How 'Liberation Day' Tariffs Reshape Stock Market Strategies

Table of Contents

What are "Liberation Day" Tariffs?

The "Liberation Day" tariffs (replace with the actual name and details of the tariffs if known; this is a placeholder name for illustrative purposes) represent a significant shift in trade policy, imposing new duties on various imported goods. The implementation of these tariffs carries significant implications for businesses and investors alike, introducing considerable uncertainty into the market. Understanding these implications is crucial for navigating the current economic climate.

1. Impact on Specific Sectors

The "Liberation Day" tariffs have had a disproportionate effect on various economic sectors, creating both winners and losers. Understanding this sector-specific impact is vital for effective investment decision-making.

-

Negatively Impacted Sectors: Industries heavily reliant on imported components or materials, such as manufacturing and certain segments of technology, have experienced significant challenges due to increased input costs. This has led to reduced profitability and potentially slower growth. For example, the automotive sector, dependent on imported parts, may face production delays and increased prices, resulting in decreased consumer demand. This highlights the tariff vulnerability of these sectors.

-

Potentially Benefiting Sectors: Conversely, some domestic industries that compete with imported goods might experience a boost. For instance, domestic manufacturers producing substitute products could see increased demand and market share. This is particularly true for agricultural products if the tariffs target imports in that sector.

-

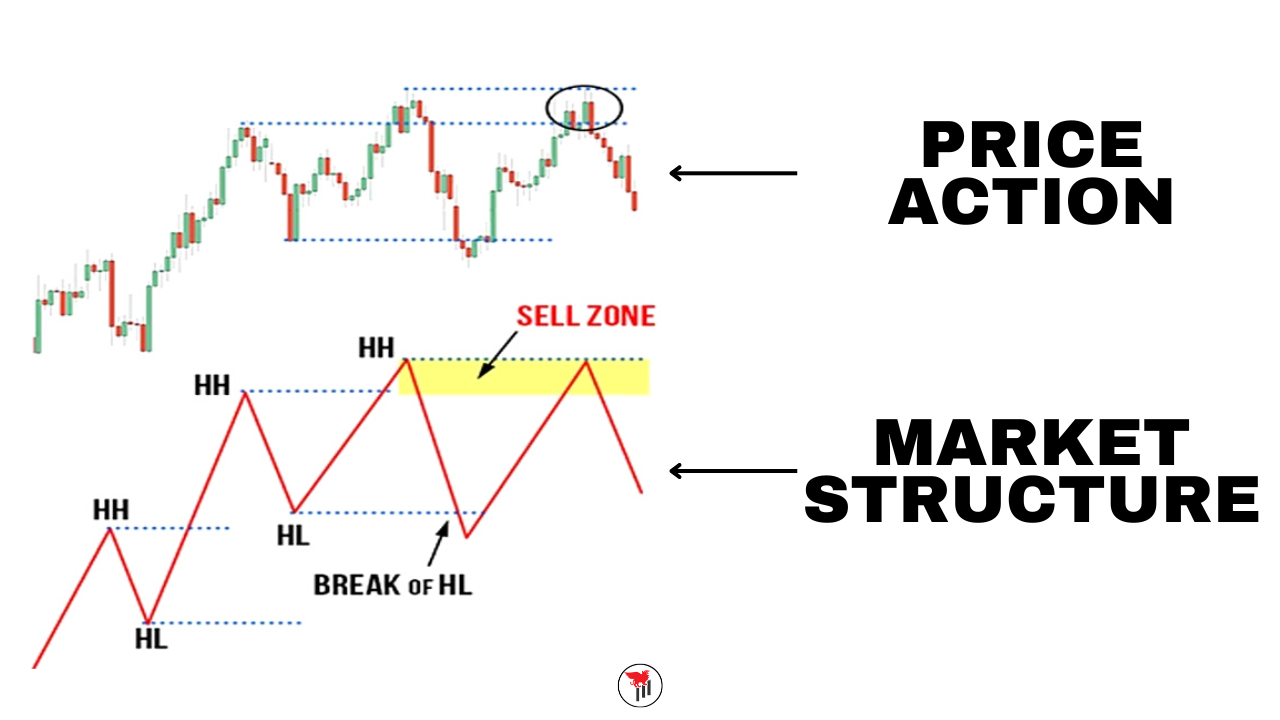

Volatility and Uncertainty: The unpredictability surrounding future tariff changes creates significant market volatility. Investors face ongoing uncertainty, making it difficult to accurately predict future earnings and making long-term planning more challenging.

