Why Current Stock Market Valuations Shouldn't Deter Investors (BofA)

Table of Contents

The Limitations of Traditional Valuation Metrics

Many investors instinctively react to high stock market valuations, often focusing solely on price-to-earnings (P/E) ratios. However, relying solely on this single metric provides an incomplete picture.

Beyond P/E Ratios

P/E ratios, while useful, are far from a perfect gauge of market valuation. Several factors limit their effectiveness:

- Accounting Variations: Different accounting practices across companies and industries can significantly skew P/E ratios, making direct comparisons misleading.

- Future Growth: Static P/E ratios fail to capture a company's future earnings growth potential, a crucial determinant of long-term value. A company with a high P/E ratio might be justified if its earnings are projected to grow substantially.

- Holistic View: Other valuation metrics offer a more comprehensive assessment. The Price-to-Sales (P/S) ratio, for instance, is less sensitive to accounting manipulations and provides a broader perspective on a company's valuation. Similarly, the Price/Earnings to Growth (PEG) ratio helps contextualize P/E ratios by considering growth rates.

The Impact of Interest Rates

Prevailing interest rate environments significantly impact equity valuations. Currently, relatively low or moderate interest rates play a crucial role in supporting seemingly high valuations:

- Discount Rates: Low interest rates reduce the discount rate used in discounted cash flow (DCF) analyses. This, in turn, leads to higher present values of future cash flows, justifying higher stock prices.

- Corporate Borrowing: Lower borrowing costs benefit companies, allowing them to invest more, expand operations, and ultimately drive future earnings growth.

- Equity Attractiveness: When bond yields are low, the relative attractiveness of equities as an investment increases, driving demand and supporting higher valuations.

The Role of Long-Term Growth Potential

Focusing solely on current valuations ignores the crucial element of long-term growth potential. Several factors underpin the expectation of sustained growth:

Technological Innovation and Disruption

Technological advancements and disruptive innovation are powerful drivers of long-term economic growth and corporate earnings:

- High-Growth Sectors: Sectors like artificial intelligence (AI), renewable energy, and biotechnology are experiencing rapid technological disruption, creating significant growth opportunities.

- Earnings Growth: These innovations drive higher earnings growth, potentially justifying what might appear to be high valuations in the short term.

- Capital Appreciation: Investment in these innovative sectors offers significant potential for long-term capital appreciation.

Global Economic Growth Projections

BofA Global Research, among other reputable sources, projects sustained global economic growth. This positive outlook supports higher stock market valuations:

- Economic Forecasts: While specific forecasts vary, the general consensus points toward continued, albeit potentially moderated, economic expansion in many regions.

- Corporate Profits: Sustained economic growth translates to higher corporate profits, providing a foundation for justifying higher equity valuations.

- Risk Mitigation: While risks to global growth exist (geopolitical uncertainty, inflation), investors can mitigate these through diversification and strategic asset allocation.

Strategic Investment Approaches to Mitigate Risk

Even with a positive long-term outlook, a strategic approach is crucial to mitigate risks associated with market volatility.

Diversification and Asset Allocation

A well-diversified portfolio across various asset classes and sectors is paramount for risk reduction:

- Market Volatility: Diversification helps mitigate the impact of market downturns by spreading risk across different investments.

- Risk Tolerance: Asset allocation strategies should be tailored to individual investor risk tolerance and time horizons, balancing risk and reward.

- Asset Class Diversification: Consider incorporating various asset classes like bonds, real estate, and alternative investments to further diversify your portfolio.

Focus on Quality Companies

Selecting high-quality companies with strong fundamentals is key to long-term success:

- Fundamental Analysis: Employ fundamental analysis to identify undervalued companies with sustainable growth prospects and strong competitive advantages.

- Key Metrics: Evaluate companies based on metrics like strong balance sheets, high return on equity (ROE), and consistent earnings growth.

- Due Diligence: Always conduct thorough due diligence before investing in any company, considering its financial health, management team, and industry outlook.

Conclusion

While current stock market valuations may initially appear high using traditional metrics like P/E ratios, a comprehensive analysis reveals a more optimistic picture. Factors such as low interest rates, technological innovation, and robust long-term growth prospects support a positive outlook for long-term investors. By employing a strategic investment approach that includes diversification and a focus on high-quality companies, investors can effectively mitigate risks associated with market volatility and capitalize on the potential for substantial long-term returns. Don't let perceived high stock market valuations deter you from pursuing your long-term investment goals. Develop a well-defined investment strategy tailored to your risk tolerance and financial objectives. Consult with a financial advisor to navigate current market conditions and optimize your portfolio for long-term growth in the stock market.

