Is Palantir Stock A Good Buy Before May 5th? Wall Street's View.

Table of Contents

Palantir's Recent Performance and Market Sentiment

Palantir's stock price has seen a rollercoaster ride recently. After reaching highs in [Insert recent high and date], the stock experienced a downturn, reaching lows around [Insert recent low and date]. This fluctuation reflects the inherent uncertainty surrounding the company's future growth and profitability, making it crucial to analyze current market sentiment.

Analyzing metrics such as analyst ratings and trading volume provides a clearer picture. Currently, the overall sentiment appears to be [Insert overall sentiment - bullish, bearish, or neutral, citing sources if possible]. This sentiment is influenced by several factors, including:

- Recent Price Changes: In the past month, PLTR experienced a [percentage]% change, fluctuating between [Low Price] and [High Price].

- Trading Volume Fluctuations: Trading volume has [increased/decreased] significantly in recent weeks, suggesting [increased/decreased] investor interest. Specific data points on volume would be helpful here (e.g., average daily volume).

- News Impact: Recent news, such as [mention specific news like new contract wins, partnerships, or regulatory changes], has directly impacted investor confidence and subsequently influenced the stock price.

Upcoming Earnings Report (May 5th) and its Potential Impact

The May 5th earnings report holds significant weight for Palantir investors. This report will offer crucial insights into the company's financial health and future prospects, directly impacting the stock price. Analysts are keenly awaiting updates on several key performance indicators:

- Revenue and EPS Expectations: Analysts predict revenue of approximately [Insert Analyst Revenue Estimate] and earnings per share (EPS) of [Insert Analyst EPS Estimate]. These figures represent a [percentage]% increase/decrease compared to the previous year.

- Key Metrics to Watch: Investors will closely scrutinize customer growth, particularly within the government and commercial sectors. The success of new product launches and the expansion of existing contracts will also be critical factors.

- Potential Scenarios: A positive surprise (exceeding expectations) could lead to a substantial price increase, while a negative surprise (missing expectations) could result in a significant drop. Meeting expectations may lead to a relatively muted market reaction.

- Price Reactions: The market's reaction will depend heavily on the company's guidance for future quarters. Strong guidance usually boosts investor confidence, resulting in a positive price movement.

Wall Street's View: Analyst Ratings and Price Targets

Wall Street analysts offer a diverse range of opinions regarding Palantir's future. While a consensus is difficult to pinpoint, the general sentiment can be summarized as follows: [Insert overall analyst sentiment - bullish, bearish, or neutral].

- Analyst Ratings Summary: A breakdown of current analyst ratings (Buy, Hold, Sell) would be included here, along with the percentage of each rating.

- Key Analyst Price Targets: Mention specific analysts and their price targets (e.g., "Analyst X has a price target of $XX, while Analyst Y projects $YY").

- Recent Rating Changes: Highlight any significant shifts in analyst ratings over the past few months, noting reasons behind the changes.

- Catalysts Influencing Future Ratings: Discuss potential factors (e.g., new contract announcements, successful product launches, improved profitability) that might lead to future rating upgrades or downgrades.

Key Risks and Considerations for Investing in Palantir

Despite its potential, investing in Palantir carries inherent risks:

- Competition: Palantir faces stiff competition from established players in the data analytics and software markets. [Mention specific competitors and their relative strengths].

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. Reductions in government spending could negatively impact the company's financial performance.

- Valuation: Palantir's current valuation is [Insert Valuation Data] which is [high/low/comparable] to its peers. This raises questions about its long-term sustainability.

- Other Risks: Geopolitical instability and technological disruptions pose additional risks that could affect the company's operations and stock price.

Conclusion

Determining whether Palantir stock is a good buy before May 5th requires careful consideration of its recent performance, the upcoming earnings report, Wall Street's outlook, and the inherent risks involved. While Palantir possesses significant growth potential, its volatile nature and dependence on certain contracts present challenges. The upcoming earnings report will be pivotal in shaping investor sentiment and the stock's trajectory.

Call to Action: Based on this analysis, decide if Palantir stock aligns with your investment risk tolerance and overall strategy before May 5th. Remember, this information is for educational purposes only. Further research is crucial, and consulting a financial advisor is recommended before making any investment decisions. Thorough due diligence is paramount before buying or selling Palantir (PLTR) stock.

