European Stock Market Outlook: Strategists Turn Pessimistic Amidst Trump Trade War

Table of Contents

Rising Trade Tensions and Their Impact on European Businesses

The Trump administration's aggressive trade policies, characterized by hefty tariffs and escalating trade disputes, have dealt a significant blow to European businesses. These actions have severely impacted US-EU trade relations, leading to a decline in exports and a surge in import costs for European companies, particularly within sectors like automotive manufacturing. The "tariff impact" is not merely theoretical; it’s tangible and deeply felt across various industries.

- Specific examples: German car manufacturers, for instance, have experienced considerable losses due to tariffs imposed on their vehicles entering the US market. Similarly, the agricultural sector in France has suffered from retaliatory tariffs imposed by the US.

- Quantifiable data: Eurostat reports show a significant decline in export volumes from Europe to the US in several key sectors since the implementation of tariffs. The precise figures vary depending on the sector, but the overall trend is undeniably negative, impacting GDP growth and business confidence.

- Supply chain disruptions: Tariffs are not only impacting final product exports but also disrupting global supply chains. European companies reliant on US-sourced components are facing increased costs and delays, further hindering their competitiveness.

Weakening Economic Indicators in Europe

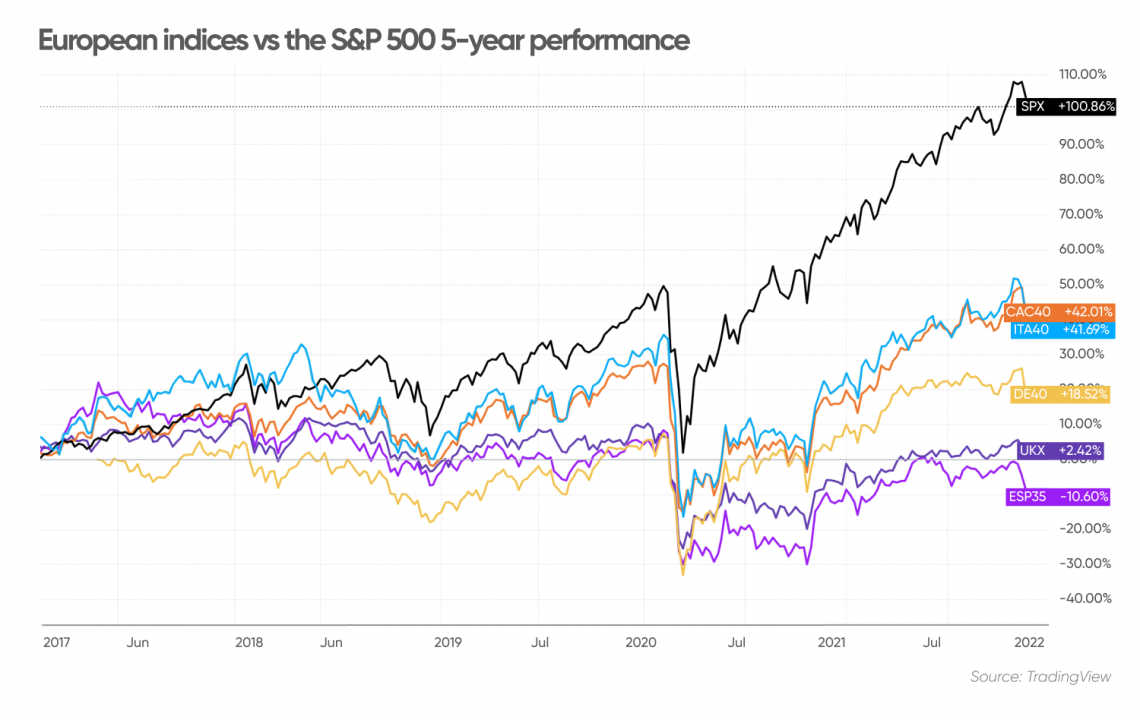

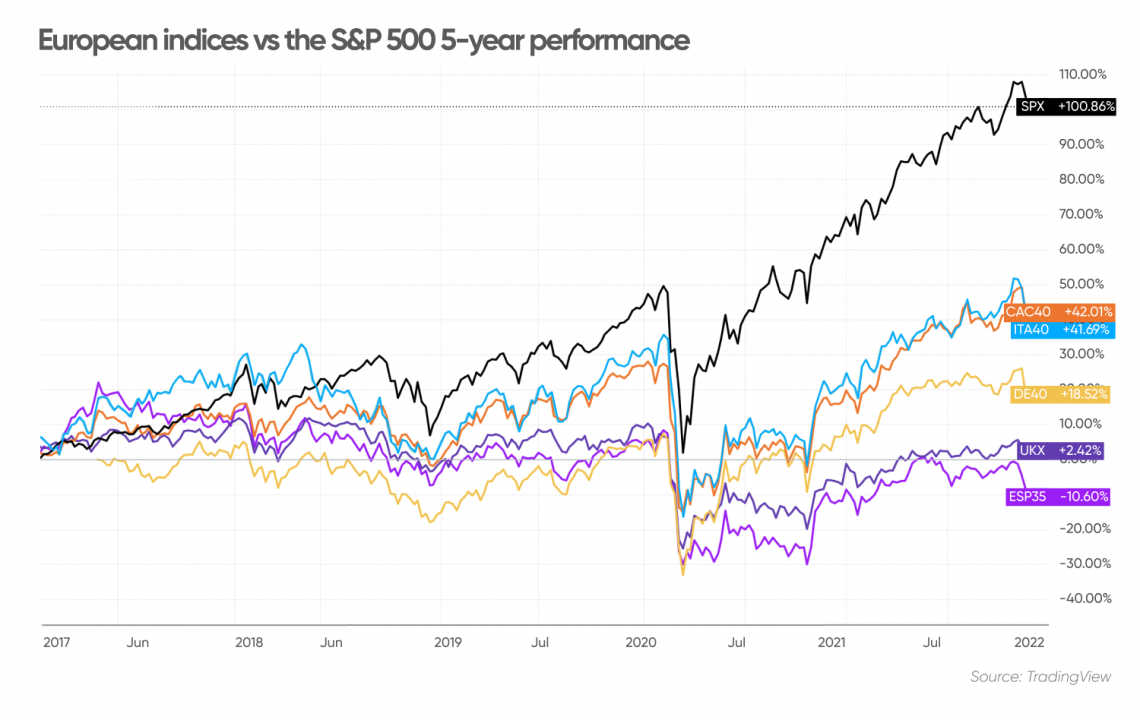

