BofA Reassures Investors: Why Stretched Valuations Aren't A Worry

Table of Contents

BofA's Rationale Behind Dismissing Valuation Concerns

BofA's assessment centers on several key arguments that mitigate concerns about current market valuations. They believe that the current market environment, while seemingly expensive, is underpinned by solid fundamentals that justify the price tags.

-

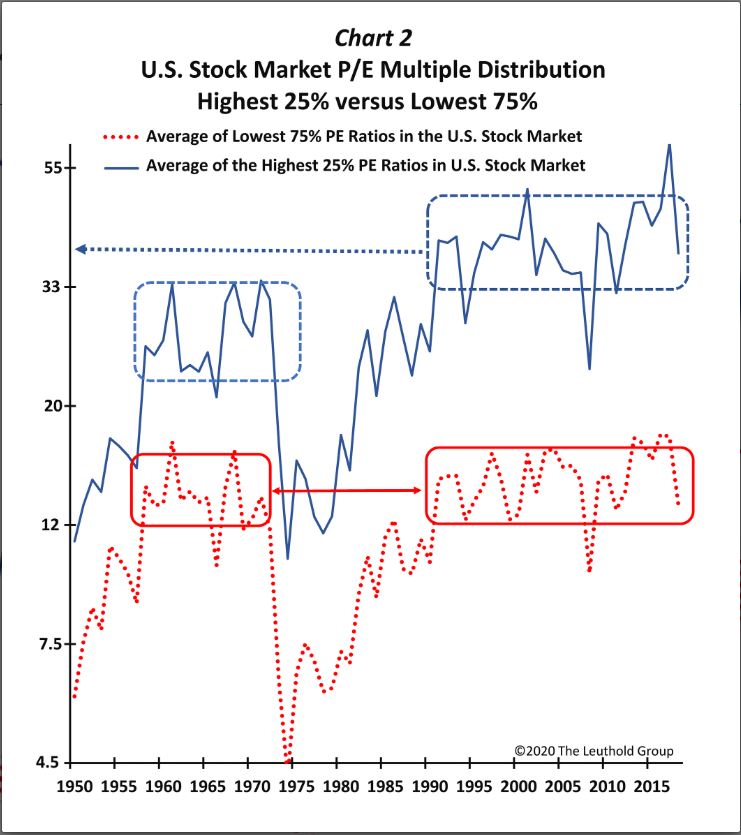

Strong Corporate Earnings Growth and Sustainability: BofA points to robust corporate earnings growth as a primary driver supporting current valuations. This isn't just short-term growth; they emphasize the sustainability of these earnings, projecting continued expansion based on solid economic indicators and innovative business models. This sustained growth, they argue, justifies higher price-to-earnings (P/E) ratios.

-

Low Interest Rates and Their Impact on Valuations: The persistently low interest rate environment plays a crucial role. Lower borrowing costs make it cheaper for companies to invest and expand, fueling growth and supporting higher valuations for stocks. This low-interest-rate environment also makes bonds less attractive relative to equities, driving more capital into the stock market.

-

Technological Innovation Driving Future Growth: BofA highlights the transformative impact of technological innovation across various sectors. This continuous innovation, leading to increased productivity and new market opportunities, justifies higher valuations for companies positioned to benefit from these trends. This future growth potential is a key element in their argument.

-

Potential for Further Monetary Easing Policies: The possibility of further monetary easing by central banks remains on the table. This would further lower interest rates, potentially boosting market valuations and mitigating some of the risks associated with already high valuations.

Analyzing the Underlying Economic Factors Supporting BofA's Stance

BofA's optimistic outlook is not solely based on corporate performance; it's also underpinned by several favorable macroeconomic factors:

-

Low Inflation: The current low inflation environment supports higher valuations. Low inflation means that the purchasing power of future earnings is not significantly eroded, allowing investors to justify higher prices for stocks based on the expectation of future growth. This low inflation environment is crucial for maintaining confidence in the market.

-

Strong Employment Numbers: Strong employment figures demonstrate a healthy economy with increased consumer spending and business confidence. This robust labor market supports corporate profitability and investor sentiment, bolstering the justification for higher valuations. The keyword here is strong employment, indicating a positive economic outlook.

-

Government Stimulus Packages: Government stimulus programs, while potentially inflationary in the long term, have provided a significant short-term boost to economic activity. This increased economic activity has supported higher corporate profits and bolstered investor confidence. The impact of government stimulus is a crucial factor for the short-term market outlook.

-

Global Economic Recovery: A global economic recovery, although uneven across different regions, contributes to the overall positive economic outlook. This international recovery supports increased trade and investment, which further supports corporate earnings and, subsequently, higher valuations. The positive effects of global economic recovery help justify current market prices.

