Impact Of US-China Dialogue And Economic Statistics On The Chinese Stock Market's Rebound

Table of Contents

The Influence of US-China Trade Relations on Chinese Stock Market Performance

The relationship between the US and China has significantly impacted the Chinese stock market. Periods of escalating trade tensions have historically coincided with market downturns, while de-escalation and improved relations have often spurred rebounds.

Trade War Escalation and Market Volatility

The trade war between the US and China, which intensified in 2018, created significant market volatility. Investor sentiment plummeted as both countries imposed tariffs and trade restrictions on billions of dollars worth of goods.

- Tariff Imposition: The imposition of tariffs on Chinese goods led to increased production costs for many companies, impacting profitability and investor confidence.

- Restriction on Technology Transfer: Restrictions on technology transfer further dampened investor enthusiasm, impacting sectors heavily reliant on US technology.

- Retaliatory Measures: China's retaliatory measures against US goods also contributed to the overall market uncertainty.

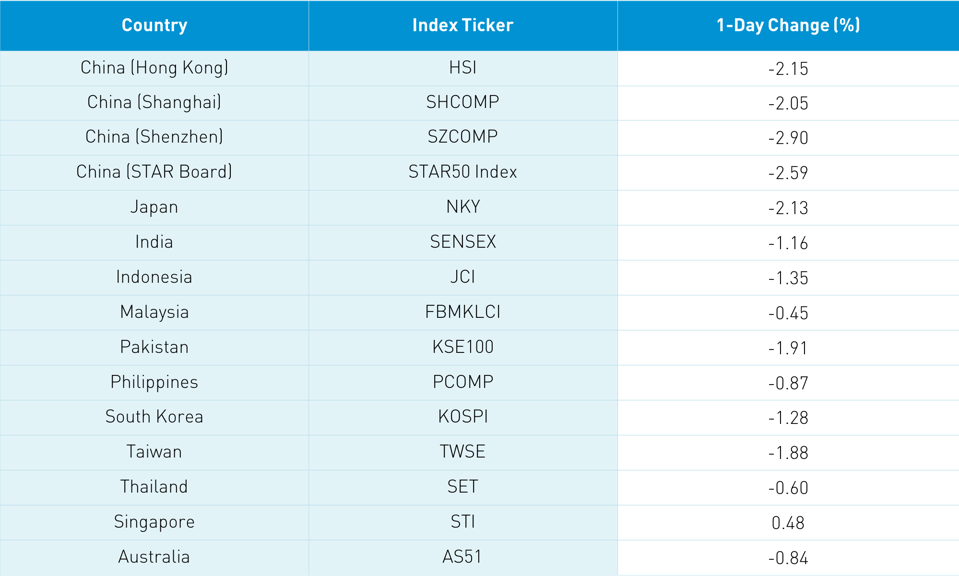

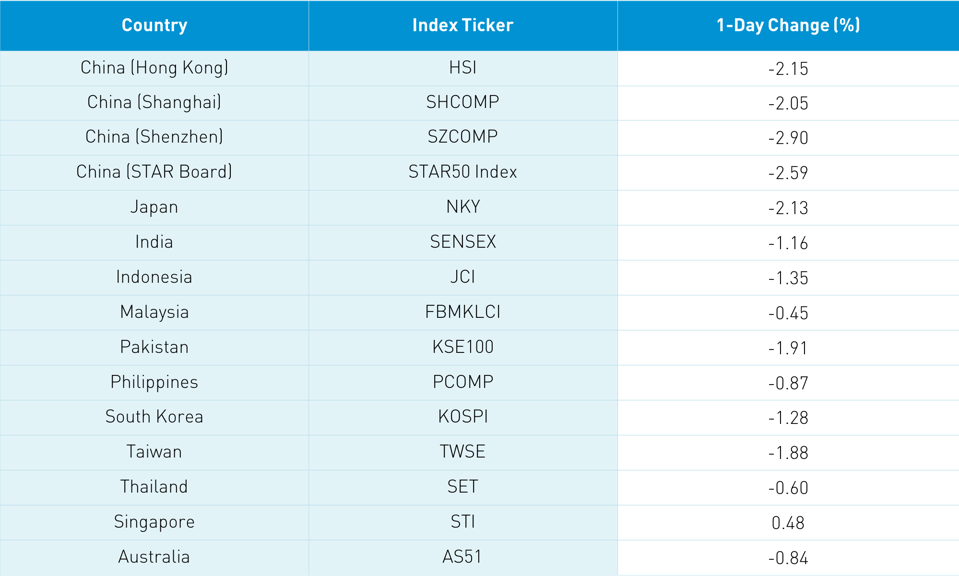

The Shanghai Composite Index and Shenzhen Component Index experienced substantial drops during these periods of heightened trade conflict. For example, the Shanghai Composite Index fell by approximately [Insert Percentage]% between [Start Date] and [End Date] amidst escalating tariff disputes. [Cite source for data].

