DBS's Stance On Environmental Reform: Breathing Room For Major Polluters

Table of Contents

DBS's Public Commitments to Sustainability

DBS has publicly committed to various sustainability goals, presenting itself as a leader in sustainable finance. They have outlined ambitious targets, aiming to showcase their commitment to environmental protection and responsible business practices.

- Specific Targets: DBS has set targets for financing renewable energy projects, aiming to reach a certain percentage of their loan portfolio dedicated to green initiatives. They've also pledged to reduce their own operational carbon footprint by a specific percentage within a defined timeframe. Further, they have committed to phasing out financing for certain high-emission sectors.

- Awards and Recognitions: DBS has received several awards and accolades for its sustainability initiatives from various organizations, indicating a certain level of recognition within the industry for their efforts in sustainable finance. However, the weight and relevance of these awards need careful consideration.

- Inconsistencies: Despite these public commitments, inconsistencies remain. Some critics argue that the rate of progress toward these ambitious targets is too slow, and the overall impact is insufficient given the scale of the environmental crisis. The gap between stated ambitions and actual progress needs further examination.

Greenwashing Accusations and Criticisms

DBS, like many other large financial institutions, has faced accusations of greenwashing – presenting a misleadingly positive image of their environmental performance. These criticisms raise concerns about the authenticity of their sustainability commitments.

- Negative Environmental Impacts: Critics point to DBS's continued investments in fossil fuel projects and industries linked to deforestation as examples of actions contradicting their stated sustainability goals. The scale of these investments compared to their renewable energy investments is often highlighted as a point of contention.

- Reports and Investigations: Several reports and investigations have raised concerns about the lack of transparency and rigor in DBS's ESG (Environmental, Social, and Governance) reporting and their overall approach to sustainable finance. These reports often highlight inconsistencies between their public statements and their actual financing practices.

- Reputational and Investor Impact: These criticisms have implications for DBS's reputation and investor confidence. Increasingly, investors are prioritizing ESG factors in their investment decisions, and accusations of greenwashing can significantly affect a company's ability to attract responsible investment.

Analysis of DBS's Financing Practices

A critical analysis of DBS's financing practices reveals a complex picture. While they have increased investment in renewable energy and sustainable projects, the proportion compared to their overall portfolio still raises questions.

- Renewable vs. Fossil Fuel Investments: A detailed breakdown of DBS's financing portfolio is necessary to assess the actual balance between investments in renewable energy sources and fossil fuels. A higher proportion in fossil fuels, despite stated commitments to sustainability, would fuel accusations of greenwashing and inadequate commitment to climate action.

- Lending Practices: Examining DBS's lending practices toward environmentally damaging industries is crucial. The conditions and requirements imposed on borrowers in these sectors need thorough scrutiny to assess whether sufficient pressure is exerted to promote environmental improvements.

- Comparison with Competitors: Comparing DBS's environmental financing policies with those of other major banks is essential for benchmarking and gauging the relative strength of their commitment to sustainable finance. A comparison will highlight whether DBS is a leader or a laggard in the sector.

The Role of ESG Investing and Sustainable Finance

DBS's approach to ESG investing is central to its sustainability strategy. The effectiveness of this strategy depends on the rigor and transparency of its ESG criteria and screening processes.

- ESG Criteria and Screening: A detailed understanding of DBS's ESG criteria and the screening processes used to assess the environmental and social impact of potential investments is crucial. A lack of clarity or weak criteria would raise concerns about the effectiveness of their ESG strategy.

- Sustainable Finance Initiatives: The scale and impact of DBS's investments in sustainable finance initiatives – such as green bonds and sustainable development projects – need to be carefully evaluated. The actual impact of such initiatives needs to be measured against their stated targets.

- Addressing Environmental Impact: The ultimate measure of DBS's ESG strategy lies in its effectiveness in addressing the environmental impact of its overall investment portfolio. The extent to which their investment choices contribute to environmental protection needs to be independently verified and critically assessed.

The Impact of DBS's Actions on Environmental Reform

Ultimately, the effectiveness of DBS's environmental policy must be judged by its overall impact on environmental protection and climate change mitigation.

- Contribution to or Hindrance of Reform: DBS's actions may contribute to environmental reform if their investments in renewable energy and sustainable projects significantly outweigh their investments in environmentally damaging sectors. Conversely, substantial investments in fossil fuels would directly contradict their purported commitment to sustainable finance.

- Consequences for the Environment: The consequences of DBS’s approach for the environment and climate change are significant. A failure to adequately address climate risk through responsible investment decisions can have severe long-term implications.

- Comparison with Best Practices: Comparing DBS's approach with best practices in sustainable banking will shed light on the relative strength of their commitment and help identify areas for improvement. Leading practices in the sector should serve as a benchmark for evaluating DBS's performance.

Conclusion

Our analysis of DBS's stance on environmental reform reveals a mixed picture. While DBS has made public commitments to sustainability and invested in some green initiatives, concerns remain about their continued involvement in environmentally damaging sectors and accusations of greenwashing. The gap between stated goals and actual practices raises questions about the genuineness of their commitment to sustainable finance. This lack of alignment between public statements and actual actions might provide “breathing room” for major polluters, hindering rather than supporting meaningful environmental reform.

