Long-Term Investment: Berkshire Hathaway's Impact On Japanese Trading Houses

Table of Contents

Berkshire Hathaway's Investment Strategy and its Alignment with Japanese Trading Houses

Berkshire Hathaway's investment philosophy centers on identifying undervalued, well-managed companies with strong competitive advantages and holding them for the long term. This "buy-and-hold" strategy, often referred to as value investing, contrasts sharply with short-term, speculative trading approaches. The decision to invest in five prominent Japanese trading houses – Mitsui & Co., Mitsubishi Corporation, Itochu Corporation, Sumitomo Corporation, and Marubeni Corporation – reflects this core philosophy.

Several factors likely contributed to Berkshire's decision:

- Diversification: Expanding into a new, geographically diverse market minimizes risk and offers exposure to different economic cycles.

- Attractive Valuations: Berkshire likely identified these trading houses as undervalued relative to their intrinsic worth and future earning potential.

- Strong Fundamentals: These sogo shosha boast decades of experience, robust balance sheets, and diversified business models. They represent stability in an often volatile global market.

The characteristics of Japanese trading houses that align perfectly with Berkshire's long-term investment approach include:

- Diversified Business Models: They operate across a wide range of industries, mitigating sector-specific risks.

- Strong Financial Positions: These companies consistently demonstrate solid financial performance and significant cash reserves.

- Established Global Presence: Their extensive international networks and relationships provide a competitive edge in global trade.

- Growth Potential in Emerging Markets: The sogo shosha are well-positioned to capitalize on growth opportunities in developing economies.

The Impact on Japanese Trading Houses' Stock Prices and Market Value

Berkshire Hathaway's investments have demonstrably impacted the stock prices and market value of the targeted Japanese trading houses. The immediate effect was a noticeable surge in share prices, reflecting increased investor confidence. This confidence stems from the association with Berkshire Hathaway, a globally recognized symbol of investment success and financial stability.

- Increased Investor Confidence: Buffett's endorsement boosted investor sentiment, leading to higher valuations.

- Market Attention: The investments brought significant global attention to these companies, attracting new investors.

- Trading Volume Increase: The increased investor interest translated into heightened trading activity.

