Navigating The Great Decoupling: Strategies For Businesses And Investors

Table of Contents

Understanding the Dynamics of the Great Decoupling

The Great Decoupling isn't a sudden event but rather a gradual shift driven by several interconnected factors. Understanding these dynamics is crucial for effective strategy development.

Geopolitical Factors Driving Decoupling

Several geopolitical factors are accelerating the decoupling process:

- Increased trade wars and protectionism: The rise of protectionist policies, including tariffs and trade barriers, is fragmenting global trade relationships and forcing businesses to reconsider their reliance on single-source suppliers.

- Rising tensions between major global powers: Geopolitical rivalry between nations is creating uncertainty and instability, impacting supply chains and investment decisions. This necessitates careful consideration of political risk in all aspects of business and investment.

- The impact of sanctions and geopolitical instability: Sanctions imposed on certain countries disrupt established trade routes and create significant disruptions for businesses operating globally. The volatility stemming from geopolitical instability further exacerbates this complexity.

- Focus on national security and self-sufficiency: Many nations are prioritizing national security concerns, leading to a push for greater self-sufficiency in critical industries and a reduction in reliance on foreign suppliers. This trend fuels the growth of near-shoring and friend-shoring.

The Reshaping of Global Supply Chains

The Great Decoupling is fundamentally reshaping global supply chains:

- Nearshoring and friend-shoring strategies: Businesses are increasingly shifting production closer to home or to countries with friendly political and economic ties to mitigate risks associated with long and complex supply chains.

- Regionalization and the rise of localized production: We are seeing a surge in regional trade blocs and the development of more localized production networks, reducing reliance on global supply chains.

- Increased costs associated with diversification and reshoring: While diversification offers resilience, it often comes with increased costs due to higher transportation expenses, potential logistical hurdles, and the establishment of new production facilities.

- The need for greater supply chain transparency and visibility: The current climate necessitates increased transparency and visibility within supply chains to better anticipate and manage potential disruptions. Advanced technologies play a crucial role in achieving this transparency.

Strategies for Businesses Navigating the Great Decoupling

Businesses need to adapt proactively to thrive in this new environment. Here are some crucial strategies:

Building Supply Chain Resilience

Building a resilient supply chain is paramount:

- Diversifying sourcing and manufacturing locations: Reducing reliance on single-source suppliers by spreading production across multiple geographically diverse locations mitigates risk.

- Investing in technology for supply chain visibility and management: Implementing advanced technologies like blockchain, AI, and IoT enhances transparency and allows for proactive risk management.

- Strengthening relationships with key suppliers: Cultivating strong relationships with trusted suppliers is essential for ensuring consistent supply during times of disruption.

- Developing contingency plans for disruptions: Businesses must have comprehensive plans in place to manage potential disruptions, including natural disasters, political instability, or pandemics.

Adapting to Shifting Geopolitical Landscapes

Understanding and managing geopolitical risks is crucial:

- Understanding and managing geopolitical risk: Businesses must conduct thorough geopolitical risk assessments to identify potential threats to their operations.

- Developing a robust risk management framework: A comprehensive framework should encompass political risk insurance, diversification strategies, and robust contingency planning.

- Complying with evolving regulations and trade policies: Staying abreast of changes in regulations and trade policies is essential to avoid legal and financial penalties.

- Building strong relationships with governments and regulatory bodies: Maintaining open communication with government agencies and regulatory bodies helps mitigate potential disruptions and ensures compliance.

Embracing Innovation and Technological Advancement

Innovation is key to navigating the complexities of the Great Decoupling:

- Adopting automation and AI to improve efficiency: Automation and AI can enhance productivity and reduce reliance on manual labor, making businesses more adaptable to disruptions.

- Investing in research and development to create new products and services: Innovation allows businesses to adapt to changing market demands and create new opportunities.

- Developing sustainable and ethical business practices: Consumers increasingly prioritize sustainability and ethical sourcing, creating a competitive advantage for businesses aligning with these values.

- Utilizing data analytics for better decision-making: Data-driven decision-making enables businesses to anticipate trends, optimize operations, and adapt proactively to changes.

