AT&T On Broadcom's VMware Deal: An Extreme 1050% Price Increase Revealed

Table of Contents

The 1050% Price Increase: A Detailed Breakdown

The reported 1050% increase in VMware licensing costs for AT&T represents a seismic shift in the enterprise software market. While precise figures haven't been officially released by either AT&T or Broadcom, industry sources suggest a dramatic jump from an estimated annual spend of X dollars to a staggering Y dollars. This substantial increase affects a range of VMware products crucial to AT&T's network infrastructure and operations.

- Specific VMware products experiencing the price surge: Reports suggest the increase impacted core virtualization products like vSphere, vSAN, and NSX, essential components of AT&T's network virtualization strategy. The impact extends beyond just the core software; associated services and support contracts are also likely to have seen significant price increases.

- Comparison of old vs. new pricing models: Previously, AT&T likely benefited from volume discounts and negotiated contracts. The post-acquisition pricing model appears to be drastically different, potentially shifting towards a per-core or per-VM licensing model, eliminating previous economies of scale.

- Potential reasons for the drastic increase: Several factors contribute to the price hike. The lack of significant competition in the enterprise virtualization market post-acquisition gives Broadcom considerable leverage. Updated licensing terms, potentially bundled services, and a shift away from previous contract agreements are also contributing factors. The consolidation of market power from the merger has enabled Broadcom to significantly increase prices.

AT&T's Response and Strategic Implications

While AT&T hasn't publicly commented extensively on the specifics of the 1050% VMware price increase, the implications are significant. This substantial cost increase directly impacts AT&T's operational budget, potentially affecting its profitability and competitiveness in the telecom sector.

- Potential cost-cutting measures AT&T might implement: To mitigate the impact, AT&T may explore various cost-cutting measures, including renegotiating contracts, optimizing its VMware deployment, and potentially reducing its reliance on certain VMware products.

- Alternative solutions AT&T might explore: The price hike may force AT&T to investigate alternative virtualization platforms, including open-source solutions like OpenStack or KVM, or consider migrating to cloud-native solutions to reduce its dependence on VMware licensing costs. This could involve a significant investment in infrastructure and retraining of staff.

- Impact on AT&T's competitive landscape: The increased operational costs could indirectly impact AT&T's competitiveness, forcing them to absorb the increased costs or pass them on to consumers. This could influence their pricing strategies and their ability to compete effectively with rivals.

Broader Implications for VMware Customers and the Tech Industry

The AT&T case serves as a stark warning to other VMware customers. Many businesses could face similar dramatic price increases, impacting their bottom lines and forcing them to re-evaluate their IT strategies.

- Potential legal challenges or regulatory investigations: The magnitude of the price increase raises significant antitrust concerns, and regulatory investigations into Broadcom's pricing practices are likely. This could lead to legal challenges and potential repercussions for Broadcom.

- Advice for businesses negotiating VMware contracts: Businesses should carefully review their VMware contracts, negotiate favorable terms, and consider exploring alternative solutions to avoid being exposed to similar dramatic price increases. A thorough understanding of licensing agreements and potential loopholes is crucial.

- Analysis of alternative virtualization platforms and their market share: The price hike is likely to accelerate the adoption of alternative virtualization platforms and open-source solutions, potentially reshaping the competitive landscape of the enterprise software market.

The Future of VMware Licensing Post-Acquisition

Broadcom's future pricing strategies for VMware remain uncertain. We might see continued price increases, a focus on higher-margin products, or changes to licensing models to maximize revenue. This uncertainty is particularly concerning for smaller businesses reliant on VMware solutions, which may lack the negotiating power of larger companies like AT&T. Changes to VMware's product offerings and support are also anticipated as Broadcom integrates VMware into its portfolio. The potential for reduced support or altered product roadmaps is a significant concern for many organizations.

Conclusion

The 1050% VMware price increase experienced by AT&T underscores the significant risks associated with mega-mergers and the potential for dramatic shifts in enterprise software pricing. The implications are far-reaching, affecting not only AT&T's bottom line but also raising concerns about the future of VMware licensing and the broader tech industry. The potential for similar price increases for other VMware customers is significant, and the antitrust implications of the Broadcom acquisition demand close scrutiny.

Call to Action: Businesses using VMware should carefully review their licensing agreements and consider negotiating better terms or exploring alternative virtualization solutions to avoid similar drastic VMware price increases. Stay informed about regulatory developments concerning the Broadcom acquisition and its impact on VMware licensing costs. Proactive planning and strategic IT decision-making are critical in navigating this evolving landscape.

Featured Posts

-

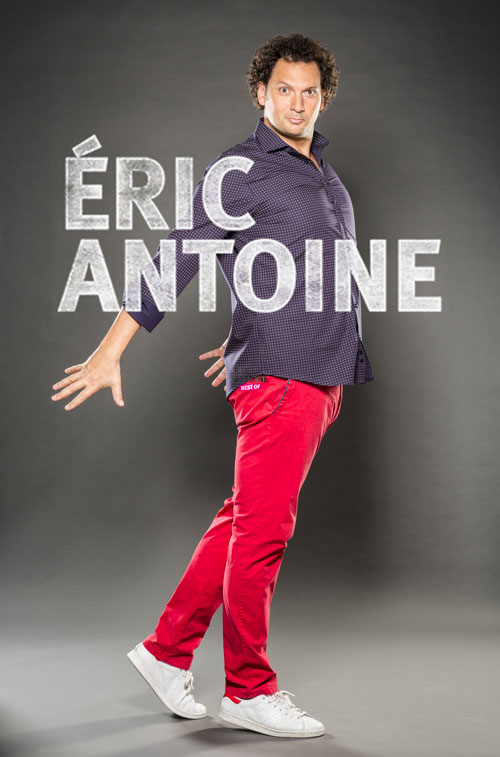

Eric Antoine Nouvelle Vie Nouveau Bebe Apres Le Divorce

May 11, 2025

Eric Antoine Nouvelle Vie Nouveau Bebe Apres Le Divorce

May 11, 2025 -

May 18th Fox Unveils New Indy Car Documentary

May 11, 2025

May 18th Fox Unveils New Indy Car Documentary

May 11, 2025 -

Sea Level Rise Urgent Action Needed To Protect Coastal Areas

May 11, 2025

Sea Level Rise Urgent Action Needed To Protect Coastal Areas

May 11, 2025 -

Dals Natasha St Pier Et Ines Reg Comparaison Des Performances

May 11, 2025

Dals Natasha St Pier Et Ines Reg Comparaison Des Performances

May 11, 2025 -

Nine Potential Successors To Pope Francis Leading Cardinal Candidates

May 11, 2025

Nine Potential Successors To Pope Francis Leading Cardinal Candidates

May 11, 2025