XRP ETF In Brazil: Ripple News And Trump's Social Media Activity

Table of Contents

The Potential of an XRP ETF in Brazil

The prospect of an XRP ETF in Brazil is a significant development for the cryptocurrency market, particularly for XRP. This section will explore the regulatory landscape in Brazil and the potential impact on XRP's price and market sentiment.

Regulatory Landscape in Brazil

Brazil has taken a relatively progressive stance on cryptocurrencies compared to many other countries. This forward-thinking approach could pave the way for the successful launch of an XRP ETF. The potential benefits for investors are considerable, including increased liquidity, improved accessibility, and a significant boost to mainstream adoption of XRP within Brazil. This contrasts sharply with the more cautious, and sometimes restrictive, regulatory environments seen in countries like the US and Canada, where the approval process for crypto ETFs has been significantly slower and more complex.

- Specific Brazilian Regulatory Bodies: The Comissão de Valores Mobiliários (CVM), Brazil's securities commission, will play a crucial role in determining the viability and approval of any XRP ETF. Understanding their regulatory framework and processes is key.

- Challenges and Hurdles: Potential challenges could include navigating specific compliance requirements, demonstrating sufficient investor protection measures, and addressing concerns about market manipulation.

- Successful ETF Launches in Brazil: Analyzing previous successful ETF launches in Brazil, particularly those involving other digital assets, can provide valuable insights into the potential timeline and hurdles for an XRP ETF.

Impact on XRP Price and Market Sentiment

The approval of an XRP ETF in Brazil could significantly impact XRP's price and overall market sentiment.

-

Price Increase: Increased demand resulting from ETF listing is likely to drive up XRP's price.

-

Trading Volume and Market Capitalization: An ETF listing will undoubtedly increase trading volume and boost XRP's overall market capitalization.

-

Institutional Investors: ETFs often attract significant investment from institutional investors, potentially leading to a more stable and mature market for XRP.

-

Technical Analysis Predictions: Technical analysts will undoubtedly provide forecasts based on various indicators.

-

Analyst Opinions and Forecasts: Leading financial analysts' views on the potential price impact will be closely monitored.

-

Historical Data: Examining historical data on ETF launches and their effect on asset prices can provide valuable context.

Ripple's Ongoing Legal Battle with the SEC

Ripple's legal battle with the Securities and Exchange Commission (SEC) casts a long shadow over the potential success of an XRP ETF in Brazil. This section will provide an update on the lawsuit and examine Ripple's efforts to enhance transparency and compliance.

Latest Developments in the SEC Lawsuit

The SEC lawsuit alleges that Ripple sold XRP as an unregistered security. The outcome will significantly influence the appetite for XRP-related investments, including the potential for an ETF in Brazil.

- Timeline of Key Events: Tracking key events in the lawsuit is crucial for understanding its trajectory.

- Key Arguments: Analyzing the core arguments presented by both Ripple and the SEC provides crucial context.

- Potential Settlement Scenarios: Several scenarios could unfold, each having its own unique impact on the Brazilian ETF proposal.

Ripple's Efforts to Improve Transparency and Compliance

Ripple has actively worked to improve transparency and enhance compliance with regulatory requirements.

- Engagement with Regulators: Ripple's efforts to engage constructively with regulators worldwide are vital.

- Compliance Program: Details of Ripple's comprehensive compliance program demonstrate their commitment to addressing regulatory concerns.

- Positive Developments: Any positive developments in Ripple's relationships with various regulatory bodies will positively influence investor confidence.

Trump's Social Media Activity and its Unintended Ripple Effect on Crypto

Donald Trump's social media posts, even those seemingly unrelated to crypto, can impact market sentiment. This section examines this phenomenon and its potential impact on XRP.

Trump's Recent Posts and Their Influence on Market Sentiment

Trump's recent comments, or even the mere mention of cryptocurrencies on his platforms, can cause significant market volatility.