The already strained situation is compounded by the weakening economic performance across major European economies. Germany, France, and the UK have all experienced slowing GDP growth, a trend further exacerbated by declining consumer confidence and reduced business investment. This economic slowdown presents a significant challenge to the overall European stock market outlook.

- Specific indicators: Eurostat data reveals a concerning fall in manufacturing PMI (Purchasing Managers' Index), indicating decreased activity within the industrial sector. Inflation rates remain subdued, suggesting weak consumer spending. Meanwhile, business investment is stagnating, indicating a lack of confidence in future economic prospects.

- Reputable sources: The IMF has downgraded its growth forecast for the Eurozone, highlighting the severity of the situation and its impact on the European stock market performance. These forecasts, combined with Eurostat data, provide a clear picture of the deteriorating economic climate.

- Interconnectedness: These weakening economic indicators are interconnected. Reduced consumer spending leads to lower demand, impacting businesses and further dampening investment. This creates a vicious cycle that negatively impacts the European stock market.

Brexit Uncertainty and its Lingering Effects

The lingering uncertainty surrounding Brexit continues to cast a long shadow over the European stock market. The lack of clarity regarding the future UK-EU trade deal fuels investment hesitation and undermines long-term economic planning. The post-Brexit economy in the UK has already experienced significant disruption, and its impact on the broader European market remains a concern.

