Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

The Impact of the Tariff Reversal on Euronext Amsterdam

The immediate impact of the tariff reversal was a palpable boost for numerous companies listed on Euronext Amsterdam. This positive shift affected various sectors, prompting a closer examination of which companies benefited most from this change in US trade policy.

Affected Sectors and Companies

Several key sectors experienced substantial gains. The automotive industry, heavily impacted by previous tariffs, saw a significant rebound. Similarly, the manufacturing and technology sectors also benefited from the reduced trade barriers. Specific examples include:

-

Specific Tariffs Reversed: The reversal primarily targeted tariffs on automotive parts, certain manufactured goods, and some technology components. These tariffs, previously ranging from 10% to 25%, significantly increased the cost of imported goods, impacting the competitiveness of European companies.

-

Financial Performance: Analysis of Q[Insert Quarter] 2024 financial reports revealed substantial increases in revenue and profits for companies like [Example Company 1, Stock Ticker: XXXX], [Example Company 2, Stock Ticker: YYYY], and [Example Company 3, Stock Ticker: ZZZZ]. These companies experienced significant improvements in their bottom line, directly attributable to the reduction in tariffs. (Insert chart/graph visualizing stock price increases for these companies).

-

Stock Price Surge: The impact was visually striking. [Insert chart/graph showing overall index increase for Euronext Amsterdam]. This sharp increase demonstrates the market's positive reaction to the news.

Investor Sentiment and Market Reaction

The announcement triggered an immediate and significant buying pressure on Euronext Amsterdam stocks. Trading volume surged as investors reacted positively to the reduced trade uncertainty.

-

Market Reaction: The initial reaction was overwhelmingly positive, characterized by a sharp increase in trading volume and a rapid rise in stock prices across multiple sectors.

-

Analyst Predictions: Leading financial analysts responded with upward revisions of their price targets for many Euronext Amsterdam-listed companies. Many issued "buy" recommendations, reflecting a renewed confidence in the market's prospects. (Include links to reputable financial news sources).

-

News and Press Releases: Positive news stories and press releases from affected companies further fueled the surge in investor confidence, creating a self-reinforcing positive feedback loop.

Long-Term Implications for Euronext Amsterdam Stocks

While the 8% jump is undeniably positive, investors need to consider the sustainability of this increase. Several factors will determine whether this is a short-term rally or the beginning of a more sustained period of growth.

Sustainable Growth or Short-Term Rally?

The question of sustainability is paramount. Several factors could influence the long-term trajectory of Euronext Amsterdam stocks.

-

Geopolitical Risks: Ongoing geopolitical instability, including the war in Ukraine and rising tensions elsewhere, could negatively impact the European economy and, consequently, Euronext Amsterdam.

-

Global Economic Conditions: A global recession or slowdown would likely dampen the positive effects of the tariff reversal. Close monitoring of global economic indicators is crucial.

-

Future Tariff Changes: The possibility of future tariff changes, either by the US or other trading partners, remains a significant risk. Uncertainty in international trade could lead to increased market volatility.

Investment Strategies for Euronext Amsterdam

Given the current situation, investors should adopt a balanced and informed approach.

-

Investment Strategies: Depending on risk tolerance, investors might consider a "buy and hold" strategy for long-term growth, or a more tactical approach involving selective buying opportunities following any dips in the market.

-

Risk Management: Diversification remains key. Spreading investments across different sectors and asset classes can help mitigate the impact of unforeseen events.

-

Sector Selection: Investors might consider focusing on sectors that stand to benefit most from the reduced tariffs, such as automotive components or specific technology sub-sectors. Research is vital to identify companies with solid fundamentals and growth potential.

Conclusion

The 8% jump in Euronext Amsterdam stocks following the Trump tariff decision represents a significant event with both short-term and long-term implications. While the reversal offers immediate relief for affected companies, sustained growth hinges on broader economic factors and future trade policies.

Call to Action: Understanding the dynamics of Euronext Amsterdam stocks is crucial for savvy investors. Stay informed on market trends and consider diversifying your portfolio to mitigate risk. Continue monitoring the performance of Euronext Amsterdam stocks and adjust your investment strategy accordingly to capitalize on future opportunities. Learn more about the factors influencing Euronext Amsterdam stocks and make informed investment decisions.

