Understanding Stock Market Valuations: A BofA Perspective

Table of Contents

Key Valuation Metrics

Several key metrics are employed to assess stock market valuations. Let's delve into some of the most commonly used, viewed through the lens of BofA's analytical approach.

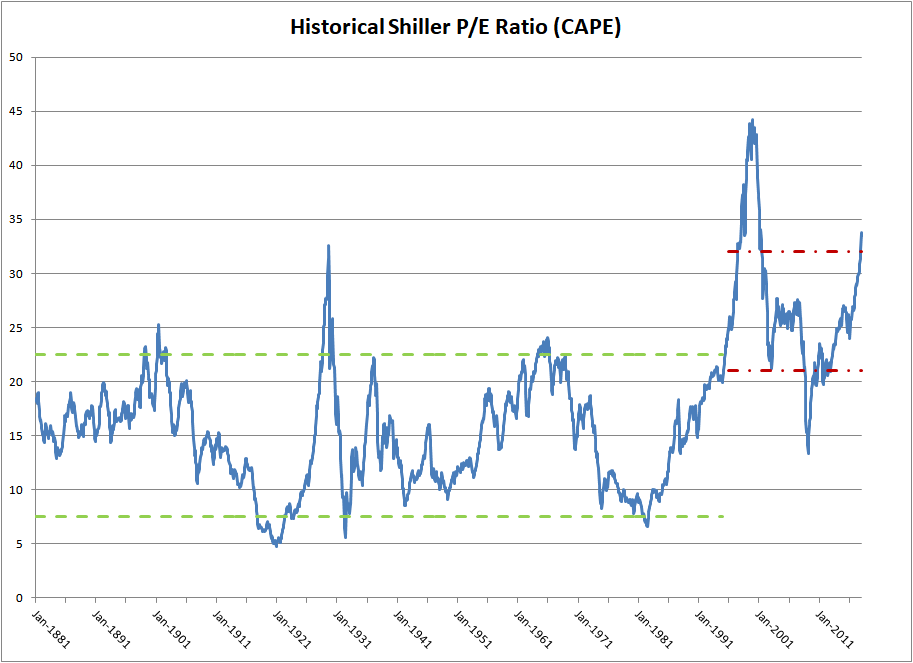

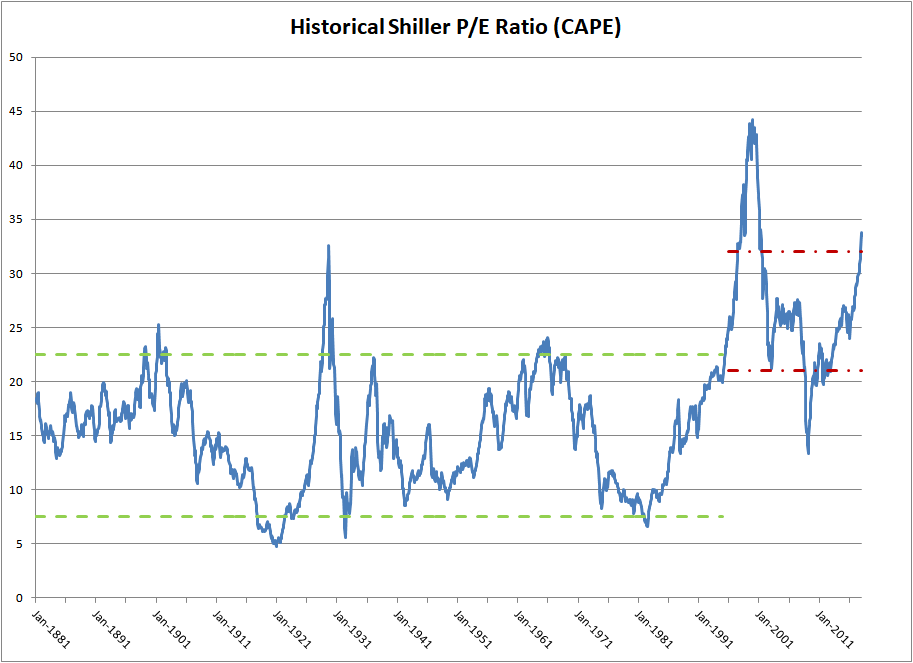

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). It's calculated by dividing the market price per share by the earnings per share. A high P/E ratio can suggest that the market expects high growth from the company in the future, potentially indicating strong future earnings. However, a high P/E ratio can also signal overvaluation or increased risk. Conversely, a low P/E ratio might suggest undervaluation or potential problems with the company. BofA analysts use P/E ratios extensively, comparing them against industry averages and historical trends to assess relative value.

- High P/E Ratio: Indicates high growth potential, but also carries higher risk. Investors need to carefully assess the company's future prospects to justify the premium valuation.

