8% Stock Market Surge On Euronext Amsterdam: Impact Of Trump's Tariff Decision

Table of Contents

Understanding Trump's Tariff Decision and its Global Ripple Effect

Trump's recent tariff decision, specifically targeting [Insert Specific Target of Tariffs Here, e.g., certain steel imports from the EU], sent shockwaves through the global economy. The intended aim was [State the stated goal of the tariffs, e.g., to protect domestic industries]. However, the potential consequences extend far beyond the immediate targets, potentially sparking a trade war and disrupting global supply chains. Initially, global markets reacted with [Describe the initial global market reaction, e.g., a mix of uncertainty and apprehension, with slight dips in major indices]. This initial uncertainty, however, paved the way for the surprising surge seen in Euronext Amsterdam. Keywords: Trump administration, trade war, tariffs, global market, economic impact.

Euronext Amsterdam's Unique Sensitivity to Trump's Tariffs

The significant 8% surge on Euronext Amsterdam wasn't a uniform reaction across all sectors. Several factors contributed to this unique sensitivity:

-

Specific Sectoral Impacts: The tariff decision disproportionately affected certain sectors listed on Euronext Amsterdam. For example, [Give specific example: e.g., companies involved in steel manufacturing might have initially experienced losses, but a subsequent counter-reaction could have triggered a surge in related sectors]. Conversely, [Give another example: e.g., companies benefiting from weakened Euro due to trade uncertainty]. This sectoral differentiation explains the uneven impact on the overall index.

-

Investor Sentiment and Capital Flows: The news likely triggered a reassessment of investment strategies, leading to shifts in capital flows. Investors may have moved funds into perceived "safe havens" within the Euronext Amsterdam market, contributing to the surge. Pre-existing vulnerabilities in certain sectors also played a role, amplifying the effect of the tariff decision.

-

Examples of Specific Company Performance:

- [Company A]: Experienced a [percentage]% increase, likely due to [reason].

- [Company B]: Showed a [percentage]% decrease, potentially because of [reason].

- [Company C]: Remained relatively stable, suggesting [reason].

Keywords: Euronext Amsterdam stocks, market volatility, sector analysis, investment strategies.

Investor Sentiment and Market Speculation after the Tariff Decision

The immediate reaction to the news was a wave of uncertainty, followed by a period of intense speculative trading. Investors attempted to gauge the long-term implications of the tariffs, leading to rapid price fluctuations.

-

Financial Analyst Opinions: [Quote from a financial analyst about their interpretation of the market reaction]. This reflects the prevailing sentiment of uncertainty and potential for further volatility.

-

Trading Volume Spikes: Significant spikes in trading volume were observed, indicating high levels of investor activity attempting to capitalize on the sudden shift in market dynamics.

-

Short-term vs. Long-term Effects: The 8% surge likely represents a short-term reaction. The long-term impact remains uncertain and hinges on the further development of trade relations and global economic conditions.

Keywords: investor confidence, market speculation, stock trading, financial analysis.

Long-Term Implications for Euronext Amsterdam and its Investors

The sustainability of the 8% surge is questionable. The long-term consequences of Trump's tariff decision on Euronext Amsterdam depend heavily on several factors:

-

Future Market Trends: The ongoing trade dispute and its broader global economic impact will continue to influence the Euronext Amsterdam market. Increased uncertainty could lead to further volatility.

-

Recommendations for Investors: Investors should adopt a cautious approach, focusing on risk management and portfolio diversification. Hedging strategies could be considered to mitigate potential losses.

-

Long-term Investment Strategies: A long-term investment strategy should consider the potential for both upside and downside risks associated with the evolving global trade landscape. Thorough due diligence and a well-diversified portfolio are crucial.

Keywords: long-term investment, risk management, portfolio diversification, market outlook.

Conclusion: Navigating the Aftermath of the Euronext Amsterdam Stock Market Surge

The 8% surge on Euronext Amsterdam following Trump's tariff decision highlights the interconnectedness of global markets and the unpredictable nature of trade policy. While the immediate reaction was a significant upward movement, the long-term implications remain uncertain and warrant careful consideration. The volatility underscores the importance of understanding the intricacies of global trade developments and their influence on investment decisions. To navigate this evolving landscape, continue researching the Euronext Amsterdam stock market and stay informed about global trade developments and their impact on your investments. Consider exploring further resources dedicated to understanding Trump's tariffs and their influence on European stock markets. Stay informed, stay diversified, and make informed investment choices regarding the Euronext Amsterdam stock market and beyond.

