Trump's Trade War: $174 Billion Net Worth Decline For Top 10 Billionaires

Table of Contents

Keywords: Trump trade war, billionaire net worth, economic impact, trade tariffs, wealth decline, stock market, US economy, financial consequences, investment losses

The Trump administration's trade war, characterized by aggressive imposition of tariffs on imported goods, had a profound and measurable impact on the American economy. While the intended goal was to protect domestic industries and renegotiate trade deals, a significant unintended consequence was a substantial decline in the net worth of the nation's wealthiest individuals. This article delves into the staggering $174 billion loss experienced by the top ten billionaires as a direct result of the trade war's economic fallout.

The Magnitude of the Loss

The $174 billion decrease in the combined net worth of America's top ten billionaires represents a significant blow to the nation's wealthiest. This figure, calculated based on market valuations and expert analysis during the peak of the trade war, highlights the far-reaching consequences of protectionist trade policies. While precise individual losses are difficult to isolate solely to the trade war due to other market fluctuations, several billionaires experienced noticeable dips in their fortunes.

- Jeff Bezos: While precise figures attributable solely to the trade war are unavailable, Amazon, Bezos's primary source of wealth, faced increased costs and reduced international sales due to tariffs.

- Elon Musk: Tesla, heavily reliant on global supply chains, experienced disruptions and increased input costs, affecting its stock price and Musk's net worth.

- Mark Zuckerberg: Facebook (now Meta), while not directly targeted by tariffs, felt the ripple effects of the slowing global economy and decreased consumer spending.

The percentage decreases in net worth varied across individuals, but estimates suggest several billionaires experienced double-digit percentage declines in their overall wealth during this period.

- Percentage Decrease Examples (Illustrative): While precise figures are debated, some analysts suggest percentage declines ranging from 10% to 20% for certain individuals in the top ten. This is a significant loss, especially in comparison to their overall wealth.

Comparing this loss to other major economic events reveals its scale. The $174 billion decline surpasses the losses experienced by many billionaires during other market downturns, highlighting the trade war’s unique and severe impact.

Sectors Most Affected by the Trade War

Trump's tariffs disproportionately impacted specific sectors of the US economy, triggering a domino effect on billionaire wealth. Industries heavily reliant on global supply chains or with significant imports faced the brunt of the increased costs and reduced competitiveness.

- Technology: The tech sector, with its intricate global supply chains, experienced significant challenges. Increased costs for components and finished goods led to reduced profit margins and slower growth.

- Retail: Retailers faced higher prices for imported goods, forcing them to either absorb the costs or pass them onto consumers, impacting sales and profits.

- Agriculture: Farmers suffered greatly, as trade disputes with major agricultural trading partners led to reduced exports and plummeting prices for crops like soybeans.

Examples of Struggles: Companies within these sectors faced difficulties ranging from reduced exports to plant closures and layoffs, directly impacting the wealth of their owners and investors.

- Specific Industry Losses (Illustrative): While precise figures are difficult to attribute solely to tariffs, reports indicate significant job losses and revenue declines in various affected sectors.

Charts and graphs illustrating the performance of stocks in these sectors during the trade war period would further illustrate the negative impact.

The Ripple Effect on the US Economy

The consequences of the trade war extended far beyond the wealth of billionaires. The broader US economy experienced several negative repercussions.

- Job Losses: Increased costs and reduced competitiveness led to job losses in multiple sectors, impacting manufacturing, retail, and agriculture.

- Consumer Price Increases: Tariffs increased the price of imported goods, leading to higher consumer prices and reduced purchasing power.

- Decreased Investor Confidence: The uncertainty and volatility caused by the trade war eroded investor confidence, leading to decreased investment and economic slowdown.

- International Trade Relationships: The trade war strained relationships with key trading partners, leading to retaliatory tariffs and a more protectionist global trade environment.

Economic reports from organizations like the Congressional Budget Office and the Federal Reserve can provide further data on these various economic impacts.

Long-Term Implications of the Trade War

The long-term consequences of Trump's trade war are still unfolding. Several significant shifts have occurred and others are projected.

- Global Supply Chain Restructuring: Companies are seeking to diversify their supply chains and reduce reliance on single sources, potentially leading to increased costs and complexity.

- Investment Pattern Shifts: Investment patterns have shifted, with some companies prioritizing domestic production while others seek alternative international markets.

- Future Economic Vulnerabilities: The trade war highlighted the vulnerability of the US economy to trade disputes and protectionist policies, underscoring the need for more diversified and resilient supply chains.

Expert opinions and forecasts on the long-term economic impacts remain varied, but many analysts express concern about the potential for lingering negative effects on economic growth and international relations.