- Long-term consequences: The potential for reduced trade between the UK and the EU poses a considerable risk to European businesses dependent on this relationship. This uncertainty undermines investment and slows economic growth across the continent.

- Lack of clarity: The absence of a clear trade agreement between the UK and the EU creates significant volatility, making it difficult for businesses to plan for the future. This ambiguity significantly contributes to the pessimistic European stock market outlook.

- Investor confidence: The prolonged uncertainty severely erodes investor confidence, leading to a reluctance to commit capital to the European market. This further exacerbates the decline in business investment and overall economic activity.

Geopolitical Risks and Their Influence on Investor Sentiment

Adding further pressure to the already fragile situation are a number of escalating geopolitical risks. Tensions in the Middle East, political instability in various regions, and ongoing global trade disputes all contribute to a heightened sense of global uncertainty and negatively impact investor sentiment.

- Specific events: The ongoing conflict in the Middle East, for example, creates significant volatility in oil prices, impacting energy-dependent European economies. Political instability in other regions can lead to capital flight and reduced investment flows into Europe.

- Increased market volatility: These geopolitical risks contribute to increased market volatility, making it harder for investors to make informed decisions. The heightened uncertainty leads to a flight to safety, with investors seeking refuge in more stable assets.

- Flight to safety: Investors often withdraw from riskier assets such as European stocks during periods of geopolitical instability, opting instead for safer havens like government bonds or gold. This exacerbates the decline in the European stock market.

Strategists' Predictions and Investment Recommendations

Leading market strategists are largely pessimistic in their predictions regarding the European stock market’s future performance. Many believe that the combined impact of the factors discussed above will continue to weigh heavily on market sentiment in the near future. Their investment recommendations emphasize cautious risk management and portfolio diversification.

- Specific recommendations: Several analysts are recommending a shift towards more defensive investment strategies, including increasing exposure to less volatile asset classes. This includes a move toward government bonds and other low-risk investments.

- Investment strategies: The current environment calls for strategies focused on mitigating risk and protecting capital. This might involve reducing equity exposure and increasing allocations to more defensive assets.

- Risk management: Careful risk management is crucial. Investors should carefully assess their risk tolerance and adjust their portfolio accordingly. Diversification across different asset classes and geographies is essential to mitigate potential losses.

Conclusion

The pessimistic European stock market outlook is a reflection of several interconnected factors: the ongoing trade war, a weakening European economy, lingering Brexit uncertainty, and significant geopolitical risks. These issues collectively contribute to increased market volatility and diminished investor confidence. The implications for investors are clear: careful risk management and portfolio diversification are paramount in this challenging environment. To make informed investment decisions, stay informed about the evolving European stock market outlook, actively follow European market analysis, monitor European stock market trends, and consider developing a robust European investment strategy. For specific guidance tailored to your individual circumstances, seeking professional financial advice is strongly recommended.

