Frankfurt Stock Market Update: DAX Climbs, Nearing Record

Table of Contents

DAX Performance and Key Drivers

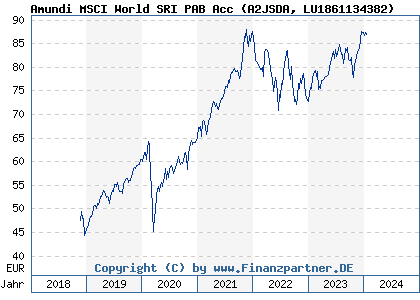

The DAX has experienced a significant surge in recent weeks, climbing by X% and currently trading at Y points. This impressive performance is fueled by a confluence of factors, positioning the DAX for further growth in the near future.

-

Strong Corporate Earnings: Major DAX companies have reported robust earnings, exceeding market expectations. This positive trend demonstrates the underlying strength of the German economy and the resilience of its leading corporations. For example, [Company A] reported a Y% increase in profits, exceeding analyst projections by Z%, while [Company B]'s innovative product launch significantly boosted their revenue streams.

-

Positive Economic Indicators: Germany and the broader Eurozone are exhibiting positive economic indicators, such as rising consumer confidence, increased industrial production, and falling unemployment rates. This positive economic climate fosters increased investment and fuels stock market growth. The latest GDP figures for Germany showcase a robust X% growth, exceeding forecasts and signaling continued economic expansion.

