Is This Cryptocurrency Immune To Trade War Effects?

Table of Contents

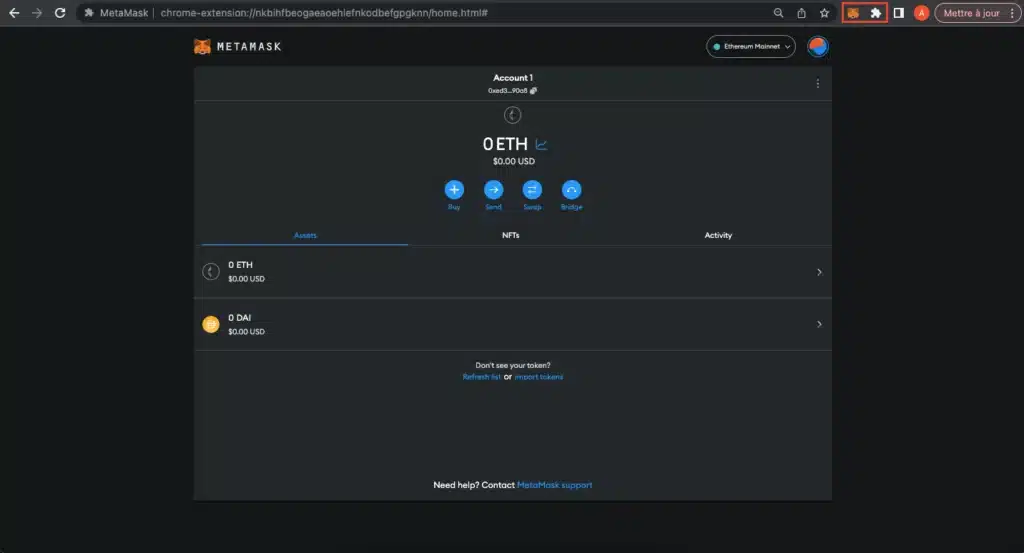

Cryptocurrency's Decentralized Nature and Trade War Resilience

Cryptocurrencies, by their very nature, possess characteristics that offer a degree of resilience against the negative impacts of trade wars. This inherent resilience stems primarily from their decentralized architecture and global accessibility.

Reduced Dependence on Geopolitical Factors

One of the key advantages of cryptocurrencies lies in their reduced dependence on geopolitical factors. Unlike traditional financial instruments heavily influenced by national policies and international relations, cryptocurrencies operate on a decentralized network, largely independent of governmental control.

- Transactions are processed on a decentralized network, bypassing centralized authorities susceptible to geopolitical pressures. This means that trade tariffs, sanctions, or other restrictive measures imposed during trade wars have a significantly diminished impact on cryptocurrency transactions.

- The lack of a central bank or government control makes them less vulnerable to national economic policies. This independence contrasts sharply with traditional assets, whose value can be directly influenced by government decisions.

- This inherent decentralization acts as a buffer against many of the negative consequences of trade conflicts, offering a potential safe haven for investors seeking to protect their assets from geopolitical instability.

Global Accessibility and Liquidity

The global nature of cryptocurrency markets is another factor contributing to their resilience. Unlike traditional markets restricted by geographical boundaries and national regulations, cryptocurrency markets operate 24/7, providing continuous trading opportunities irrespective of geopolitical tensions.

- Trading isn't restricted by national borders, providing alternative avenues for investment and exchange, even during periods of heightened trade conflict. This facilitates smoother transactions and prevents artificial scarcity driven by national trade barriers.

- Increased liquidity during times of geopolitical uncertainty can potentially mitigate losses. While price volatility might exist, the ability to quickly buy or sell cryptocurrencies can help minimize potential losses.

- However, overall market sentiment can still affect pricing, regardless of decentralization. Fear, uncertainty, and doubt (FUD) surrounding global economic conditions can still influence the cryptocurrency market.

Potential Vulnerabilities of Cryptocurrency to Trade War Impacts

Despite their inherent decentralization, cryptocurrencies are not completely immune to the impacts of trade wars. Several factors can still negatively affect their value and usage.

Regulatory Uncertainty and Governmental Responses

While cryptocurrencies operate on a decentralized network, they are not beyond the reach of government regulation. Governments worldwide are increasingly implementing regulations that impact the trading and usage of cryptocurrencies within their jurisdictions.