2. Shifting Investment Strategies

The introduction of "Liberation Day" tariffs has prompted a significant shift in investment strategies as investors seek to mitigate risks and identify opportunities in this new environment. This includes a focus on portfolio restructuring and risk management.

-

Defensive Stocks: Investors are increasingly favoring defensive stocks, companies whose earnings are less susceptible to economic downturns. This includes sectors such as utilities, consumer staples, and healthcare.

-

International Diversification: The impact of these tariffs highlights the importance of global diversification. Investors are looking beyond domestic markets to mitigate the risks associated with trade disputes and tariff uncertainty.

-

Alternative Investments: There's a growing interest in alternative investments, such as real estate, infrastructure, or private equity, perceived as less vulnerable to the direct impacts of trade policy changes.

-

Hedging Strategies: Risk management through hedging strategies, such as using derivatives to protect against currency fluctuations or commodity price changes, has become increasingly prevalent.

3. The Role of Geopolitical Risk

The "Liberation Day" tariffs contribute significantly to broader geopolitical risk and influence investor sentiment. The implications extend beyond just immediate economic effects.

-

Trade Wars and Investor Sentiment: The imposition of tariffs often escalates into trade wars, leading to retaliatory measures and further dampening investor sentiment. Negative news surrounding trade conflicts can trigger market sell-offs.

-

Supply Chain Disruption: Tariffs can severely disrupt global supply chains, forcing companies to reconsider their sourcing strategies and potentially leading to higher production costs and delays.

-

Importance of Geopolitical Analysis: Understanding geopolitical risk has become crucial for investment decisions. Investors need to incorporate geopolitical analysis into their due diligence processes to anticipate and mitigate potential negative impacts.

4. Government Intervention and Policy Response

Governments are likely to implement various measures to counter the negative impacts of the "Liberation Day" tariffs. Analyzing potential government intervention is vital.

-

Support for Affected Industries: Governments might offer financial support to industries severely impacted by the tariffs, such as providing tax breaks or subsidies to help maintain employment and competitiveness.

-

Fiscal and Monetary Policy Responses: Fiscal policy adjustments, such as tax cuts or infrastructure spending, could be used to stimulate the economy. Monetary policy responses, such as interest rate cuts, might be employed to counter economic slowdowns.

-

Market Stabilization: Central banks may intervene to stabilize markets by injecting liquidity and managing interest rates to mitigate excessive volatility.

Conclusion: Rethinking Stock Market Strategies in the Age of "Liberation Day" Tariffs

The "Liberation Day" tariffs represent a significant disruption to the global economy, profoundly impacting stock market strategies. Investors must adapt to this new economic reality, focusing on diversification, risk management, and a thorough understanding of geopolitical factors. Understanding the implications of "Liberation Day" tariffs is crucial for navigating the current market. Reassess your investment strategy today and consider consulting a financial advisor to optimize your portfolio in this new environment of increased tariff-related risk. The Liberation Day tariff impact on stocks necessitates a proactive and informed approach to investment management.

Featured Posts

-

Counting Crows Announce Las Vegas Show

May 08, 2025

Counting Crows Announce Las Vegas Show

May 08, 2025 -

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025 -

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025 -

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025 -

The Countrys Hottest New Business Locations A Geographic Analysis

May 08, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

May 08, 2025

Latest Posts

-

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025

Jayson Tatum Ankle Injury Updates On Celtics Forwards Status

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatums Skills

May 08, 2025 -

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025

Celtics Star Jayson Tatums Ankle Injury Severity And Impact

May 08, 2025 -

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 08, 2025

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 08, 2025 -

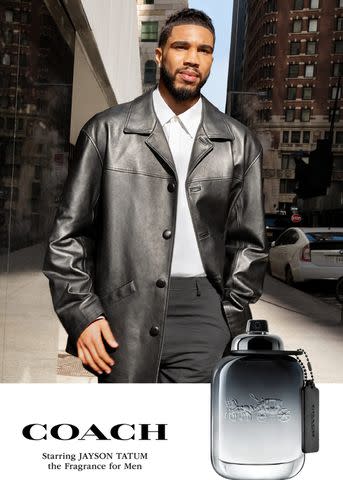

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025