MicroStrategy Stock Vs. Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, known for its business intelligence software, has made a bold move by accumulating a substantial amount of Bitcoin as a corporate treasury asset. This strategy, spearheaded by CEO Michael Saylor, positions the company as a significant player in the cryptocurrency market. Their business model now involves two distinct revenue streams: software sales and the value appreciation of their Bitcoin holdings. This dual focus presents both opportunities and risks for investors.

Risks of Investing in MicroStrategy Stock

Investing in MicroStrategy stock inherently ties your investment to the volatile nature of Bitcoin. A downturn in Bitcoin's price directly impacts MicroStrategy's stock valuation, as a significant portion of its assets are tied to the cryptocurrency's performance. Furthermore, the company’s core business, the software division, faces its own set of challenges and risks, independent of Bitcoin's performance.

- Dependence on Bitcoin price for stock appreciation: MicroStrategy's stock price is heavily correlated with Bitcoin's price movements. A Bitcoin price drop significantly impacts the company's market capitalization.

- Potential for dilution through future Bitcoin purchases: Further Bitcoin acquisitions by MicroStrategy could lead to share dilution, potentially reducing the value of existing shares.

- Risk of regulatory changes affecting Bitcoin adoption: Negative regulatory developments impacting Bitcoin's adoption and usage could severely impact MicroStrategy's Bitcoin holdings and, consequently, its stock price.

Potential Rewards of Investing in MicroStrategy Stock

Despite the inherent risks, investing in MicroStrategy stock offers potential rewards. If Bitcoin's price appreciates significantly, MicroStrategy's stock price is likely to follow suit. Furthermore, the company's core business in business intelligence could experience growth independent of Bitcoin's price fluctuations.

- Exposure to Bitcoin without directly owning it: Investing in MicroStrategy stock provides indirect exposure to Bitcoin without the complexities of managing a cryptocurrency portfolio.

- Potential for dividends (if declared): While not guaranteed, MicroStrategy could potentially declare dividends in the future, providing additional returns to shareholders.

- Growth potential tied to both Bitcoin and MicroStrategy's business performance: The company's success hinges on both its software business and the performance of its Bitcoin holdings, offering a diversified, albeit risky, investment opportunity.

Direct Bitcoin Investment: Pros and Cons

Investing directly in Bitcoin offers a different set of considerations. This approach allows for more direct exposure to Bitcoin's price movements but also introduces additional risks.

Benefits of Direct Bitcoin Investment

Direct Bitcoin ownership offers the potential for significant returns should the price of Bitcoin appreciate substantially. The decentralized nature of Bitcoin also eliminates the reliance on a single company's performance.

