Expanded Manufacturing Tax Credits Proposed In Ontario's Next Budget

Table of Contents

Details of the Proposed Tax Credit Expansion

Currently, Ontario offers several manufacturing tax credits, including the Ontario Manufacturing Investment Tax Credit and various sector-specific programs. However, these existing programs often have limitations, such as narrow eligibility criteria or relatively low credit rates, hindering their effectiveness in stimulating significant investment. The limitations often affect smaller businesses and those in niche sectors.

The proposed changes aim to address these shortcomings by:

-

Increased Credit Rates: The rumored expansion includes a significant increase in the credit rate for eligible investments. For example, the current 8% rate for certain investments in advanced manufacturing technologies might be increased to 12%, or even higher, depending on the specific investment and the sector.

-

Broadened Eligibility: The proposed expansion is expected to significantly broaden eligibility criteria. This includes potentially extending benefits to small and medium-sized enterprises (SMEs) currently excluded from certain programs, specifically targeting sectors like food processing and sustainable manufacturing.

-

New Tax Credits: The government may introduce entirely new tax credits to incentivize specific activities crucial for Ontario's manufacturing competitiveness. For example, a new tax credit might incentivize investments in reshoring initiatives, bringing manufacturing operations back to Ontario from other jurisdictions. This initiative could directly address supply chain concerns and improve economic resilience.

-

Financial Impact: While precise figures are yet to be released, the estimated cost to the province is expected to be substantial, reflecting the government's commitment to revitalizing the manufacturing sector. This substantial investment should result in a projected increase in manufacturing investment, driving overall economic growth.

(Link to relevant government source will be inserted here upon release of official documentation)

Impact on Ontario Manufacturers

The proposed expansion of Ontario Manufacturing Tax Credits holds significant potential benefits for Ontario manufacturers:

-

Increased Investment in Modernization and Expansion: Higher tax credits will incentivize businesses to invest in new equipment, technologies, and expansion projects, improving efficiency and competitiveness. This modernization will allow companies to adopt Industry 4.0 technologies and remain at the forefront of global manufacturing trends.

-

Job Creation and Retention: Increased investment directly translates to job creation and retention. Modernization efforts often lead to new roles and higher skill requirements, raising the skill level of the province's workforce.

-

Enhanced Competitiveness: Access to these expanded credits will make Ontario manufacturers more competitive, both domestically and internationally, enabling them to attract investment and secure new contracts. This enhanced competitiveness will solidify Ontario's position as a manufacturing hub in North America.

-

Improved Profitability and Sustainability: The improved efficiency and competitiveness will positively impact profitability and enable the adoption of more sustainable manufacturing practices. This focus on sustainability is aligned with growing global demands for environmentally responsible products and processes.

However, potential challenges exist:

-

Implementation Complexities: The successful implementation of these expanded credits will require a clear and efficient application process, to avoid delays and frustrations for businesses.

-

Eligibility Requirements: Clearly defined and easily understandable eligibility requirements are crucial to ensure that the intended beneficiaries can access the credits without undue administrative burden.

-

Potential for Unintended Consequences: A thorough cost-benefit analysis and careful consideration of potential unintended consequences are essential to maximize the positive impact of the expanded program.

Comparison with other Provinces’ Manufacturing Incentives

To analyze the competitiveness of the proposed changes, a comparison with other provinces' manufacturing incentives is necessary. While the specific details of the proposed Ontario expansion are still pending, a preliminary comparison (once details are released) could reveal if Ontario is offering a competitive package compared to programs in provinces like Quebec, British Columbia, and Alberta. A table summarizing key features of these programs (credit rates, eligibility criteria, specific sectors targeted) will provide a clearer picture of Ontario’s position once details of the expansion are confirmed.

Next Steps for Ontario Manufacturers

Ontario manufacturers should take proactive steps to prepare for the potential benefits:

-

Review Eligibility Requirements: Once the details are released, carefully review the eligibility requirements to determine if their business qualifies for the expanded credits.

-

Consult Tax Advisors: Consult with tax advisors to understand the implications of the expanded credits on their specific financial situation and investment plans.

