Elon Musk Net Worth Dips Under $300 Billion: Impact Of Tesla Challenges And Tariffs

Table of Contents

Tesla's Production and Delivery Challenges

Tesla's recent struggles are significantly impacting Elon Musk's net worth. The company has faced substantial production and delivery challenges, directly affecting its financial performance and consequently, the value of its stock.

Production Bottlenecks

Tesla's ambitious production targets have sometimes been hampered by various bottlenecks. These disruptions ripple through the entire system, delaying vehicle deliveries and impacting overall revenue.

- Supply chain disruptions: The global supply chain continues to experience instability, with shortages of crucial components affecting Tesla's manufacturing process.

- Factory upgrades: While necessary for long-term growth, ongoing factory upgrades and expansions often temporarily reduce production capacity.

- Labor shortages: Finding and retaining skilled labor in a competitive job market poses another significant challenge.

- Quality control issues: Reports of quality control problems in some Tesla models have led to recalls and repairs, adding to production delays and costs.

These bottlenecks directly affect Tesla's financial performance. Lower production numbers translate to lower revenues, impacting profitability and ultimately, the company's stock price, which is the primary driver of Elon Musk's net worth.

Increased Competition in the EV Market

The electric vehicle market is no longer Tesla's exclusive domain. Established automakers and emerging EV startups are aggressively entering the market, creating fierce competition.

- New EV models entering the market: Numerous competitors are launching innovative and compelling electric vehicles, challenging Tesla's market dominance.

- Price wars: Increased competition is leading to price wars, putting pressure on Tesla's profit margins.

- Innovative battery technologies from competitors: Competitors are making significant advancements in battery technology, potentially surpassing Tesla in range and charging times.

This intensifying competition is impacting Tesla's market share and profitability, further contributing to the recent decline in Elon Musk's net worth.

The Impact of Tariffs on Tesla's Global Operations

Tariffs on Tesla vehicles and components play a significant role in the current situation. These tariffs impact pricing, sales, and profitability in various global markets.

Import/Export Tariffs

Tariffs imposed by different countries directly affect Tesla's ability to compete internationally.

- Specific examples of tariffs in key markets (e.g., China, Europe): Varying tariff structures in major markets increase the cost of importing and exporting Tesla vehicles and parts, making them less competitive.

- Impact on international sales figures: These increased costs can significantly impact international sales figures, reducing Tesla's overall revenue and profitability.

The financial implications of these tariffs are substantial, directly impacting Tesla's bottom line and, consequently, Elon Musk's net worth.

Trade Wars and Geopolitical Uncertainty

Global trade tensions and geopolitical instability add another layer of complexity to Tesla's operations.

- Examples of geopolitical risks and their impact on Tesla's supply chain and market access: Geopolitical events can disrupt Tesla's supply chain, impacting production and leading to further delays.

- Impact on international sales figures: Geopolitical instability can also affect market access and consumer confidence, impacting sales in certain regions.

These factors contribute to the volatility of Tesla's stock price and, ultimately, the fluctuations in Elon Musk's net worth.

Other Factors Contributing to the Net Worth Decline

Beyond Tesla's challenges, other factors influence Elon Musk's overall net worth.

Market Sentiment and Investor Confidence

Investor sentiment and confidence play a crucial role in influencing Tesla's stock price.

- News coverage, social media impact, analyst ratings and predictions: Negative news coverage, social media controversies, and negative analyst predictions can all impact investor confidence and lead to a decline in the stock price.

- Impact on stock prices and net worth: This reduced confidence can trigger sell-offs, directly impacting Tesla's stock price and therefore, Elon Musk's net worth.

Musk's Other Ventures and Investments

Elon Musk's net worth is not solely tied to Tesla. The performance of his other ventures also plays a role.

- Examples of other ventures (SpaceX, The Boring Company): While SpaceX has been successful, the performance of these other ventures also contributes to Musk's overall financial picture.

- How their performance impacts overall wealth: The success or struggles of these companies can influence his overall wealth, adding another layer of complexity to understanding his net worth.

Conclusion

The recent dip in Elon Musk's net worth is a result of a convergence of factors. Tesla's production challenges, increased competition in the EV market, and the impact of tariffs all play a significant role. While fluctuations in Elon Musk's net worth are notable, they underscore the inherent risks and challenges faced by even the most successful companies in today's dynamic global economy. Understanding the interplay of production efficiency, competitive pressures, and global trade policies is essential for assessing the future trajectory of both Tesla and Elon Musk's financial standing. Stay informed about the latest developments concerning Elon Musk's net worth and Tesla's performance by regularly checking reputable financial news sources for updates on Tesla stock, market analysis, and the impact of evolving global trade policies. Understanding the intricacies of Elon Musk's net worth requires close monitoring of these critical factors.

Featured Posts

-

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025 -

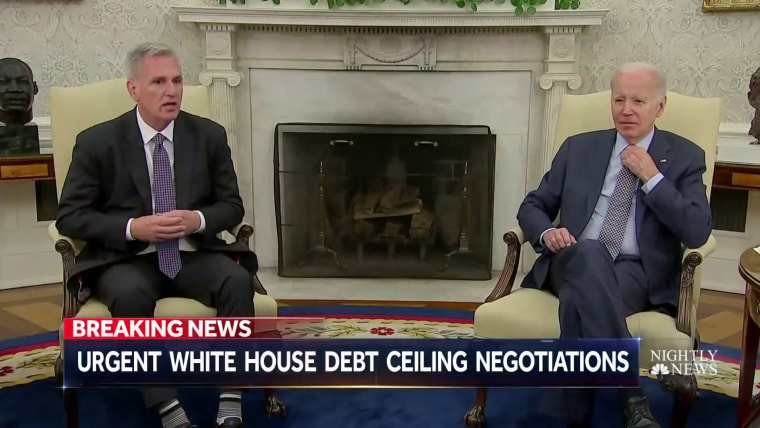

Us Debt Ceiling August Deadline Looms Treasury Warns

May 10, 2025

Us Debt Ceiling August Deadline Looms Treasury Warns

May 10, 2025 -

The Aftermath Of Hate A Familys Struggle After A Racist Killing

May 10, 2025

The Aftermath Of Hate A Familys Struggle After A Racist Killing

May 10, 2025 -

Us Debt Limit Potential August Crisis According To Treasurys Bessent

May 10, 2025

Us Debt Limit Potential August Crisis According To Treasurys Bessent

May 10, 2025 -

Strengthening Financial Cooperation Joint Venture Between Pakistan Sri Lanka And Bangladesh Capital Markets

May 10, 2025

Strengthening Financial Cooperation Joint Venture Between Pakistan Sri Lanka And Bangladesh Capital Markets

May 10, 2025