Exclusive Report: Elliott's Bet On The Russian Gas Pipeline

Table of Contents

Elliott's Investment Strategy: A Deep Dive

Understanding Elliott's Approach

Elliott Management is known for its activist investment style, often targeting undervalued or distressed companies. Their investment philosophy centers on identifying opportunities where skillful management and strategic interventions can unlock significant value. They have a history of taking on high-risk, high-reward ventures, particularly in sectors facing significant challenges.

- Past Successes: Elliott has a proven track record of successfully navigating complex situations and generating substantial returns in sectors with inherent risks. Their past investments in the telecom and financial sectors demonstrate their capacity for deep due diligence and effective risk management.

- Due Diligence: Elliott's approach involves rigorous due diligence, employing a team of experts across various fields including legal, financial, and geopolitical analysis. This ensures a comprehensive understanding of the risks and potential rewards involved.

- Previous Russian Involvement: While details remain scarce regarding prior direct involvement with Russian energy companies, Elliott's experience with navigating complex international regulatory environments suggests preparedness for the challenges presented by this investment.

The Allure of Russian Gas

Despite the considerable risks, the potential financial incentives driving Elliott's decision are significant. The Russian gas pipeline sector, while fraught with geopolitical complexities, offers the potential for substantial returns.

- Projected Gas Demand: Continued demand for natural gas, particularly in Europe, creates a potential market for Russian gas even amidst geopolitical tensions.

- Price Volatility and Potential Increases: The volatile nature of the energy market presents opportunities for significant price increases, enhancing the potential returns on investment.

- Pipeline Expansion: The potential for future pipeline expansions and infrastructural improvements can further boost the value of Elliott's investment. While this aspect is laden with risk, it offers another key incentive. Specific details about the pipelines involved remain confidential, but indications suggest interest in established networks supplying Europe.

Assessing the Risks

The investment in Russian gas pipelines presents considerable challenges and potential downsides. These risks are substantial and must be carefully considered.

- Geopolitical Instability: The ongoing geopolitical tensions between Russia and the West create a volatile environment for investment in Russian energy assets. Sanctions and potential retaliatory measures pose significant threats.

- Impact of Sanctions: International sanctions, imposed due to geopolitical events, pose a substantial risk to the profitability, if not the viability, of the investment. The ever-changing regulatory landscape necessitates constant vigilance and adaptation.

- Legal Challenges: Navigating the legal complexities of operating in Russia and interacting with Russian entities presents inherent risks. Potential disputes and legal challenges could significantly impact investment returns.

- Environmental Concerns: Environmental concerns associated with gas pipelines, including potential leaks and methane emissions, add another layer of risk to the investment. Increased scrutiny of environmental impact is a growing factor influencing the energy sector.

- Supply Disruptions: Potential disruptions to the supply of Russian gas, due to geopolitical events or technical issues, could severely impact the viability of this investment.

Geopolitical Implications and Market Analysis

The International Relations Angle

Elliott's investment has significant geopolitical implications, affecting the delicate balance of power between Russia, Europe, and the United States.

- Russia-Europe Relations: The investment highlights the complex interplay between economic interests and geopolitical tensions in the relationship between Russia and Europe.

- Sanctions and Global Politics: The investment's success or failure will be strongly influenced by the evolution of sanctions and the broader geopolitical environment. Any escalation of tensions could severely impact the investment.

- US Influence: The actions and reactions of the United States government regarding sanctions and energy policy will play a significant role in shaping the outcome.

Energy Market Volatility

Elliott's investment has the potential to influence the global energy market, particularly impacting natural gas prices and overall market stability.

- Supply and Demand Dynamics: The investment could affect the balance of supply and demand for natural gas, potentially impacting prices worldwide.

- Competing Energy Sources: The investment's success or failure will depend in part on the competition from alternative energy sources such as renewables.

- Long-Term Implications for Energy Security: The investment carries substantial long-term implications for energy security, particularly in Europe, which relies heavily on Russian gas imports. This is intertwined with the broader geopolitical climate.

Expert Opinions and Future Outlook

Analyst Predictions

Energy market analysts and geopolitical experts offer diverse perspectives on the potential success or failure of Elliott's investment.

- Diverse Opinions: Some analysts see the potential for significant returns, highlighting the enduring demand for natural gas and the possibility of price increases. Others are far more cautious, pointing to the multitude of geopolitical risks involved.

- Expert Quotes: [Insert quotes from relevant experts, citing their sources.] This section should include commentary from a variety of experts with differing viewpoints, presenting a balanced perspective.

Long-Term Projections

Predicting the long-term outcome of Elliott's bet on the Russian gas pipeline sector is inherently challenging given the inherent volatility.

- Scenario Planning: Several scenarios could unfold, ranging from significant returns for Elliott to a complete loss of investment. Each scenario carries distinct implications for the global energy market and international relations.

- Market Factors: Future projections must consider the evolving geopolitical climate, the impact of sanctions, and the trajectory of alternative energy sources.

Conclusion

Elliott's investment in the Russian gas pipeline sector represents a high-stakes gamble with significant potential rewards and considerable risks. The investment's success will hinge on navigating a complex geopolitical landscape marked by intense volatility in the energy market. The long-term implications for international relations and global energy security are substantial.

Stay informed about the evolving situation surrounding Elliott's high-stakes gamble on the Russian gas pipeline. Follow our future reports for updates on this developing story and further analysis of the implications for the energy market and international relations. Subscribe to our newsletter for exclusive insights into major financial and geopolitical events. Learn more about the complexities of investing in the volatile Russian gas pipeline market by [link to relevant resource].

Featured Posts

-

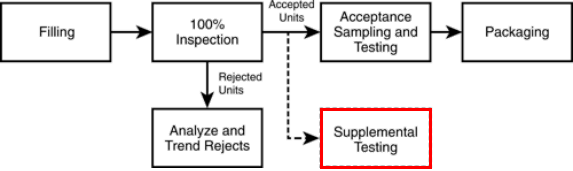

Improving Automated Visual Inspection For Lyophilized Vials

May 11, 2025

Improving Automated Visual Inspection For Lyophilized Vials

May 11, 2025 -

Uruguay A Rising Star In The International Film Industry

May 11, 2025

Uruguay A Rising Star In The International Film Industry

May 11, 2025 -

Adam Sandler And His Wife Their On Screen And Off Screen Love Story Started On Netflix

May 11, 2025

Adam Sandler And His Wife Their On Screen And Off Screen Love Story Started On Netflix

May 11, 2025 -

At And T On Broadcoms V Mware Deal An Extreme 1050 Price Increase Revealed

May 11, 2025

At And T On Broadcoms V Mware Deal An Extreme 1050 Price Increase Revealed

May 11, 2025 -

Optimizing Automated Visual Inspection Systems For Lyophilized Vials

May 11, 2025

Optimizing Automated Visual Inspection Systems For Lyophilized Vials

May 11, 2025