Conclusion

Trump's trade war had a significant impact on the US economy, resulting in a substantial $174 billion decrease in the net worth of the top ten American billionaires. This loss is just one facet of the broader economic repercussions, which included job losses, increased consumer prices, decreased investor confidence, and damaged international relations. The long-term implications of these trade disputes, including the reshaping of global supply chains and investment patterns, warrant continued analysis and discussion. Understand the complexities of Trump's trade war and its lasting effects on the American economy and billionaire wealth. Learn more about the economic consequences of trade disputes by exploring [link to relevant resource/further reading]. Continue your research on the impact of Trump’s trade war on billionaire net worth.

Featured Posts

-

La Cite De La Gastronomie A Dijon Intervention Municipale Face Aux Defis D Epicure

May 09, 2025

La Cite De La Gastronomie A Dijon Intervention Municipale Face Aux Defis D Epicure

May 09, 2025 -

Palantir Stock Outlook Should You Invest Before May 5th

May 09, 2025

Palantir Stock Outlook Should You Invest Before May 5th

May 09, 2025 -

Daycare Costs Soar After Expensive Babysitting A Mans Costly Mistake

May 09, 2025

Daycare Costs Soar After Expensive Babysitting A Mans Costly Mistake

May 09, 2025 -

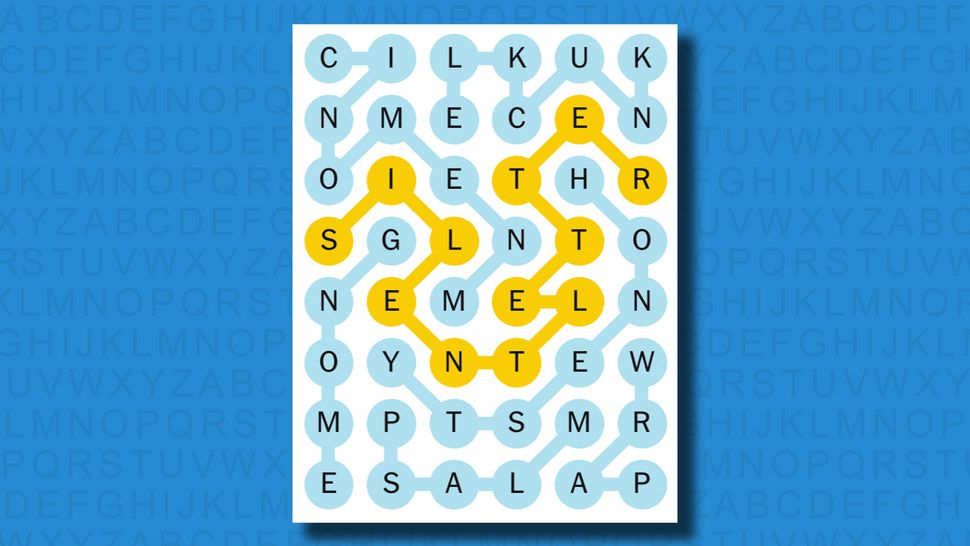

Nyt Strands Answers For Saturday February 15th Game 349

May 09, 2025

Nyt Strands Answers For Saturday February 15th Game 349

May 09, 2025 -

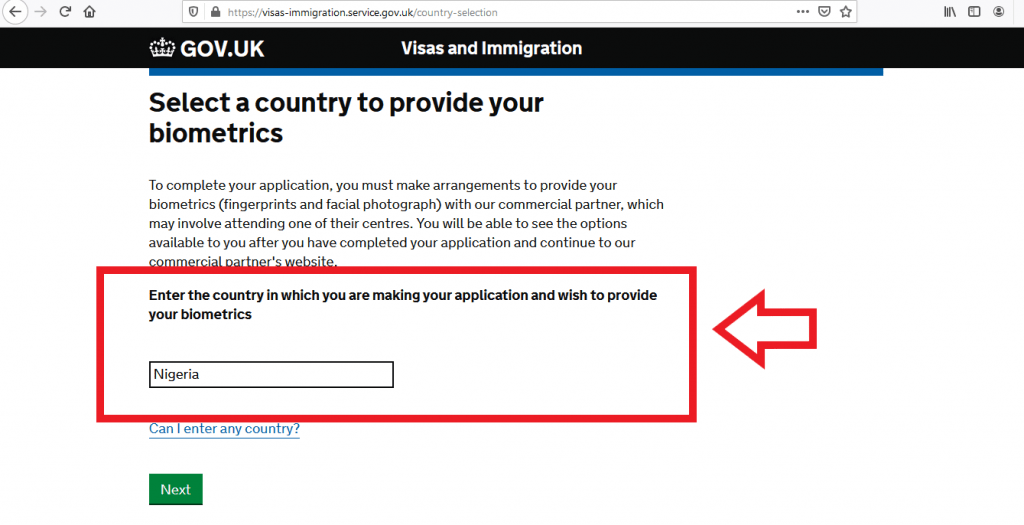

Changes To Uk Visa Applications From Nigeria And Pakistan

May 09, 2025

Changes To Uk Visa Applications From Nigeria And Pakistan

May 09, 2025