Cryptocurrency Investment: Weathering The Trade War Storm

How Trade Wars Affect Cryptocurrency Markets

Trade wars create a ripple effect across global finance, and the cryptocurrency investment landscape is no exception. The uncertainty and volatility they generate significantly impact crypto markets in several ways.

Increased Volatility

Trade wars often lead to increased market uncertainty, which directly translates to higher volatility in cryptocurrency prices. Investors react to negative news by selling off assets, driving prices down. This "risk-off" sentiment affects even seemingly unrelated markets like cryptocurrencies.

- Trade wars often increase inflation, making investors look for alternative stores of value; however, the volatility of cryptocurrencies can counteract this.

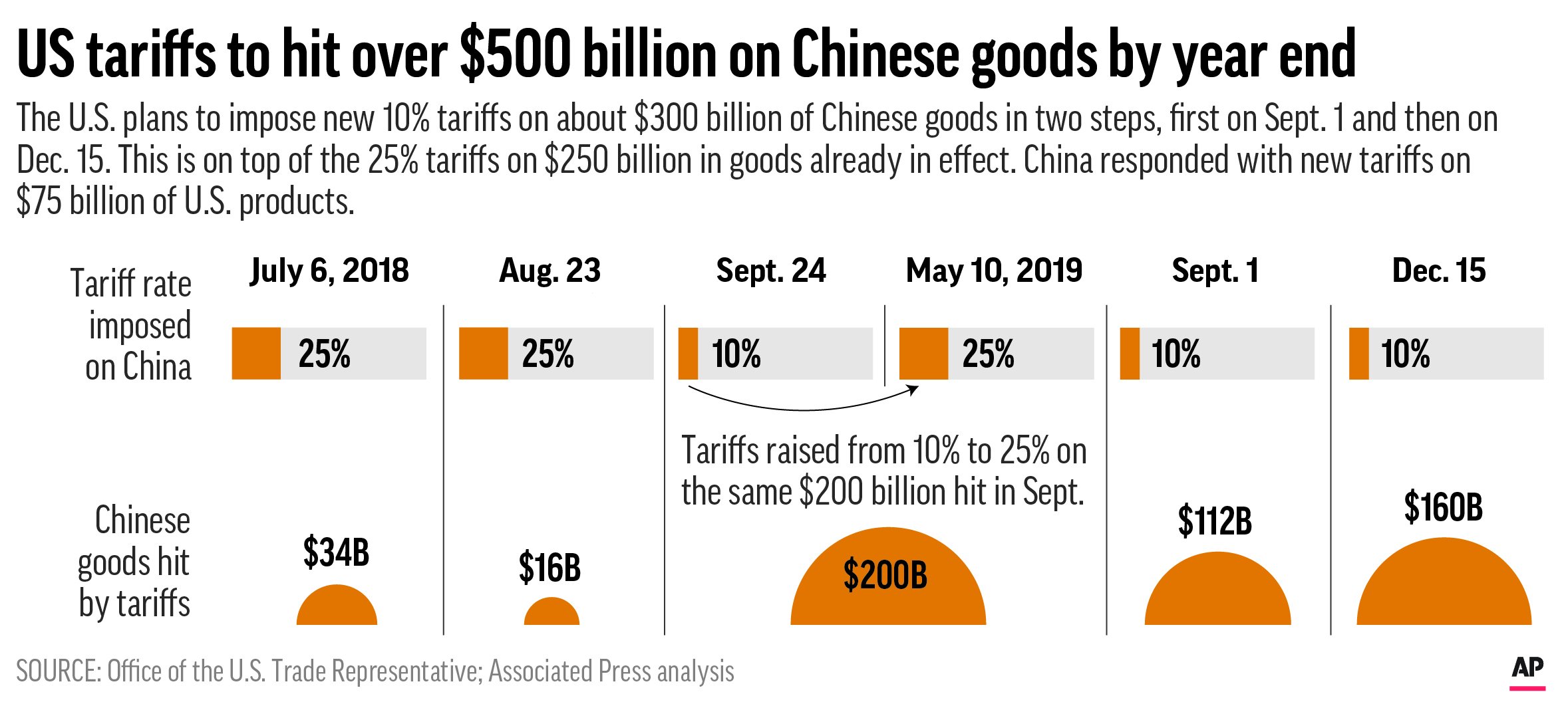

- The US-China trade war, for example, saw significant price swings in Bitcoin and other major cryptocurrencies, demonstrating the direct correlation between geopolitical tensions and crypto market volatility.

