Dubai Holding's REIT IPO: $584 Million Target

Table of Contents

Understanding the Dubai Holding REIT IPO

This IPO represents a significant step for Dubai Holding and the UAE's financial markets. Understanding the structure and investment strategy behind this REIT is crucial for potential investors. A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs offer several benefits, including diversification, relatively high dividend yields, and professional management. Dubai Holding's investment strategy for this IPO is likely focused on capitalizing on the continued growth of the Dubai property market.

The portfolio assets included in this REIT will likely encompass a diverse range of high-quality properties, possibly including:

- Residential properties: Apartments and villas in prime locations across Dubai.

- Commercial properties: Office buildings and business parks catering to a diverse tenant base.

- Retail properties: Shopping malls and retail spaces in high-traffic areas.

The anticipated returns are expected to be competitive, reflecting the strong performance of the Dubai real estate market. However, potential investors should conduct thorough due diligence and carefully assess the inherent risks associated with any real estate investment, including market fluctuations and potential changes in government regulations.

Bullet Points:

- Asset Class Breakdown: A detailed breakdown of the asset classes within the REIT portfolio will be released in the official prospectus.

- Projected Dividend Yield: The projected dividend yield and payout ratio will be a key factor influencing investor decisions.

- Key Management Team: Dubai Holding will likely highlight the expertise and experience of the management team responsible for the REIT's operation.

- IPO Timeline: The official offering period and listing date will be announced in the coming weeks or months.

Market Analysis and Investment Potential

The Dubai real estate market has experienced robust growth in recent years, driven by several factors including:

- Expo 2020 Legacy: The infrastructure development and increased tourism associated with Expo 2020 have positively impacted the property market.

- Tourism: Dubai's thriving tourism sector continues to fuel demand for residential and hospitality real estate.

- Infrastructure Development: Ongoing infrastructure projects enhance connectivity and further strengthen Dubai's appeal as a global hub.

Dubai Holding's strong market position, coupled with the attractive investment outlook for the Dubai real estate market, positions this REIT favorably. The projected Return on Investment (ROI) is anticipated to be competitive, attracting both local and international investors. However, a comprehensive analysis of the competitive landscape, considering existing REITs in the region and potential market risks, is necessary for a sound investment decision.

Bullet Points:

- Market Growth Predictions: Independent analysts will likely offer growth predictions for the Dubai real estate market in the coming years.

- Regional REIT Comparison: A comparison with other REITs operating in the UAE and the wider region will help investors assess the relative attractiveness of Dubai Holding's offering.

- Risk Analysis: A thorough assessment of potential risks, including market volatility and economic downturns, is essential.

- Investor Interest: Anticipated investor interest will depend on factors such as the offering price, projected returns, and market conditions.

Regulatory Framework and Compliance

The Dubai Holding REIT IPO will be subject to the UAE's robust regulatory framework governing securities and financial markets. The Securities and Commodities Authority (SCA) will play a key role in ensuring compliance with all relevant regulations and protecting investor interests. Transparency and due diligence are paramount. Dubai Holding is expected to adhere strictly to all legal and regulatory requirements throughout the IPO process.

Bullet Points:

- Regulatory Bodies: The SCA and other relevant authorities will oversee the IPO process to ensure compliance.

- Legal Requirements: All relevant securities laws and regulations applicable to IPOs in the UAE will govern the offering.

- Investor Protection: Measures will be in place to protect investors and ensure transparency throughout the process.

Conclusion

The Dubai Holding REIT IPO, aiming for a substantial $584 million, presents a significant investment opportunity in the thriving Dubai real estate market. The REIT's diverse portfolio, coupled with the positive outlook for the Dubai economy and the strength of the regulatory framework, makes it an attractive proposition. However, potential investors should conduct thorough due diligence and carefully consider the associated risks. Don't miss out on this significant investment opportunity: Explore the Dubai Holding REIT IPO today! For more information, please refer to Dubai Holding’s official investor relations website and the IPO prospectus when it becomes available.

Featured Posts

-

Drug Discovery Accelerated D Waves Qbts Quantum Computing And Ai Integration

May 20, 2025

Drug Discovery Accelerated D Waves Qbts Quantum Computing And Ai Integration

May 20, 2025 -

Suki Waterhouses Met Gala 2023 A Full Circle Fashion Moment

May 20, 2025

Suki Waterhouses Met Gala 2023 A Full Circle Fashion Moment

May 20, 2025 -

Mirra Andreeva Put K Vershinam Bolshogo Tennisa

May 20, 2025

Mirra Andreeva Put K Vershinam Bolshogo Tennisa

May 20, 2025 -

Nigerias Pragmatic Choices A Kite Runner Analysis

May 20, 2025

Nigerias Pragmatic Choices A Kite Runner Analysis

May 20, 2025 -

Decouvrir L Integrale Des Romans D Agatha Christie

May 20, 2025

Decouvrir L Integrale Des Romans D Agatha Christie

May 20, 2025

Latest Posts

-

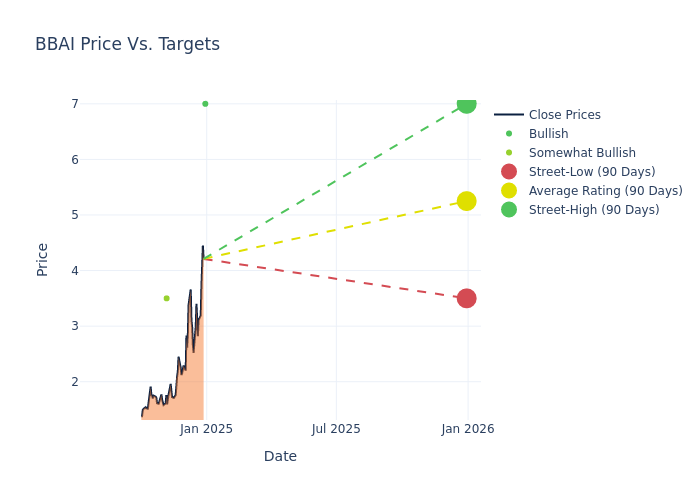

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Defense Sector Growth

May 20, 2025

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Defense Sector Growth

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons Explained

May 20, 2025 -

Bbai Stock Analyzing The Recent Analyst Downgrade And Future Growth Prospects

May 20, 2025

Bbai Stock Analyzing The Recent Analyst Downgrade And Future Growth Prospects

May 20, 2025 -

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 20, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 20, 2025 -

D Wave Quantum Inc Qbts Reasons Behind The 2025 Stock Market Dip

May 20, 2025

D Wave Quantum Inc Qbts Reasons Behind The 2025 Stock Market Dip

May 20, 2025