This Week's Bitcoin Mining Boom: Causes And Implications

Table of Contents

Factors Contributing to the Bitcoin Mining Boom

Several interconnected factors have contributed to the current Bitcoin mining boom. Understanding these factors is key to comprehending the current market dynamics and predicting future trends in Bitcoin mining profitability.

Increased Bitcoin Price

A rising Bitcoin price is the most direct and significant driver of increased Bitcoin mining activity. Higher Bitcoin prices directly translate to increased profitability for miners.

- Miners receive Bitcoin as a reward for successfully solving complex cryptographic puzzles.

- A higher Bitcoin price means each reward is worth more in fiat currency, making the mining operation more lucrative.

- This increased profitability offsets the costs associated with electricity consumption, specialized mining hardware (ASICs), and maintenance.

For example, if the price of Bitcoin doubles, miners' revenue doubles, making it attractive for more individuals and companies to enter the Bitcoin mining market. Many price prediction websites, such as [insert example of a reputable price prediction website], offer forecasts that can influence miner decisions regarding investment and scaling operations. The correlation between Bitcoin's price and mining hash rate is clearly evident in historical data, with peaks in hash rate often coinciding with price increases.

Reduced Mining Difficulty (If Applicable)

Bitcoin's mining difficulty adjusts automatically approximately every two weeks to maintain a consistent block generation time of around 10 minutes. If the total network hash rate (the combined computing power of all miners) increases significantly, the difficulty adjusts upwards, making it harder to solve the cryptographic puzzles. Conversely, if the hash rate decreases, the difficulty decreases, making it easier and more profitable to mine.

- A period of reduced difficulty, if recently experienced, can significantly boost miner profitability, leading to a rush of new miners joining the network.

- This influx of miners then contributes to an increased hash rate, eventually triggering a difficulty adjustment upwards. It's a dynamic equilibrium.

- Analyzing recent difficulty adjustments is crucial for understanding the contributing factors to the current boom. (Insert data on recent difficulty adjustments if applicable).

Technological Advancements in Mining Hardware

The development and deployment of more efficient and powerful ASICs (Application-Specific Integrated Circuits) play a crucial role in the Bitcoin mining boom.

- Manufacturers like Bitmain and MicroBT continuously release new generations of ASICs with improved hash rates and energy efficiency.

- These advancements allow miners to solve more cryptographic puzzles per unit of energy consumed, boosting profitability and incentivizing investment in newer, more powerful equipment.

- However, this technological race also leads to higher capital expenditure for miners and increases the barrier to entry for smaller players. The increased energy efficiency, however, partially mitigates this cost.

Regulatory Changes (If Applicable)

Regulatory changes in various jurisdictions can significantly impact Bitcoin mining activity.

- Countries with supportive or lax regulatory environments may attract more miners seeking favorable conditions.

- Conversely, regions with stringent regulations or outright bans can discourage mining activity.

- Any recent changes in specific countries concerning Bitcoin mining (e.g., changes in taxation, licensing, or energy policies) should be considered when analyzing the current boom. (Include specific examples if relevant).

Implications of the Bitcoin Mining Boom

The current Bitcoin mining boom has several significant implications, both positive and negative.

Enhanced Bitcoin Network Security

The most significant positive implication is a substantial increase in Bitcoin's network security.

- A higher hash rate makes it exponentially more difficult for malicious actors to execute a 51% attack—a scenario where a single entity controls more than half of the network's computing power, allowing them to potentially manipulate the blockchain.

- This enhanced security strengthens Bitcoin's decentralization and resilience, fostering greater trust and confidence in the network.

Increased Energy Consumption

The increasing mining activity inevitably leads to a higher energy consumption rate.

- Bitcoin mining requires substantial computational power, translating into a significant electricity demand.

- Concerns about Bitcoin's environmental impact are valid and require proactive measures.