- Sudden shifts in government policies regarding international trade can cause rapid and unpredictable cryptocurrency price fluctuations.

Safe-Haven Status Debate

Some argue that cryptocurrencies can act as a safe haven during trade wars, offering diversification away from traditional assets. The idea is that during times of economic uncertainty, investors seek refuge in assets perceived as less vulnerable to geopolitical risks. However, this "safe haven" status for crypto is debatable.

- Cryptocurrencies are themselves highly volatile and can be negatively impacted by overall global economic uncertainty. Their price movements often mirror, or even exceed, those of traditional markets during times of stress.

- Factors impacting the potential cryptocurrency safe haven status include:

- Regulatory clarity: Clear and consistent regulations inspire confidence.

- Market maturity: A more mature market is less susceptible to panic selling.

- Overall global economic sentiment: Even if crypto is technically a safe haven, negative global sentiment will likely still impact it.

Regulatory Uncertainty

Trade wars can lead to increased regulatory scrutiny of cryptocurrencies, impacting investor confidence and market stability. Governments, facing economic pressure, may tighten regulations in an attempt to control capital flows or increase tax revenue.

- Increased cryptocurrency regulation can create uncertainty for investors, leading to decreased trading activity and price volatility.

- Examples include increased KYC/AML (Know Your Customer/Anti-Money Laundering) regulations, which, while important for security, can also stifle innovation and adoption.

- The unpredictability surrounding government oversight of crypto during times of trade conflict adds another layer of risk for investors.

Strategies for Navigating Trade War Risks in Cryptocurrency Investment

While trade wars present challenges, informed investors can mitigate risks by adopting effective strategies.

Diversification

Don't put all your eggs in one basket. Diversify your cryptocurrency portfolio across different assets to reduce risk. This is a fundamental principle of successful investing, and it's especially crucial during periods of geopolitical uncertainty.

- Consider investing in both established cryptocurrencies like Bitcoin and Ethereum, and emerging projects with promising fundamentals.

- Allocate funds based on your risk tolerance and investment goals. A well-balanced portfolio can cushion the impact of losses in any single asset.

- Proper crypto portfolio diversification is key to effective cryptocurrency asset allocation and overall risk management in crypto.

Fundamental Analysis

Thoroughly research the underlying technology and use cases of different cryptocurrencies before investing. Avoid making investment decisions solely based on hype or short-term price movements.

- Focus on projects with strong fundamentals, a clear roadmap, and a credible team. This approach minimizes the impact of market fluctuations based purely on speculation.

- Conduct thorough cryptocurrency fundamental analysis and crypto due diligence before committing funds.

- Effective crypto project research helps in identifying projects with long-term potential, reducing the risk of losses during market corrections.

Risk Management

Implement risk mitigation strategies to protect your investments. This is crucial when dealing with the volatile nature of cryptocurrencies, especially during times of global uncertainty.

- Implement stop-loss orders to limit potential losses. These orders automatically sell your crypto assets when the price falls below a predetermined level.

- Only invest what you can afford to lose. This is a core principle of responsible investing, especially in the volatile cryptocurrency investment market.

- Stay informed about global events and their potential impact on cryptocurrency markets. Keeping up-to-date with news and analysis will help you make better informed decisions. Effective crypto risk management requires constant vigilance and adaptability.

Conclusion

The impact of trade wars on cryptocurrency investment is multifaceted and complex. While offering potential opportunities, they also introduce significant risks, particularly increased volatility and regulatory uncertainty. By employing strategies like diversification, fundamental analysis, and robust risk management, investors can better navigate this challenging environment and potentially weather the storm. Don't let trade war anxieties deter you completely from exploring the potential of cryptocurrency investment, but remember to approach it with caution and a well-defined strategy. Learn more about mitigating risks and making informed cryptocurrency investment decisions today!

The Zuckerberg Trump Dynamic Implications For Technology And Politics

The Zuckerberg Trump Dynamic Implications For Technology And Politics

David Dodge Raising Productivity Must Be Carneys Top Priority

David Dodge Raising Productivity Must Be Carneys Top Priority

Lower Interest Rates In China A Response To Trade Tensions And Tariffs

Lower Interest Rates In China A Response To Trade Tensions And Tariffs

Neymar Vs Messi Brasil Convoca A Neymar Para El Partido En El Monumental

Neymar Vs Messi Brasil Convoca A Neymar Para El Partido En El Monumental

The Importance Of Trustworthy Crypto News Sources

The Importance Of Trustworthy Crypto News Sources