Addressing Specific Sector Valuations

While some sectors appear to have stretched valuations, BofA's analysis identifies potential in specific areas:

-

Tech Valuation: The technology sector, often seen as overvalued, shows high valuations justified by strong growth potential in areas like artificial intelligence, cloud computing, and big data. Specific sub-sectors within technology display strong growth trajectories and innovative business models, potentially offsetting concerns about high valuations.

-

Healthcare Valuation: High valuations in the healthcare sector are partly explained by ongoing R&D leading to groundbreaking innovations and aging demographics driving increased demand. Specific companies exhibiting strong growth in key areas like biotechnology and pharmaceuticals might justify their high valuations.

-

Energy Valuation: The energy sector valuation depends on factors like commodity prices and the transition to cleaner energy. However, BofA might identify specific sub-sectors, such as renewable energy or energy-efficient technologies, which could justify their valuations based on long-term growth potential.

Risks and Counterarguments to BofA's Optimism

Despite BofA's optimistic stance, several potential risks and counterarguments need consideration:

-

Interest Rate Hikes: A sudden and significant increase in interest rates could negatively impact valuations, making borrowing more expensive and potentially slowing economic growth. This is a significant risk to the current market.

-

Inflationary Pressures: A surge in inflation could erode corporate profits and investor confidence, leading to a market correction. The potential for inflationary pressures remains a major concern.

-

Geopolitical Risk: Geopolitical events and uncertainties can significantly impact global markets and investor sentiment, creating volatility and potentially leading to lower valuations. Geopolitical risk is an ever-present threat to market stability.

-

Market Correction: Despite strong fundamentals, a market correction is always a possibility, driven by factors like investor sentiment shifts or unexpected economic events. A market correction, even after a period of growth, remains a potential risk.

Investor Strategies in Light of BofA's Assessment

BofA's analysis provides a nuanced perspective on current market valuations. Investors should consider the following:

-

Portfolio Diversification: Diversifying your investment portfolio across different asset classes and sectors can mitigate risks associated with high valuations in specific areas. Portfolio diversification is a crucial element of risk management.

-

Long-Term Investment Approach: A long-term investment strategy focused on sustainable growth is vital, allowing investors to ride out short-term market fluctuations. Long-term investment is crucial for weathering market volatility.

-

Sector-Specific Investment Choices: Carefully evaluate sector-specific investments based on their individual growth prospects and valuations, considering BofA's analysis of specific sectors. Sector investment decisions should be informed and strategic.

-

Risk Management Strategies: Implement robust risk management strategies to protect your portfolio against potential downsides, including diversification, stop-loss orders, and regular portfolio reviews. Risk management is essential for successful investing.

Conclusion

BofA's reassurances regarding stretched valuations offer investors a compelling perspective, albeit one that acknowledges inherent market risks. The bank's argument rests on strong corporate earnings, low interest rates, technological innovation, and a supportive macroeconomic environment. While risks like interest rate hikes, inflationary pressures, geopolitical events, and market corrections remain, understanding BofA's analysis and considering the supporting economic factors can inform a more strategic approach to your investment decisions. Learn more about managing your portfolio effectively in light of these high valuations and navigate the complexities of current market conditions.

Featured Posts

-

Kharkovschina Svadebniy Rekord Pochti 40 Par Obvenchalis

May 24, 2025

Kharkovschina Svadebniy Rekord Pochti 40 Par Obvenchalis

May 24, 2025 -

Complete Guide Nyt Mini Crossword Answers April 18 2025

May 24, 2025

Complete Guide Nyt Mini Crossword Answers April 18 2025

May 24, 2025 -

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 24, 2025

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 24, 2025 -

Escape To The Countryside Choosing The Right Property For You

May 24, 2025

Escape To The Countryside Choosing The Right Property For You

May 24, 2025 -

Dylan Dreyer And Today Show Co Stars A Mishap And Its Aftermath

May 24, 2025

Dylan Dreyer And Today Show Co Stars A Mishap And Its Aftermath

May 24, 2025

Latest Posts

-

Billie Jean King Cup Qualifier Kazakhstans Stunning Win Against Australia

May 24, 2025

Billie Jean King Cup Qualifier Kazakhstans Stunning Win Against Australia

May 24, 2025 -

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025

Kazakhstan Secures Billie Jean King Cup Spot After Australia Win

May 24, 2025 -

Billie Jean King Cup Kazakhstans Victory Over Australia

May 24, 2025

Billie Jean King Cup Kazakhstans Victory Over Australia

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025 -

Kubok Billi Dzhin King Kazakhstan V Finale Tretiy Raz Za Istoriyu

May 24, 2025

Kubok Billi Dzhin King Kazakhstan V Finale Tretiy Raz Za Istoriyu

May 24, 2025