Ethereum Price Prediction: $2,700 Target As Wyckoff Accumulation Completes

Table of Contents

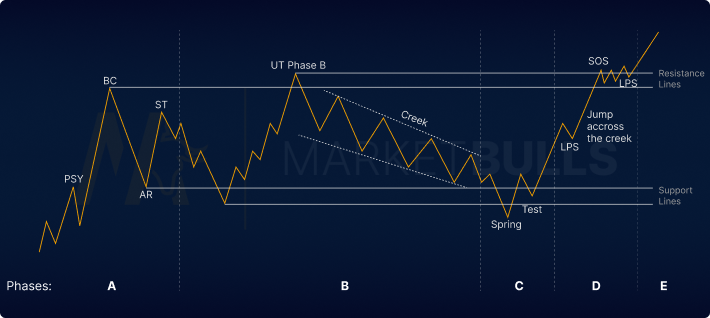

Understanding the Wyckoff Accumulation Pattern

The Wyckoff Accumulation pattern is a technical analysis method used to identify periods of significant buying pressure by large institutional investors before a substantial price increase. It's characterized by a period of sideways price consolidation, often accompanied by decreasing trading volume, suggesting a gradual absorption of available supply. This accumulation phase precedes a strong upward price movement. Understanding this pattern is crucial for making informed Ethereum price predictions.

Key characteristics of a Wyckoff Accumulation include:

- Testing of support levels: The price repeatedly tests and holds support levels, indicating strong buying interest at those price points.

- Increasing volume on up days: As the price rallies, increased trading volume confirms the buying pressure.

- Decreasing volume on down days: Conversely, declining volume during price dips suggests a lack of selling pressure.

- Signs of accumulation by large investors: This often manifests as large buy orders or unusual price movements that are not explained by typical market activity.

[Insert relevant chart showing Wyckoff Accumulation pattern on Ethereum's price chart here]

Further supporting the Wyckoff Accumulation theory on Ethereum are indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), which often show signs of bullish divergence during this phase.

Technical Indicators Supporting the $2,700 Ethereum Price Target

Several technical indicators strengthen the Ethereum price prediction of $2,700. These indicators, when considered together, paint a compelling picture of a potential bullish trend.

Supporting indicators include:

- Moving averages (e.g., 50-day, 200-day) crossing or approaching: A bullish crossover of the 50-day and 200-day moving averages often signals a significant upward trend change.

- Relative Strength Index (RSI) showing oversold conditions: An RSI below 30 often indicates that the asset is oversold, suggesting a potential price reversal.

- Moving Average Convergence Divergence (MACD) showing bullish signals: A bullish crossover of the MACD lines (MACD and signal line) often precedes price increases.

- On-chain metrics (e.g., active addresses, transaction volume) showing increased activity: Higher on-chain activity suggests increased network usage and growing investor interest.

[Insert charts showing these indicators and their relationship to Ethereum's price here]

Potential Roadblocks and Risks to the Ethereum Price Prediction

While the technical analysis suggests a potential price increase towards $2,700, several factors could hinder this prediction. A comprehensive Ethereum price prediction must account for these potential roadblocks.

Potential risks include:

- Overall market sentiment and Bitcoin's price action: Bitcoin's price significantly influences the entire cryptocurrency market, including Ethereum. A bearish Bitcoin trend could negatively impact Ethereum's price.

- Regulatory uncertainty and its impact on cryptocurrency markets: Changes in cryptocurrency regulations can significantly impact investor confidence and price movements.

- Unexpected negative news or events impacting the Ethereum network: Security breaches, significant bugs, or other negative news could lead to a price drop.

- Competition from other Layer-1 blockchain solutions: The emergence of competing blockchain platforms could divert investor interest away from Ethereum.

Effective risk management strategies for investors include diversification, setting stop-loss orders, and conducting thorough due diligence before making investment decisions.

Ethereum's Long-Term Potential Beyond $2,700

Beyond the $2,700 target, Ethereum’s long-term potential is substantial. Several factors could contribute to significant price growth in the years to come.

- Ethereum 2.0: The successful implementation of Ethereum 2.0, with its transition to a proof-of-stake consensus mechanism, is expected to significantly improve scalability, security, and energy efficiency, boosting investor confidence.

- DeFi and NFTs: The continued growth of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) on the Ethereum network will drive demand for ETH, further pushing the price upwards.

Conclusion

This Ethereum price prediction suggests a bullish outlook for ETH, with a potential target of $2,700 based on the observed Wyckoff Accumulation pattern and supporting technical indicators. However, several potential risks and roadblocks must be considered. Remember that this is a prediction, not financial advice. Conduct thorough research, consider your risk tolerance, and stay updated on the latest market developments before making any investment decisions. Learn more about refining your Ethereum price prediction strategy and the Wyckoff method [link to relevant resource]. Remember, responsible investing is key when considering any cryptocurrency price prediction, including those for Ethereum.

Featured Posts

-

Mike Trouts Absence Impacts Angels Fifth Straight Loss

May 08, 2025

Mike Trouts Absence Impacts Angels Fifth Straight Loss

May 08, 2025 -

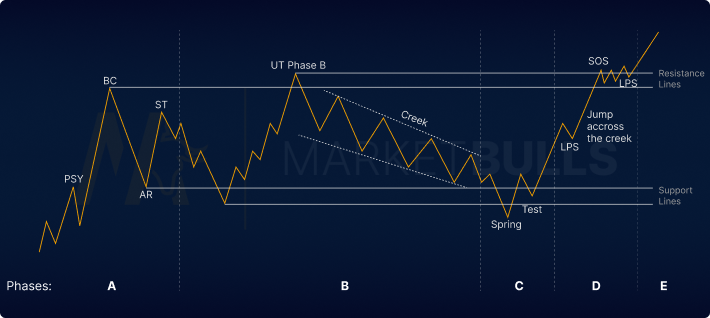

Ps Plus March 2024 Games Premium And Extra Titles Announced

May 08, 2025

Ps Plus March 2024 Games Premium And Extra Titles Announced

May 08, 2025 -

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025 -

Is The Recent Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Is The Recent Bitcoin Rebound A Sign Of Things To Come

May 08, 2025 -

Minecraft Superman 5 Minute Preview Leaked By Thailand Theater

May 08, 2025

Minecraft Superman 5 Minute Preview Leaked By Thailand Theater

May 08, 2025

Latest Posts

-

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Possible Parabolic Move In Xrp

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025