- Specific Examples: Analyzing specific social media posts related to cryptocurrencies or broader financial markets is vital.

- Expert Opinions: Gathering opinions from financial experts on the impact of Trump's posts on investor confidence is insightful.

- Statistical Analysis: Examining statistical correlations (if any) between Trump's posts and XRP price movements can reveal potential connections.

The Power of Social Media in Shaping Public Opinion on Crypto

Social media's power in shaping public opinion on cryptocurrencies cannot be underestimated.

- Influential Figures: Trump's influence is just one example; other prominent figures similarly impact crypto markets.

- Critical Thinking and FOMO: Encouraging critical thinking and cautioning against fear of missing out (FOMO) is paramount.

- Ethical Considerations: Addressing the ethical implications of social media influence on financial markets is crucial.

Conclusion

The potential launch of an XRP ETF in Brazil presents a significant opportunity for investors, but the outcome remains intertwined with the ongoing Ripple-SEC lawsuit and the unpredictable influence of social media personalities like Donald Trump. Understanding the regulatory landscape in Brazil, the legal complexities surrounding Ripple, and the ever-shifting sands of social media influence is crucial for navigating this dynamic market. Stay informed about developments regarding the XRP ETF in Brazil and continue to research the complexities of this exciting, albeit volatile, investment opportunity. Learn more about the latest developments concerning the XRP ETF in Brazil and stay updated on the ever-evolving world of cryptocurrency.

