Interest Rate Decisions: Understanding The Fed's Cautious Approach

Table of Contents

The global economy is a tightrope walk, and the Federal Reserve (Fed) is the careful tightrope walker. Their decisions regarding interest rates are crucial, impacting everything from the price of your groceries to the availability of mortgages. This article will delve into the Fed's cautious approach to interest rate decisions, exploring the complexities of monetary policy and the factors driving their choices. We'll examine the current economic landscape, the tools at the Fed's disposal, the reasons behind their measured approach, and potential future scenarios.

The Current Economic Landscape and Inflationary Pressures

The current economic climate presents the Fed with a significant challenge. While GDP growth may show positive numbers, inflationary pressures remain a significant concern. High inflation erodes purchasing power, impacting consumers and businesses alike. Several factors contribute to this complex situation:

- Current inflation rate and its impact on consumers: The persistent inflation we've seen has squeezed household budgets, forcing consumers to make difficult choices about spending. This impacts consumer confidence and overall economic demand.

- The role of supply chain disruptions in inflation: Global supply chain disruptions, exacerbated by geopolitical events, have contributed significantly to rising prices. The inability to meet demand efficiently fuels inflation.

- The impact of geopolitical events on the economy: The war in Ukraine, trade tensions, and other geopolitical uncertainties create volatility and contribute to economic instability, making it harder to predict future economic trends and the effectiveness of monetary policy.

The Fed must carefully balance stimulating economic growth with controlling inflation. Aggressive action could stifle growth, leading to job losses and a potential recession. However, inaction could allow inflation to become entrenched, leading to long-term economic instability.

The Fed's Tools for Managing Interest Rates

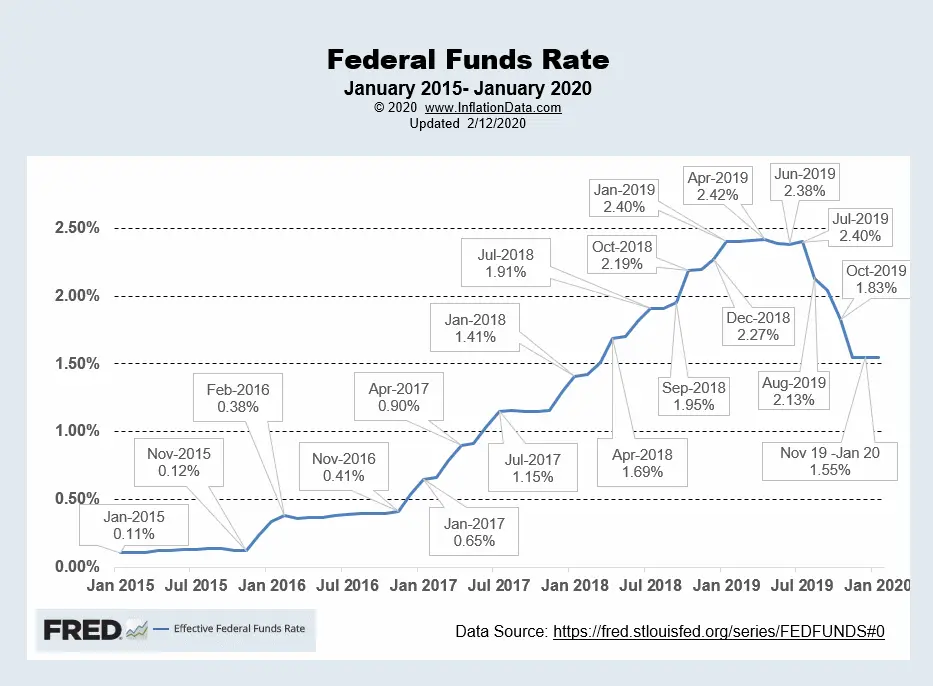

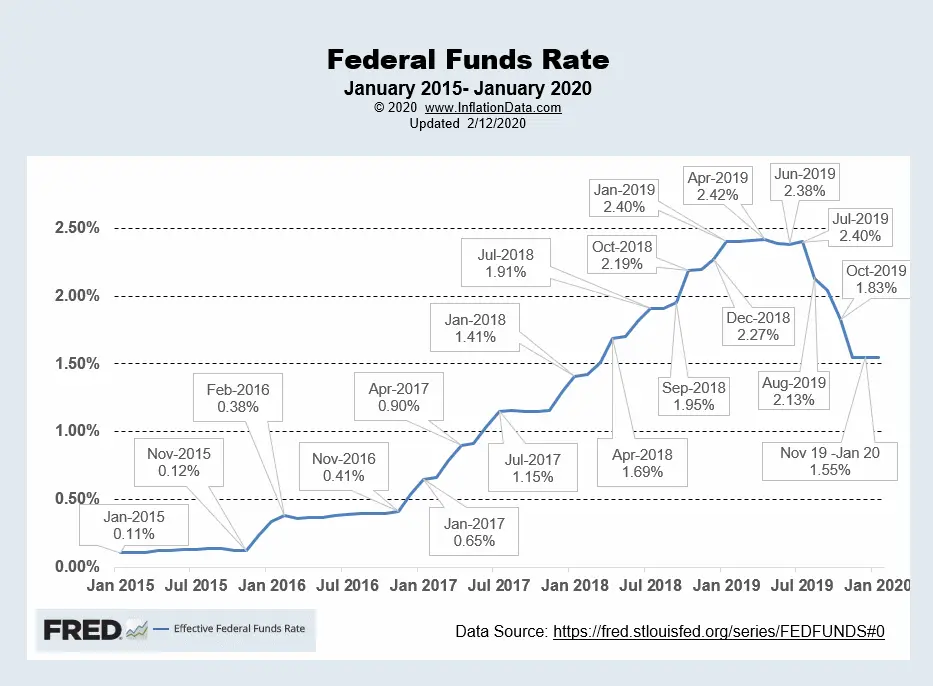

The Fed's primary tool for managing interest rates is the federal funds rate, the target rate that banks charge each other for overnight loans. Changes to this rate ripple through the entire financial system, influencing borrowing costs for consumers and businesses.

