Japan Trading Houses See Share Price Increase Following Berkshire Investment

Table of Contents

Berkshire Hathaway's Investment Strategy in Japan

The Significance of Long-Term Holdings

Berkshire Hathaway's investment strategy is renowned for its focus on long-term holdings. This approach, a hallmark of Warren Buffett's philosophy, instills significant confidence in the market. Unlike short-term speculative investments, Berkshire's commitment to long-term growth provides stability and reliability for the Japanese trading houses.

- Stability and Reliability: The long-term commitment signals a vote of confidence, reassuring investors and mitigating the impact of short-term market fluctuations. This is particularly valuable in the current volatile global economic climate.

- Buffett's Reputation: Warren Buffett's impeccable track record as a shrewd investor further enhances the credibility of the investment, attracting additional investors to these Japanese trading companies.

- Future Growth Collaborations: The investment opens doors for potential collaborations and synergies between Berkshire Hathaway and the Japanese trading houses, leading to future growth opportunities and further enhancing their share value.

Target Companies: Mitsui, Mitsubishi, Sumitomo, Itochu, and Marubeni

Berkshire Hathaway's investment targeted five of Japan's largest sogo shosha (general trading companies): Mitsui & Co., Mitsubishi Corporation, Sumitomo Corporation, Itochu Corporation, and Marubeni Corporation. These companies hold significant market positions, operating across a diverse range of industries.

- Mitsui & Co.: A global leader in energy, metals, and machinery, with a strong presence in various sectors.

- Mitsubishi Corporation: Known for its extensive operations in natural resources, industrial materials, and infrastructure development.

- Sumitomo Corporation: A diversified conglomerate with significant holdings in metals, mining, and infrastructure projects worldwide.

- Itochu Corporation: A major player in textiles, machinery, and energy, boasting a substantial global network.

- Marubeni Corporation: A prominent player in food products, energy, and infrastructure projects, with a diverse portfolio of global businesses.

Impact on Share Prices

Immediate Surge Following the Announcement

The announcement of Berkshire Hathaway's investment triggered an immediate and substantial surge in the share prices of the targeted Japanese trading houses.

- Percentage Increases: Each company experienced a double-digit percentage increase in its share price within days of the announcement. Specific figures and dates should be included here, citing reputable financial news sources. For example, "Mitsui & Co. saw a 15% increase on [Date], while Mitsubishi Corporation rose by 12% on [Date]."

- Market Trend Comparison: These increases significantly outperformed broader market trends during the same period, highlighting the specific impact of Berkshire Hathaway's investment.

- Analyst Commentary: Financial analysts widely applauded the move, citing the positive impact on investor sentiment and the long-term potential for growth.

Long-Term Implications for Share Value

The long-term implications of Berkshire Hathaway's investment are significant, potentially leading to sustained share price appreciation.

- Increased Investor Interest: The investment has significantly increased investor interest in Japanese trading houses, attracting both domestic and international capital.

- Future Expansion and Diversification: Berkshire Hathaway's involvement could facilitate future expansion and diversification strategies for these companies, leading to improved profitability and share value.

- Berkshire's Expertise and Network: Access to Berkshire Hathaway's extensive network and expertise in global markets is expected to provide valuable strategic advantages.

Reasons Behind the Investment

Attractiveness of Japanese Trading Houses

Berkshire Hathaway's investment in these Japanese trading houses stems from their inherent attractiveness as long-term investments.

- Stable Earnings: These companies have demonstrated a consistent track record of stable earnings, even during periods of economic uncertainty.

- Global Reach and Diversification: Their extensive global networks and diverse portfolios mitigate risk and provide resilience in fluctuating market conditions.

- Undervalued Assets and Long-Term Growth Potential: Many analysts believe these companies were undervalued before Berkshire Hathaway's investment, presenting an attractive opportunity for long-term growth in the Japanese and global markets.

Global Economic Context

The investment also reflects broader geopolitical and economic factors.

- Increased US-Japan Trade: The investment could signal an increase in trade and collaboration between the US and Japan.

- Growing Importance of Asia: The move highlights the growing significance of the Asian market in the global economy.

- Global Supply Chain Shifts: The investment could reflect a strategic move to secure access to reliable and diverse global supply chains.

Conclusion

Berkshire Hathaway's investment in major Japanese trading houses has significantly boosted their share prices, demonstrating the attractiveness and potential of these companies for long-term investment. The investment highlights a shift in global investment strategies towards stable, well-established companies with a long history of success. These Japanese trading houses, with their diversified portfolios and global reach, represent compelling investment opportunities.