- The mining industry is increasingly adopting renewable energy sources (e.g., solar, hydro) to reduce its carbon footprint. Several initiatives are focusing on promoting sustainable Bitcoin mining practices. (Cite relevant studies and reports on Bitcoin's energy consumption and sustainability efforts).

Impact on Bitcoin Price Volatility

The interplay between mining activity and Bitcoin's price is complex and can lead to both increased and decreased volatility.

- Increased mining could initially lead to increased selling pressure as miners liquidate their rewards, potentially causing short-term price dips.

- However, the enhanced network security resulting from a higher hash rate can contribute to long-term price stability and increased investor confidence, potentially counteracting the initial negative pressure.

Potential for Market Saturation

The current boom raises the question of market saturation.

- As more miners enter the market, the competition intensifies, potentially leading to reduced profitability for individual miners.

- This could trigger consolidation within the industry, with larger, more efficient mining operations absorbing smaller players.

- The long-term sustainability of the current boom hinges on factors such as the Bitcoin price, technological advancements, and regulatory developments.

Conclusion

This week's Bitcoin mining boom is a multifaceted event with significant implications for the future of Bitcoin. The confluence of factors such as increased Bitcoin price, technological advancements, and potential regulatory shifts has contributed to this surge in mining activity. While this boom enhances network security, concerns regarding energy consumption and market saturation remain. Understanding these causes and implications is crucial for navigating the evolving landscape of Bitcoin and the broader cryptocurrency market. Stay informed about the latest developments in the Bitcoin mining world to capitalize on future opportunities. Keep monitoring this exciting space to understand the ongoing dynamics of the Bitcoin mining boom.

