$800 Million Week 1 XRP ETF Inflows: A Realistic Possibility?

Table of Contents

Analyzing the Potential Demand for an XRP ETF

To assess the plausibility of an $800 million week 1 inflow, we need to analyze the potential demand for an XRP ETF. This involves examining current market sentiment, the size of the potential investor base, and comparing it to the performance of other successful crypto ETF launches.

Current Market Sentiment Towards XRP

The sentiment surrounding XRP is complex and often volatile. Recent price movements have been influenced by a number of factors, most notably the ongoing SEC lawsuit. While some view the lawsuit as a major hurdle, others see it as a catalyst for eventual regulatory clarity and increased adoption.

- Positive news impacting XRP price: Potential positive rulings in the SEC lawsuit, increased institutional adoption, partnerships with major companies, development of XRP Ledger functionalities.

- Negative news impacting XRP price: Negative rulings in the SEC lawsuit, regulatory uncertainty in various jurisdictions, negative media coverage, competition from other cryptocurrencies.

- Current institutional investment in XRP: While institutional investment in XRP is growing, it remains significantly lower compared to Bitcoin or Ethereum. The level of institutional participation will largely dictate the inflow scale.

Assessing the Size of the Potential Investor Base

The potential investor base for an XRP ETF encompasses both retail and institutional investors, with the potential for significant international participation.

- Retail investor interest: A large segment of retail investors are interested in cryptocurrencies, and XRP's relatively low price point makes it accessible. The level of interest will depend greatly on marketing and overall market sentiment.

- Institutional investor interest: Institutional interest, while growing, is still cautious due to regulatory uncertainty. A positive SEC ruling would significantly increase this.

- Potential for international investment: XRP enjoys considerable international adoption and interest, which could significantly contribute to inflows if a global ETF is launched.

Comparing to Other Successful ETF Launches

To gauge the realism of an $800 million week 1 inflow, it's crucial to analyze successful crypto ETF launches.

- Examples of successful crypto ETF launches: Examining the launch data of other crypto ETFs, focusing on their week 1 performance, will provide a benchmark against which to measure the potential success of an XRP ETF.

- Their week 1 performance: Data on the inflow numbers during the first week of successful crypto ETF launches will provide realistic comparison points.

- Comparison to the projected XRP ETF inflow: By comparing the projected $800 million inflow with historical data, a clearer picture of its realism emerges.

Factors that Could Influence Week 1 Inflows

Several factors could significantly impact the week 1 inflows into an XRP ETF. These include regulatory hurdles, market volatility, and the ETF's structure and fees.

Regulatory Landscape and SEC Approval

SEC approval is paramount. A favorable ruling would dramatically boost investor confidence and likely lead to substantial inflows. Conversely, delays or rejection could severely dampen enthusiasm.

- Potential regulatory hurdles: The SEC's stance on XRP and the ongoing legal battle remain significant hurdles.

- Positive regulatory developments: A positive SEC ruling, coupled with clear regulatory frameworks in other major markets, would positively impact the inflow.

- Influence of SEC decisions on market sentiment: The SEC’s decision will overwhelmingly influence the market sentiment and thus the investor’s appetite for an XRP ETF.

Market Volatility and General Market Conditions

The cryptocurrency market is inherently volatile. Broader market conditions and the performance of Bitcoin, in particular, will influence investor risk appetite.

- Impact of Bitcoin price fluctuations: Bitcoin price movements often correlate with altcoin performance, including XRP.

- General economic uncertainty: Economic downturns can impact investor risk tolerance across all asset classes, including cryptocurrencies.

- Impact of competing asset performance: The performance of competing cryptocurrencies and other asset classes will influence investor choices.

ETF Structure and Fees

The structure of the XRP ETF (physically backed or futures-based) and associated fees will impact its attractiveness to investors.

- Comparison of different ETF structures: Investors may favor physically backed ETFs over futures-based ones for various reasons.

- Impact of expense ratios on investor decisions: High expense ratios can deter investors seeking cost-effective investment options.