Call to Action: Stay informed about the evolving landscape of Japanese trading houses and their global impact. Learn more about investment opportunities in this dynamic sector by researching individual companies like Mitsui, Mitsubishi, Sumitomo, Itochu, and Marubeni, and follow the developments in the Japanese stock market following this significant investment by Berkshire Hathaway. Consider exploring investment options in Japan trading houses for potentially lucrative returns. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025 -

Lotto 6aus49 Vom 9 April 2025 Ziehungsergebnis And Gewinnzahlen

May 08, 2025

Lotto 6aus49 Vom 9 April 2025 Ziehungsergebnis And Gewinnzahlen

May 08, 2025 -

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025 -

Psl 2024 Tickets Sale Starts Today

May 08, 2025

Psl 2024 Tickets Sale Starts Today

May 08, 2025 -

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025

Latest Posts

-

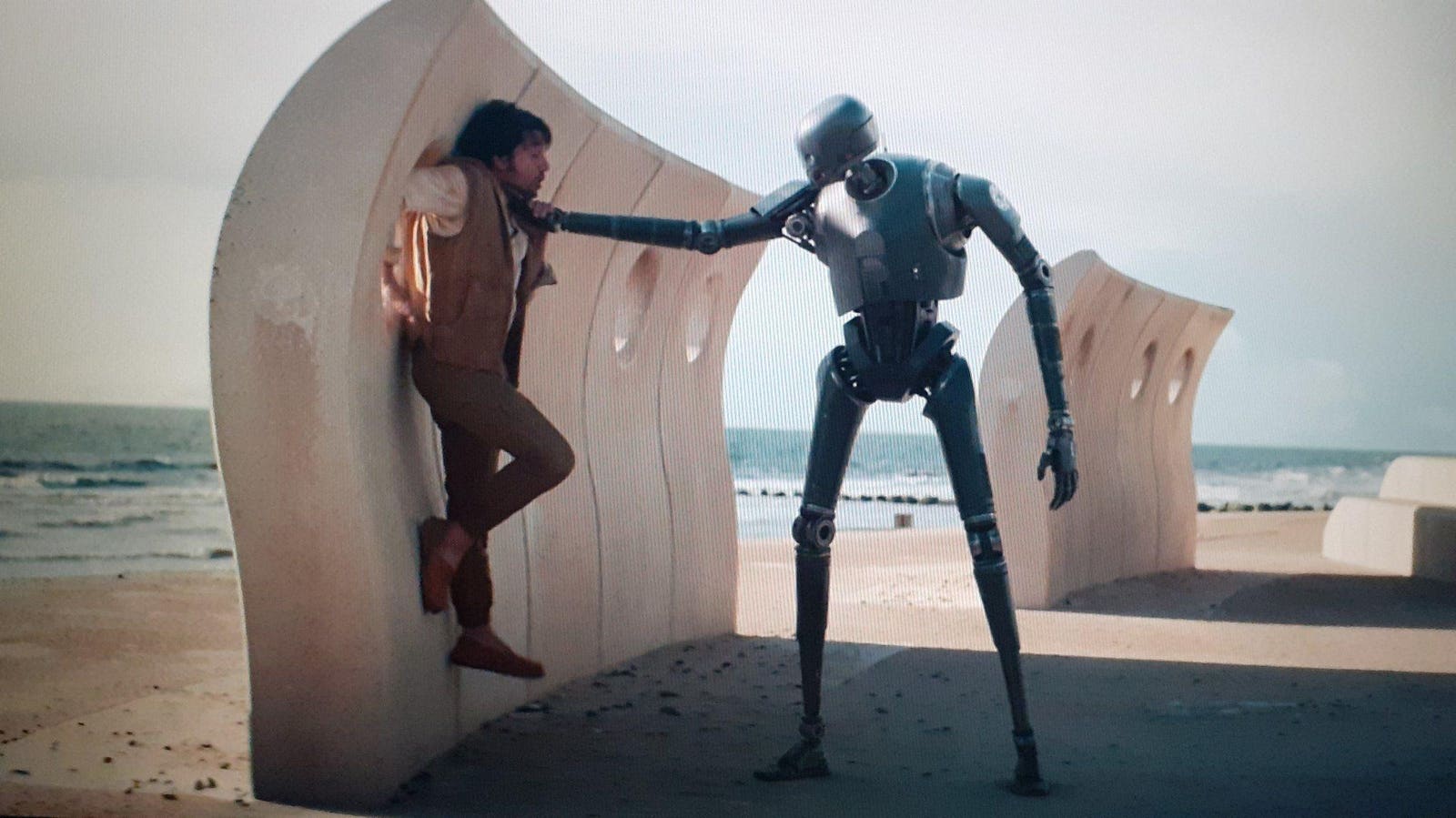

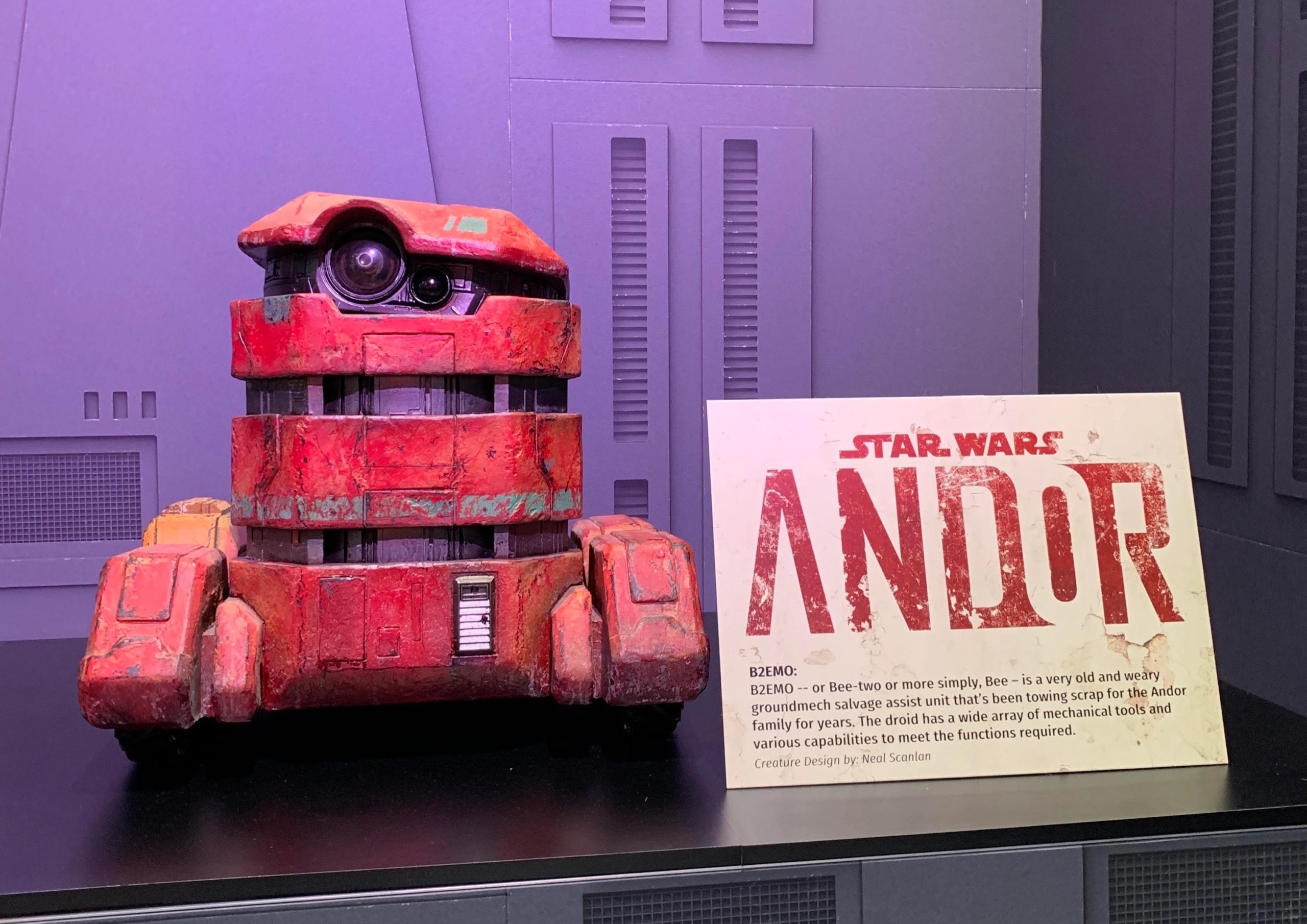

Andor Season 2 The Trailers Absence Sparks Intense Fan Debate

May 08, 2025

Andor Season 2 The Trailers Absence Sparks Intense Fan Debate

May 08, 2025 -

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unscheduled

May 08, 2025

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unscheduled

May 08, 2025 -

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025 -

Andor First Look Everything Fans Have Been Waiting For

May 08, 2025

Andor First Look Everything Fans Have Been Waiting For

May 08, 2025