Economic Pressures Prompt Federal Reserve To Maintain Interest Rates

Table of Contents

Inflation Remains a Primary Concern

Inflation continues to be a primary concern for the Federal Reserve. The current Consumer Price Index (CPI) remains above the Fed's target of 2%, indicating persistent upward pressure on prices. This elevated inflation rate impacts various aspects of the economy.

-

Current CPI and its components: The current CPI reflects increases across several sectors, including energy, food, and housing. These increases contribute to the overall cost of living and reduce consumer purchasing power.

-

Impact of inflation on consumer spending and business investment: High inflation erodes consumer purchasing power, potentially leading to reduced consumer spending. Businesses also face challenges with rising input costs, potentially impacting investment decisions and overall economic growth.

-

Fed's mandate to control inflation: The Federal Reserve has a dual mandate: to maintain price stability and maximize employment. Controlling inflation is paramount to achieving both goals. Persistent inflation can destabilize the economy and undermine long-term economic growth. The Fed's monetary policy tools, primarily interest rate adjustments, are designed to influence inflation.

Employment Data Influences the Decision

Recent employment reports present a mixed picture, further complicating the Fed's decision. While job creation remains relatively strong, the relationship between employment and inflation (often described by the Phillips Curve) is not straightforward.

-

Recent unemployment figures: The unemployment rate has hovered around [insert current unemployment rate], indicating a relatively healthy labor market.

-

Wage growth and its impact on inflation: Strong wage growth, while positive for workers, can contribute to inflationary pressures if businesses pass these increased labor costs onto consumers.

-

Fed's assessment of the labor market: The Fed carefully analyzes employment data to assess the overall health of the labor market and its potential impact on inflation. A tight labor market can fuel wage growth and contribute to inflationary pressures, while high unemployment can stifle economic growth. This balancing act significantly impacts the Fed's decision-making process.

Global Economic Uncertainty and Its Impact

Global economic uncertainty significantly impacts the U.S. economy and influences the Federal Reserve's decisions. Geopolitical factors and global economic slowdowns present considerable challenges.

-

Impact of geopolitical events on inflation and supply chains: The war in Ukraine, for example, has disrupted global supply chains, contributing to inflationary pressures on energy and other commodities.

-

Risks of a global recession: The possibility of a global recession looms large, potentially impacting U.S. economic growth and further complicating the Fed's monetary policy decisions.

-

The Fed's consideration of global economic conditions: The Federal Reserve carefully considers global economic conditions when making interest rate decisions, acknowledging the interconnectedness of the global economy.

Potential Future Actions by the Federal Reserve

The Federal Reserve's future actions will depend heavily on upcoming economic data. Several scenarios are possible:

