Trump On Banning Congressional Stock Trading: Full Time Interview Discussion

Table of Contents

Keywords: Trump, Congressional Stock Trading, Stock Trading Ban, Congressional Ethics, Insider Trading, Trump Interview, Political Reform, Financial Transparency, Washington DC, Government Reform

Donald Trump's outspoken views on a wide range of political issues are well-known. One area where his opinions have generated significant debate is the question of banning congressional stock trading. This deep dive analyzes a full interview with Trump, examining his arguments for a ban, the counterarguments, and the broader political implications of this contentious issue. We explore the complexities surrounding Congressional ethics, financial transparency, and the potential reforms needed to restore public trust in Washington D.C.

Trump's Arguments Against Congressional Stock Trading

Trump's position on banning congressional stock trading stems from deep-seated concerns about ethics and transparency within the government. His arguments consistently center on three main pillars: conflicts of interest, the impact on legislative decision-making, and the critical need for increased transparency.

Concerns about Conflicts of Interest

Trump frequently argues that the current system allows for inherent conflicts of interest. He claims members of Congress use their privileged access to information to make lucrative stock trades, gaining an unfair advantage over ordinary citizens.

- Examples cited by Trump: While specifics may vary across interviews, Trump often cites anecdotal examples of legislators seemingly profiting from inside knowledge gained through their official duties.

- Potential legislative loopholes: He points to the complexities and potential loopholes within existing disclosure laws, allowing for manipulation and exploitation.

- Impact on public trust: Trump emphasizes the devastating effect these perceived conflicts have on public trust and faith in the integrity of the legislative process. "It's a disgrace," he's been quoted as saying, "and it undermines the entire system."

Impact on Legislative Decision-Making

Trump believes that the potential for personal financial gain significantly influences congressional votes and the crafting of legislation. He argues that legislators may prioritize policies that benefit their own investments over the best interests of the American people.

- Examples of potential bias: He suggests examples where votes on certain bills might be swayed by a legislator's personal financial stake in the outcome.

- Influence of lobbying: Trump often links this issue to the pervasive influence of lobbying, arguing that legislators are susceptible to pressure from special interests seeking favorable legislation.

- Perceived lack of impartiality: The perceived lack of impartiality erodes public confidence in the fairness and objectivity of the legislative process, a core element of a functioning democracy.

The Need for Increased Transparency

A central theme in Trump's argument is the need for significantly increased transparency in the financial dealings of members of Congress. He advocates for a system where financial disclosures are more comprehensive, readily accessible, and subject to stricter scrutiny.

- Suggestions for improved disclosure: This includes more detailed reporting requirements, timelines, and potentially even independent audits of financial holdings.

- Potential penalties for non-compliance: Stronger penalties for violations are essential to deter unethical behavior and enforce accountability.

- Strengthening existing regulations: Trump advocates for strengthening the existing Stock Act and closing any loopholes that allow for the exploitation of privileged information. He often highlights the shortcomings of current financial disclosure laws.

Counterarguments and Criticisms of a Ban

While Trump's arguments resonate with many, a complete ban on congressional stock trading faces considerable opposition. Critics raise concerns about unintended consequences, potential constitutional challenges, and the availability of alternative solutions.

Potential Unintended Consequences

A complete ban might have unintended negative consequences, impacting the ability of Congress to attract qualified individuals.

- Impact on retirement savings: Restricting the ability of legislators to invest in the stock market could disproportionately affect those with limited retirement savings options.

- Difficulty attracting qualified candidates: A ban might deter highly skilled professionals from seeking public office, limiting the pool of qualified candidates.

- Potential for a black market in financial transactions: A complete ban could drive transactions underground, making oversight and enforcement even more difficult.

Constitutional Concerns and Individual Freedoms

Concerns have been raised regarding the potential infringement on individual rights and freedoms.

- Arguments against government overreach: Opponents argue that a complete ban constitutes excessive government overreach into the personal financial lives of elected officials.

- Debates on the scope of government regulation: The debate often revolves around the appropriate balance between regulating ethical conduct and preserving individual liberties.

- Constitutional challenges: Legal challenges to such a ban are likely, centering on potential violations of constitutional rights.

Alternative Solutions and Reforms

Many propose alternative approaches to address the concerns without resorting to a complete ban.

- Stricter ethics rules: Strengthening existing ethics rules and enforcement mechanisms could address many of the problems.

- Independent oversight bodies: Creating independent bodies to monitor and investigate financial disclosures could enhance transparency and accountability.

- Increased penalties for insider trading: Substantially increasing penalties for insider trading would deter such behavior.

- Blind trusts: Requiring the use of blind trusts could remove conflicts of interest by preventing legislators from directly managing their investments.

Public Opinion and Political Implications

Public sentiment regarding congressional stock trading and the need for reform significantly influences the political trajectory of this debate.

Public Sentiment Towards Congressional Stock Trading

Polls consistently show widespread public dissatisfaction with the current system and a strong desire for reform.

- Statistics on public trust in Congress: Public trust in Congress remains historically low, partly due to concerns about ethical lapses and financial conflicts of interest.

- Breakdown of opinion by political affiliation: While there's general agreement on the need for reform, the specific solutions proposed often differ along partisan lines.

