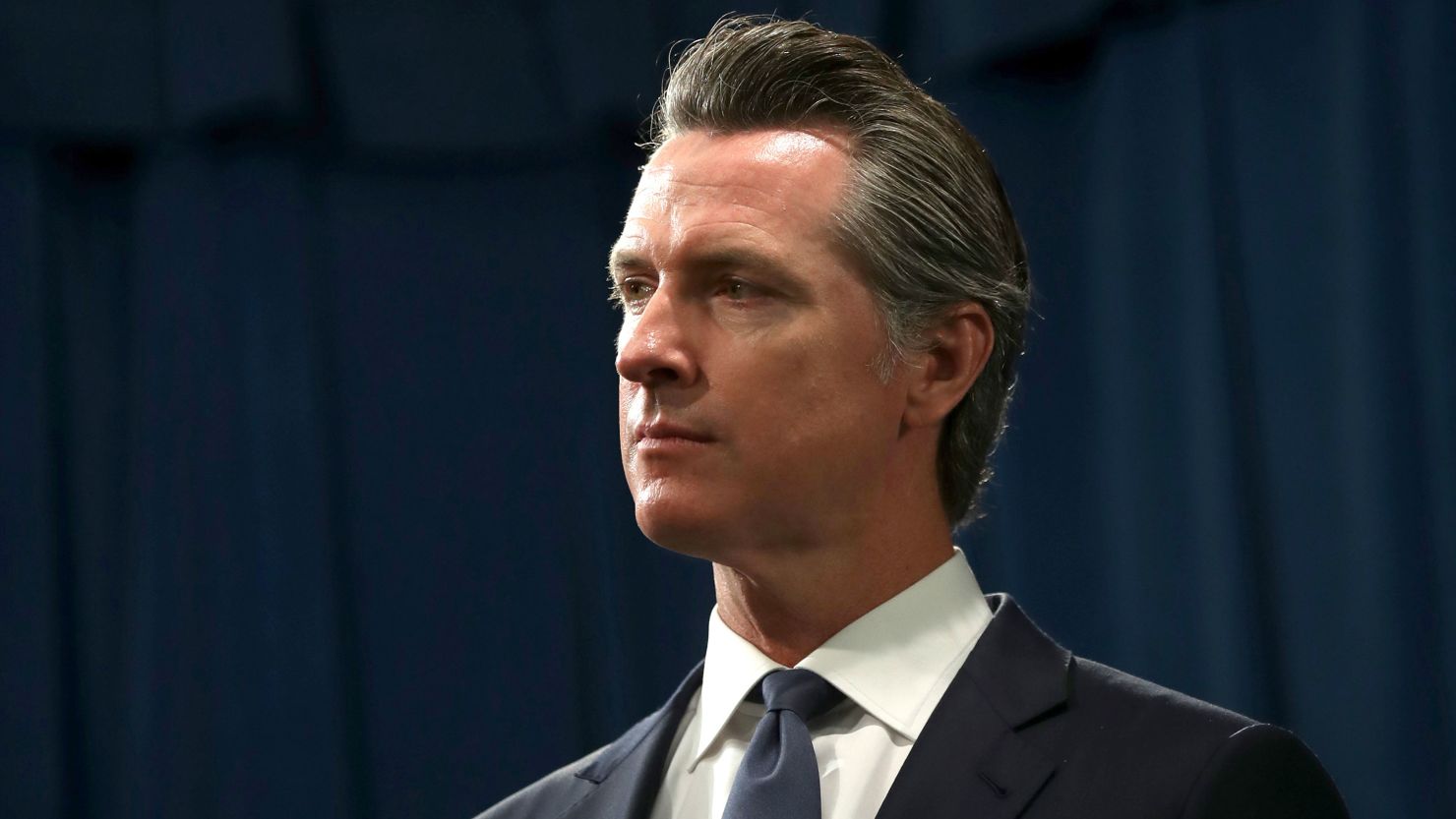

Is Gavin Newsoms Political Strategy Backfiring

Apr 26, 2025

Is Gavin Newsoms Political Strategy Backfiring

Apr 26, 2025 -

Access To Elon Musks Private Companies A Potential Side Business

Apr 26, 2025

Access To Elon Musks Private Companies A Potential Side Business

Apr 26, 2025 -

Mission Impossible Dead Reckonings Selective Franchise History

Apr 26, 2025

Mission Impossible Dead Reckonings Selective Franchise History

Apr 26, 2025 -

Trump On Banning Congressional Stock Trading Full Time Interview Discussion

Apr 26, 2025

Trump On Banning Congressional Stock Trading Full Time Interview Discussion

Apr 26, 2025 -

Cam Newton Picks His Top 2025 Qb Where Should Shedeur Sanders Play

Apr 26, 2025

Cam Newton Picks His Top 2025 Qb Where Should Shedeur Sanders Play

Apr 26, 2025

Latest Posts

-

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025 -

Pete Hegseth On Pentagon Chaos Exclusive Details On Leaks Polygraph Threats And Internal Conflicts

Apr 26, 2025

Pete Hegseth On Pentagon Chaos Exclusive Details On Leaks Polygraph Threats And Internal Conflicts

Apr 26, 2025 -

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Pete Hegseth Responds

Apr 26, 2025

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Pete Hegseth Responds

Apr 26, 2025 -

Pentagon Leaks And Infighting Pete Hegseths Exclusive Reaction To Polygraph Threats

Apr 26, 2025

Pentagon Leaks And Infighting Pete Hegseths Exclusive Reaction To Polygraph Threats

Apr 26, 2025 -

Harvard University Reform Insights From A Conservative Professor

Apr 26, 2025

Harvard University Reform Insights From A Conservative Professor

Apr 26, 2025