Net Asset Value (NAV) Explained: Amundi MSCI World Ex-US UCITS ETF Acc

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net worth of a fund's assets. It's calculated by subtracting a fund's liabilities from its assets: Assets - Liabilities = NAV. For the Amundi MSCI World ex-US UCITS ETF Acc, understanding this calculation is key to assessing its performance.

The assets of this ETF primarily consist of:

- Holdings in a diverse range of international equities, excluding the US market, mirroring the MSCI World ex-US Index.

- Cash and cash equivalents held by the fund.

- Receivables (if any).

The liabilities include:

- Management fees charged by Amundi.

- Operational expenses incurred by the fund.

- Payables (if any).

Let's illustrate with a simplified example: Assume the ETF's assets total €100 million, and its liabilities are €1 million. The NAV would be €99 million. The NAV per share is then calculated by dividing the total NAV by the number of outstanding shares.

The Amundi MSCI World ex-US UCITS ETF Acc calculates its NAV daily, reflecting the closing market prices of its underlying assets. This daily NAV calculation is crucial for transparency and accurate valuation.

- Daily NAV Calculation: Ensures up-to-date valuation reflecting market changes.

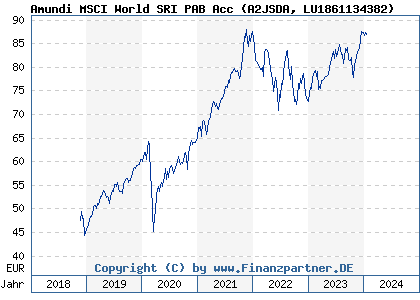

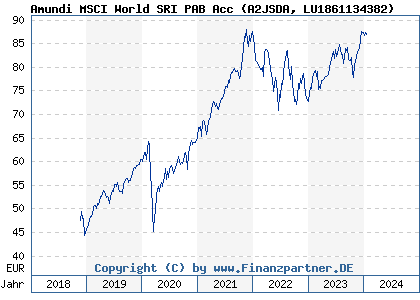

- Impact of Market Fluctuations on NAV: The NAV will rise and fall based on the performance of the underlying assets.

- Transparency of NAV Disclosure: The ETF's NAV is publicly available, usually on the fund's website and through financial data providers.

NAV and the Amundi MSCI World ex-US UCITS ETF Acc: A Deeper Dive

The NAV of the Amundi MSCI World ex-US UCITS ETF Acc serves as a benchmark for its share price. While ideally, the share price should closely track the NAV, a small difference, known as tracking error, can exist due to trading costs and market dynamics. Investors utilize the NAV to evaluate the ETF's performance over time, comparing its growth against benchmarks and similar ETFs.

The NAV is also fundamental to buying and selling ETF shares. When you buy shares, you effectively buy a portion of the underlying assets represented by the NAV. Understanding this relationship avoids misconceptions about share price fluctuations.

- NAV as a benchmark for performance evaluation: Allows direct comparison with the fund's underlying asset performance.

- Impact of trading volume on share price vs. NAV: High trading volume may create temporary discrepancies between share price and NAV.

- Understanding premium/discount to NAV: Occasionally, the ETF share price may trade at a slight premium or discount to the NAV, depending on supply and demand.

Investing with a thorough understanding of NAV offers several benefits:

- Informed decision-making: Avoids impulsive trades based solely on short-term share price movements.

- Risk management: Allows for better assessment of the fund's performance relative to its assets.

- Performance tracking: Enables a clear understanding of the actual return generated by the ETF’s investments.

Factors Affecting the NAV of the Amundi MSCI World ex-US UCITS ETF Acc

Several factors influence the NAV of the Amundi MSCI World ex-US UCITS ETF Acc. Understanding these factors is vital for informed investment decisions.

-

Market Movements: Changes in the value of the ETF's underlying assets directly impact the NAV. A bull market generally leads to NAV appreciation, while a bear market does the opposite.

-

Currency Fluctuations: As the ETF invests in non-US companies, currency exchange rates between the respective currencies and the base currency of the ETF (likely EUR) can significantly impact the NAV. Strengthening of the Euro relative to other currencies where the fund holds assets can reduce the NAV and vice versa.

-

Dividends and Distributions: When the underlying companies pay dividends, these are usually passed on to the ETF shareholders, leading to a temporary decrease in the NAV. However, reinvestment of these dividends can subsequently increase the NAV.

-

Management Fees and Expenses: These fees are deducted from the fund's assets, therefore reducing the NAV.

-

Market risk and NAV volatility: Exposure to market fluctuations inevitably leads to NAV volatility.