Featured Posts

-

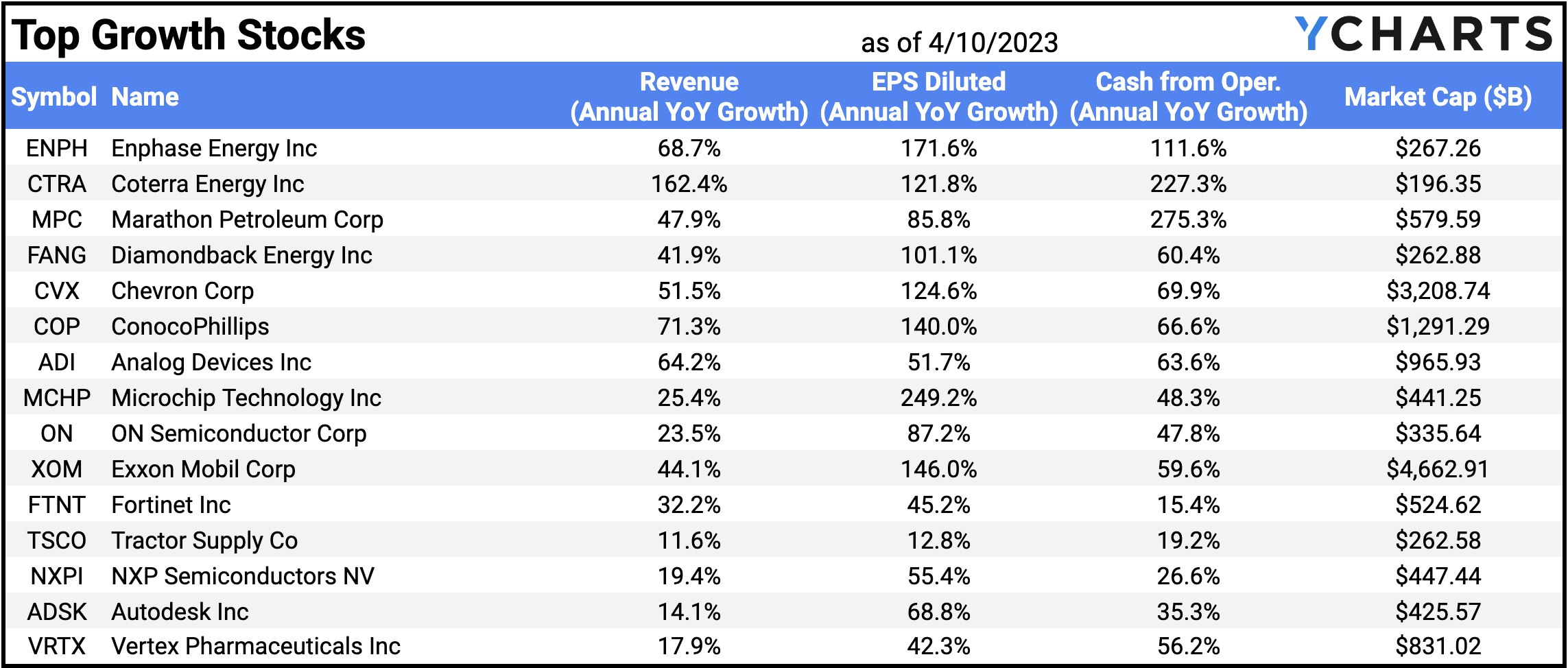

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025 -

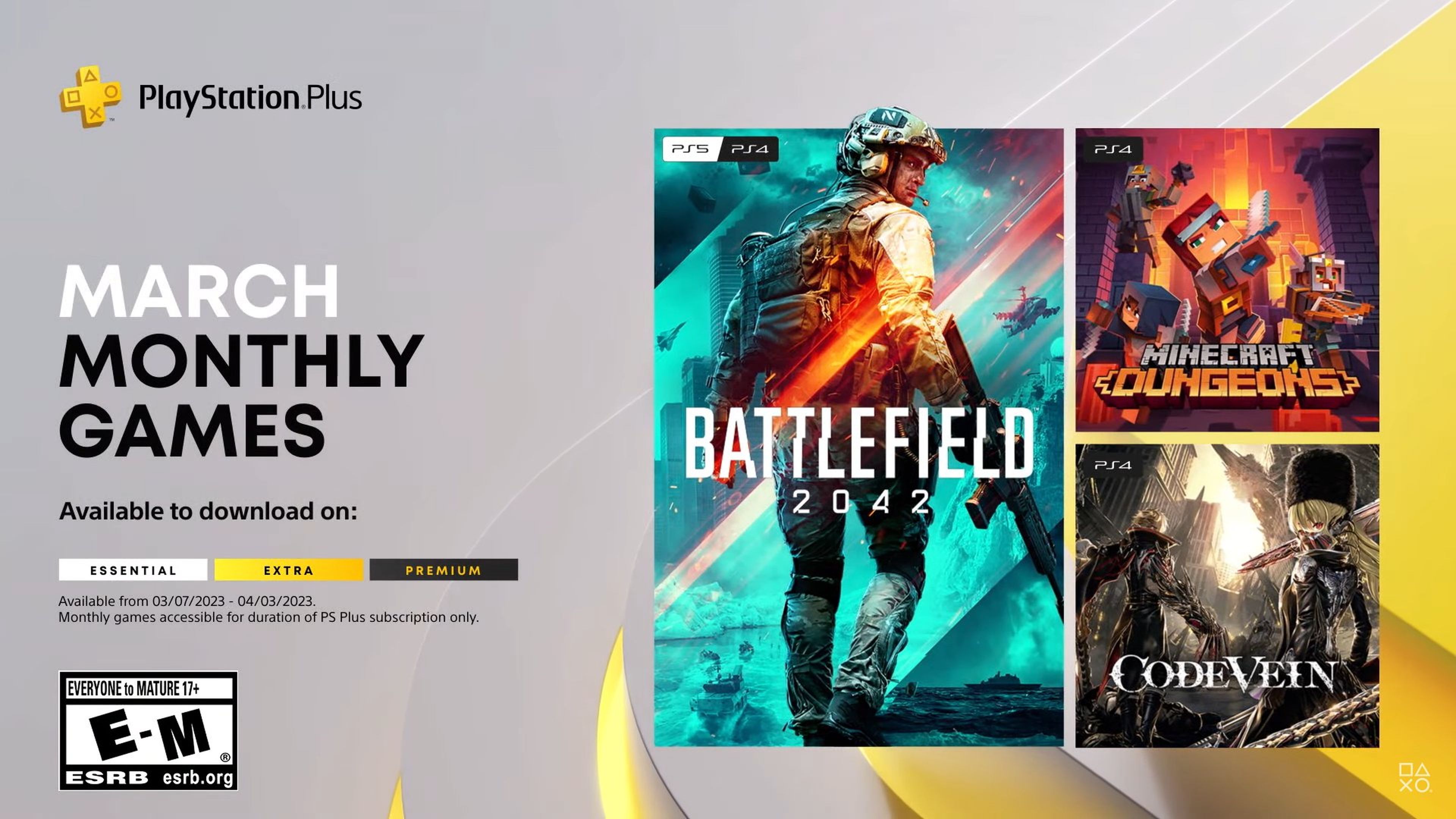

New Ps Plus Premium And Extra Games March 2024 Lineup

May 08, 2025