- Low P/E Ratio: Might indicate undervaluation, or it could signal underlying issues affecting the company's profitability. Further investigation is required to determine the cause.

- BofA's Approach: BofA utilizes P/E ratios in conjunction with other valuation metrics and qualitative factors to arrive at a comprehensive assessment of a company's worth. They often compare a company's P/E ratio to its peers within the same sector to gain a relative perspective.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value of equity. The book value represents the net asset value of a company, calculated as total assets minus total liabilities. P/B ratios are particularly useful for valuing companies with significant tangible assets, such as real estate or manufacturing firms. However, it's less relevant for companies with primarily intangible assets, like technology firms where intellectual property holds significant value. BofA's analysts consider the P/B ratio alongside other metrics, especially when assessing companies in sectors with substantial tangible assets.

- P/B Ratio and Tangible Assets: Companies with high tangible asset values tend to have lower P/B ratios, offering a potential indicator of undervaluation.

- Limitations of P/B Ratio: The P/B ratio can be less informative for companies with significant intangible assets or those undergoing rapid growth, as book value might not accurately reflect the true value of the enterprise.

- BofA's Sector-Specific Approach: BofA's approach to interpreting P/B ratios is highly sector-specific. They understand that a seemingly high or low P/B ratio can be entirely appropriate given the unique characteristics of a particular industry.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a more sophisticated valuation method that estimates the present value of a company's future cash flows. It requires forecasting future cash flows, choosing an appropriate discount rate (reflecting risk), and discounting those future cash flows back to their present value. This approach provides a theoretically more accurate valuation, but it relies heavily on the accuracy of the forecasts, making it sensitive to changes in assumptions. BofA analysts employ DCF analysis for a more in-depth valuation of companies, especially those with stable and predictable cash flows.

- Forecasting Accuracy: Accurate forecasting of future cash flows is crucial for a reliable DCF valuation. BofA analysts employ rigorous forecasting techniques and consider various economic scenarios.

- Discount Rate Sensitivity: The chosen discount rate significantly impacts the DCF valuation. A higher discount rate will lead to a lower present value, reflecting higher perceived risk. BofA's analysts carefully select the appropriate discount rate based on the company's risk profile and market conditions.

- BofA's Use of DCF: BofA uses DCF as a key tool for evaluating long-term investment opportunities, complementing other valuation metrics for a more robust assessment.

BofA's Approach to Valuation

BofA's valuation approach goes beyond simply applying standard metrics. It emphasizes a nuanced understanding of specific industries and incorporates qualitative factors.

Sector-Specific Considerations

BofA tailors its valuation approach to different sectors, recognizing that appropriate metrics vary across industries. What might be a reasonable P/E ratio for a technology company might be entirely inappropriate for a utility company.

- Sector-Specific Metrics: Certain metrics are more relevant to specific sectors. For example, P/B ratios are more meaningful for financial institutions than for technology companies.

- Industry Trends: BofA analysts closely monitor industry trends and competitive landscapes, which significantly influence their valuation judgments.

- Industry Dynamics Adjustment: BofA adjusts its valuation models to account for unique characteristics and dynamics specific to each industry.

Qualitative Factors

BofA understands that quantitative metrics alone are insufficient for a complete valuation. Qualitative factors, such as management quality, competitive landscape, and regulatory environment, play a crucial role.

- Management Quality: BofA assesses management's track record, strategic vision, and execution capabilities.

- Competitive Landscape: A thorough analysis of the competitive landscape, including market share, competitive intensity, and barriers to entry, is essential.

- ESG Factors: BofA integrates Environmental, Social, and Governance (ESG) factors into its valuation analysis, considering their impact on long-term value creation and risk.

- Due Diligence: Comprehensive due diligence and thorough research form the foundation of BofA's valuation process.

Conclusion

Understanding stock market valuations is crucial for successful investing. This article, from a BofA perspective, highlighted key metrics like P/E, P/B, and DCF analysis, emphasizing the importance of a comprehensive approach that includes both quantitative and qualitative factors. BofA's approach emphasizes sector-specific considerations and incorporates ESG factors for a holistic view. By understanding these principles and incorporating thorough research, investors can make more informed decisions regarding stock market valuations. To further your knowledge of stock market valuations and stay updated on BofA’s insights, explore our comprehensive research reports and resources. Learn more about effective stock valuation strategies today!