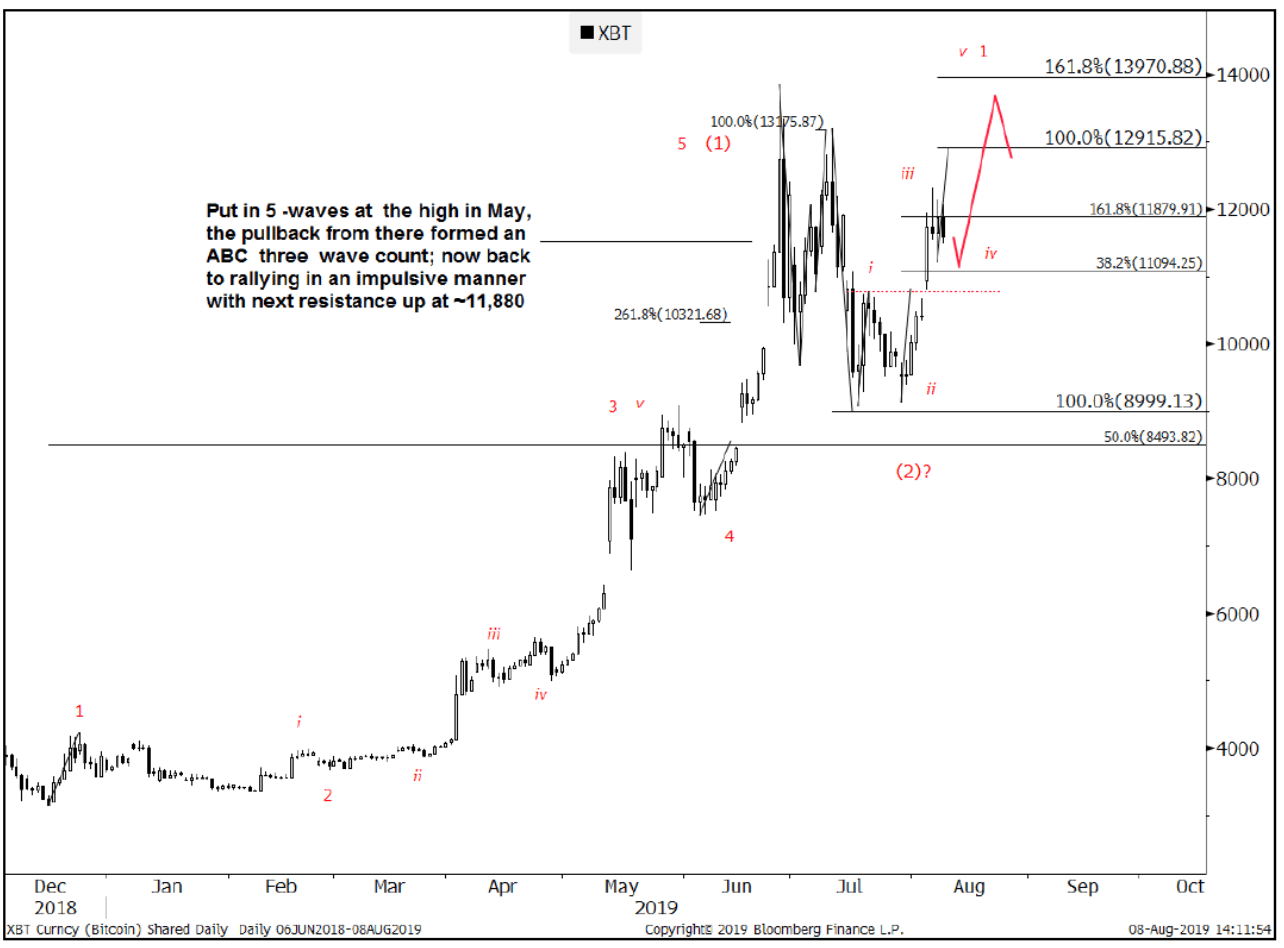

While precise quantitative data on the impact requires detailed financial analysis over time, anecdotal evidence and market reaction strongly suggest a positive correlation between Berkshire's investment and the improved market performance of these Japanese trading houses. (Note: Inclusion of charts and graphs showing stock price movements before and after Berkshire's investment would significantly enhance this section if data is accessible.) Keywords: Stock price increase, market capitalization, investor confidence, trading volume.

Broader Implications for the Japanese and Global Markets

Berkshire Hathaway's investment holds broader implications for both the Japanese and global markets.

- Increased Foreign Investment: It signals to other international investors that Japan remains an attractive investment destination, boosting overall foreign direct investment (FDI).

- Positive Market Sentiment: The move positively impacts market sentiment towards Japanese equities and strengthens the Japanese yen.

- Influence on Trading House Strategies: The investment could spur these companies to further optimize their operations and pursue strategic growth initiatives.

- Economic Impact on Japan: Increased investment contributes to economic growth and job creation.

The ripple effect extends beyond Japan's borders. It reinforces the global recognition of long-term value investing as a viable and successful strategy, influencing the investment decisions of other institutional investors worldwide. Keywords: Foreign investment, global markets, economic impact, market sentiment, investment destination.

Conclusion

Berkshire Hathaway's long-term investment in Japanese trading houses marks a significant development in global finance. The strategic move has demonstrably boosted stock prices, increased investor confidence, and highlighted the enduring appeal of these companies as attractive, stable investments. The positive impact extends beyond the individual companies, fostering a more positive perception of the Japanese market and attracting further foreign investment. This successful investment further validates Berkshire Hathaway's long-term value investing approach and underscores the potential for growth and collaboration between Western and Asian businesses. To learn more about successful long-term investment strategies and opportunities within the Japanese market, we encourage further research into Berkshire Hathaway's investment philosophy and the evolving dynamics of the sogo shosha industry. Consider exploring the potential of similar long-term investment approaches for your own portfolio. Keywords: Berkshire Hathaway, long-term investment, Japanese trading houses, investment strategy, value investing.

Featured Posts

-

Forza Horizon 5 Ps 5 Release Date When Does It Unlock

May 08, 2025

Forza Horizon 5 Ps 5 Release Date When Does It Unlock

May 08, 2025 -

See The Winning Lotto Numbers 12 04 2025

May 08, 2025

See The Winning Lotto Numbers 12 04 2025

May 08, 2025 -

Will Trumps Policies Affect Bitcoins Price A 2024 Prediction

May 08, 2025

Will Trumps Policies Affect Bitcoins Price A 2024 Prediction

May 08, 2025 -

Understanding The Bitcoin Rebound Potential Risks And Rewards

May 08, 2025

Understanding The Bitcoin Rebound Potential Risks And Rewards

May 08, 2025 -

Psg Nice Maci Canli Izle Hangi Kanalda Nasil Izlenir

May 08, 2025

Psg Nice Maci Canli Izle Hangi Kanalda Nasil Izlenir

May 08, 2025

Latest Posts

-

Saglik Bakanligi Ndan 37 Bin Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025

Saglik Bakanligi Ndan 37 Bin Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025 -

Son Dakika Saglik Bakanligi 37 000 Personel Alimina Basvurmak Icin Bilmeniz Gerekenler

May 08, 2025

Son Dakika Saglik Bakanligi 37 000 Personel Alimina Basvurmak Icin Bilmeniz Gerekenler

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12wyn Brsy Ky Tqrybat Ka Aneqad

May 08, 2025 -

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Duyurulari Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Son Dakika Duyurulari Ve Basvuru Sartlari

May 08, 2025