Featured Posts

-

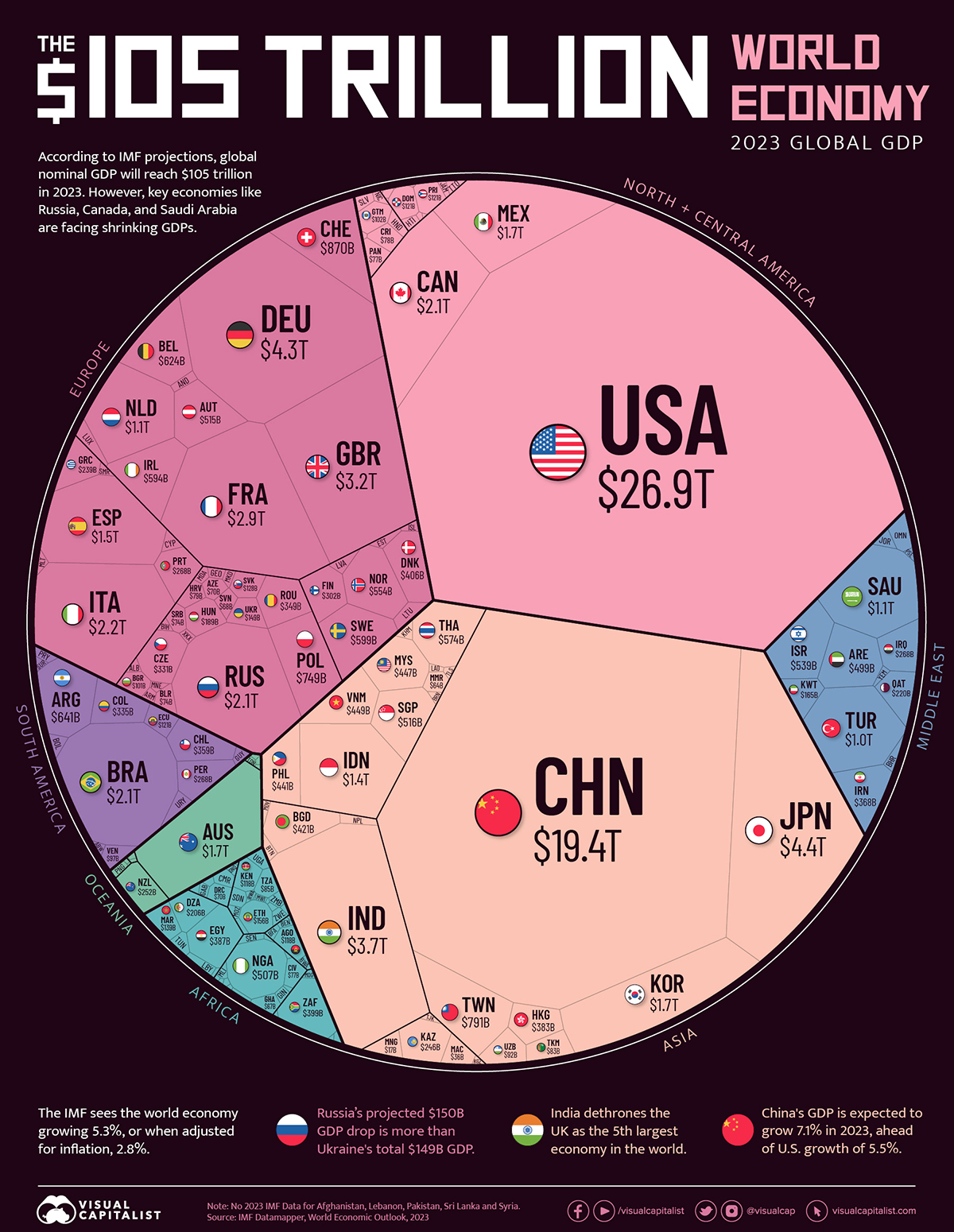

California Economy A New Global Ranking Fourth Largest In The World

Apr 26, 2025

California Economy A New Global Ranking Fourth Largest In The World

Apr 26, 2025 -

Examining The Truthfulness Of Gavin Newsoms Claims

Apr 26, 2025

Examining The Truthfulness Of Gavin Newsoms Claims

Apr 26, 2025 -

California Governor Newsom Condemns Internal Democratic Toxicity

Apr 26, 2025

California Governor Newsom Condemns Internal Democratic Toxicity

Apr 26, 2025 -

Newsoms Sharp Words Calling Out Toxic Behavior Within The Democratic Party

Apr 26, 2025

Newsoms Sharp Words Calling Out Toxic Behavior Within The Democratic Party

Apr 26, 2025 -

Hollywoods Nepotism Problem The Oscars After Party And The Fury It Ignited

Apr 26, 2025

Hollywoods Nepotism Problem The Oscars After Party And The Fury It Ignited

Apr 26, 2025

Latest Posts

-

Top Seed Pegula Claims Charleston Title After Collins Battle

Apr 27, 2025

Top Seed Pegula Claims Charleston Title After Collins Battle

Apr 27, 2025 -

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025 -

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025 -

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025