Trump Wants To Ban Congressional Stock Trading: A Time Magazine Interview Analysis

Table of Contents

Trump's Stance on Banning Congressional Stock Trading

In his Time Magazine interview, Trump unequivocally voiced his support for a complete ban on stock trading by members of Congress. He argued that such a ban is crucial for restoring public trust in a system often perceived as riddled with conflicts of interest. His key arguments included:

- Eliminates potential conflicts of interest: Trump asserted that the current system allows for the potential abuse of power, where lawmakers might prioritize personal financial gain over the best interests of their constituents. He stated, "It's a disgrace. They shouldn't be allowed to do it."

- Increases public trust in government: The former president emphasized that a ban would significantly enhance public confidence in the integrity of the legislative process. He believes that the perception of impropriety, even without proof of wrongdoing, erodes public faith.

- Reduces the appearance of impropriety: Trump highlighted that even the appearance of a conflict of interest can undermine the public's trust, regardless of whether actual wrongdoing occurs. This is a crucial aspect of maintaining ethical standards in government.

While Trump's stance is clear, some inconsistencies emerge when comparing this recent statement to his past actions and statements on the issue. A thorough analysis of his entire record is needed for a complete understanding.

Arguments For and Against a Congressional Stock Trading Ban

The debate surrounding a ban on Congressional stock trading is multifaceted, with compelling arguments on both sides.

Proponents' Arguments

Supporters of a ban cite several compelling reasons:

- Preventing insider trading: The potential for lawmakers to exploit non-public information gained through their positions for personal financial gain is a major concern. Numerous instances of alleged insider trading by members of Congress have fueled public distrust. [Link to relevant article on alleged insider trading].

- Improving public perception of Congress: A ban would demonstrably improve the public's perception of Congress and restore some faith in the integrity of government institutions. This is vital for maintaining the legitimacy of the democratic process.

- Promoting ethical conduct: A ban establishes a clear ethical standard, preventing even the appearance of impropriety and ensuring that lawmakers prioritize public service over personal enrichment.

- Strengthening campaign finance reform: A ban could be seen as a crucial step toward broader campaign finance reform, addressing the influence of money in politics.

Opponents' Arguments

Opponents raise valid counterpoints:

- Infringes on individual liberties: They argue that banning stock trading constitutes an infringement on the personal liberties of elected officials and could deter qualified individuals from seeking public office.

- Difficult to enforce effectively: Creating and enforcing a comprehensive ban could be extremely challenging, requiring significant resources and potentially leading to loopholes.

- Unintended consequences: Opponents warn of unintended consequences, such as limiting the diversity of backgrounds and experiences among lawmakers, as those with significant financial investments might be less likely to run for office.

- Alternative solutions: Instead of a complete ban, some propose stricter disclosure requirements, more stringent ethics rules, and stronger independent oversight committees to address conflicts of interest.

The Practicality and Challenges of Implementing a Ban

Implementing a ban on Congressional stock trading presents significant practical and legal challenges. The feasibility hinges on addressing several key issues:

- Legal challenges: A ban might face legal challenges based on constitutional arguments regarding individual liberties and the right to participate in the free market.

- Constitutional concerns: The potential for such a ban to be deemed unconstitutional raises serious questions about its enforceability.

- Logistical hurdles: Creating and enforcing such a ban would involve considerable logistical hurdles, including defining what constitutes "stock trading," creating mechanisms for monitoring compliance, and establishing penalties for violations.

- Alternative approaches: Exploring and implementing alternative solutions, such as enhanced disclosure requirements and independent ethics commissions, could prove more effective and less legally contentious.

Public Opinion and Political Implications

Public opinion polls consistently reveal significant support for stricter regulations on Congressional stock trading, reflecting widespread dissatisfaction with the current system. [Link to relevant poll data]. However, the political implications of a ban are complex:

- Bipartisan support? While the idea has some bipartisan appeal, the level of support varies significantly between political parties and ideologies.

- Electoral effects: The proposed ban could significantly impact election campaigns and strategies, influencing candidate selection and fundraising.

- Lobbying group influence: Powerful lobbying groups, with a vested interest in the status quo, are likely to oppose any significant reform.

- Long-term effects: A successful ban could lead to increased transparency and accountability in government, potentially transforming the relationship between elected officials and the public.

Conclusion

Donald Trump's call to ban Congressional stock trading, as highlighted in the Time Magazine interview, has reopened a crucial debate on ethics and transparency in American politics. While the proposal enjoys substantial public support and aims to address legitimate concerns about conflicts of interest and insider trading, its implementation faces significant legal, practical, and political hurdles. The arguments for and against a ban highlight the complexities of balancing individual liberties with the need for greater public trust in government. Alternative solutions, such as enhanced disclosure and stronger oversight mechanisms, merit careful consideration. Ultimately, the path forward requires thoughtful discussion and compromise to ensure a system that balances the interests of lawmakers with the imperative for ethical and transparent governance.

What are your thoughts on Trump's proposed ban on Congressional stock trading? Share your perspective in the comments below!

