Are Thames Water Executive Bonuses Justified?

Table of Contents

Thames Water's Financial Performance and its Relation to Bonuses

H3: Profitability and Investment: Thames Water's financial performance is central to the debate surrounding executive compensation. While the company reports profits, the question remains: are these profits sufficient to justify the substantial bonuses awarded to executives? A crucial aspect to consider is the level of investment in upgrading aging water infrastructure. This investment, while necessary for long-term sustainability and improved service, often impacts short-term profitability and can lead to increased customer bills.

- Examine profit margins compared to industry averages: Comparing Thames Water's profit margins to those of other UK water companies is essential to determine whether its profitability is exceptional, average, or below par. This comparison provides context for evaluating the size of executive bonuses.

- Detail investment in upgrading water infrastructure: Thames Water has undertaken significant investment in upgrading its infrastructure. Quantifying this investment, and demonstrating its impact on future profitability and service reliability, is vital for a fair assessment of the company's financial health.

- Analyze the impact of investment on customer bills: Increased investment often translates to higher customer bills. The relationship between investment, bill increases, and executive bonuses needs careful scrutiny to ensure fairness and transparency.

- Discuss the long-term financial health of the company: Looking beyond short-term profits, assessing the long-term financial health of Thames Water is critical. A robust financial outlook strengthens the argument for bonuses, while a precarious financial position weakens it.

H3: Debt Levels and Financial Risk: Thames Water carries a significant debt burden. This debt significantly influences the company's financial risk profile and raises questions about the appropriateness of awarding large bonuses. High levels of debt can restrict a company's ability to invest, impacting service quality and potentially increasing the risk of default.

- Examine Thames Water's level of indebtedness: The magnitude of Thames Water's debt needs to be clearly stated and compared to industry benchmarks. This clarifies the financial pressure the company faces.

- Analyze the impact of debt servicing on profitability: A substantial portion of Thames Water's profits may be dedicated to servicing its debt. This needs to be considered when evaluating the remaining profit available for bonuses.

- Discuss the risk of default and its potential consequences: The risk of default, and its potential impact on customers and the broader economy, needs to be weighed against the justification for executive bonuses.

- Consider the relationship between debt and executive compensation: A company facing significant debt should exercise caution in awarding large executive bonuses. The level of risk should directly inform the level of compensation.

Environmental Performance and Regulatory Compliance

H3: Sewage Discharges and Environmental Fines: Thames Water has faced significant criticism for its record on sewage discharges and the resulting environmental fines. These incidents directly impact public perception and raise serious questions about the appropriateness of executive bonuses.

- Quantify the number and severity of sewage discharge incidents: Precise data on the frequency, duration, and volume of sewage discharges is crucial for assessing the severity of the environmental impact.

- Detail the amount of fines levied against Thames Water: The financial penalties imposed on Thames Water due to environmental violations are a clear indication of its performance.

- Analyze the environmental impact of these incidents: The ecological consequences of sewage discharges need to be fully examined and communicated.

- Discuss the company's response to criticism: The company's response to public criticism and its commitment to improving its environmental performance are key elements to evaluate.

H3: Regulatory Compliance and Customer Service: Thames Water's track record on regulatory compliance and customer service is another critical aspect. Poor performance in these areas undermines the justification for substantial executive bonuses.

- Review customer satisfaction ratings: Customer satisfaction surveys and ratings offer valuable insights into the public perception of Thames Water's services.

- Assess the company's regulatory compliance record: A detailed review of Thames Water's regulatory compliance record reveals whether it has consistently met or exceeded legal requirements.

- Discuss the impact of poor performance on public trust: Poor performance erodes public trust, making the awarding of significant bonuses even more problematic.

- Analyze the link between performance and executive compensation: The link between operational performance and executive pay should be transparent and justifiable.

Comparison with Other Water Companies

H3: Industry Benchmarks for Executive Pay: Comparing Thames Water's executive compensation to other water companies in the UK and internationally provides valuable context. Are bonuses in line with industry standards, considering the relative performance and challenges faced?

- Compare CEO salaries and bonus structures across different water companies: A comparative analysis of executive pay across the water industry helps determine if Thames Water's compensation is an outlier.

- Analyze the factors influencing executive pay in the water industry: Understanding the various factors impacting executive pay, such as company size, performance, and market conditions, provides a more nuanced perspective.

- Discuss the impact of regulatory frameworks on executive compensation: Regulatory frameworks often play a role in influencing executive compensation within the water industry.

- Examine the correlation between company performance and executive pay: Analyzing the relationship between company performance metrics and executive compensation reveals whether bonuses are truly performance-based.

Conclusion

This article has examined the various factors influencing the debate over Thames Water executive bonuses. We've analyzed financial performance, environmental impact, regulatory compliance, and industry benchmarks. The justification for these bonuses remains highly contested, raising important questions about corporate governance and accountability within the water sector. The public deserves transparency and a clear link between performance and compensation.

Call to Action: Continue the conversation: Share your thoughts on whether you believe Thames Water executive bonuses are justified, and what criteria should be used to evaluate their fairness. Use #ThamesWaterBonuses to join the discussion. Let's ensure responsible corporate governance and transparency in the water industry. We need to hold water companies accountable for their actions and ensure fair compensation practices.

Featured Posts

-

Pre Q2 Apple Stock A Look At Current Market Conditions

May 24, 2025

Pre Q2 Apple Stock A Look At Current Market Conditions

May 24, 2025 -

Todays Good News Dylan Dreyer And Brian Ficheras Family Celebrates

May 24, 2025

Todays Good News Dylan Dreyer And Brian Ficheras Family Celebrates

May 24, 2025 -

La Censure Chinoise Atteint La France Le Cas Des Dissidents

May 24, 2025

La Censure Chinoise Atteint La France Le Cas Des Dissidents

May 24, 2025 -

Finding Your Dream Home Escape To The Country For Under 1m

May 24, 2025

Finding Your Dream Home Escape To The Country For Under 1m

May 24, 2025 -

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Terrapins Softball Edges Delaware In Thrilling 5 4 Contest

May 24, 2025

Latest Posts

-

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025 -

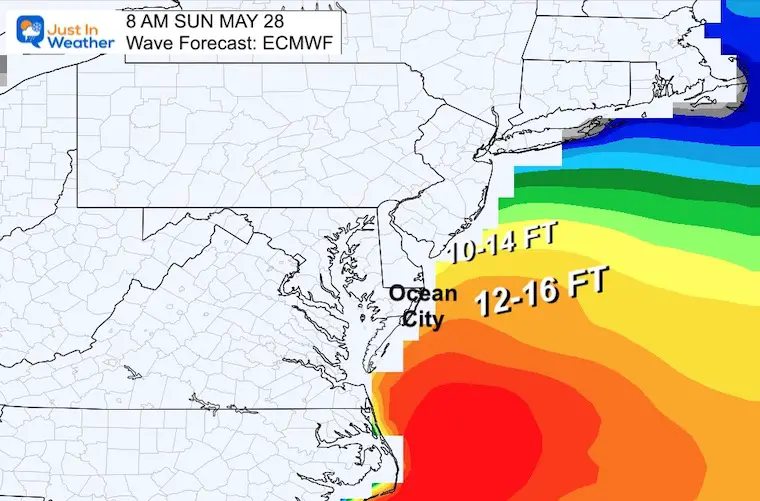

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025 -

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025