Bitcoin Miner Surge: Understanding This Week's Increase

Table of Contents

The Price of Bitcoin and its Impact on Mining Profitability

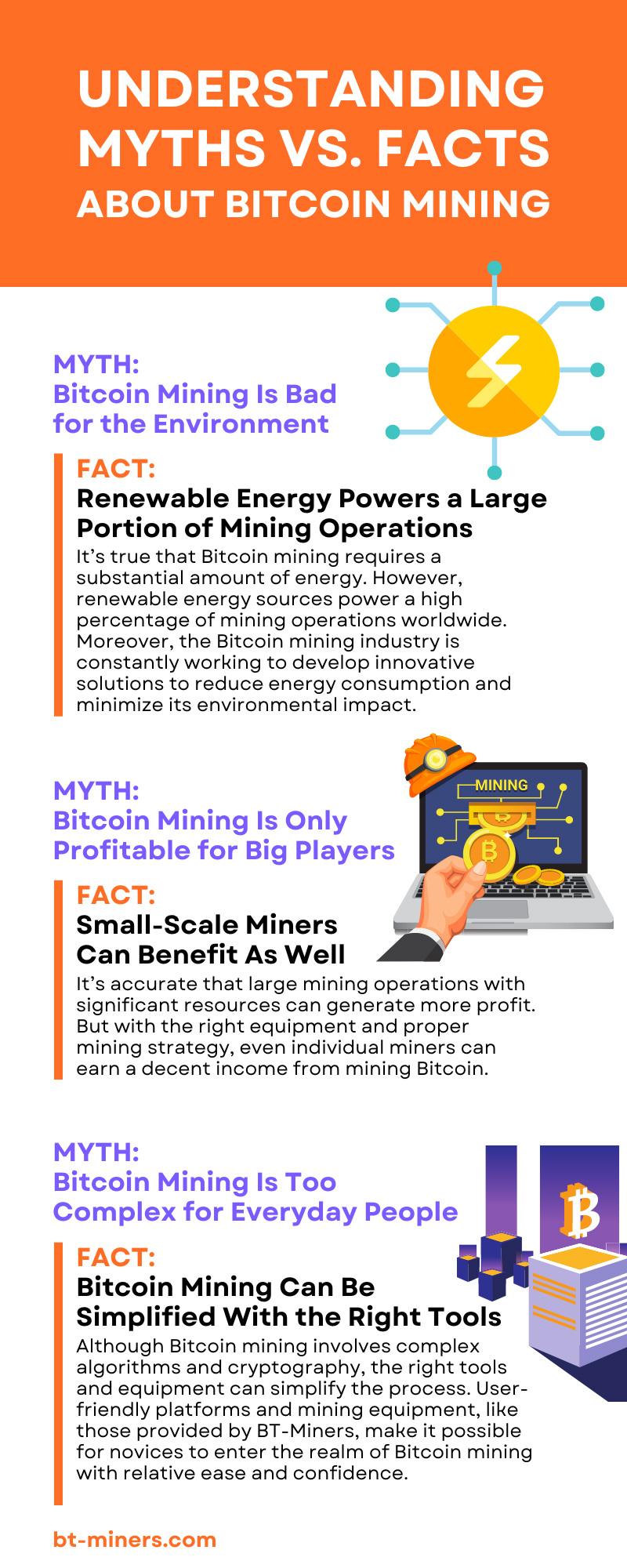

The price of Bitcoin is intrinsically linked to the profitability of mining. A higher Bitcoin price directly translates into higher rewards for miners, making the activity significantly more attractive. This week's price increase, which saw Bitcoin climb [insert actual percentage and price data here, citing a reliable source like CoinMarketCap], has undoubtedly played a crucial role in the surge in mining activity. This increase incentivizes existing miners to operate at full capacity and encourages new players to enter the market.

Beyond the price itself, transaction fees contribute to miner revenue. Higher transaction volumes on the Bitcoin network lead to increased fees, boosting miners' overall earnings. The interplay between Bitcoin's price and transaction fees creates a powerful incentive for increased mining.

- Price increase directly translates to higher rewards for miners. A 10% price increase, for example, directly increases the reward for each mined block by 10%.

- Higher Bitcoin price makes mining more attractive to new entrants. The improved profitability threshold encourages investment in new mining hardware and operations.