Political Fallout and the Debate's Trajectory

Trump's stance on this issue has significant political ramifications.

- Impact on Republican and Democratic parties: Both parties face internal divisions on this issue, making legislative action challenging.

- Potential legislative action: The likelihood of comprehensive legislative reform depends on the ability of Congress to overcome partisan gridlock.

- Influence on upcoming elections: The debate is likely to be a significant factor in upcoming elections, influencing voter choices and shaping political campaigns.

Conclusion

Donald Trump's advocacy for banning congressional stock trading highlights a critical need for increased financial transparency and ethical conduct in government. While his arguments resonate with many voters concerned about conflicts of interest and the influence of money in politics, counterarguments highlight potential unintended consequences and constitutional concerns. The debate underscores the importance of finding effective solutions to restore public trust and ensure the integrity of the legislative process. Ultimately, the path forward will likely involve a combination of stricter regulations, enhanced transparency measures, and robust enforcement mechanisms. Learn more about Donald Trump's position and the ongoing debate surrounding a ban on congressional stock trading. Stay informed and engage in the discussion about necessary reforms to enhance ethical standards and restore public trust in government. Search for "Trump Congressional Stock Trading Ban" for more information.

Featured Posts

-

Shedeur Sanders And Nike Following In His Fathers Footsteps

Apr 26, 2025

Shedeur Sanders And Nike Following In His Fathers Footsteps

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Comprehensive Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Comprehensive Analysis

Apr 26, 2025 -

Espn Analyst Expands On Deion Sanders Shedeur Sanders Draft Stock Theory

Apr 26, 2025

Espn Analyst Expands On Deion Sanders Shedeur Sanders Draft Stock Theory

Apr 26, 2025 -

Assessing Dam Safety During The Ajax 125th Anniversary

Apr 26, 2025

Assessing Dam Safety During The Ajax 125th Anniversary

Apr 26, 2025 -

127 Years Of Brewing History Anchor Brewing Company Announces Closure

Apr 26, 2025

127 Years Of Brewing History Anchor Brewing Company Announces Closure

Apr 26, 2025

Latest Posts

-

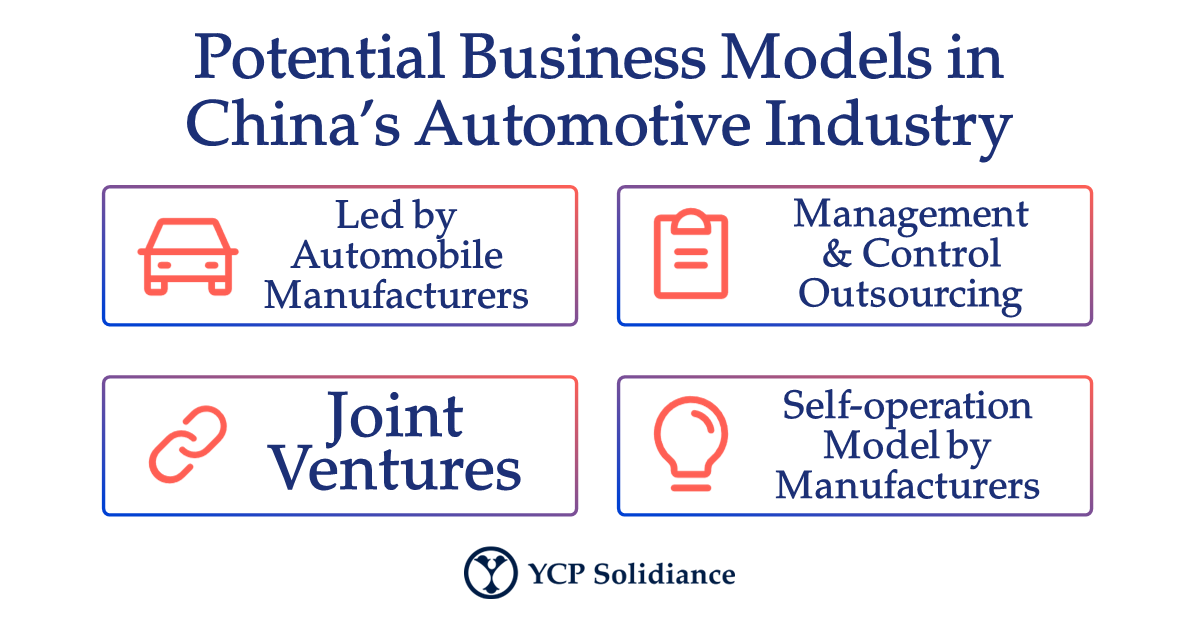

The Rise Of Chinese Automakers A Competitive Analysis

Apr 26, 2025

The Rise Of Chinese Automakers A Competitive Analysis

Apr 26, 2025 -

Will Chinese Cars Dominate The Global Market

Apr 26, 2025

Will Chinese Cars Dominate The Global Market

Apr 26, 2025 -

Chinas Auto Industry A Look At The Future Of Electric Vehicles

Apr 26, 2025

Chinas Auto Industry A Look At The Future Of Electric Vehicles

Apr 26, 2025 -

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025 -

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025