- Changes in tax policies or regulations related to cryptocurrency exchanges can significantly affect market value. Sudden changes can trigger market uncertainty and lead to price corrections.

- Increased scrutiny and stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) measures could limit accessibility. Stringent regulations can make it harder for individuals to participate in the cryptocurrency market.

- Governments might respond to trade wars by tightening crypto regulations to control capital flows. This can be a direct response to protect their national interests or to counter the potential use of cryptocurrencies to bypass trade restrictions.

Impact on Global Economic Sentiment and Market Volatility

Negative global economic sentiment stemming from trade wars significantly impacts cryptocurrency markets, despite their decentralized nature. Investor confidence plays a crucial role in the valuation of cryptocurrencies, and periods of economic uncertainty can lead to considerable volatility.

- Risk-off sentiment can drive investors to move away from volatile assets like cryptocurrencies into safer havens such as gold or government bonds. This capital flight can put downward pressure on cryptocurrency prices.

- Market volatility can increase substantially, leading to significant price fluctuations. During times of heightened trade tensions, the cryptocurrency market can experience amplified price swings.

- The overall health of the global economy directly influences investor confidence and cryptocurrency valuation. A weakening global economy, often associated with trade wars, can negatively impact the perception of riskier assets like cryptocurrencies.

Specific Cryptocurrencies and Their Resilience

It's crucial to remember that not all cryptocurrencies are created equal in terms of their resilience to trade war effects. Their susceptibility depends on various factors, including technology, market capitalization, and community support.

Comparing Different Cryptocurrencies

The diverse nature of cryptocurrencies dictates their varying degrees of resilience. Stablecoins, for example, tend to be less susceptible to major price swings than other more volatile cryptocurrencies.

- Stablecoins, pegged to fiat currencies, tend to be less volatile than other cryptocurrencies. Their value is directly tied to a stable asset, mitigating the impact of market fluctuations.

- Larger-market-cap cryptocurrencies might experience less drastic price swings compared to smaller ones. Larger market caps often imply greater liquidity and established communities, making them less prone to extreme price volatility.

- The specific use case of a cryptocurrency and its adoption rate also affect its susceptibility to broader economic forces. Cryptocurrencies with clear use cases and widespread adoption may demonstrate greater resilience.

Conclusion

While the decentralized nature of cryptocurrencies offers a degree of protection against the direct impacts of trade wars, they are not entirely immune. Regulatory uncertainty, global economic sentiment, and the specific characteristics of individual cryptocurrencies all play a significant role in determining their resilience. Understanding these factors is crucial for making informed investment decisions. Therefore, carefully consider the potential vulnerabilities and benefits before investing in any cryptocurrency, keeping in mind the complexities of the relationship between cryptocurrency and global trade dynamics. Conduct thorough research to determine whether this cryptocurrency is a suitable addition to your portfolio, taking into account the current geopolitical climate and associated risks.

Featured Posts

-

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025 -

Review Microsofts 12 Inch Surface Pro At 799

May 08, 2025

Review Microsofts 12 Inch Surface Pro At 799

May 08, 2025 -

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025

Reviewing The Best Krypto Stories A Comprehensive Guide

May 08, 2025 -

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Latest Posts

-

Aprel 2025 V Permi I Permskom Krae Neblagopriyatniy Prognoz Pogody Pokholodanie I Sneg

May 09, 2025

Aprel 2025 V Permi I Permskom Krae Neblagopriyatniy Prognoz Pogody Pokholodanie I Sneg

May 09, 2025 -

Sta Xamilotera Epipeda 23 Eton I Krisimi Meiosi Ton Xionion Sta Imalaia

May 09, 2025

Sta Xamilotera Epipeda 23 Eton I Krisimi Meiosi Ton Xionion Sta Imalaia

May 09, 2025 -

Prognoz Pogody Na Konets Aprelya 2025 Pokholodanie I Snegopady V Permi I Permskom Krae

May 09, 2025

Prognoz Pogody Na Konets Aprelya 2025 Pokholodanie I Snegopady V Permi I Permskom Krae

May 09, 2025 -

Sor Norge Vinter Guide Til Trygge Fjellturer I Snorike Omrader

May 09, 2025

Sor Norge Vinter Guide Til Trygge Fjellturer I Snorike Omrader

May 09, 2025 -

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025