- Analysis of the price-to-hash rate ratio. This ratio provides a key indicator of miner profitability, showing the relationship between Bitcoin's price and the computational power dedicated to mining. A rising ratio typically indicates increased profitability.

The Role of New Mining Hardware and Technology

Advancements in Application-Specific Integrated Circuit (ASIC) technology are continuously improving mining efficiency and profitability. Newer ASIC chips boast higher hash rates, allowing miners to solve complex cryptographic problems faster and earn more Bitcoin. Furthermore, the development of more energy-efficient miners significantly reduces operating costs, enhancing profitability even with fluctuating Bitcoin prices.

This technological progress facilitates the entry of new, large-scale mining operations. Companies with access to capital and advanced technology can leverage these efficiencies to gain a competitive edge in the market, contributing to the overall increase in mining activity.

- Advancements in ASIC chips lead to higher hash rates. This directly translates to a greater probability of successfully mining a block and earning the reward.

- Lower energy consumption reduces operating costs. Energy costs are a major expense in Bitcoin mining; therefore, more efficient miners significantly improve profitability.

- Increased competition among hardware manufacturers. This competition drives innovation and leads to continuous improvements in mining hardware.

Regulatory Changes and Their Influence on Bitcoin Mining

Regulatory landscapes significantly impact Bitcoin mining operations. Favorable regulations in certain jurisdictions can attract miners, while stricter regulations in others can force miners to relocate or scale back operations. Recent [mention specific region and policy, providing a link to a reliable news source], for instance, has created a more favorable environment for Bitcoin mining, potentially contributing to the recent surge. Conversely, increased scrutiny and stricter regulations in other regions may cause a shift in the geographical distribution of mining activity.

- Impact of any new mining-friendly policies in certain jurisdictions. These policies can provide tax incentives, streamlined licensing processes, or access to cheaper energy sources.

- Effects of stricter regulations in other regions. These regulations can lead to increased operating costs, limitations on energy consumption, or even outright bans.

- Analysis of the geographical distribution of mining activity. Tracking the geographical shift helps to understand the influence of regulatory environments on the overall mining landscape.

Network Difficulty Adjustment and its Effect on the Surge

Bitcoin's network difficulty adjustment mechanism is designed to maintain a consistent block generation time of approximately 10 minutes. As the total mining hash rate increases, the network difficulty automatically adjusts upwards, making it harder to mine blocks. This prevents the network from becoming overly congested and ensures its stability.

The recent increase in hash rate has inevitably led to an upward adjustment in network difficulty. While this initially might seem counterintuitive to the surge, the adjustment ensures the long-term sustainability of the network and the continued profitability of mining operations, albeit at a potentially slower rate.

- Explanation of how the difficulty adjustment works. The difficulty adjusts approximately every two weeks based on the average block generation time over the preceding period.

- Data showing the recent changes in network difficulty. This data should be sourced from a reputable blockchain explorer like Blockchain.com or similar.

- Prediction of how the difficulty adjustment will influence future mining profitability. The adjustment will likely moderate the profitability, creating a more balanced and sustainable mining environment.

Conclusion: Understanding the Bitcoin Miner Surge and What it Means

The recent Bitcoin miner surge is a multifaceted phenomenon driven by several interconnected factors. The increase in Bitcoin's price, coupled with advancements in mining hardware and potentially influenced by regulatory changes, has created a more profitable environment for Bitcoin mining. The network difficulty adjustment mechanism, while increasing the difficulty, ensures the continued health and stability of the Bitcoin network.

Understanding these factors is crucial for investors and anyone involved in the Bitcoin ecosystem. While the current surge is significant, it's essential to maintain a cautious outlook, considering potential future shifts in the market, including price fluctuations and further regulatory developments. Stay tuned for more updates on the Bitcoin mining landscape and continue to monitor the factors influencing this volatile yet fascinating market. Understanding the intricacies of Bitcoin miner surges is crucial for navigating the crypto world effectively.