De-escalation and Market Recovery

Conversely, periods of improved US-China relations and trade agreements have generally been met with positive market reactions. The signing of the "Phase One" trade deal in 2020, for instance, provided a temporary boost to investor confidence.

- Phase One Trade Deal: This agreement led to a temporary reduction in tariffs and increased predictability in trade relations, bolstering market sentiment.

- Other Positive Developments: Other periods of diplomatic engagement and reduced trade tensions have also shown positive correlations with market recoveries.

Following the signing of the "Phase One" deal, the Shanghai Composite Index saw a [Insert Percentage]% increase within [Timeframe]. [Cite source for data]. This highlights the sensitivity of the Chinese stock market to changes in the US-China relationship.

The Role of Geopolitical Uncertainty

Beyond trade, broader geopolitical uncertainty significantly influences investor behavior. Tensions over Taiwan, human rights concerns, and technological competition all contribute to the overall risk perception surrounding Chinese investments.

- Geopolitical Risk Premium: Investors often demand a higher risk premium for investing in Chinese assets during periods of heightened geopolitical tensions.

- Capital Flight: Geopolitical instability can lead to capital flight, putting downward pressure on the market.

- Shifting Investment Strategies: Investors may shift their portfolios away from Chinese assets in favor of perceived safer alternatives during times of uncertainty.

The Impact of Key Economic Indicators on Chinese Stock Market Sentiment

China's economic performance is another crucial factor influencing its stock market. Key economic indicators, such as GDP growth, inflation rates, and other macroeconomic data, strongly correlate with market sentiment.

GDP Growth and Market Performance

China's GDP growth rate has historically shown a strong correlation with stock market performance. Higher GDP growth generally leads to increased corporate earnings and investor optimism, while slower growth can trigger concerns about economic slowdown and market corrections.

- Growth Expectations: Investor expectations regarding future GDP growth significantly impact market valuations.

- Earnings Growth: Higher GDP growth often translates to higher corporate earnings, leading to increased stock prices.

- Policy Response: The government's policy response to slower growth also influences market sentiment.

For example, periods of robust GDP growth above [Percentage]% have generally been accompanied by positive market returns in the Shanghai and Shenzhen indices. [Cite source for data].

Inflation Rates and Stock Market Valuation

Inflation rates also affect investor confidence and stock valuations. High inflation erodes purchasing power and can increase interest rates, negatively affecting corporate profits and market valuations. Conversely, low inflation can be viewed positively, boosting investor confidence.

- Interest Rate Sensitivity: Higher inflation often leads to higher interest rates, making borrowing more expensive for businesses and reducing investment.

- Erosion of Corporate Profits: High inflation can erode corporate profits if companies cannot pass on increased costs to consumers.

- Investor Sentiment: Unpredictable inflation rates create uncertainty, negatively impacting investor sentiment.

Data comparing inflation rates and stock market performance in China can illustrate this correlation. [Cite source for data].

Other Key Economic Indicators

Other important economic indicators impacting the Chinese stock market include employment data, industrial production, and consumer spending. Strong employment numbers, rising industrial production, and robust consumer spending signal a healthy economy, boosting investor confidence. Conversely, weak data in these areas can lead to concerns about economic slowdown and market corrections.

- Employment Data: High unemployment rates can dampen consumer confidence and reduce spending, negatively impacting market sentiment.

- Industrial Production: Decreases in industrial production indicate potential economic weakness, affecting investor confidence.

- Consumer Spending: Weak consumer spending can signal a weakening economy and put downward pressure on the market.

Analyzing the Chinese Stock Market's Rebound Strategies

The Chinese government plays a significant role in stabilizing the market during periods of volatility, while investor sentiment and long-term growth prospects also shape rebound strategies.