- Attractiveness of different investment vehicles: The choice between an XRP ETF and other investment vehicles such as spot trading will impact the overall inflow.

Arguments For and Against an $800 Million Week 1 Inflow

Let’s weigh the arguments for and against such a substantial inflow.

Arguments for a High Inflow

Several factors suggest the potential for significant demand.

- High retail investor interest: The large retail investor base interested in XRP could lead to significant inflows.

- Institutional FOMO (fear of missing out): A successful launch could trigger FOMO among institutional investors, driving up demand.

- Potential for rapid price appreciation: The anticipation of price appreciation could attract speculative investment.

Arguments against a High Inflow

Counterarguments highlight potential limitations and risks.

- Regulatory uncertainty: The ongoing SEC lawsuit and regulatory uncertainty represent significant risks.

- Market volatility: The inherent volatility of the cryptocurrency market presents a risk to investors.

- Potential for delayed SEC approval: Delays in approval could significantly reduce initial inflows.

- Competition from other crypto assets: Competition from other cryptocurrencies and their respective ETFs could diminish XRP's appeal.

Conclusion: Is an $800 Million Week 1 XRP ETF Inflow Realistic?

Based on our analysis, an $800 million week 1 inflow into an XRP ETF appears unlikely, at least in the near term. While there is significant retail interest and the potential for institutional FOMO, the substantial regulatory uncertainty surrounding XRP and the inherent volatility of the crypto market present considerable headwinds. The structure and fees of the ETF will also play a significant role. SEC approval is a critical factor that could dramatically shift the outlook.

The crucial factors influencing potential inflows remain regulatory approval, market sentiment, and the ETF's structure. A positive SEC ruling, combined with favorable market conditions and a well-structured ETF, would increase the likelihood of substantial inflows, though $800 million in the first week remains a highly ambitious target.

Call to Action: Stay informed about the developments in the XRP ETF space. Conduct your own research before investing in XRP ETFs. Learn more about the potential benefits and risks of XRP ETF investments. The potential for an $800 million week 1 inflow into an XRP ETF is a significant topic; continue to monitor the situation and make informed decisions based on your own risk tolerance.