Featured Posts

-

Brezhnev Ryazanov I Garazh Istoriya Satiry Pod Plenumom

May 24, 2025

Brezhnev Ryazanov I Garazh Istoriya Satiry Pod Plenumom

May 24, 2025 -

Complete Bbc Radio 1 Big Weekend Lineup Announced Jorja Smith Biffy Clyro Blossoms And Other Artists

May 24, 2025

Complete Bbc Radio 1 Big Weekend Lineup Announced Jorja Smith Biffy Clyro Blossoms And Other Artists

May 24, 2025 -

O Chem Govorit Uspekh Nashego Pokoleniya Analiz I Prognozy

May 24, 2025

O Chem Govorit Uspekh Nashego Pokoleniya Analiz I Prognozy

May 24, 2025 -

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025

Latest Posts

-

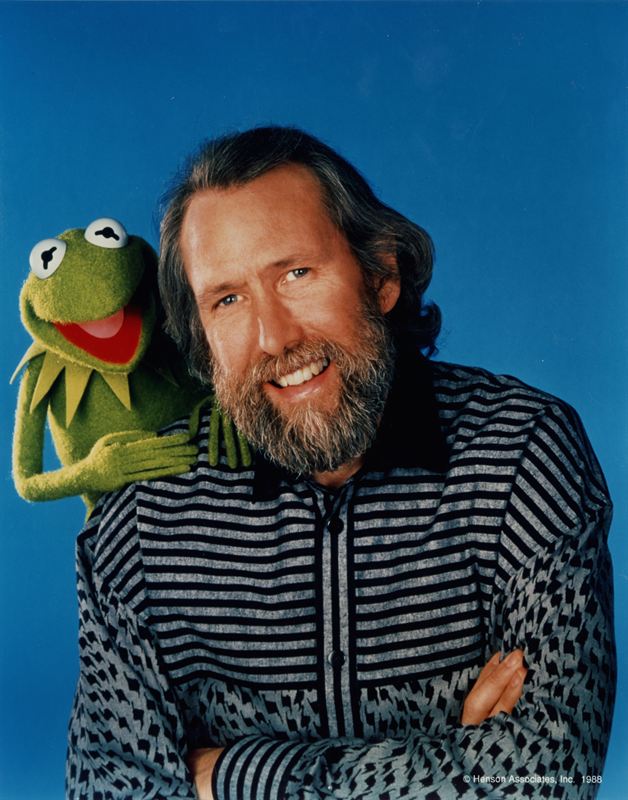

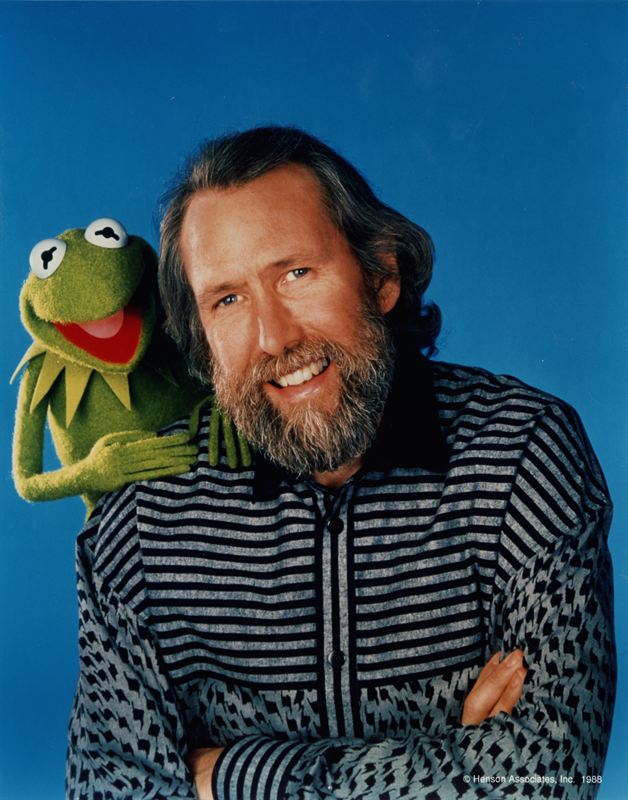

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025 -

Kermit The Frog To Deliver Commencement Address At University Of Maryland

May 24, 2025

Kermit The Frog To Deliver Commencement Address At University Of Maryland

May 24, 2025 -

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025 -

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025