Featured Posts

-

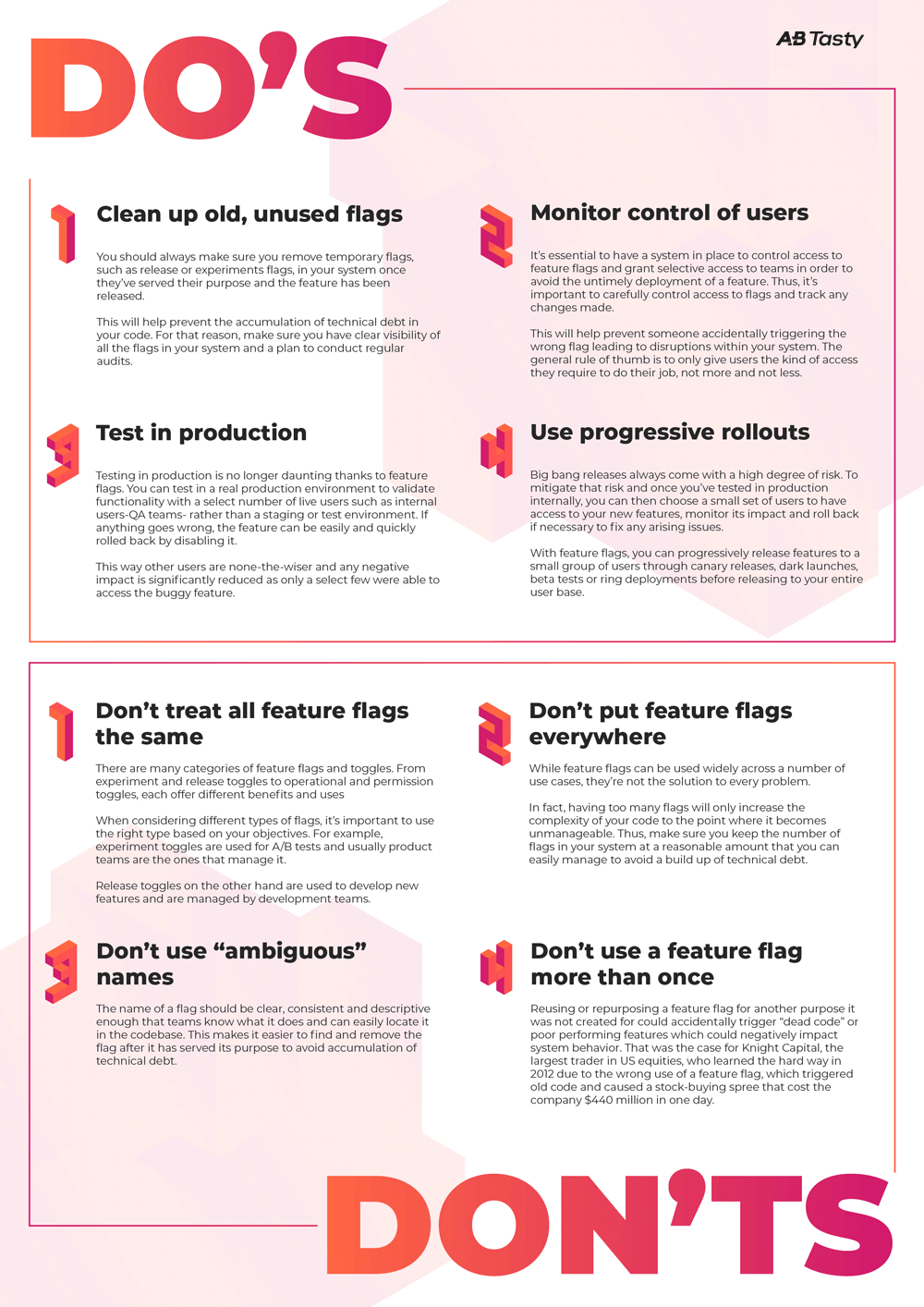

Navigate The Private Credit Boom 5 Dos And Don Ts

Apr 26, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts

Apr 26, 2025 -

Unmasking The Stench Identifying The Smelliest Member Of Congress

Apr 26, 2025

Unmasking The Stench Identifying The Smelliest Member Of Congress

Apr 26, 2025 -

Ecbs View On The Disinflationary Impact Of Trumps Tariffs Holzmanns Analysis

Apr 26, 2025

Ecbs View On The Disinflationary Impact Of Trumps Tariffs Holzmanns Analysis

Apr 26, 2025 -

Trump On Ukraine Joining Nato Assessing The Political Realities

Apr 26, 2025

Trump On Ukraine Joining Nato Assessing The Political Realities

Apr 26, 2025 -

Strategists Ditch Optimism For European Stocks Trumps Trade War Risk

Apr 26, 2025

Strategists Ditch Optimism For European Stocks Trumps Trade War Risk

Apr 26, 2025

Latest Posts

-

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025 -

Pete Hegseth On Pentagon Chaos Exclusive Details On Leaks Polygraph Threats And Internal Conflicts

Apr 26, 2025

Pete Hegseth On Pentagon Chaos Exclusive Details On Leaks Polygraph Threats And Internal Conflicts

Apr 26, 2025 -

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Pete Hegseth Responds

Apr 26, 2025

Exclusive Polygraph Threats Leaks And Infighting Shake Up The Pentagon Pete Hegseth Responds

Apr 26, 2025 -

Pentagon Leaks And Infighting Pete Hegseths Exclusive Reaction To Polygraph Threats

Apr 26, 2025

Pentagon Leaks And Infighting Pete Hegseths Exclusive Reaction To Polygraph Threats

Apr 26, 2025 -

Harvard University Reform Insights From A Conservative Professor

Apr 26, 2025

Harvard University Reform Insights From A Conservative Professor

Apr 26, 2025