Featured Posts

-

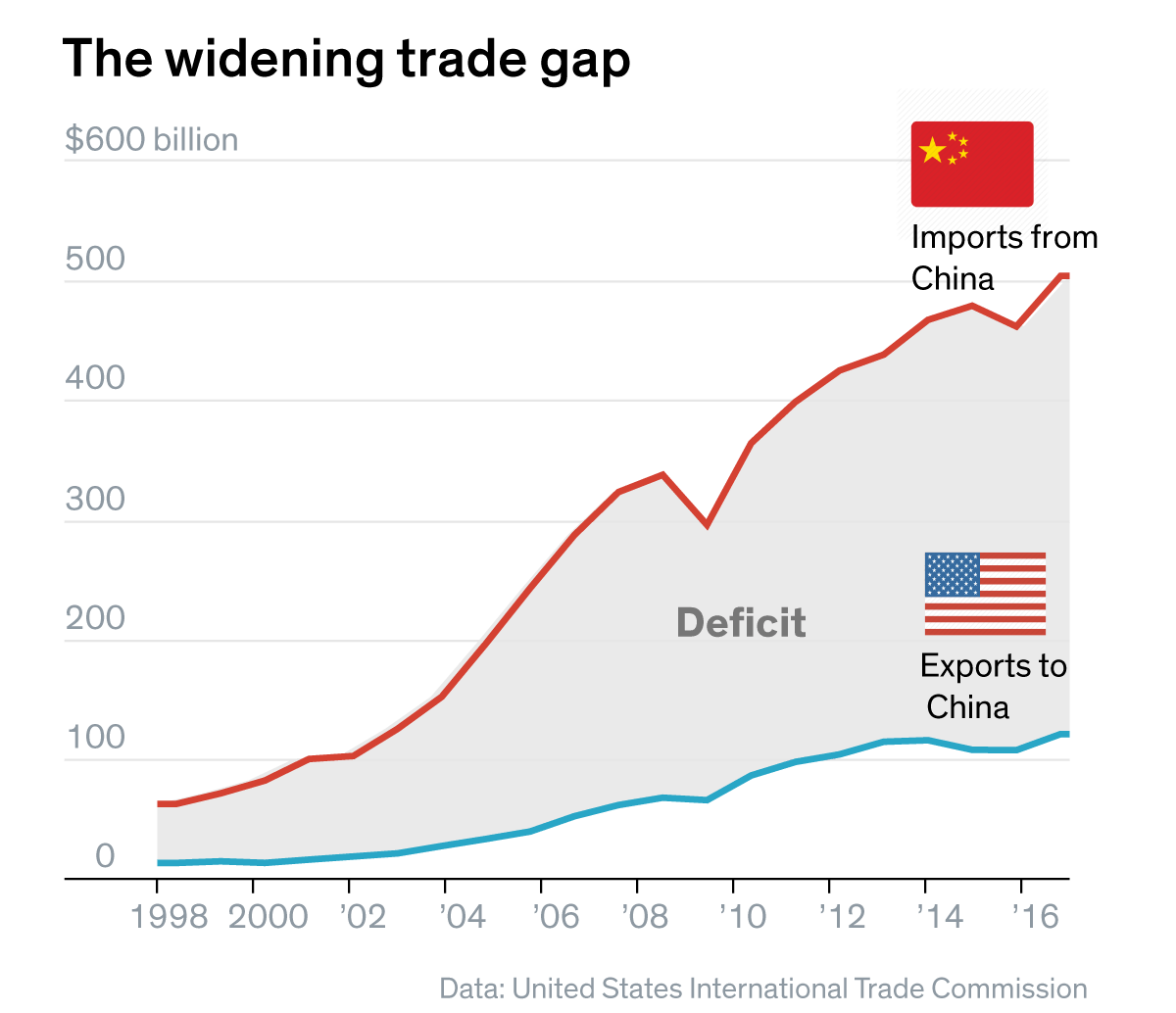

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025

U S And China Trade War What To Expect From The Upcoming Official Meeting

May 08, 2025 -

Daily Planet Set Photo Hints At Unusual Superman Easter Egg James Gunns Tribute To Jimmy Olsen

May 08, 2025

Daily Planet Set Photo Hints At Unusual Superman Easter Egg James Gunns Tribute To Jimmy Olsen

May 08, 2025 -

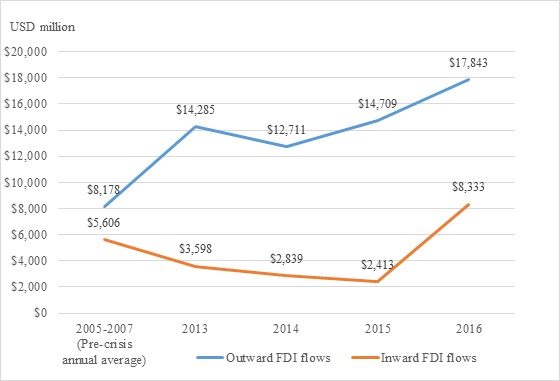

Us Bond Etf Outflows Taiwan Investors Reverse Course

May 08, 2025

Us Bond Etf Outflows Taiwan Investors Reverse Course

May 08, 2025 -

Pakistan Super League 10 Tickets On Sale Now

May 08, 2025

Pakistan Super League 10 Tickets On Sale Now

May 08, 2025 -

Two Day Lahore Weather Forecast For Eid Ul Fitr In Punjab

May 08, 2025

Two Day Lahore Weather Forecast For Eid Ul Fitr In Punjab

May 08, 2025

Latest Posts

-

Hulu And You Tube Catch Up On Andor Season 1 Before Season 2

May 08, 2025

Hulu And You Tube Catch Up On Andor Season 1 Before Season 2

May 08, 2025 -

Andor Season 1 Where To Stream Episodes Before Season 2 Premieres

May 08, 2025

Andor Season 1 Where To Stream Episodes Before Season 2 Premieres

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Is Princess Leia Returning 3 Pieces Of Evidence Pointing To A Cameo

May 08, 2025

Is Princess Leia Returning 3 Pieces Of Evidence Pointing To A Cameo

May 08, 2025 -

Princess Leias Return 3 Reasons To Expect A Cameo In The New Star Wars Series

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The New Star Wars Series

May 08, 2025