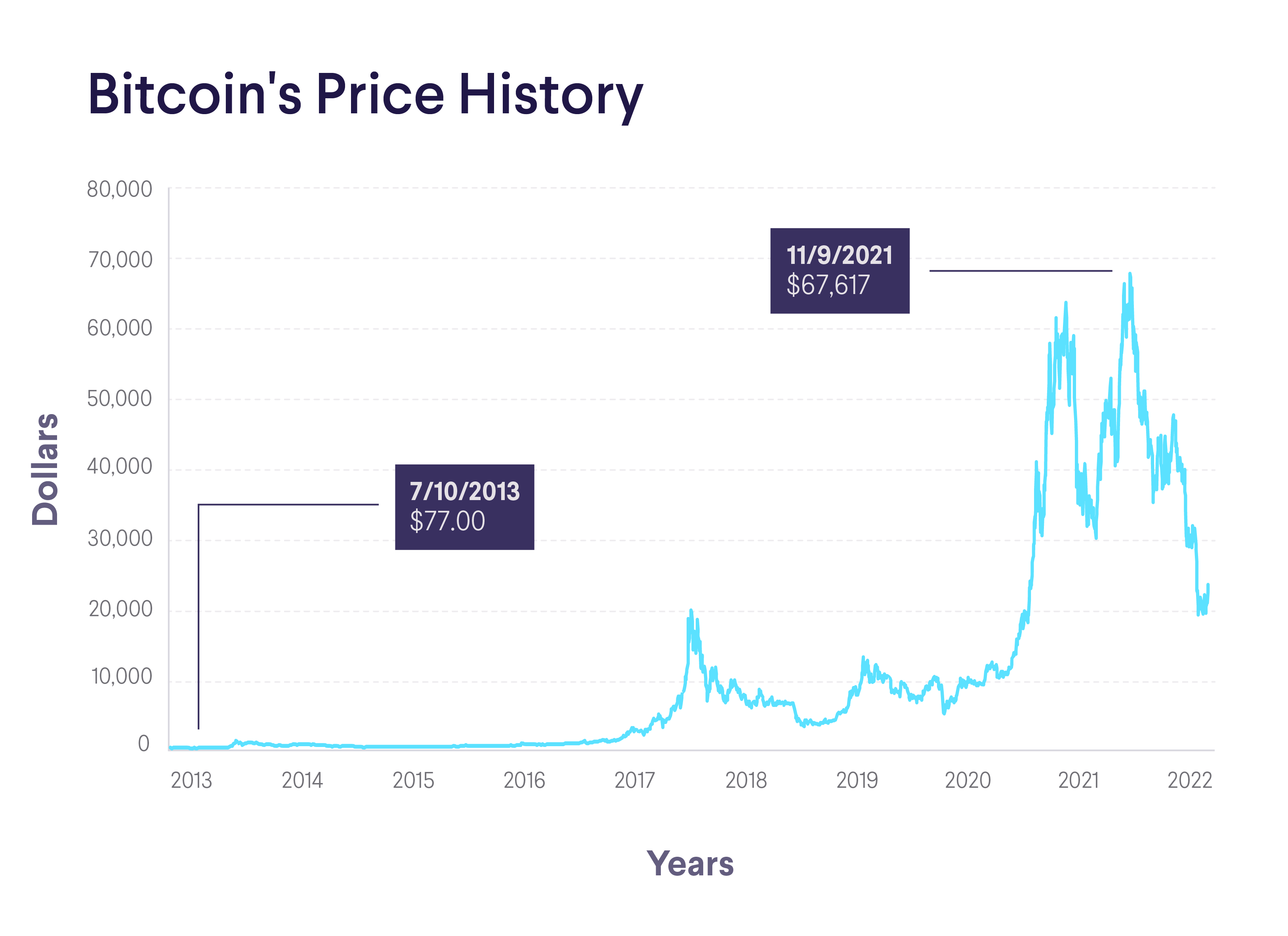

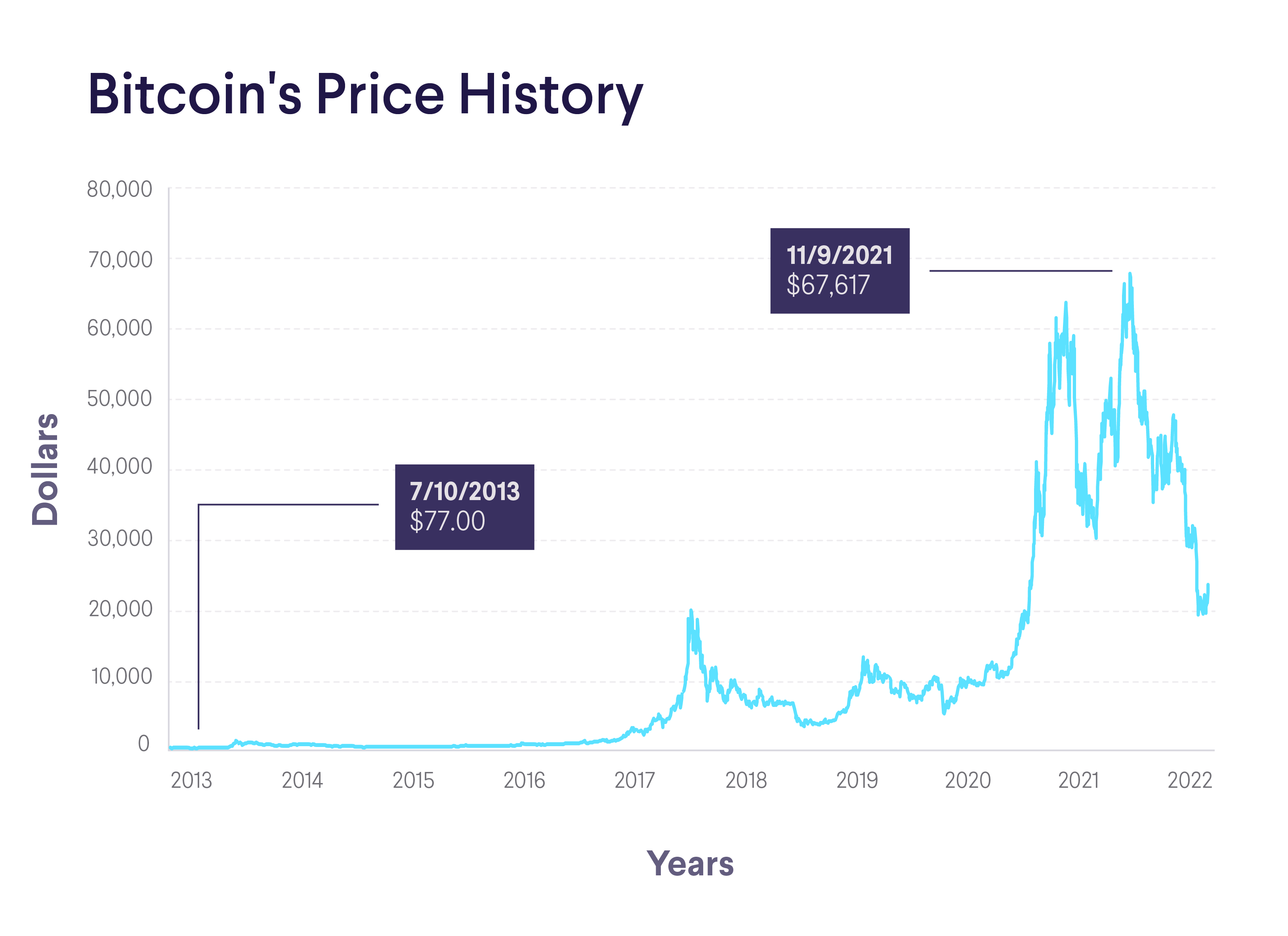

- Higher potential for significant returns: Bitcoin's history shows periods of dramatic price increases.