Featured Posts

-

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025 -

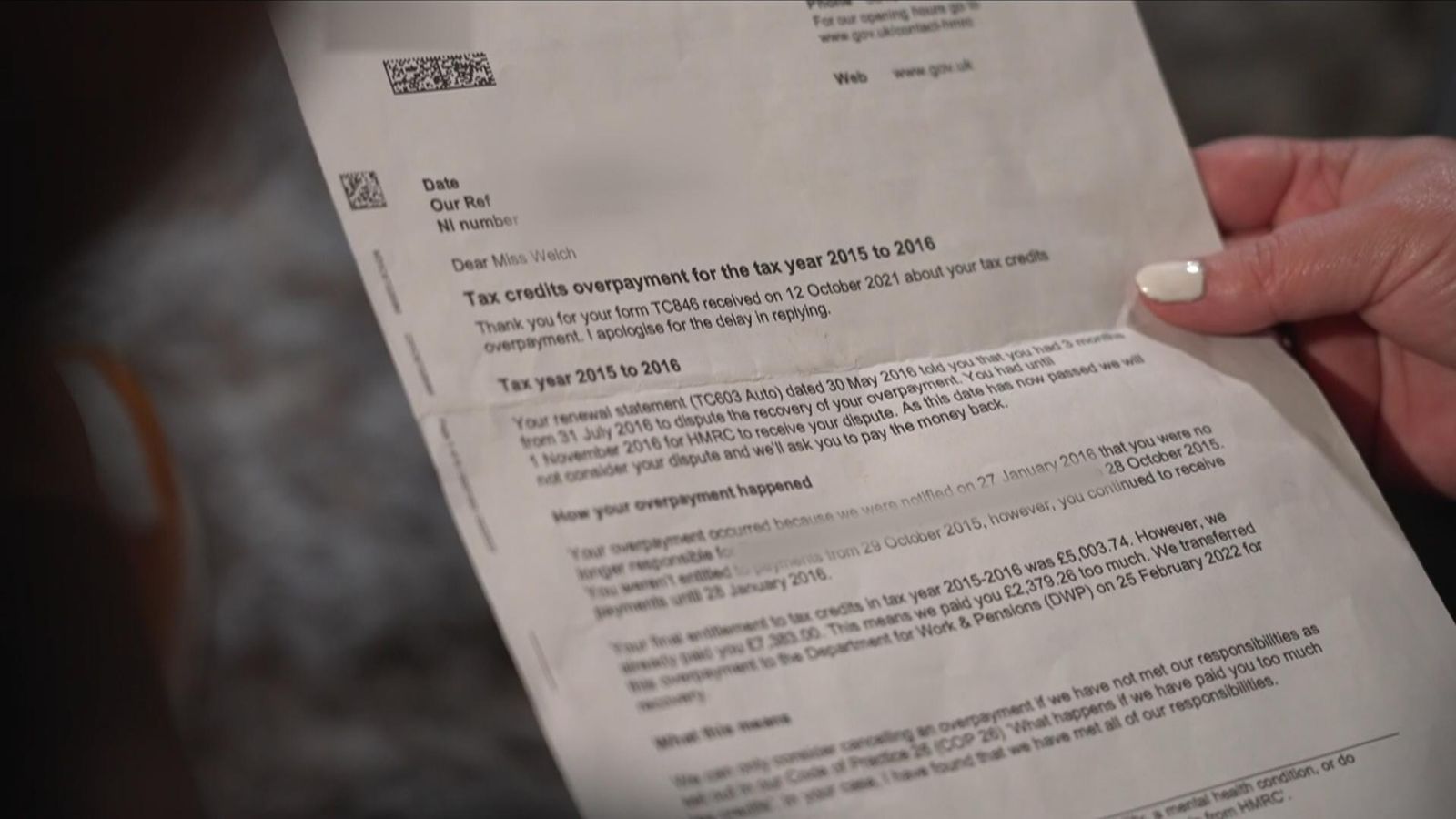

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025 -

X Men Beyond Rogues Skimpiest Outfit A New Era Of Costume Design

May 08, 2025

X Men Beyond Rogues Skimpiest Outfit A New Era Of Costume Design

May 08, 2025 -

Andor Season 2 How It Will Change Star Wars Canon

May 08, 2025

Andor Season 2 How It Will Change Star Wars Canon

May 08, 2025

Latest Posts

-

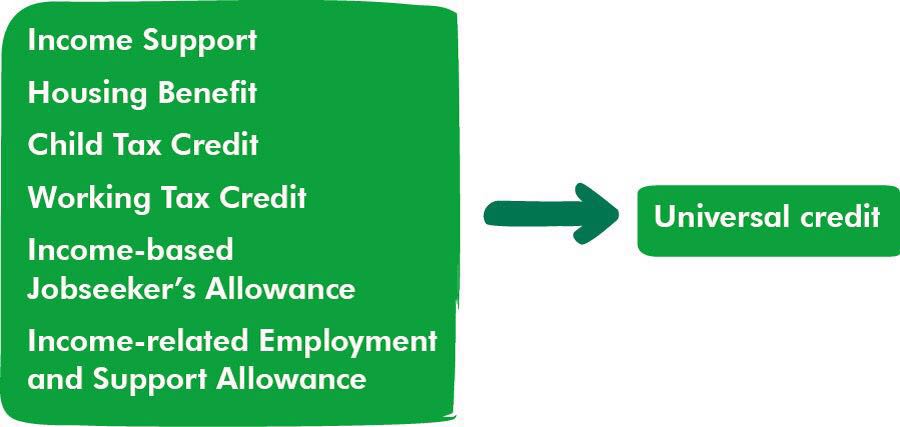

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025 -

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025 -

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025 -

Have You Missed Out On Universal Credit Back Payments

May 08, 2025

Have You Missed Out On Universal Credit Back Payments

May 08, 2025 -

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025