Ethereum CrossX Signals Strong Buy: Institutional Accumulation Fuels $4,000 Price Target

Table of Contents

The cryptocurrency market is buzzing with excitement, and Ethereum is at the center of the storm. Powerful CrossX signals are flashing a strong buy recommendation, fueled by significant institutional accumulation, pointing towards a potential $4,000 Ethereum price target. This presents a compelling opportunity for savvy investors to capitalize on this bullish outlook and potentially secure substantial returns. Don't miss out on this crucial window of opportunity; let's delve into the factors driving this exciting price prediction.

H2: Deciphering the CrossX Signals:

H3: Understanding CrossX Indicators:

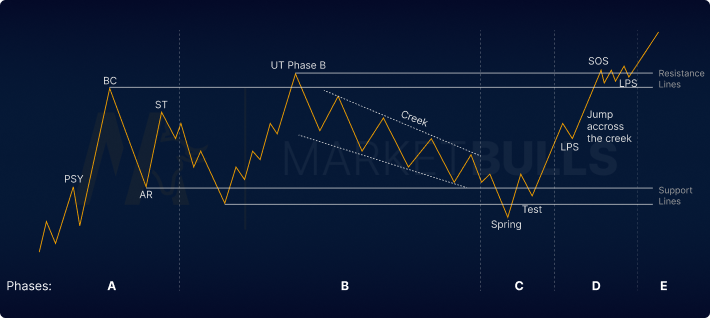

Ethereum CrossX is a sophisticated analytical tool employing a unique blend of on-chain metrics, price action analysis, and volume indicators to predict market trends. Unlike simpler indicators, CrossX considers a multitude of interwoven factors, providing a more comprehensive and nuanced view of the market sentiment and potential price movements. Its signals are widely considered significant due to their accuracy in past predictions and their focus on confirming trends through multiple data points.

- Increased Trading Volume: A surge in trading volume often precedes significant price movements. CrossX detects an unusually high volume of Ethereum transactions, indicating strong buying pressure. (Insert chart showing volume spike here).

- Positive Price Momentum: CrossX algorithms detect a clear upward price trend, supported by consistent higher highs and higher lows. This indicates a sustained bullish sentiment driving the price increase. (Insert chart showing price trend here).

- On-Chain Accumulation: CrossX analyzes on-chain data, such as the number of addresses holding Ethereum and the distribution of holdings. The current data shows a significant increase in accumulation, suggesting long-term investment interest. (Insert chart showing on-chain metrics here).

- Decreased Exchange Supply: A decline in the amount of Ethereum held on cryptocurrency exchanges signifies reduced selling pressure and increased holding by long-term investors, further supporting the bullish outlook. (Insert chart showing exchange supply here).

- Strong RSI Readings: The Relative Strength Index (RSI) calculated by CrossX shows Ethereum is currently in oversold territory, suggesting a potential price reversal and upward movement. (Insert chart showing RSI here).

H3: CrossX Signals Compared to Other Market Analysis:

While other tools, like moving averages or simple RSI, provide valuable insights, CrossX distinguishes itself by combining a broader range of data points and employing advanced algorithms to synthesize the information. This holistic approach reduces the risk of false signals and enhances the accuracy of the price predictions, particularly in the complex and volatile cryptocurrency market.

H2: Institutional Accumulation: A Driving Force Behind the $4,000 Target:

H3: Evidence of Institutional Investment:

The recent surge in Ethereum's price isn't just fueled by retail investors; significant institutional players are actively accumulating ETH.

- Grayscale Investments: Grayscale, a leading digital asset management firm, has consistently increased its Ethereum holdings, reflecting a growing institutional appetite for this leading smart contract platform.

- ETF Filings: Numerous applications for Ethereum-based exchange-traded funds (ETFs) are currently pending regulatory approval. The approval of even one ETF could trigger a massive influx of institutional capital into Ethereum.

- Corporate Treasury Holdings: More and more corporations are adding Ethereum to their treasury reserves, demonstrating a belief in the long-term potential of the asset as a store of value and a utility token.

H3: Why Institutions are Buying Ethereum:

The institutional interest in Ethereum stems from several key factors:

- DeFi Growth: The burgeoning Decentralized Finance (DeFi) ecosystem, built on Ethereum, offers compelling investment opportunities.

- Scalability Improvements: Ongoing developments, such as Ethereum 2.0, are addressing scalability challenges, improving the platform's efficiency and transaction speed.

- Smart Contract Adoption: Ethereum's smart contract functionality is driving widespread adoption across various industries, creating a strong foundation for long-term growth.

H2: Technical Analysis Supporting the Bullish Outlook:

H3: Chart Patterns and Price Projections:

Technical analysis of Ethereum's price charts reveals several bullish patterns that support the $4,000 price target.

- Double Bottom: The price chart shows a clear double bottom pattern, indicating a potential reversal of the previous downtrend. (Insert chart here).

- Breaking Resistance Levels: Ethereum has recently broken through several key resistance levels, indicating increased buying pressure and a strengthening bullish trend. (Insert chart here).

H3: Key Resistance and Support Levels:

While the outlook is bullish, Ethereum's price might encounter resistance levels around $3,500 and $3,800 before reaching $4,000. However, the strong underlying fundamentals and institutional support suggest a high likelihood of breaking through these levels. Support levels around $3,000 and $2,800 could provide a cushion in case of temporary price corrections.

H2: Risks and Considerations:

H3: Potential Downsides and Market Volatility:

Investing in cryptocurrencies inherently carries risk. Several factors could impact the price prediction:

- Regulatory Changes: Unfavorable regulatory decisions could negatively impact the market.

- Macroeconomic Conditions: Global economic downturns can affect investor sentiment and cryptocurrency prices.

- Competitor Developments: Advances by competing blockchain platforms could potentially impact Ethereum's market share.

H3: Diversification and Risk Management:

It is crucial to diversify your investment portfolio and implement appropriate risk management strategies. Never invest more than you can afford to lose.

3. Conclusion:

The confluence of strong buy signals from Ethereum CrossX, significant institutional accumulation, and supportive technical analysis paints a compelling picture for Ethereum's future. The potential for substantial gains is significant, particularly given the momentum behind institutional investment. The $4,000 price target appears achievable, given current trends. Don't miss out on the potential of Ethereum CrossX signals; capitalize on the institutional momentum driving Ethereum's price. Explore the potential for significant gains with a strategic Ethereum investment. Remember to conduct thorough research and consider your personal risk tolerance before making any investment decisions.

Featured Posts

-

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025 -

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025 -

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Completes

May 08, 2025

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Completes

May 08, 2025 -

Rogue One Actor Reflects On Popular Character

May 08, 2025

Rogue One Actor Reflects On Popular Character

May 08, 2025 -

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025

Latest Posts

-

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025