-

Plan Potential Investments: Begin planning for potential investments that could maximize the benefits of the expanded tax credits. Prioritize projects that align with the program’s focus areas.

-

Monitor Government Announcements: Stay informed about further announcements and official program details from the Ontario government to ensure they can take full advantage of these opportunities.

Conclusion

The proposed expansion of Ontario Manufacturing Tax Credits presents a significant opportunity for the province's manufacturing sector. By increasing investment incentives, the government aims to stimulate growth, create jobs, and strengthen Ontario's competitive position. Understanding the details of these expanded Ontario Manufacturing Tax Credits is crucial for businesses to leverage this potential economic boost. Manufacturers are encouraged to proactively assess their eligibility and plan their investments accordingly. Stay informed on the latest updates regarding Ontario manufacturing tax credits to fully capitalize on this opportunity. Don't miss out – prepare now for the benefits of these enhanced tax incentives.

Featured Posts

-

Public Opinion On Anthony Edwards Baby Mama Situation

May 07, 2025

Public Opinion On Anthony Edwards Baby Mama Situation

May 07, 2025 -

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025 -

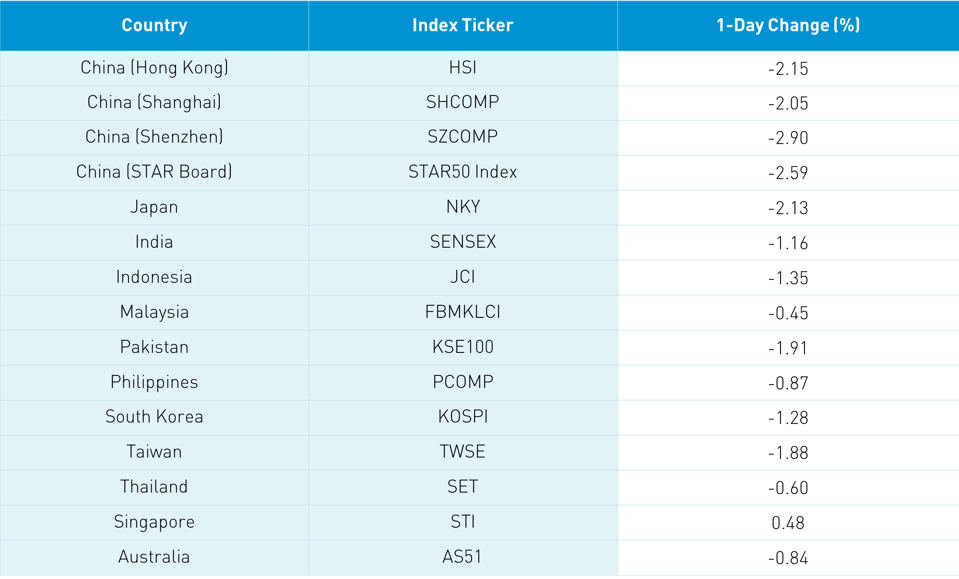

Impact Of Us China Dialogue And Economic Statistics On The Chinese Stock Markets Rebound

May 07, 2025

Impact Of Us China Dialogue And Economic Statistics On The Chinese Stock Markets Rebound

May 07, 2025 -

Lewis Capaldis Musical Return A Friends Announcement

May 07, 2025

Lewis Capaldis Musical Return A Friends Announcement

May 07, 2025 -

Lewis Capaldis Album Maintains Top Chart Position

May 07, 2025

Lewis Capaldis Album Maintains Top Chart Position

May 07, 2025

Latest Posts

-

Investing In The Future A Map Of Emerging Business Hubs

May 08, 2025

Investing In The Future A Map Of Emerging Business Hubs

May 08, 2025 -

Growth Opportunities Mapping The Countrys Newest Business Hot Spots

May 08, 2025

Growth Opportunities Mapping The Countrys Newest Business Hot Spots

May 08, 2025 -

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025 -

How Liberation Day Tariffs Reshape Stock Market Strategies

May 08, 2025

How Liberation Day Tariffs Reshape Stock Market Strategies

May 08, 2025 -

A Geographic Overview Of Promising New Business Locations

May 08, 2025

A Geographic Overview Of Promising New Business Locations

May 08, 2025