-

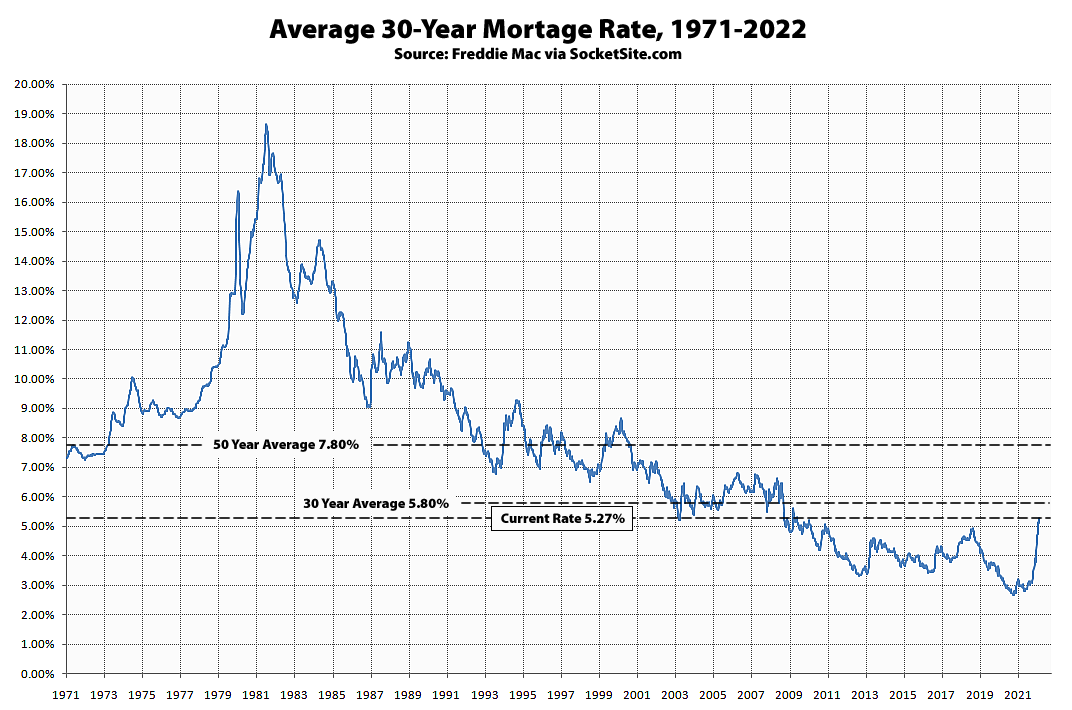

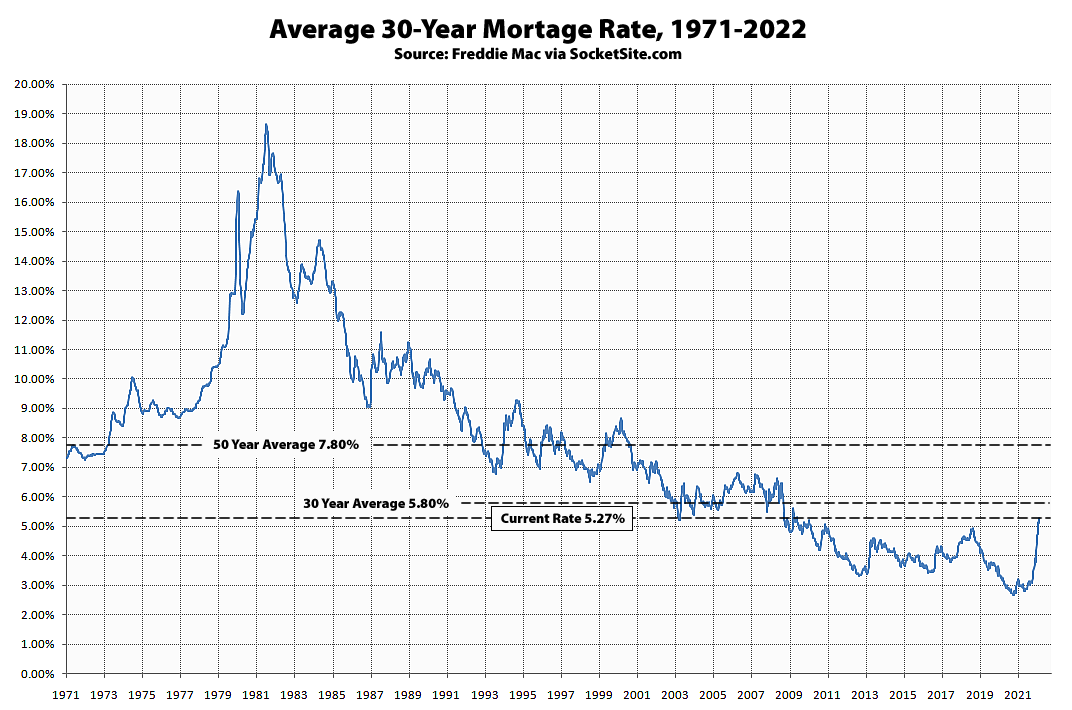

Increased Investor Confidence: Global economic recovery and lower interest rates have boosted investor confidence, leading to increased capital inflows into the German stock market. This influx of investment further propels the DAX's upward trajectory. The declining interest rate environment makes equity investments more attractive compared to traditional bonds, further driving demand for DAX stocks.

-

Sector-Specific Growth: Specific sectors are driving the DAX's growth. The automotive industry, fueled by strong global demand and technological advancements, and the technology sector, benefiting from innovation and digital transformation, have been particularly strong contributors. [Specific example of a company and its contribution].

Analysis of Contributing Factors

The DAX's growth is not solely attributed to corporate performance but is also influenced by significant macroeconomic factors.

-

Global Economic Outlook: The positive global economic outlook, particularly the recovery in key trading partners, significantly impacts German exports, a cornerstone of the German economy. Increased global demand fuels production and profits, boosting the performance of export-oriented DAX companies.

-

Eurozone Stability: The relative stability within the Eurozone contributes to investor sentiment. A stable Eurozone minimizes currency risks and encourages foreign investment, which further supports the DAX's rise. The ongoing efforts to strengthen the Eurozone economy have positively impacted investor confidence.

-

Government Policies: Government policies, such as fiscal stimulus measures and investments in infrastructure, positively influence the German economy and, consequently, the DAX. Supportive government policies create a conducive environment for business growth and investment.

-

Geopolitical Events: While geopolitical events can introduce uncertainty, the current relatively stable geopolitical landscape contributes to investor confidence in the German stock market. Monitoring global events remains crucial, but the current climate is relatively favorable for investment.

-

Comparison to Other Indices: Compared to other major European stock market indices like the CAC 40 (France) and FTSE 100 (UK), the DAX has shown relatively stronger performance recently, highlighting the strength of the German economy and its resilience. [Include comparative chart if possible].

Potential Future Outlook for the DAX

While the DAX's current trajectory is positive, investors must consider potential risks and uncertainties.

-

Risks and Uncertainties: Potential risks include global economic slowdown, rising inflation, geopolitical instability, and potential supply chain disruptions. Careful monitoring of these factors is crucial for informed investment decisions.

-

Expert Opinions: Experts generally foresee continued growth for the DAX, but warn about potential corrections. [Cite specific expert opinions and forecasts, including sources].

-

Opportunities and Challenges: Opportunities lie in sectors experiencing strong growth, while challenges include navigating potential market volatility and identifying stocks poised for continued success.

-

Strategies for Volatility: Diversification of investment portfolios, careful risk management, and a long-term investment approach are crucial strategies to mitigate the impact of market volatility.

-

Investment Recommendations: Investors should consider both short-term and long-term strategies, balancing risk and reward based on their individual investment goals and risk tolerance. [Offer general advice, not financial guidance].

Conclusion

The Frankfurt Stock Market's DAX index has experienced significant gains, fueled by strong corporate earnings, positive economic indicators, and increased investor confidence. The positive global economic outlook, Eurozone stability, and supportive government policies all contribute to this upward trend. While potential risks exist, the overall outlook for the DAX remains positive, presenting opportunities for investors. However, it is crucial to stay informed and adapt strategies to navigate potential market fluctuations.

Call to Action: Stay informed about the dynamic Frankfurt Stock Market and the DAX's performance. Follow our updates for the latest news and analysis on the DAX index and the German stock market. Consider diversifying your investment portfolio with exposure to the strong-performing DAX to capitalize on future growth. Learn more about investing in the DAX and explore the opportunities within the German stock market.

Featured Posts

-

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Snelle Koerswijziging

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025 -

Yurskiy Zhizn I Tvorchestvo Legendarnogo Intellektuala

May 24, 2025

Yurskiy Zhizn I Tvorchestvo Legendarnogo Intellektuala

May 24, 2025 -

La Repression Chinoise Des Dissidents S Etend En France

May 24, 2025

La Repression Chinoise Des Dissidents S Etend En France

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Latest Posts

-

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

De Kracht Van Ai Hoe Relx Economische Uitdagingen Overwint En Groei Realiseert Tot 2025

May 24, 2025

De Kracht Van Ai Hoe Relx Economische Uitdagingen Overwint En Groei Realiseert Tot 2025

May 24, 2025 -

Relx Ai Aangedreven Groei En Winstgevendheid Zelfs Tijdens Economische Onzekerheid

May 24, 2025

Relx Ai Aangedreven Groei En Winstgevendheid Zelfs Tijdens Economische Onzekerheid

May 24, 2025 -

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Toekomstperspectief

May 24, 2025

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Toekomstperspectief

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025