-

Currency risk and its impact on NAV: Fluctuations in exchange rates can positively or negatively affect the NAV.

-

Impact of dividend reinvestment on NAV: Dividend reinvestment can contribute to long-term NAV growth.

Conclusion: Making Informed Investment Decisions with Net Asset Value (NAV)

Understanding Net Asset Value (NAV) is paramount when investing in ETFs like the Amundi MSCI World ex-US UCITS ETF Acc. By grasping how NAV is calculated, its relationship to the share price, and the various factors influencing it, you can make more informed investment decisions. Regularly monitoring the ETF's NAV alongside its share price and understanding the potential impacts of currency fluctuations and market movements allows for a more nuanced assessment of its performance and the overall suitability of the investment within your portfolio. Learn more about the Amundi MSCI World ex-US UCITS ETF Acc and its daily Net Asset Value (NAV) to make well-informed investment decisions. Use the NAV information to compare the Amundi MSCI World ex-US UCITS ETF Acc against similar ETFs to ensure you're making the best choice for your financial goals.

Featured Posts

-

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 24, 2025 -

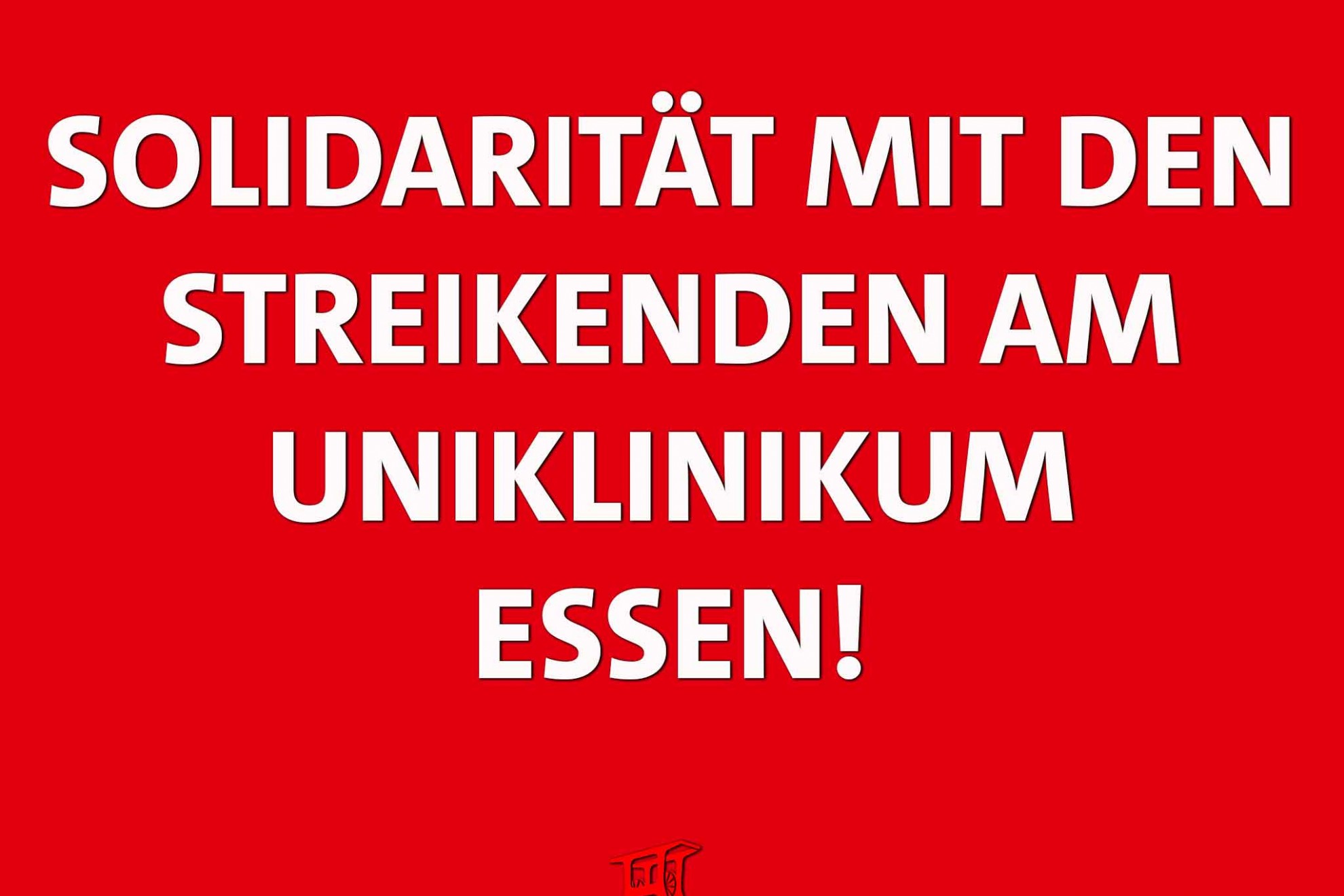

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025 -

Smart Memorial Day Travel 2025 Flight Booking Tips And Dates To Avoid

May 24, 2025

Smart Memorial Day Travel 2025 Flight Booking Tips And Dates To Avoid

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Bersatu

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Bersatu

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Latest Posts

-

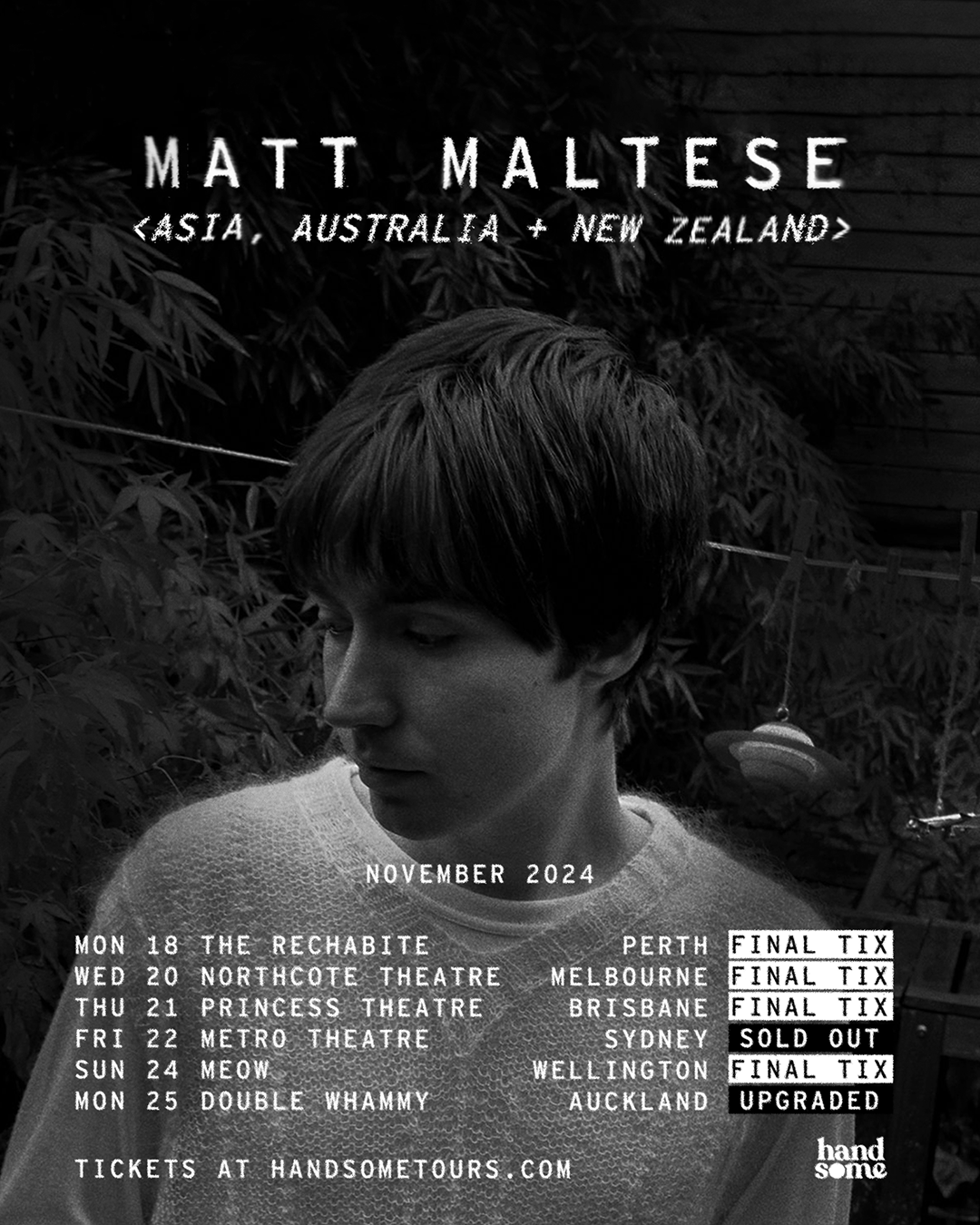

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025