New Ps Plus Premium And Extra Games March 2024 Lineup

May 08, 2025 -

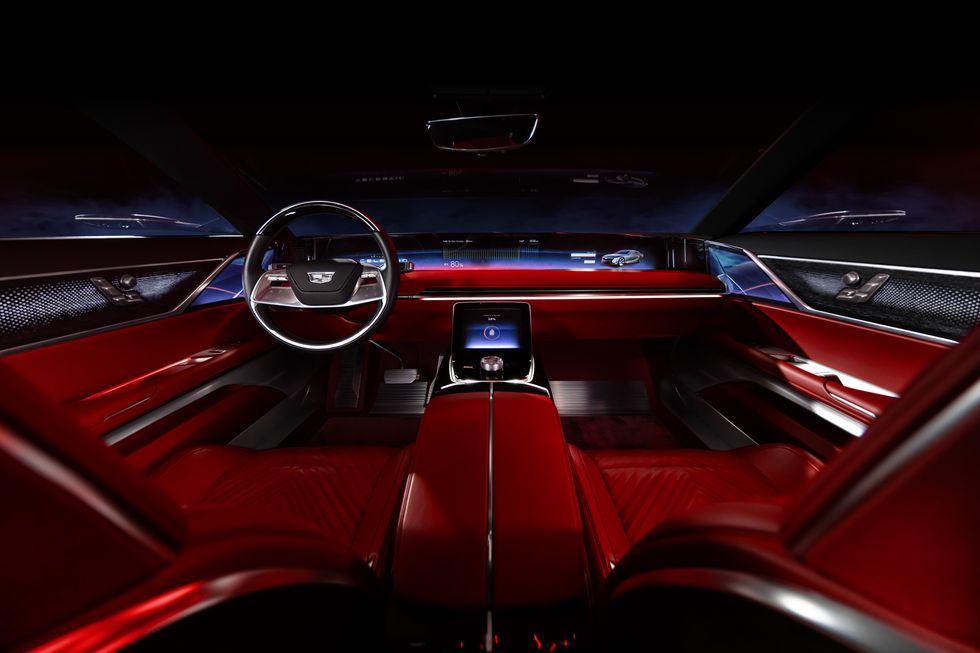

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025 -

Westbrook Trade Rumors A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Rumors A Nuggets Players Reaction

