FTC Appeals Activision Blizzard Acquisition: Microsoft Deal Faces Legal Hurdle

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's core argument against the Microsoft-Activision Blizzard merger centers on the potential for anti-competitive practices that could harm consumers. The commission believes the acquisition would give Microsoft an unfair advantage, stifling competition and potentially leading to higher prices and reduced innovation.

-

Concerns Regarding Market Dominance: The FTC argues that Microsoft already holds significant market share in gaming consoles (Xbox) and the burgeoning cloud gaming market (Xbox Cloud Gaming). Acquiring Activision Blizzard, with its vast portfolio of popular titles, would further solidify Microsoft's dominance, potentially squeezing out competitors.

-

Exclusive Access to Key Titles: The FTC's primary concern revolves around the potential for Microsoft to make Activision Blizzard titles, particularly the enormously popular Call of Duty franchise, exclusive to its Xbox ecosystem. This could harm competitors like Sony PlayStation, significantly impacting their ability to compete and potentially limiting consumer choice.

-

Impact on Consumer Choice and Pricing: The FTC fears that reduced competition could lead to higher prices for games, subscription services, and potentially even gaming hardware. The lack of alternatives could also diminish the quality and innovation of games offered to consumers.

-

Specific Examples: The FTC cited examples of past instances where Microsoft has made games exclusive to its platform, using this as evidence to support its claim of potential anti-competitive behavior post-acquisition.

The Judge's Initial Ruling and its Rationale

A federal judge initially ruled in favor of Microsoft, allowing the acquisition to proceed. The judge's decision was based on a thorough review of the evidence presented by both sides.

-

Key Points from the Ruling: The judge found that the FTC had not presented enough evidence to convincingly demonstrate that the merger would substantially lessen competition in the gaming market.

-

Assessment of FTC Arguments: The judge acknowledged the FTC's concerns but ultimately found them insufficient to justify blocking the acquisition. The judge’s analysis weighed the potential harms against the potential benefits of the merger.

-

Evidence Presented in Court: The court proceedings involved extensive testimony and documentation from both Microsoft and the FTC, exploring market analysis, financial projections, and expert opinions on the competitive landscape of the gaming industry.

The Significance of the FTC's Appeal

The FTC's appeal of the initial ruling is a highly significant development with far-reaching consequences.

-

Impact on Acquisition Timeline: The appeal significantly delays—and potentially jeopardizes—the completion of the acquisition. The legal process could take months, even years, to resolve.

-

Precedent for Future Mergers: This appeal sets a crucial precedent for future mergers and acquisitions in the tech industry. The outcome will heavily influence how regulatory bodies approach similar deals in the future.

-

Implications for Microsoft's Gaming Strategy: The appeal presents a substantial risk to Microsoft's ambitious plans to expand its gaming business. A blocked acquisition would be a major setback for the company.

-

Further Regulatory Scrutiny: The appeal underscores the increasing scrutiny of large tech mergers by regulatory bodies worldwide, reflecting a growing focus on antitrust issues and the preservation of competition.

Potential Outcomes and Their Implications

Several scenarios are possible following the FTC's appeal.

-

Complete Block of the Acquisition: The appellate court could overturn the initial ruling and ultimately block the acquisition, forcing Microsoft to abandon its attempt to buy Activision Blizzard. This outcome would be a significant win for the FTC and potentially set a strong precedent.

-

Settlement or Compromise: Microsoft and the FTC might reach a settlement or compromise that addresses the regulatory concerns. This could involve concessions from Microsoft, such as agreeing to licensing agreements to ensure Call of Duty remains available on competing platforms.

-

Further Legal Challenges: Regardless of the appellate court's decision, further legal challenges are possible. The case could even reach the Supreme Court, significantly prolonging the legal battle.

-

Impact on Activision Blizzard: The protracted legal battle creates uncertainty for Activision Blizzard's employees and shareholders, affecting morale, stock price, and long-term planning.

The Broader Context: Antitrust Concerns in the Gaming Industry

The FTC Activision Blizzard acquisition highlights broader antitrust concerns within the rapidly consolidating video game industry.

-

Similar Antitrust Cases: The case echoes similar antitrust concerns raised in other tech industry mergers, emphasizing the growing trend of large corporations acquiring smaller companies to eliminate competition.

-

Increasing Concentration of Power: The gaming sector is witnessing an increasing concentration of power in the hands of a few major players, raising concerns about market dominance and the potential for stifled innovation.

-

Maintaining a Competitive Gaming Market: Regulatory bodies play a critical role in ensuring a healthy and competitive gaming market by preventing mergers that could lead to monopolies or anti-competitive practices.

Conclusion

The FTC's appeal of the Microsoft-Activision Blizzard acquisition represents a significant legal hurdle for Microsoft and a pivotal moment for the future of the gaming industry. The outcome will have substantial implications, setting a precedent for future mergers and acquisitions in the tech sector and influencing the competitive landscape of the gaming market for years to come. The appeal underscores ongoing concerns about market dominance and the crucial need to maintain fair competition.