Featured Posts

-

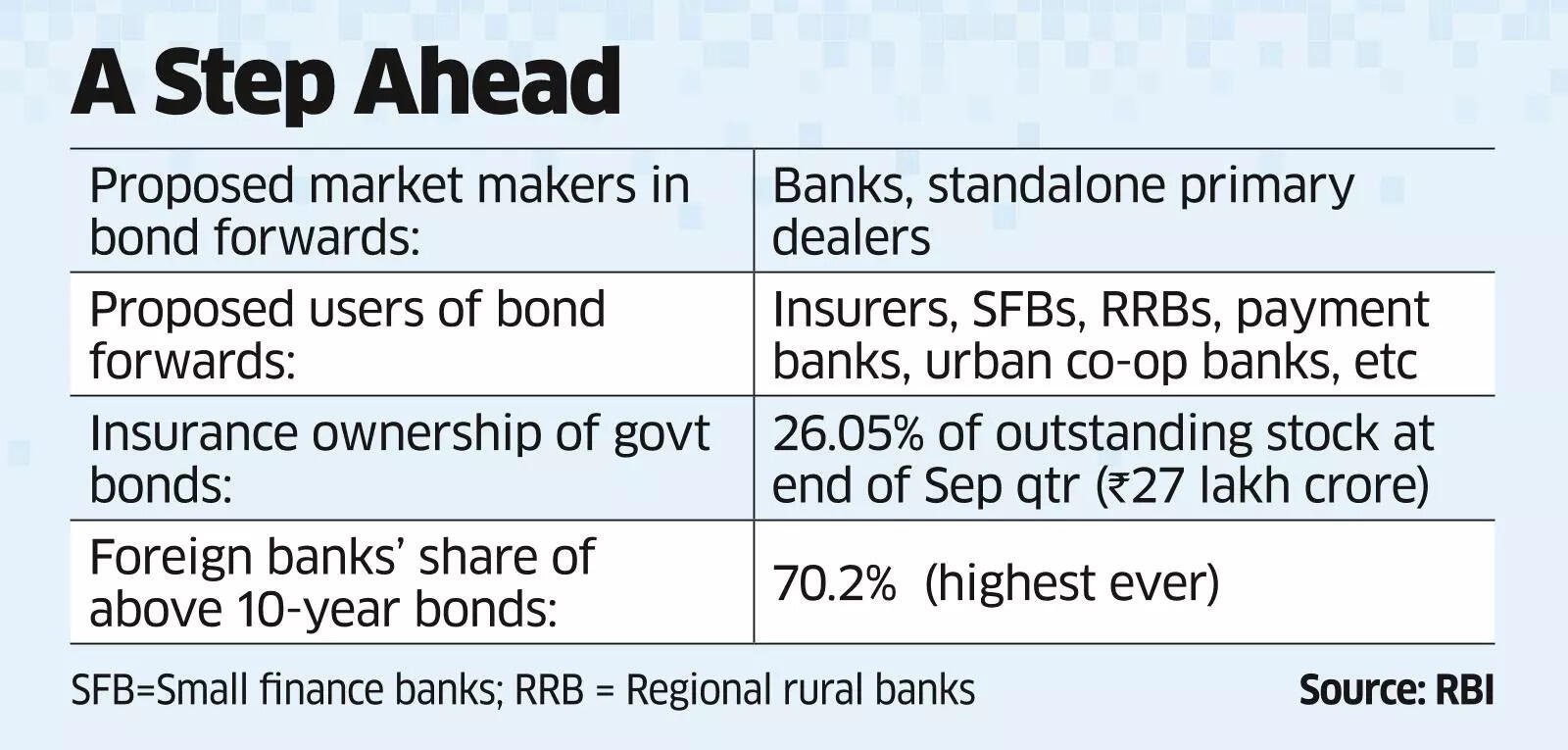

Easing Regulations For Bond Forwards A Plea From Indian Insurers

May 09, 2025

Easing Regulations For Bond Forwards A Plea From Indian Insurers

May 09, 2025 -

Lightning Defeat Oilers 4 1 Kucherovs Stellar Performance Shines

May 09, 2025

Lightning Defeat Oilers 4 1 Kucherovs Stellar Performance Shines

May 09, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Yine De Kazancli Mi

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Yine De Kazancli Mi

May 09, 2025 -

Trumps Trade War 174 Billion Net Worth Decline For Top 10 Billionaires

May 09, 2025

Trumps Trade War 174 Billion Net Worth Decline For Top 10 Billionaires

May 09, 2025 -

Navigating The Great Decoupling Strategies For Businesses And Investors

May 09, 2025

Navigating The Great Decoupling Strategies For Businesses And Investors

May 09, 2025