Investment Strategies in a Decoupled World

The Great Decoupling also presents significant opportunities for investors:

Diversifying Investment Portfolios

Diversification is crucial in this new environment:

- Investing across different geographies and sectors: Spreading investments across various regions and industries reduces exposure to risks associated with specific locations or sectors.

- Reducing reliance on single-country or single-industry exposures: Over-reliance on any one country or sector creates vulnerability to shocks; diversification mitigates this risk.

- Exploring opportunities in emerging markets and regional hubs: Emerging markets and regional hubs often offer significant growth potential as businesses relocate and invest locally.

- Considering ESG factors in investment decisions: Environmental, Social, and Governance (ESG) factors are increasingly important to investors and consumers, shaping investment choices.

Identifying Opportunities in Reshoring and Nearshoring

The shift towards reshoring and nearshoring creates attractive investment opportunities:

- Investing in companies involved in reshoring and near-shoring initiatives: Companies engaged in these activities are likely to benefit from increased demand and reduced logistical complexities.

- Supporting the growth of regional supply chains: Investments in regional supply chains create economic growth and resilience within a region.

- Identifying companies with strong resilience and adaptability: Companies demonstrating agility and adaptability in response to changing market conditions represent sound investments.

Managing Geopolitical Risk in Investment Decisions

Geopolitical risk must be factored into all investment decisions:

- Conducting thorough due diligence on geopolitical factors: A comprehensive analysis of geopolitical risks associated with any investment is critical.

- Developing strategies for managing investment risk in unstable regions: Strategies for mitigating risk in volatile regions include diversification, hedging, and political risk insurance.

- Utilizing hedging strategies to mitigate potential losses: Hedging strategies, such as currency hedging, can help protect investments against unexpected fluctuations.

Conclusion

The Great Decoupling presents significant challenges, but also offers new opportunities for businesses and investors. By understanding the underlying dynamics, implementing robust strategies for supply chain resilience and diversification, and adapting to shifting geopolitical landscapes, businesses can not only survive but thrive in this new era. Investors, too, can capitalize on the changing global order by diversifying their portfolios and identifying opportunities in reshoring, nearshoring and regional growth. Successfully navigating the Great Decoupling requires proactive adaptation and a long-term perspective. Begin building your resilience and exploring opportunities presented by the Great Decoupling today. Learn more about effective strategies for navigating the Great Decoupling and protecting your investments.

Featured Posts

-

Sensex Jumps 200 Points Nifty Surges Past 18 600 Stock Market Update

May 09, 2025

Sensex Jumps 200 Points Nifty Surges Past 18 600 Stock Market Update

May 09, 2025 -

Ukraine Conflict Putin Announces Ceasefire For Victory Day

May 09, 2025

Ukraine Conflict Putin Announces Ceasefire For Victory Day

May 09, 2025 -

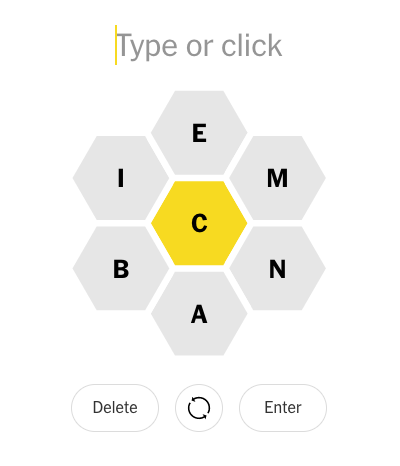

New York Times Spelling Bee April 1 2025 Hints Answers And Pangram Help

May 09, 2025

New York Times Spelling Bee April 1 2025 Hints Answers And Pangram Help

May 09, 2025 -

Navigating Real Id For Effortless Summer Travel

May 09, 2025

Navigating Real Id For Effortless Summer Travel

May 09, 2025 -

The Jesse Watters Controversy Hypocrisy Accusations Following Cheating Joke

May 09, 2025

The Jesse Watters Controversy Hypocrisy Accusations Following Cheating Joke

May 09, 2025