Government Intervention and Market Stabilization

The Chinese government utilizes various tools to manage market volatility, including monetary policy adjustments, fiscal stimulus packages, and regulatory interventions.

- Monetary Policy: Changes in interest rates and reserve requirements influence liquidity and borrowing costs, affecting market sentiment.

- Fiscal Stimulus: Government spending on infrastructure projects and other initiatives can stimulate economic activity and boost market confidence.

- Regulatory Interventions: Government intervention to curb speculation or support specific sectors can also impact market performance.

Investor Sentiment and Market Psychology

Investor sentiment and market psychology heavily influence the Chinese stock market's response to external shocks and economic data.

- Herd Behavior: Investors often mimic the actions of others, leading to amplified market swings.

- Risk Aversion: Periods of uncertainty can increase risk aversion, leading investors to sell assets and seek safer investments.

- Market Speculation: Speculative trading can amplify market volatility, both during rebounds and corrections.

Long-Term Growth Prospects and Investment Strategies

Despite short-term volatility, China's long-term economic growth potential presents attractive opportunities for long-term investors.

- Sector-Specific Opportunities: Certain sectors, like technology, renewable energy, and consumer goods, offer promising long-term growth prospects.

- Diversification: Diversifying investments across different sectors and asset classes is crucial to mitigate risk.

- Long-Term Perspective: A long-term investment strategy is essential for navigating short-term market fluctuations and benefiting from China's long-term growth potential.

Conclusion: Understanding the Impact of US-China Dialogue on the Chinese Stock Market's Future

The Chinese stock market's performance is inextricably linked to the ongoing US-China dialogue and China's economic fundamentals. Monitoring the evolving relationship between the two countries and analyzing key economic statistics, such as GDP growth, inflation, and trade data, is paramount for understanding the market’s potential for rebound. The government's role in stabilizing the market, investor sentiment, and long-term growth prospects must also be considered. To successfully navigate the complexities of the Chinese stock market, investors must diligently monitor the impact of US-China dialogue and analyze Chinese economic statistics to understand the Chinese stock market's rebound and future performance. Further research into specific sectors and indicators can further refine your understanding and investment strategies.

Featured Posts

-

Report Negotiations Sour George Pickens May Leave Steelers Before 2026

May 07, 2025

Report Negotiations Sour George Pickens May Leave Steelers Before 2026

May 07, 2025 -

Indias Yes Bank Potential Investment By Smfg

May 07, 2025

Indias Yes Bank Potential Investment By Smfg

May 07, 2025 -

All Star Game 2024 Steph Currys Triumph And Format Debate

May 07, 2025

All Star Game 2024 Steph Currys Triumph And Format Debate

May 07, 2025 -

Rihannas Savage X Fenty Bridal Lingerie For The Modern Bride

May 07, 2025

Rihannas Savage X Fenty Bridal Lingerie For The Modern Bride

May 07, 2025 -

The Moment Zendaya Discovered Her Spider Man Audition

May 07, 2025

The Moment Zendaya Discovered Her Spider Man Audition

May 07, 2025

Latest Posts

-

Who Wants To Be A Millionaire Contestants Slow Play Sparks Outrage

May 07, 2025

Who Wants To Be A Millionaire Contestants Slow Play Sparks Outrage

May 07, 2025 -

Xrp Jumps After Presidential Mention Of Trump And Ripples Relationship

May 07, 2025

Xrp Jumps After Presidential Mention Of Trump And Ripples Relationship

May 07, 2025 -

Xrp Price Soars Grayscale Etf Filing News Drives Xrp Past Bitcoin And Other Top Cryptocurrencies

May 07, 2025

Xrp Price Soars Grayscale Etf Filing News Drives Xrp Past Bitcoin And Other Top Cryptocurrencies

May 07, 2025 -

Xrp Price Soars Following Presidents Post On Trumps Influence On Ripple

May 07, 2025

Xrp Price Soars Following Presidents Post On Trumps Influence On Ripple

May 07, 2025 -

Grayscale Xrp Etf Filing Xrps Market Dominance Grows Amidst Bitcoin Price Action

May 07, 2025

Grayscale Xrp Etf Filing Xrps Market Dominance Grows Amidst Bitcoin Price Action

May 07, 2025