- Greater control over your investment: You are directly in control of your Bitcoin holdings.

- Potential for long-term growth: Many believe Bitcoin has long-term growth potential as a store of value and medium of exchange.

Risks of Direct Bitcoin Investment

Investing directly in Bitcoin comes with considerable risk. Bitcoin's price volatility is legendary, and significant losses are possible. Furthermore, self-custody of Bitcoin introduces security risks.

- High risk of significant losses: Bitcoin's price is highly volatile and subject to dramatic fluctuations.

- Security risks associated with self-custody: Losing your private keys means losing your Bitcoin.

- Regulatory uncertainty and potential for bans: Government regulations surrounding cryptocurrencies remain uncertain, and bans or restrictions are possible.

Comparative Analysis: MicroStrategy Stock vs. Bitcoin in 2025

| Feature | MicroStrategy Stock | Direct Bitcoin Investment |

|---|---|---|

| Risk Tolerance | Moderate to High | High |

| Potential Return | Moderate to High (dependent on Bitcoin) | Very High (but also very high risk) |

| Liquidity | Relatively High (publicly traded) | Moderate to Low (depending on exchange) |

| Management | Managed by MicroStrategy | Self-managed |

| Regulatory Risk | Subject to regulatory changes | Subject to regulatory changes |

The liquidity of MicroStrategy stock is significantly higher than that of Bitcoin. Selling MicroStrategy shares is easier and faster than selling Bitcoin, especially in large quantities. However, the long-term potential of both investments depends heavily on future market trends and the continued adoption of Bitcoin.

Conclusion

Investing in either MicroStrategy stock or Bitcoin in 2025 presents both significant opportunities and substantial risks. MicroStrategy stock offers indirect exposure to Bitcoin while also relying on the performance of its core business. Direct Bitcoin investment carries higher risk but potentially higher rewards. Both options are highly volatile. Investment decisions should be carefully considered and based on individual risk tolerance and financial goals.

Call to Action: Carefully weigh the factors discussed in this comparison before making your investment decision regarding MicroStrategy stock and Bitcoin. Thorough research and understanding of the risks associated with both MicroStrategy stock and Bitcoin are crucial before investing. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Dodgers Fall To Angels In Battle Of Injured Shortstops

May 08, 2025

Dodgers Fall To Angels In Battle Of Injured Shortstops

May 08, 2025 -

Andor Season 2 Diego Lunas Promise Of A Game Changing Star Wars Series

May 08, 2025

Andor Season 2 Diego Lunas Promise Of A Game Changing Star Wars Series

May 08, 2025 -

Selling Sunset Star Condemns Landlord Price Gouging Amidst La Fires

May 08, 2025

Selling Sunset Star Condemns Landlord Price Gouging Amidst La Fires

May 08, 2025 -

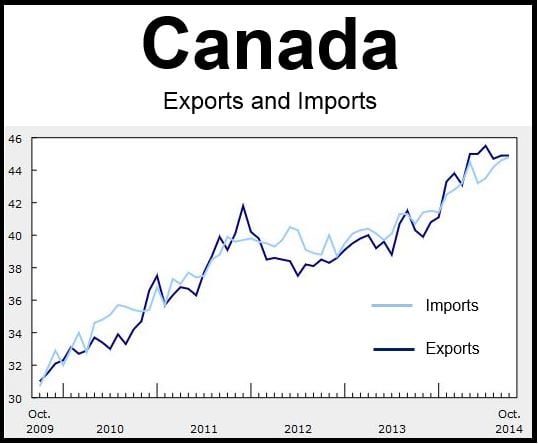

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025

506 Million Canadas Narrowed Trade Deficit And The Role Of Tariffs

May 08, 2025 -

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Latest Posts

-

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025 -

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025 -

Kripto Varliklarinizi Ailenize Nasil Emanet Edersiniz

May 08, 2025

Kripto Varliklarinizi Ailenize Nasil Emanet Edersiniz

May 08, 2025 -

Saturday Night Live The Catalyst For Counting Crows Rise

May 08, 2025

Saturday Night Live The Catalyst For Counting Crows Rise

May 08, 2025 -

Miras Birakanlar Icin Kripto Varlik Guevenligi Rehberi

May 08, 2025

Miras Birakanlar Icin Kripto Varlik Guevenligi Rehberi

May 08, 2025