Featured Posts

-

Lente Lingo Your Guide To Springtime Vocabulary

Apr 26, 2025

Lente Lingo Your Guide To Springtime Vocabulary

Apr 26, 2025 -

King Announces Early Start To Birthday Celebrations

Apr 26, 2025

King Announces Early Start To Birthday Celebrations

Apr 26, 2025 -

April Events Celebrate Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest

Apr 26, 2025

April Events Celebrate Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025 -

Luxury Car Sales In China Why Bmw And Porsche Are Facing Headwinds

Apr 26, 2025

Luxury Car Sales In China Why Bmw And Porsche Are Facing Headwinds

Apr 26, 2025

Latest Posts

-

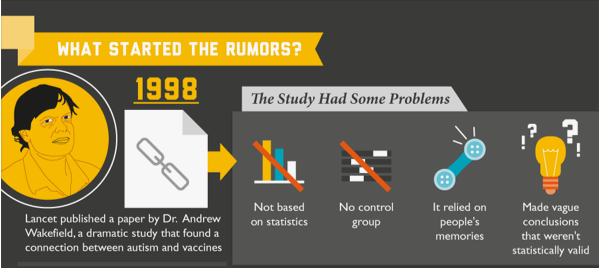

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

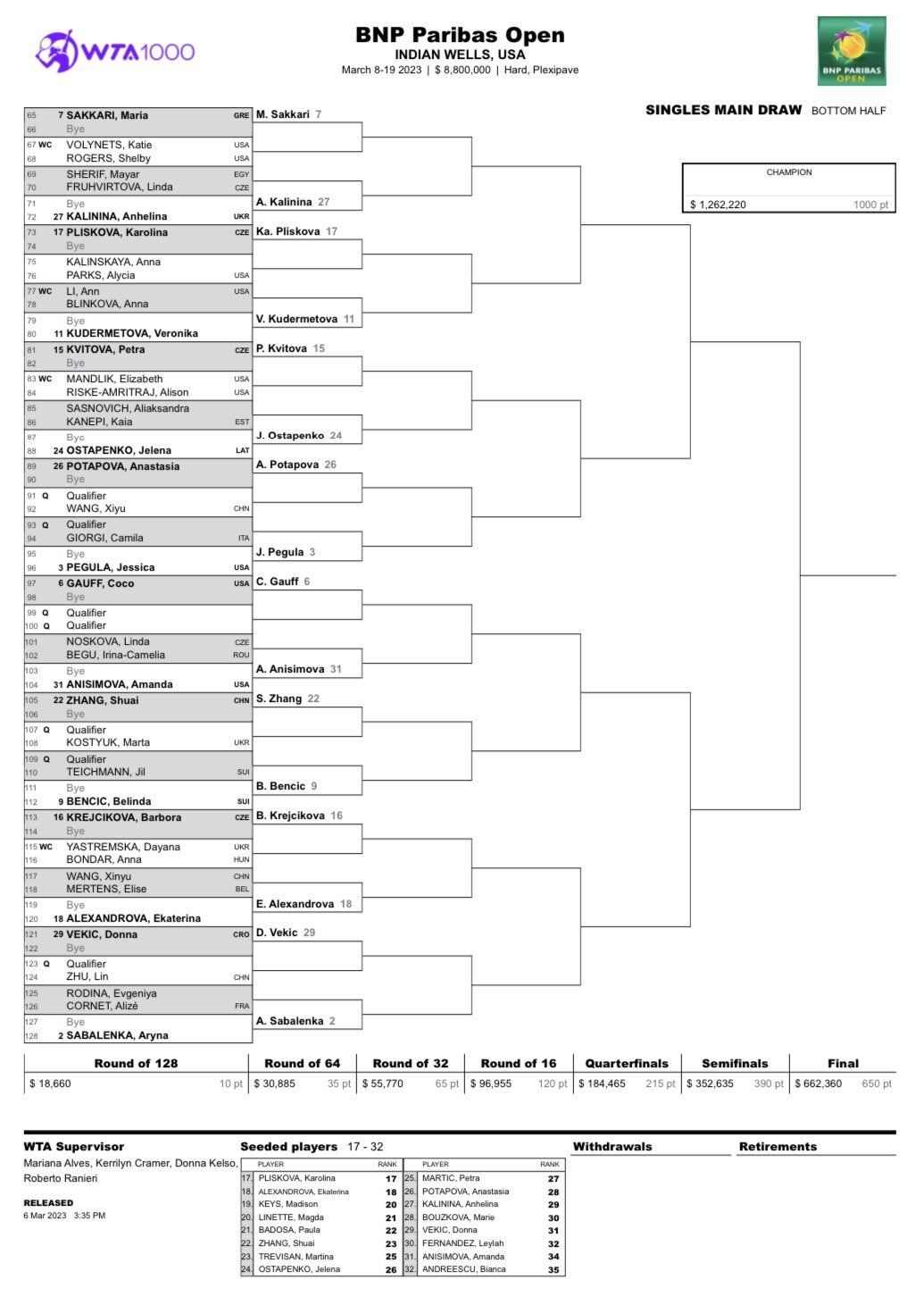

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025