May 08, 2025

Latest Posts

-

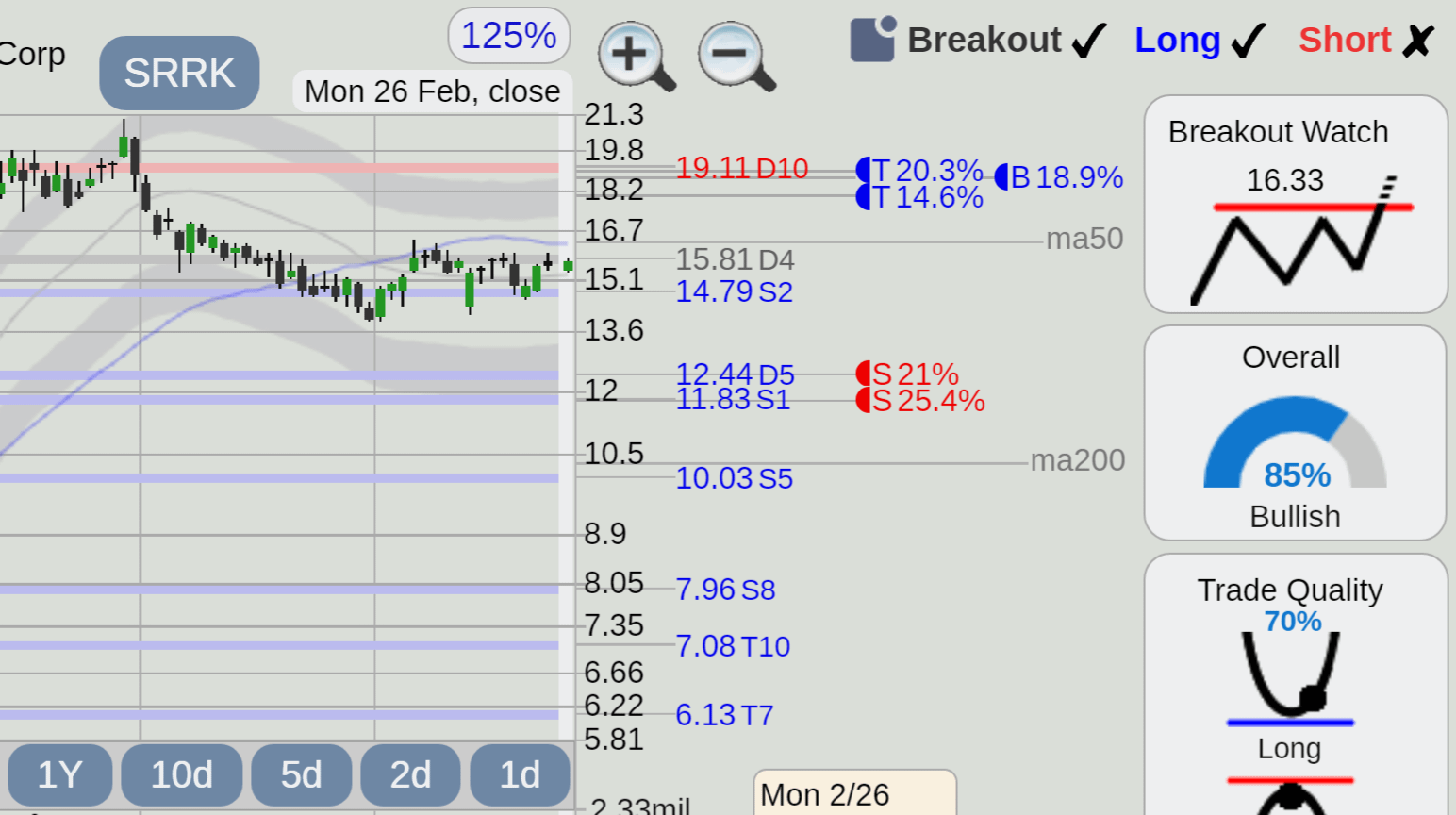

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025 -

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025 -

Dwp Benefit Cuts Thousands Affected By April 5th Changes

May 08, 2025

Dwp Benefit Cuts Thousands Affected By April 5th Changes

May 08, 2025 -

Dwps Increased Home Visits What Benefit Claimants Need To Know

May 08, 2025

Dwps Increased Home Visits What Benefit Claimants Need To Know

May 08, 2025 -

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025