The future of our planet depends on the responsible actions of major financial institutions. We urge readers to critically evaluate DBS's environmental policy and demand greater transparency and accountability from all banks regarding their impact on environmental reform. Demand more than just “greenwashing”; demand genuine commitment to sustainable finance from DBS and other major players in the financial sector. Let's hold DBS accountable for its DBS environmental policy commitments and push for stronger action on sustainable finance.

Featured Posts

-

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025 -

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025 -

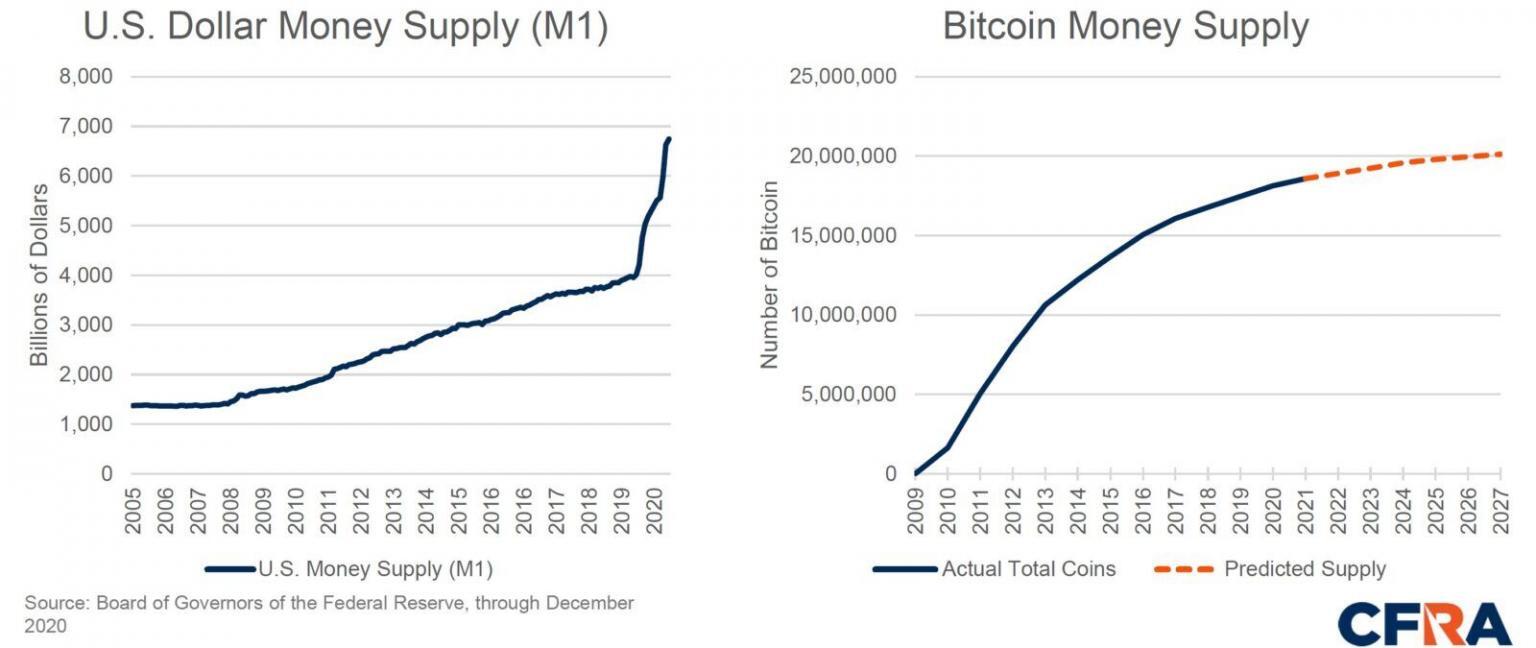

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025

Is A 10x Bitcoin Multiplier Realistic Wall Streets Perspective

May 08, 2025 -

Gta Vi Second Trailer Deep Dive Exploring The Bonnie And Clyde Dynamic

May 08, 2025

Gta Vi Second Trailer Deep Dive Exploring The Bonnie And Clyde Dynamic

May 08, 2025 -

Will Xrp Reach 5 In 2025 A Comprehensive Analysis

May 08, 2025

Will Xrp Reach 5 In 2025 A Comprehensive Analysis

May 08, 2025

Latest Posts

-

800 Million Week 1 Xrp Etf Inflows A Realistic Possibility

May 08, 2025

800 Million Week 1 Xrp Etf Inflows A Realistic Possibility

May 08, 2025 -

Xrps Surge Outpacing Bitcoin After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025

Xrps Surge Outpacing Bitcoin After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025 -

Xrp Outperforms Bitcoin And Top Cryptos Following Sec Grayscale Etf Filing

May 08, 2025

Xrp Outperforms Bitcoin And Top Cryptos Following Sec Grayscale Etf Filing

May 08, 2025 -

The Future Of Xrp The Impact Of Sec Decisions And Etf Applications

May 08, 2025

The Future Of Xrp The Impact Of Sec Decisions And Etf Applications

May 08, 2025 -

Get The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025

Get The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025