Featured Posts

-

Porsche 956 Nin Tavan Sergilemesi Tasarim Ve Muehendislik

May 24, 2025

Porsche 956 Nin Tavan Sergilemesi Tasarim Ve Muehendislik

May 24, 2025 -

Vervolg Snelle Koerswijziging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025

Vervolg Snelle Koerswijziging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025 -

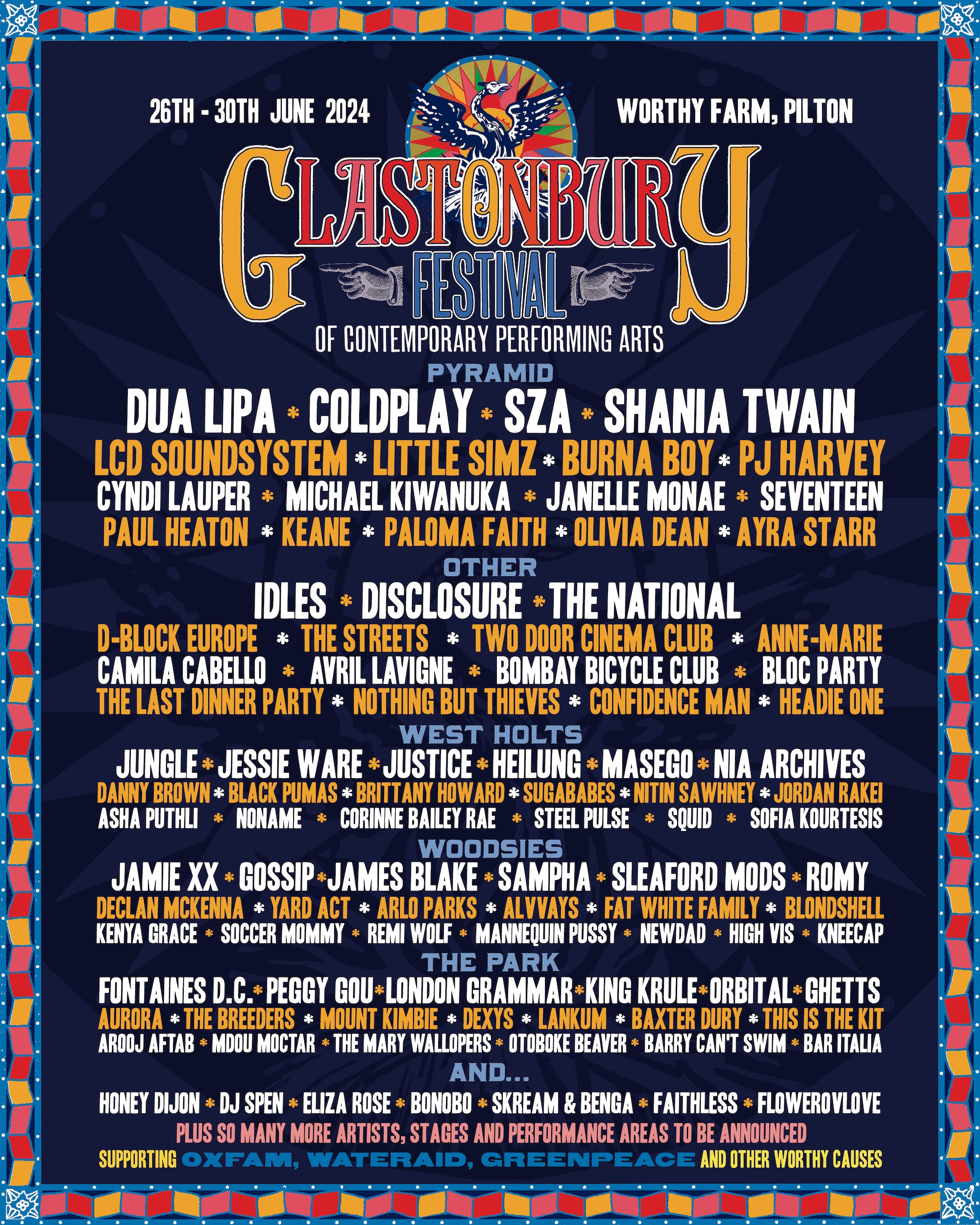

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025

Official Glastonbury 2025 Lineup Where To Get Tickets Following Leak

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Deportation Policy

May 24, 2025

Latest Posts

-

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025 -

Are Thames Water Executive Bonuses Justified

May 24, 2025

Are Thames Water Executive Bonuses Justified

May 24, 2025 -

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025 -

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025 -

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025