- How changes in the Federal Funds Rate affect borrowing costs: Raising the federal funds rate increases borrowing costs, making loans more expensive. This reduces borrowing and spending, helping to cool down an overheated economy and curb inflation. Lowering the rate has the opposite effect, stimulating economic activity.

- The mechanism by which interest rate changes impact the economy: Interest rate changes affect mortgage rates, credit card interest, business loans, and investment decisions, influencing overall economic activity.

- The limitations of monetary policy: Monetary policy isn't a silver bullet. It takes time for interest rate changes to fully impact the economy, and their effectiveness can be influenced by numerous unpredictable factors. The Fed also has limited control over factors like supply chain issues or geopolitical events.

Beyond the federal funds rate, the Fed utilizes other monetary policy tools, including quantitative easing (QE) and adjustments to reserve requirements. These tools provide additional levers for influencing the money supply and credit conditions.

Reasons Behind the Fed's Cautious Approach

The Fed's cautious approach stems from the inherent risks associated with aggressive interest rate hikes:

- The lagged effects of interest rate changes on the economy: It takes time for interest rate changes to fully impact the economy. The Fed must carefully consider the potential delayed consequences of their actions.

- The difficulty in predicting future economic conditions: Economic forecasting is inherently uncertain. The Fed must navigate unpredictable factors, including geopolitical events and shifts in consumer behavior.

- The political considerations impacting the Fed's decisions: The Fed’s decisions are scrutinized from all sides. Balancing economic stability with political pressures requires a cautious and data-driven approach.

The risk of triggering a recession or causing significant job losses necessitates a measured approach. Overshooting the desired outcome (overly aggressive tightening) or undershooting (inadequate tightening) could have serious economic consequences. Therefore, the Fed prioritizes data-driven decision-making, closely monitoring economic indicators before adjusting interest rates.

Potential Future Scenarios and Their Implications

Several scenarios could unfold depending on future economic developments:

- Scenario 1: Continued inflation, leading to further rate hikes: If inflation remains stubbornly high, the Fed may need to continue raising interest rates, potentially risking a recession.

- Scenario 2: Inflation subsiding, allowing for a pause or rate cuts: If inflation begins to cool, the Fed could pause rate hikes or even begin cutting rates to stimulate economic growth.

- Scenario 3: Recessionary pressures, necessitating a different approach: If recessionary pressures emerge, the Fed may need to shift its focus to supporting economic growth, potentially lowering interest rates.

These different scenarios will have significant implications for various sectors. For example, rising interest rates typically impact the housing market and business investment decisions.

Conclusion

The Federal Reserve's cautious approach to interest rate decisions reflects the delicate balancing act between controlling inflation and fostering economic growth. Understanding the complexities of monetary policy, the various tools at the Fed's disposal, and the potential impacts of their decisions is crucial. The Fed's data-driven approach underscores the importance of monitoring key economic indicators. Stay updated on future interest rate decisions by following the Federal Reserve's announcements for the latest information. Understanding the impact of interest rate decisions on your finances and the broader economy is essential for navigating these uncertain times. The ongoing impact of interest rate decisions on the economy makes staying informed a necessity.

Featured Posts

-

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025 -

Transgender Experiences And Trumps Executive Orders Sharing Your Story

May 10, 2025

Transgender Experiences And Trumps Executive Orders Sharing Your Story

May 10, 2025 -

The Epstein Files And The Bondi Comer Exchange A Closer Look

May 10, 2025

The Epstein Files And The Bondi Comer Exchange A Closer Look

May 10, 2025 -

Understanding The Casting Choice For David In High Potential Episode 13

May 10, 2025

Understanding The Casting Choice For David In High Potential Episode 13

May 10, 2025 -

Apples Ai A Deep Dive Into Its Strengths And Weaknesses

May 10, 2025

Apples Ai A Deep Dive Into Its Strengths And Weaknesses

May 10, 2025

Latest Posts

-

Edmonton Oilers Projected To Win Against Los Angeles Kings A Look At The Odds

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings A Look At The Odds

May 10, 2025 -

Federal Riding Changes In Greater Edmonton A Voters Guide

May 10, 2025

Federal Riding Changes In Greater Edmonton A Voters Guide

May 10, 2025 -

Oilers Favored To Finish Kings In Playoff Series Betting Odds Analysis

May 10, 2025

Oilers Favored To Finish Kings In Playoff Series Betting Odds Analysis

May 10, 2025 -

Edmonton Oilers Vs Los Angeles Kings Betting Odds And Series Prediction

May 10, 2025

Edmonton Oilers Vs Los Angeles Kings Betting Odds And Series Prediction

May 10, 2025 -

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025