Featured Posts

-

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025 -

Investing In The Future A Map Of Emerging Business Hubs

May 08, 2025

Investing In The Future A Map Of Emerging Business Hubs

May 08, 2025 -

Arsenal Manager Arteta Under Fire Following Collymores Criticism

May 08, 2025

Arsenal Manager Arteta Under Fire Following Collymores Criticism

May 08, 2025 -

Thunder Face Stiff Memphis Test Upcoming Game Preview

May 08, 2025

Thunder Face Stiff Memphis Test Upcoming Game Preview

May 08, 2025 -

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

Latest Posts

-

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025 -

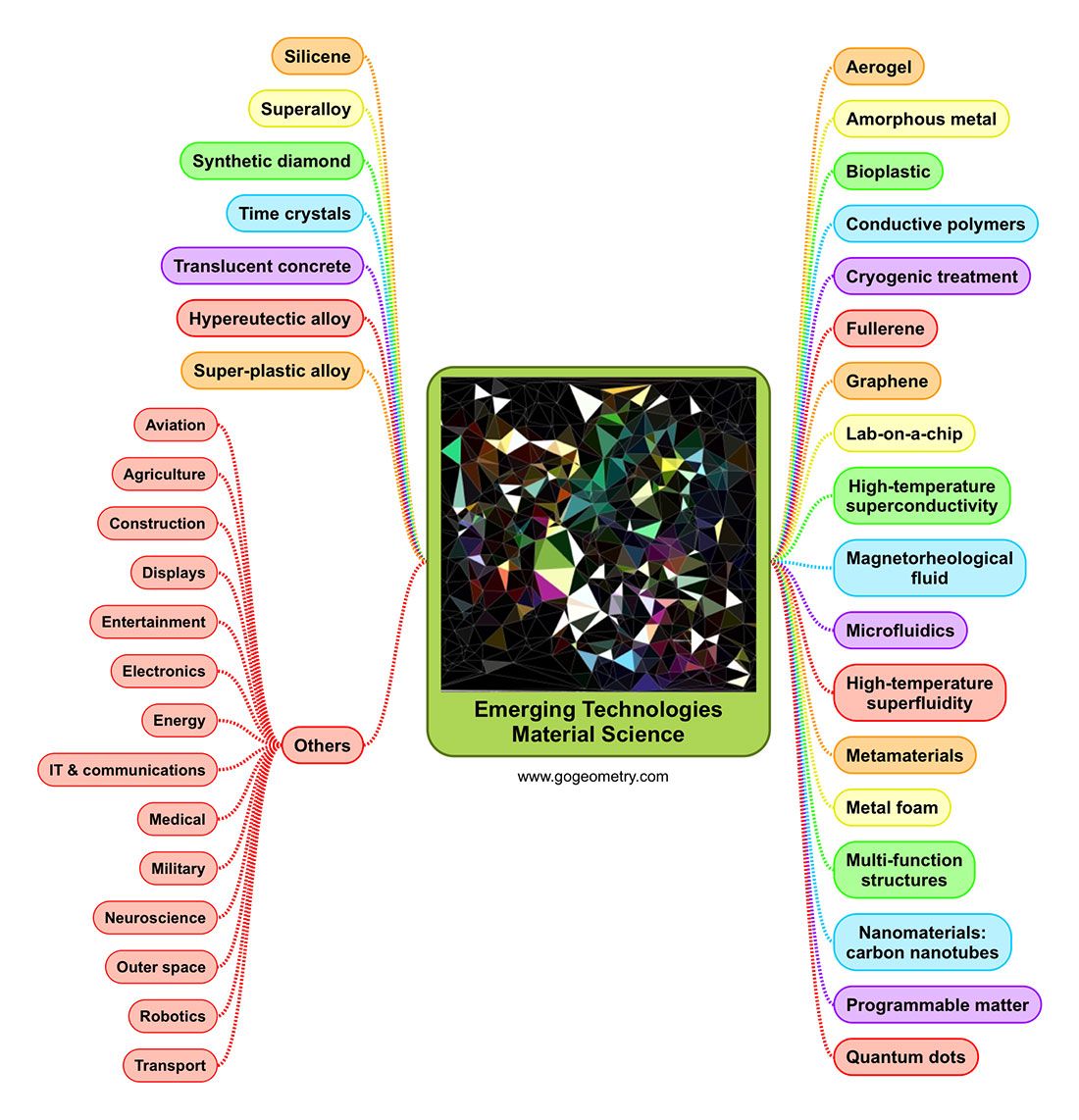

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025 -

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025