Call to Action: Stay informed about the latest developments in the FTC Activision Blizzard acquisition case. Follow this website for updates and analysis on this crucial legal battle impacting the future of gaming. Keep reading for further insights into the FTC Activision Blizzard Acquisition and its implications.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Microsoft Deal Faces Legal Hurdle

Apr 26, 2025

Ftc Appeals Activision Blizzard Acquisition Microsoft Deal Faces Legal Hurdle

Apr 26, 2025 -

Deion Sanders Coaching Impact How It Affects Shedeur Sanders Nfl Prospects

Apr 26, 2025

Deion Sanders Coaching Impact How It Affects Shedeur Sanders Nfl Prospects

Apr 26, 2025 -

Seven Year Sentence Sought For George Santos In Federal Fraud And Identity Theft Case

Apr 26, 2025

Seven Year Sentence Sought For George Santos In Federal Fraud And Identity Theft Case

Apr 26, 2025 -

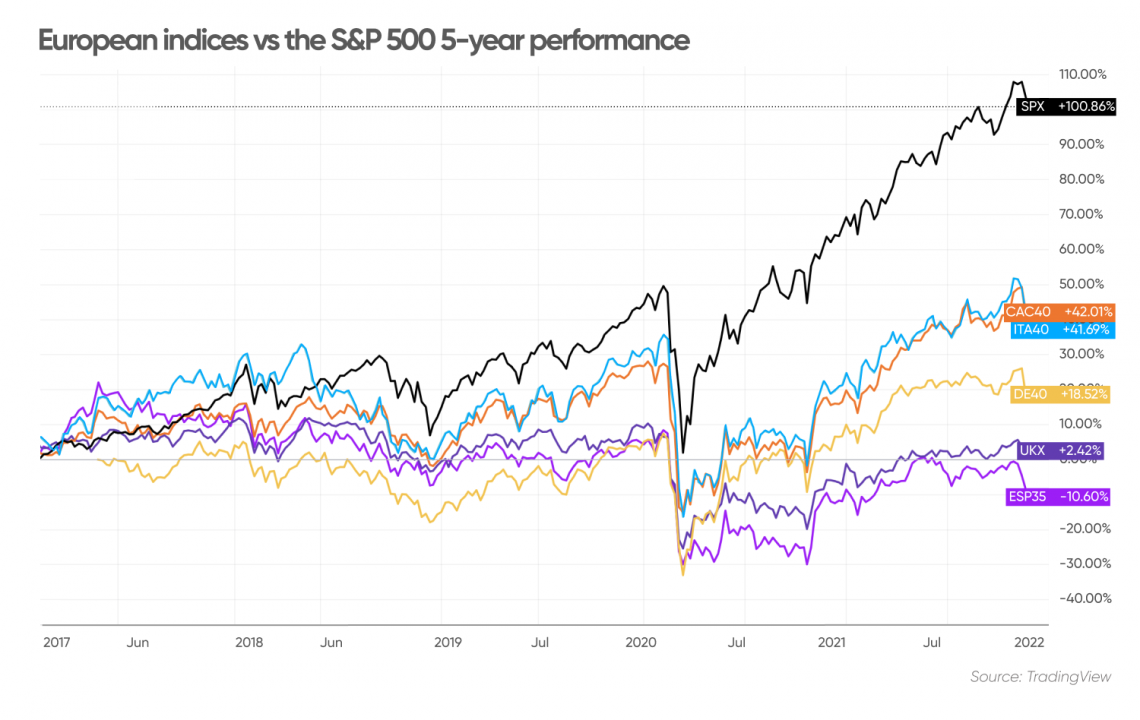

European Stock Market Outlook Strategists Turn Pessimistic Amidst Trump Trade War

Apr 26, 2025

European Stock Market Outlook Strategists Turn Pessimistic Amidst Trump Trade War

Apr 26, 2025 -

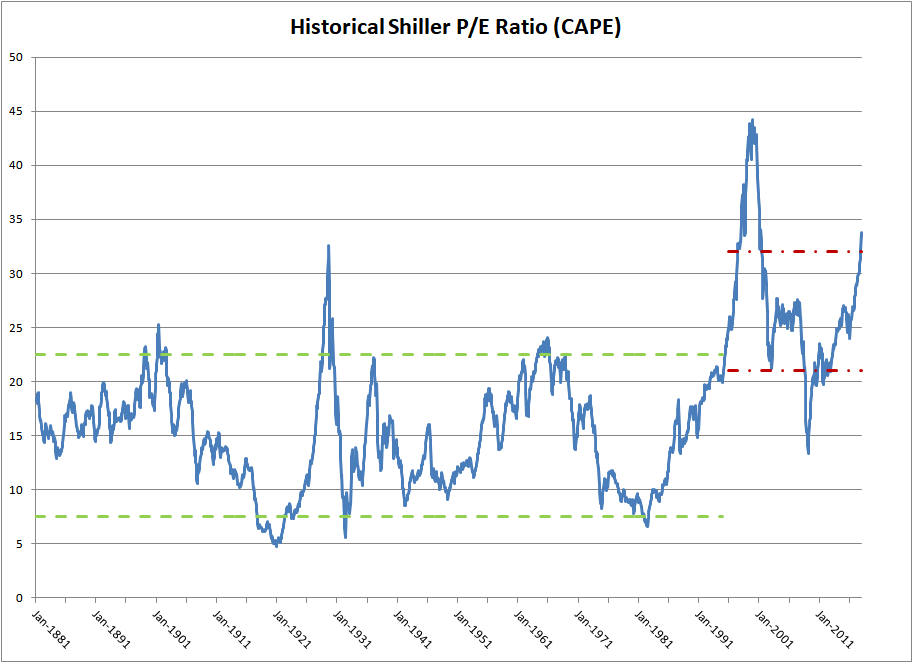

Understanding Stock Market Valuations A Bof A Perspective

Apr 26, 2025

Understanding Stock Market Valuations A Bof A Perspective

Apr 26, 2025

Latest Posts

-

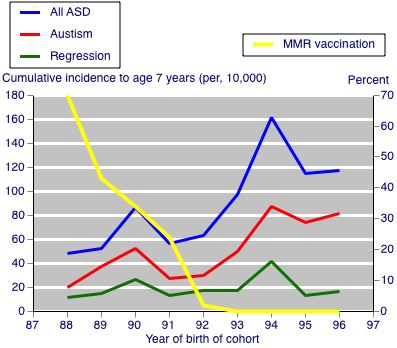

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025