Featured Posts

-

Frances Juvenile Justice System A Push For Stricter Sentencing

May 24, 2025

Frances Juvenile Justice System A Push For Stricter Sentencing

May 24, 2025 -

Your Dream Country Escape Making The Move A Reality

May 24, 2025

Your Dream Country Escape Making The Move A Reality

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025 -

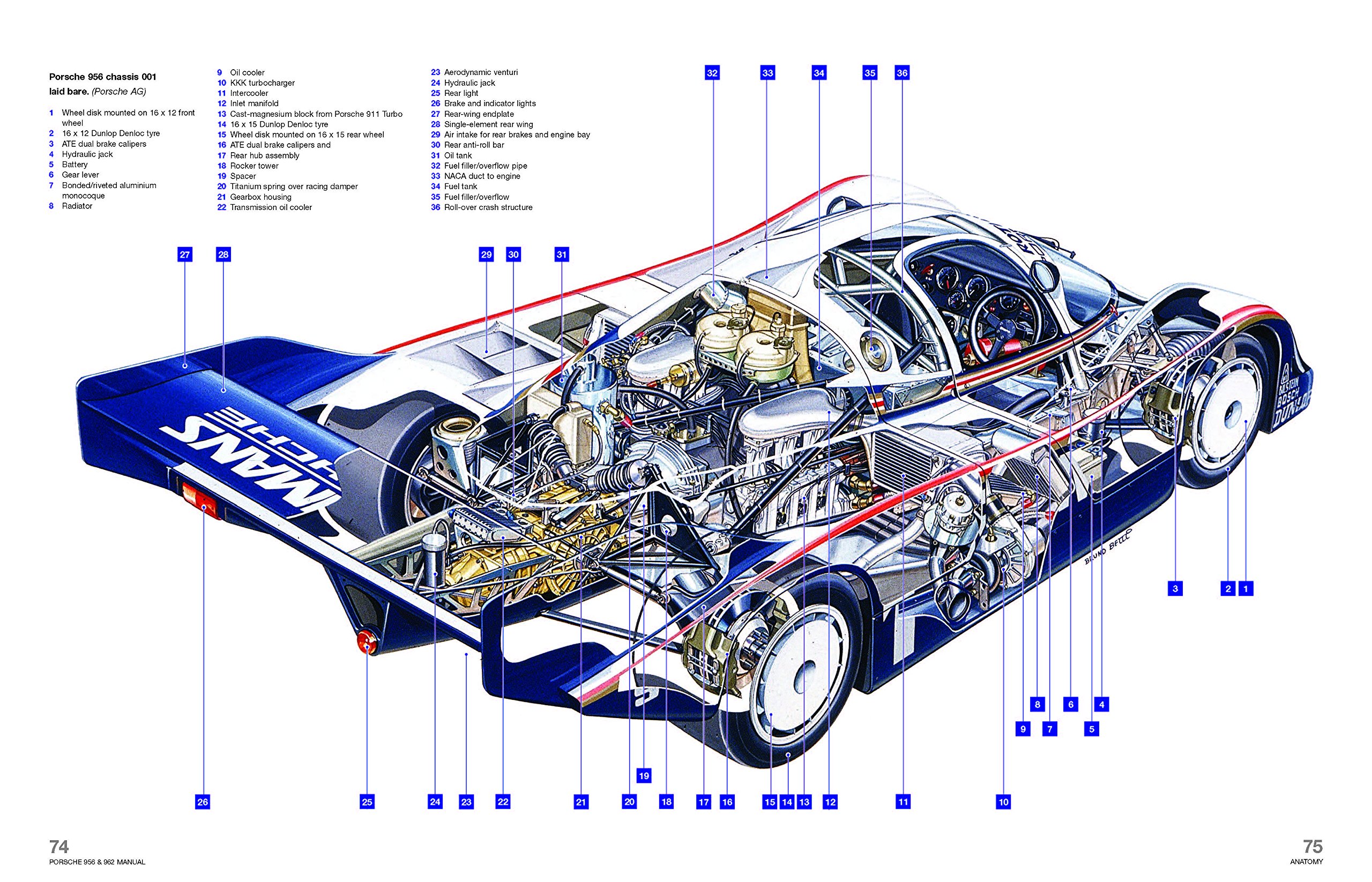

Porsche 956 Nin Havada Sergilenme Anlami Ve Tarihcesi

May 24, 2025

Porsche 956 Nin Havada Sergilenme Anlami Ve Tarihcesi

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Latest Posts

-

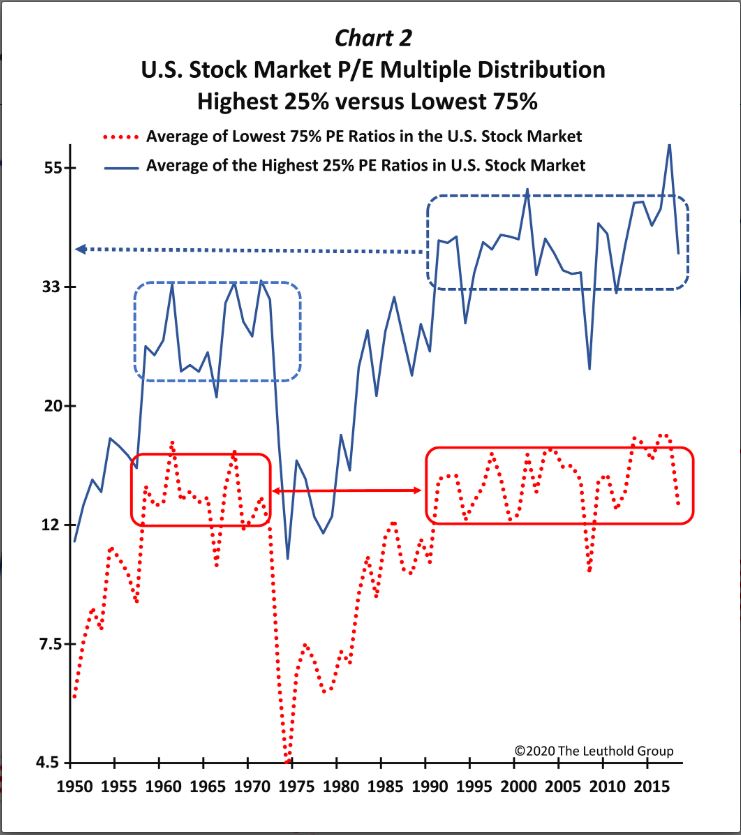

Why Current Stock Market Valuations Shouldnt Deter Investors Bof A

May 24, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Bof A

May 24, 2025 -

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025

Bof A Reassures Investors Why Stretched Valuations Arent A Worry

May 24, 2025 -

Are Thames Water Executive Bonuses Justified

May 24, 2025

Are Thames Water Executive Bonuses Justified

May 24, 2025 -

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025

The Thames Water Bonus Scandal Examining The Facts

May 24, 2025 -

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025

Public Outrage Over Thames Water Executive Bonuses

May 24, 2025