-

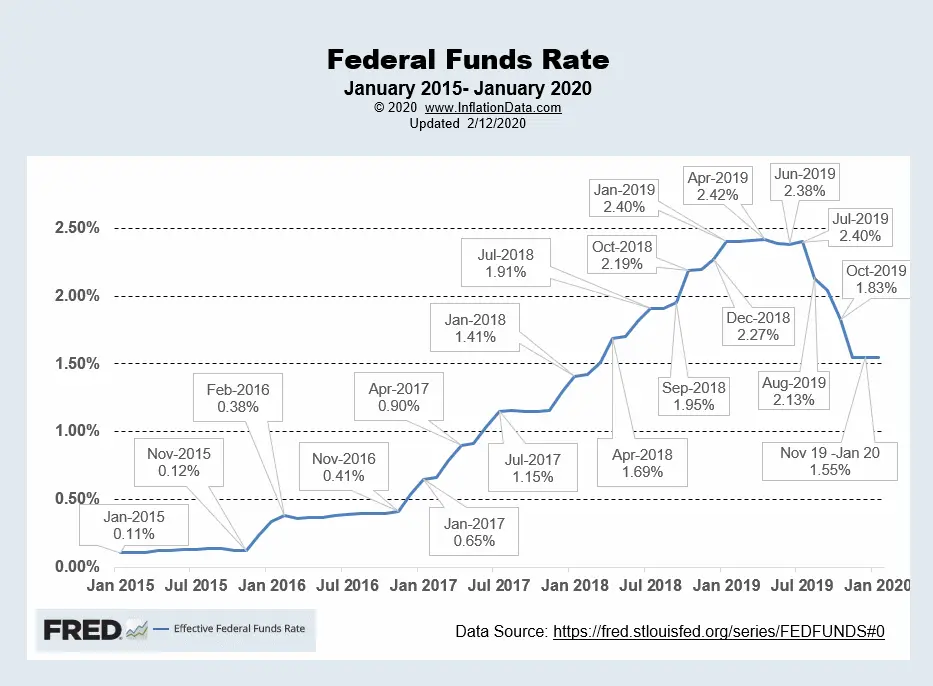

Interest rate hikes: If inflation remains persistently high and the labor market continues to tighten, the Fed may opt for interest rate hikes to cool down the economy.

-

Interest rate cuts: Conversely, if economic growth slows significantly or inflation falls substantially, the Fed may consider interest rate cuts to stimulate the economy.

-

Monetary policy tools: Beyond interest rate adjustments, the Fed has other monetary policy tools at its disposal, such as quantitative easing or reverse repurchase agreements, which might be employed to influence economic conditions. These tools can be deployed independently or in combination with interest rate changes.

Navigating Economic Challenges: The Federal Reserve's Continued Role

The Federal Reserve's decision to maintain interest rates reflects the delicate balance between controlling inflation and supporting economic growth. Inflation, employment data, and global economic uncertainty all play crucial roles in shaping the Fed's approach to monetary policy. The Fed's ongoing role in managing the economy is vital for maintaining price stability and promoting sustainable economic expansion. The need to carefully monitor key economic indicators and the potential for future interest rate adjustments remains paramount.

Stay updated on the Federal Reserve's actions and their impact on interest rates by regularly checking the Federal Reserve website and reputable financial news outlets. Understanding the Federal Reserve's decisions and their implications is critical for navigating the complexities of the current economic climate.

Featured Posts

-

Uy Scuti Release Date Young Thugs New Album

May 10, 2025

Uy Scuti Release Date Young Thugs New Album

May 10, 2025 -

Elon Musk Net Worth Dips Under 300 Billion Impact Of Tesla Challenges And Tariffs

May 10, 2025

Elon Musk Net Worth Dips Under 300 Billion Impact Of Tesla Challenges And Tariffs

May 10, 2025 -

Vegas Golden Nayts Vyigryvayut U Minnesoty V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Vyigryvayut U Minnesoty V Overtayme Pley Off

May 10, 2025 -

Navigating The Chinese Market The Hurdles Faced By Bmw Porsche And Other Auto Brands

May 10, 2025

Navigating The Chinese Market The Hurdles Faced By Bmw Porsche And Other Auto Brands

May 10, 2025 -

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025

Latest Posts

-

Stephen King And His 5 Most Notorious Celebrity Disputes

May 10, 2025

Stephen King And His 5 Most Notorious Celebrity Disputes

May 10, 2025 -

Stiven King Rezko Kritikuet Trampa I Maska

May 10, 2025

Stiven King Rezko Kritikuet Trampa I Maska

May 10, 2025 -

Golden Knights Win Fueled By Hertls Double Hat Trick

May 10, 2025

Golden Knights Win Fueled By Hertls Double Hat Trick

May 10, 2025 -

Tomas Hertl Dominates Golden Knights Win Over Red Wings

May 10, 2025

Tomas Hertl Dominates Golden Knights Win Over Red Wings

May 10, 2025 -

The Stephen King Connection Comparing Stranger Things And It

May 10, 2025

The Stephen King Connection Comparing Stranger Things And It

May 10, 2025